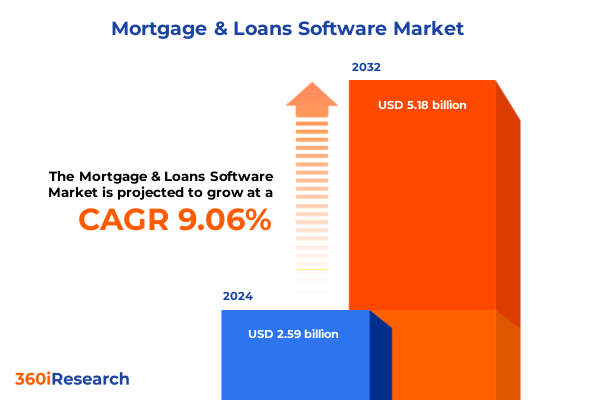

The Mortgage & Loans Software Market size was estimated at USD 2.82 billion in 2025 and expected to reach USD 3.03 billion in 2026, at a CAGR of 9.08% to reach USD 5.18 billion by 2032.

Illuminating the Rapid Evolution of Mortgage and Loan Software Amidst Intensifying Digital Transformation and Market Complexity

In an era characterized by rapid technological advancement and the convergence of financial services with digital ecosystems, the mortgage and loan software domain stands at a pivotal inflection point. Organizations across the lending continuum are contending with soaring borrower expectations for seamless digital experiences, while simultaneously navigating tighter regulatory scrutiny and the imperative for robust risk management. These forces are driving a wave of investment in integrated platforms that can deliver end-to-end loan lifecycle automation without sacrificing compliance or data security. As a result, leading institutions are shifting from siloed point solutions toward unified suites capable of orchestrating origination, servicing, analytics, and secondary marketing in a cohesive framework.

Amid these dynamics, software providers are racing to embed artificial intelligence and advanced analytics more deeply into core workflows, enabling predictive decisioning, automated underwriting, and dynamic risk assessment. Furthermore, the ongoing shift toward cloud-native architectures underscores a broader industry commitment to agility, scalability, and cost efficiency. Against this backdrop, stakeholders must not only assess the current capabilities of available solutions but also anticipate how emerging innovations-such as blockchain-enabled collateral tracking and digital identity verification-will reshape market expectations. Consequently, the initial challenge for decision makers is to establish a clear understanding of the evolving landscape, ensuring they invest in platforms that can adapt to both present requirements and future disruptions.

Navigating Fundamental Paradigm Shifts Reshaping Mortgage Software Solutions Through Advanced Analytics and Automation Innovations

The landscape of mortgage and loan software is undergoing transformative shifts driven by a confluence of technological breakthroughs, changing borrower behaviors, and regulatory recalibrations. The proliferation of mobile engagement has elevated expectations for frictionless, omnichannel interactions, compelling providers to prioritize seamless user interfaces alongside robust backend integrations. Concurrently, the adoption of embedded finance models is expanding software’s role from standalone loan management to interconnected hubs that interface with broader banking, payments, and wealth management systems. This integration trend is further catalyzed by open banking initiatives and the rise of application programming interfaces, encouraging an ecosystem approach that positions software platforms as central conduits for financial data flow.

At the same time, artificial intelligence is migrating from experimental pilots to production deployments, with natural language processing streamlining document ingestion and machine learning enhancing early warning systems for loan delinquency. Cloud-native deployments have moved beyond mere infrastructure cost savings, now serving as springboards for microservices architectures that foster continuous delivery and rapid feature iterations. These collective shifts signify a departure from legacy, monolithic systems toward modular, adaptive environments capable of responding to market volatility and evolving compliance mandates without extensive redevelopment.

Analyzing the Broad-Reaching Consequences of Recent United States Tariffs on Mortgage Software Procurement and Deployment Strategies in 2025

The implementation of newly announced United States tariffs in 2025 has introduced an additional layer of complexity for vendors and financial institutions alike, particularly in areas reliant on cross-border technology procurement and hardware infrastructure. With increased duties imposed on imported data center components, network equipment, and certain software preloads, providers have begun evaluating the redistribution of supply chains and reconsidering their total cost of ownership models. This reconfiguration has directly influenced pricing strategies, compelling some vendors to absorb tariff-related expenses while others have opted to adjust subscription fees or seek alternative suppliers within allied trading partners to mitigate financial impacts.

For institutions leveraging on-premise deployments, heightened hardware costs have accelerated migration plans toward cloud-based platforms, effectively sidestepping the tariff burden on physical infrastructure. At the same time, software vendors are exerting renewed focus on optimizing efficiencies within their cloud operations and exploring strategic partnerships with domestic infrastructure providers. Collectively, these responses underscore the cumulative impact of the 2025 tariffs, which extend beyond import costs to shape procurement decisions, deployment architectures, and the broader competitive positioning within the mortgage and loan software ecosystem.

Unpacking Comprehensive Segmentation Dynamics to Illuminate How Diverse Software Modules and Deployment Models Address Varied Lender Requirements

Deep-diving into application-based segmentation reveals a multifaceted software ecosystem. Mortgage and loan platforms configured for Analytics And Reporting encompass capabilities ranging from performance analytics-enabling lenders to track key operational metrics-to risk analytics, which drive proactive portfolio surveillance. Origination modules have evolved to integrate automated underwriting engines, sophisticated credit scoring algorithms, and comprehensive document management suites that streamline borrower onboarding. Secondary Marketing components now support nuanced loan sales workflows, detailed portfolio management dashboards, and securitization analytics that enhance capital optimization. Equally, servicing solutions are designed with customer management portals, escrow management services, and automated payment processing engines to ensure consistent borrower engagement and regulatory compliance.

Examining the market through the lens of product type underscores divergent requirements between commercial and residential lending. Commercial mortgage platforms must support diverse asset classes-including industrial properties, multifamily units, office buildings, and retail portfolios-each with bespoke underwriting and covenant management demands. Conversely, residential mortgage software prioritizes features such as adjustable rate mortgage calculations, fixed rate amortization schedules, and reverse mortgage compliance, reflecting the nuanced lifecycle intricacies of consumer lending.

Deployment-based segmentation highlights the strategic choice between cloud-based models-valued for their elasticity and operational cost efficiencies-and on-premise solutions, which continue to appeal for institutions with stringent data residency and governance mandates. Finally, end-user analysis demonstrates that banks, brokers, credit unions, mortgage banks, and online lenders each engage with software platforms differently, with variances in customization needs, integration complexities, and support requirements. This layered segmentation framework provides a holistic perspective on how distinct market segments drive feature development and vendor positioning within the broader mortgage software landscape.

This comprehensive research report categorizes the Mortgage & Loans Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Deployment

- End User

Revealing Distinct Regional Adoption Patterns and Regulatory Drivers Shaping Mortgage Software Strategies Across Key Global Markets

Regional analysis underscores pronounced divergences in adoption trajectories and regulatory environments. In the Americas, leading banks and nonbank lenders have accelerated digital transformations, with mobile-first borrower portals and AI-driven underwriting gaining widespread traction. Latin American markets are gradually embracing cloud deployments, though they remain cautious around data sovereignty and cross-border flow regulations. Conversely, Europe, Middle East & Africa present a mosaic of regulatory frameworks, from the stringent data privacy and capital requirements of the European Union’s guidelines to emerging markets in the Middle East where digital mortgage platforms are nascent but show strong growth potential. In North Africa, local financial authorities are actively piloting e-lending initiatives to broaden financial inclusion, indicating a forward-looking regulatory posture that will shape software demand.

Across the Asia-Pacific region, diverse maturity levels yield distinct patterns: developed economies like Australia and Japan focus on integrating blockchain for collateral traceability and digital identity verification, while Southeast Asian markets are prioritizing mobile wallet integration and real-time credit scoring to serve underbanked populations. India’s expanding digital infrastructure has fueled partnerships between software vendors and government-backed credit bureaus, facilitating faster loan disbursals. Meanwhile, China’s tightly regulated financial ecosystem emphasizes domestic technology standards and localized compliance modules. These regional nuances drive product feature roadmaps, deployment preferences, and vendor alliances, highlighting the imperative for software providers to tailor their offerings to the specific regulatory and operational contexts of each sub-region.

This comprehensive research report examines key regions that drive the evolution of the Mortgage & Loans Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Maneuvers and Collaborations That Define Leadership in the Dynamic Mortgage Software Vendor Ecosystem

Key players in the mortgage and loan software arena are investing heavily to secure leadership positions through platform enhancements, strategic alliances, and geographic expansion. Leading incumbents have leveraged their established customer bases to introduce AI-powered underwriting modules and omnichannel servicing portals, aiming to increase wallet share within existing accounts. At the same time, fintech-focused software providers have differentiated themselves via cloud-native architectures and open API frameworks, enabling rapid integrations with third-party origination channels and digital broker networks.

Collaborations between core mortgage vendors and specialized analytics firms are on the rise, reflecting a broader industry shift toward embedded intelligence within loan management workflows. Additionally, strategic partnerships between software providers and national regulatory bodies are emerging, particularly in markets where standardization of data formats and reporting requirements is still evolving. Smaller, niche-oriented companies are capitalizing on underserved segments-such as community credit unions and online lending marketplaces-by offering preconfigured compliance packages and streamlined customer experiences. This competitive tapestry underscores a multi-tiered market structure, where innovation, adaptability, and partnership models are key determinants of vendor success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mortgage & Loans Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Systems Inc.

- ArivuSoft Inc.

- Black Knight Inc.

- Byte Software

- Calyx Software

- Cloudvirga Inc.

- Credit Plus Inc.

- Ellie Mae Inc.

- Finastra Limited

- Fiserv Inc.

- ICE Mortgage Technology

- LendingQB

- MeridianLink Inc.

- Mortgage Automator

- Mortgage Builder Software

- Mortgage Cadence LLC

- Mortgage Coach

- MortgageFlex Systems Inc.

- Optimal Blue LLC

- SimpleNexus LLC

- Wipro Gallagher Solutions

Proactive Strategies and Technology Roadmaps That Enable Mortgage Providers to Thrive Amid Rapidly Changing Market and Regulatory Environments

Industry leaders should prioritize the acceleration of cloud migration roadmaps to capitalize on the operational efficiencies and innovation cadence enabled by microservices and containerization. Decision makers must undertake comprehensive portfolio audits to identify legacy modules that can be sunsetted in favor of agile, API-driven platforms. Embracing modular product architectures will facilitate incremental feature rollouts, reducing implementation risks and aligning investments with evolving borrower expectations.

Furthermore, institutions should deepen partnerships with analytics and data science specialists to embed predictive models that optimize credit adjudication and early-stage delinquency interventions. Establishing Centers of Excellence for digital underwriting and customer engagement will foster cross-functional collaboration, enabling continuous improvement in borrower experience and operational resilience. In parallel, proactive engagement with regulatory sandboxes and industry consortia will ensure that compliance requirements are anticipated and incorporated into product roadmaps. By adopting a venture-building mindset-staffing dedicated teams to pilot emerging technologies such as blockchain-based collateral registries and AI-driven identity verification-organizations can maintain a forward-leaning posture and safeguard against disruptive entrants.

Comprehensive Methodological Framework Integrating Primary Interviews Quantitative Analytics and Regional Validation Workshops to Ensure Robust Findings

This research report synthesizes qualitative and quantitative insights derived from a multifaceted methodology. Primary interviews were conducted with senior executives across top-tier banks, nonbank lenders, and technology vendors to capture firsthand perspectives on strategic imperatives and technology adoption barriers. Secondary research encompassed an extensive review of industry regulations, white papers, and academic journals to validate findings and benchmark best practices. Additionally, detailed case studies of leading implementations provided practical illustrations of successful digital transformations.

Quantitative data was aggregated from proprietary transaction databases, technology spend audits, and anonymized usage metrics to chart adoption trajectories. Segmentation analyses leveraged vendor solution portfolios and client deployment data to map feature sets across application, product type, deployment, and end-user axes. Regional intelligence was enriched through engagements with local chapters of regulatory bodies and market research firms to ensure contextual accuracy. Finally, rigorous validation workshops with industry thought leaders and technology partners refined the report’s conclusions, guaranteeing that recommendations are both actionable and aligned with real-world imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mortgage & Loans Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mortgage & Loans Software Market, by Application

- Mortgage & Loans Software Market, by Product Type

- Mortgage & Loans Software Market, by Deployment

- Mortgage & Loans Software Market, by End User

- Mortgage & Loans Software Market, by Region

- Mortgage & Loans Software Market, by Group

- Mortgage & Loans Software Market, by Country

- United States Mortgage & Loans Software Market

- China Mortgage & Loans Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Observations on the Imperative for Agility Data-Centric Workflows and Strategic Collaboration to Secure Competitive Advantage in Mortgage Software Market

The mortgage and loan software market is unequivocally entering an era defined by digital agility, data-driven decision making, and heightened regulatory scrutiny. Vendors and lenders alike must embrace modular, API-first platforms to navigate the complexities of cross-border data flows, tariff-induced cost pressures, and evolving borrower expectations for seamless, omnichannel experiences. Strategic partnerships-both with analytics specialists and regulatory consortia-will be instrumental in driving product roadmaps and ensuring compliance fidelity.

As software solutions continue to embed artificial intelligence within core workflows, institutions that cultivate internal capabilities in data science and digital transformation will outpace competitors. Cloud-native architectures have proven their resilience, scalability, and cost benefits, reinforcing the imperative for accelerated migration strategies. Ultimately, success in this dynamic landscape will hinge on an organization’s ability to orchestrate technology, process, and people in a cohesive, forward-looking framework. By heeding the insights and recommendations detailed in this report, mortgage providers can forge a path toward sustainable operational excellence and enhanced borrower satisfaction.

Empower Your Business Growth with Personalized Consultation from Ketan Rohom to Unlock In-Depth Mortgage Software Market Insights

Engaging with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) ensures that decision makers receive tailored guidance on integrating the comprehensive insights contained within this report into their strategic initiatives. By partnering directly with Ketan Rohom, stakeholders gain access to personalized consultations that translate complex market dynamics into actionable growth pathways. Taking this next step will equip your organization with a clear roadmap for harnessing modernization opportunities, addressing emerging regulatory challenges, and outpacing competitors in an increasingly competitive landscape. Reach out today to secure your copy of the full market research report and begin leveraging these critical findings to drive tangible business outcomes.

- How big is the Mortgage & Loans Software Market?

- What is the Mortgage & Loans Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?