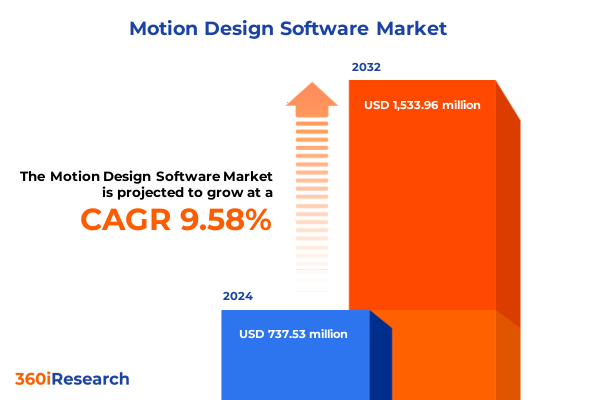

The Motion Design Software Market size was estimated at USD 807.72 million in 2025 and expected to reach USD 891.20 million in 2026, at a CAGR of 9.59% to reach USD 1,533.96 million by 2032.

Unveiling the Core Dynamics and Emerging Forces Shaping the Motion Design Software Landscape for 2025 and Beyond with Strategic Perspectives on Market Evolution

The motion design software sphere stands at the forefront of digital innovation, enabling organizations to captivate audiences through dynamic visual storytelling. As content consumption patterns shift toward immersive and interactive experiences, designers and marketers alike are seeking advanced tools that streamline complex workflows without compromising creative flexibility. The confluence of accelerating digital transformation initiatives, expanding social media channels, and burgeoning demand for high-quality video content has driven sustained interest in platforms that deliver both technical robustness and intuitive interfaces.

Against this backdrop, the current executive summary unpacks the critical drivers steering market evolution and contextualizes how emerging technologies are redefining user expectations. It synthesizes the essential market forces-from the democratization of creative tools and heightened emphasis on remote collaboration to the rise of cloud-native architectures-providing leaders with a coherent narrative for informed decision-making. This foundational overview primes stakeholders to explore deeper analyses of transformative trends, tariff impacts, segmentation dynamics, and region-specific developments shaping the future of motion design software.

Examining Pivotal Technological Developments and Shifts Reshaping the Motion Design Software Ecosystem in Response to AI, Cloud, and User Expectations

Recent years have witnessed an unprecedented weaving of artificial intelligence capabilities into motion design workflows, fundamentally altering the production paradigm. From generative animation assistants that auto-complete keyframes to AI-driven asset libraries that adapt to brand guidelines in real time, developers are equipping creative teams with tools that substantially accelerate output cycles. Concurrently, the migration toward cloud architectures is democratizing access by enabling seamless collaboration, version control, and resource scaling-removing the hardware bottlenecks that once constrained intricate rendering tasks.

Moreover, the proliferation of mobile and web-based editors has ushered in a new era of accessibility, allowing stakeholders beyond specialist studios to participate in content creation. This shift is complemented by the integration of real-time rendering engines, AR/VR preview environments, and native support for emerging formats such as 3D ads and interactive videos. As a result, user expectations have evolved toward platforms that offer intuitive interfaces, single-pane workflows, and extensible ecosystems that interoperate with complementary design and analytics tools. Taken together, these transformative shifts underscore the imperative for software providers to continuously innovate at the intersection of AI, cloud, and cross-platform user experiences.

Analyzing the Cumulative Impact of United States Tariffs Enacted Through 2025 on Accessibility, Cost Structures, and Adoption Patterns in Motion Design Software

Throughout 2025, a series of tariff adjustments imposed by the United States government have reverberated across technology supply chains, indirectly impacting the motion design software sector. While the software itself is inherently digital, its efficacy often depends on high-performance computing hardware, graphic processing units, specialized peripherals, and cloud infrastructure components that are sourced globally. Tariffs targeting imported hardware have led to incremental cost increases for GPUs and workstations, influencing capital expenditure decisions within design firms.

In turn, these elevated hardware costs have exerted pressure on pricing models, prompting some software vendors to accelerate the transition from perpetual licensing to subscription frameworks that bundle cloud compute credits. This strategic pivot mitigates the need for heavy upfront investments in workstations, instead distributing total cost of ownership across predictable recurring fees. Simultaneously, enterprises have begun exploring hybrid deployment strategies, combining on-premise rendering farms with cloud-burst capabilities to maintain performance while containing tariff-induced expenses.

To navigate this environment, market participants are adopting proactive measures: negotiating bulk purchasing agreements with hardware resellers, exploring domestic manufacturing partnerships, and investing in software-only enhancements that reduce reliance on specialized peripherals. These adaptive strategies demonstrate resilience, ensuring that creative teams can continue to push the boundaries of motion design without compromising budgetary constraints, even as tariff policies evolve.

Deriving Actionable Intelligence from Market Segmentation Across Component Types, Deployment Models, Applications, End Users, Enterprise Size, and Licensing Models

Insight into component segmentation reveals a clear bifurcation between services and solutions, each presenting unique value propositions. Consulting and training engagements have emerged as critical enablers, guiding organizations through complex software ecosystems and maximizing return on investment. Providers that offer tailored workshops and certification programs complement robust solutions such as animated explainer builders, cinemagraph creators, and advanced motion graphics suites, thereby fostering deeper customer relationships and reducing churn.

Deployment models further differentiate vendor offerings. Cloud-native platforms dominate new client acquisitions by offering frictionless onboarding, continuous feature delivery, and elastic compute resources. In contrast, on-premise implementations remain prevalent in highly regulated industries and large enterprises with strict data sovereignty requirements. This duality underscores the importance of modular architectures that can seamlessly transition workloads between private data centers and public clouds in response to evolving security and performance imperatives.

Application segmentation illuminates the rich tapestry of end-use scenarios. In the advertising and marketing domain, solutions are fine-tuned to support digital campaigns, social media narratives, and traditional broadcast spots, delivering tailored workflows for each sub-use case. Educational institutions leverage e-learning modules and interactive presentations to enhance learner engagement, while film and television studios capitalize on animation, post-production, and visual effects pipelines optimized for cinematic quality. Gaming companies, meanwhile, integrate game and in-user cinematics alongside UI animation tools to craft immersive player experiences.

End-user segmentation emphasizes how different organizational types harness motion design capabilities. From boutique and global advertising agencies to higher education and K-12 institutions, the spectrum of use cases is vast. Healthcare organizations utilize animated medical device demos and hospital training modules, while broadcasters, film studios, and streaming platforms demand advanced VFX and post-production features. Retail brands, both in brick-and-mortar storefronts and e-commerce channels, employ motion graphics to elevate product storytelling. Finally, enterprise size and licensing models influence purchasing behaviors, with large organizations often favoring perpetual licenses and on-premise deployments, while small and medium enterprises gravitate toward subscription-based, cloud-hosted solutions to minimize upfront investment.

This comprehensive research report categorizes the Motion Design Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Enterprise Size

- Licensing Model

- Application

- End User

Uncovering Regional Nuances and Growth Catalysts in the Motion Design Software Market Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics reveal distinct growth trajectories and adoption patterns across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, the convergence of a mature digital marketing ecosystem and robust media production infrastructure has fueled early adoption of sophisticated motion design platforms. Major entertainment hubs and gaming studios in North America drive demand for seamless integration between design tools and high-performance rendering pipelines, while Latin American agencies are rapidly embracing cloud-based editors to serve burgeoning digital advertising needs.

Across Europe, Middle East, and Africa, Western Europe maintains a competitive edge through deep investments in creative industries and a strong emphasis on standards compliance. German and UK agencies prioritize interoperability with enterprise resource planning and digital asset management systems, whereas emerging markets in the Middle East and Africa are leveraging mobile-first motion graphics solutions to engage rapidly growing online audiences. Asia Pacific showcases some of the fastest adoption rates, driven by dynamic e-commerce growth in China and India, proliferating mobile video consumption, and the gaming powerhouse of Japan and South Korea. In the region, localized feature sets-such as support for non-Latin scripts and regional content templates-underscore vendors’ commitment to market specificity.

This comprehensive research report examines key regions that drive the evolution of the Motion Design Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of Motion Design Software Solutions Worldwide

The competitive landscape is shaped by a blend of entrenched incumbents and nimble challengers. Established industry titans offer comprehensive suites with end-to-end workflows, extensive third-party integrations, and global support networks. These providers continue to expand their portfolios through strategic acquisitions, deepening their foothold in adjacent spaces such as video editing, 3D modeling, and digital asset management. In contrast, emerging vendors specialize in lightweight, vertical-focused applications that target specific use cases-from social media animation generators to real-time collaborative platforms built around browser-native technologies.

A growing number of companies are differentiating themselves through advanced AI modules that automate repetitive tasks, generate context-aware motion presets, and facilitate generative design explorations. Partnerships between platform developers and hardware manufacturers are also reshaping product roadmaps, ensuring optimized performance on next-generation GPUs and accelerated encoding chips. Additionally, open-source communities and plugin ecosystems play a pivotal role in driving innovation, as they foster rapid prototyping and enable third parties to contribute specialized effects, transition libraries, and automation scripts that extend core functionality.

Investment activity underscores the sector’s vibrancy: venture capital firms and strategic buyers continue to back startups that address niche requirements, ranging from 3D character animation to voice-driven storyboard generation. These capital infusions are fueling a wave of product launches characterized by lower barriers to entry, transparent pricing, and flexible consumption models that cater to freelancers and small creative teams. As the market matures, collaboration between larger incumbents and high-growth innovators will be instrumental in shaping the next generation of motion design software offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motion Design Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alight Motion

- Apple Inc.

- Autodesk, Inc.

- Blackmagic Design Pty. Ltd.

- Boris FX, Inc.

- CAVALRY

- FlexClip

- Friction

- Jawset Postshot

- Jitter

- Linearity

- Maxon Computer GmbH by Nemetschek Group

- Powtoon.com, Inc.

- Rive, Inc.

- SideFX

- Trapcode AB

- Unreal Engine by Epic Games

- Vizrt

Empowering Industry Leaders with Strategic Roadmaps and Best Practices to Navigate Complexity and Capitalize on Emerging Opportunities in Motion Design Software

To maintain a competitive edge, industry leaders must prioritize the integration of intelligent automation capabilities that reduce manual intervention and accelerate creative ideation. Investing in machine learning pipelines-capable of analyzing project metadata to suggest composition enhancements or asset optimizations-will streamline workflows and free up designers to focus on higher-order creative challenges. Alongside this, a robust cloud collaboration framework that supports real-time co-editing, share links, and granular permission controls will become a baseline requirement for distributed teams.

Building a comprehensive services ecosystem is equally critical. Vendors should expand their consulting and training offerings with on-demand tutorials, immersive workshops, and certification programs that drive user proficiency and foster brand advocacy. Tailored educational resources not only enhance client retention but also create upsell pathways for advanced modules and add-on services. In parallel, providers must diversify deployment footprints to accommodate hybrid and on-premise scenarios, ensuring that organizations with stringent security policies can seamlessly adopt new releases without compromising compliance.

Finally, establishing strategic partnerships with hardware manufacturers, cloud providers, and content distributors will fortify product roadmaps and unlock synergistic go-to-market opportunities. Collaborations that embed optimized render engines into emerging GPU architectures or that integrate motion assets directly into streaming platforms can accelerate time to market while enhancing end-user experiences. By aligning product development with evolving industry standards and cross-sector trends, software companies can capture new revenue streams and solidify their positions as indispensable enablers of visual storytelling.

Outlining Rigorous Research Methodologies Integrating Primary and Secondary Insights to Ensure Validity and Depth in Motion Design Software Market Analysis

This analysis is grounded in a blend of primary and secondary research approaches designed to ensure both breadth and depth of insights. Primary data collection encompassed in-depth interviews with creative directors, IT decision-makers, and software architects across multiple regions. These qualitative discussions were augmented by structured surveys of practitioners spanning advertising agencies, media studios, educational institutions, and gaming companies, yielding nuanced perspectives on functionality priorities and adoption barriers.

Secondary research drew upon a review of public financial disclosures, technology trend reports, industry white papers, and relevant patent filings. Market intelligence was triangulated by cross-referencing vendor roadmaps, customer case studies, and open data sources to validate emerging patterns. Quantitative data points were subjected to rigorous cleaning and consistency checks, while qualitative feedback was coded thematically to identify recurring pain points and innovation drivers. This multifaceted methodology underpins the credibility of the strategic insights and ensures that the findings resonate with both domain experts and executive stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motion Design Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motion Design Software Market, by Component

- Motion Design Software Market, by Deployment

- Motion Design Software Market, by Enterprise Size

- Motion Design Software Market, by Licensing Model

- Motion Design Software Market, by Application

- Motion Design Software Market, by End User

- Motion Design Software Market, by Region

- Motion Design Software Market, by Group

- Motion Design Software Market, by Country

- United States Motion Design Software Market

- China Motion Design Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Strategic Implications to Illuminate Future Pathways for Stakeholders in the Motion Design Software Ecosystem

The converging trajectories of AI-augmented creative engines, cloud-native collaboration frameworks, and user-centric interface innovations signal a transformative chapter for motion design software. As tariffs reshape the economics of hardware-dependent workflows, the shift toward subscription-based, cloud-oriented models will further democratize access and foster greater platform agility. Strategic segmentation insights highlight opportunities for targeted solutions, whether catering to specialized advertising agencies, educational providers, film and gaming studios, or healthcare and retail enterprises.

Regionally distinct growth catalysts-rooted in mature media ecosystems, emerging mobile video markets, and diverse regulatory landscapes-underscore the need for localization and flexible deployment strategies. The competitive landscape, rich with both established incumbents and agile startups, places a premium on continuous innovation, strategic alliances, and a robust services framework. Ultimately, organizations that harness these insights and align investments with evolving user expectations will be best positioned to craft compelling visual narratives and sustain growth in an increasingly dynamic market.

Connect with Ketan Rohom to Secure Exclusive Access to the Comprehensive Market Research Report on Motion Design Software and Drive Your Strategic Advantage

For tailored insights and to secure comprehensive access to the detailed market research report on motion design software, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will enable stakeholders to explore customized data packages, in-depth segment analyses, and exclusive strategic add-ons designed to meet organizational objectives.

By connecting with Ketan Rohom, decision-makers can leverage early access benefits, priority briefing sessions, and special engagement opportunities that translate research insights into actionable strategies. Act now to equip your teams with the competitive intelligence necessary to excel in the rapidly evolving motion design software landscape.

- How big is the Motion Design Software Market?

- What is the Motion Design Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?