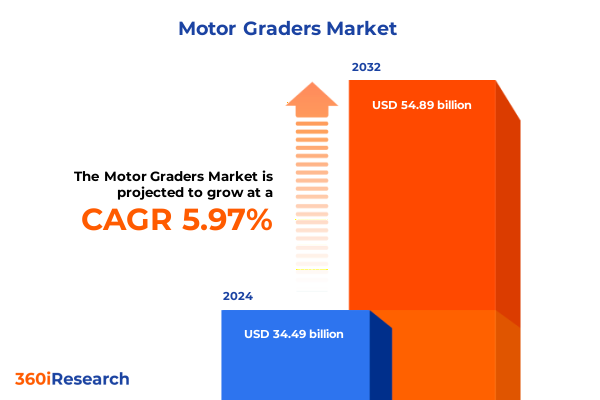

The Motor Graders Market size was estimated at USD 36.56 billion in 2025 and expected to reach USD 38.80 billion in 2026, at a CAGR of 5.97% to reach USD 54.89 billion by 2032.

Exploring the dynamic market forces and technological advancements shaping the contemporary motor grader landscape in modern construction environments

The motor grader industry stands at a pivotal juncture characterized by a confluence of technological innovations, shifting end user requirements and evolving regulatory landscapes. With infrastructure investment priorities intensifying globally, the need for precise earthmoving and surface preparation machinery has surged, driving renewed attention on motor grader capabilities. Leading manufacturers continue to push the envelope through advanced machine control systems, telematics integration and powertrain electrification, setting new benchmarks for operational efficiency and environmental performance.

Furthermore, the landscape is being reshaped by a growing emphasis on sustainability, digitalization and workforce safety. Autonomous features and remote monitoring capabilities are no longer futuristic concepts but rapidly adopted functionalities that deliver tangible productivity gains and cost reductions. At the same time, stringent emissions standards demand cleaner engine solutions, prompting deeper investments in alternative fuels and electrified powertrains. These combined forces create a dynamic environment in which industry stakeholders must adapt quickly to maintain competitive advantage and meet the precise demands of modern construction and mining applications.

Unveiling the pivotal shifts in electrification, autonomy, and sustainability redefining performance metrics and operational efficiency for motor graders

Over the past few years, the motor grader sector has undergone transformative shifts driven by advancements in digital integration, electrification and autonomy. Machine control systems equipped with high-precision GPS guidance and three-dimensional terrain modeling have become standard offerings, enhancing grading accuracy and reducing rework cycles. Simultaneously, telematics platforms provide real-time performance monitoring, enabling predictive maintenance strategies that minimize unplanned downtime and extend machine lifecycle value.

Analyzing the multifaceted repercussions of United States tariffs on motor grader supply chains, pricing structures and cross-border equipment flows in 2025

The imposition of new United States tariffs in early 2025 has reverberated across motor grader supply chains, influencing component sourcing, manufacturing footprints and import pricing structures. Equipment originally sourced from key international suppliers now faces elevated duty burdens, prompting OEMs to explore localized production alternatives and negotiate revised commercial agreements to mitigate cost escalation.

Discovering how nuanced segmentation by type, engine power, application categories and end user profiles illuminates distinct market dynamics for motor graders

Delving into market segmentation reveals distinct demand patterns shaped by machine configuration, engine capacity, application environments and end user profiles. The differentiation between crawler and wheel-type motor graders underscores a performance-versus-mobility trade-off, with crawler models favored for uneven terrain and steep gradients while wheel variants excel in road finishing and highway applications. Engine power categories further stratify requirements, where sub-125 horsepower units meet light-duty tasks and precise landscaping needs, whereas mid-range models between 125 and 175 horsepower deliver balanced productivity for municipal and contractor fleets, and high-power machines exceeding 175 horsepower tackle heavy earthmoving in expansive infrastructure and mining operations.

Application-based segmentation provides deeper insight into end market drivers. Agricultural grading processes demand machines with robust torque delivery for field preparation, while mining operations-whether surface or underground-prioritize resilience against abrasive conditions and stringent safety protocols. Meanwhile, road construction segments such as earthmoving and paving integration highlight the necessity for machines that can transition seamlessly between rough cut-and-fill grading and fine surface leveling. Finally, end user analysis differentiates between heavy construction conglomerates seeking comprehensive fleet solutions, landscaping enterprises requiring precise and compact grading capabilities and road maintenance authorities focused on rapid response and operational flexibility.

This comprehensive research report categorizes the Motor Graders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Engine Power

- Application

- End User

Examining regional trends across Americas, EMEA and Asia-Pacific to uncover pivotal drivers, infrastructure demands and growth opportunities for motor graders

Regional insights paint a varied picture of motor grader adoption across the Americas, EMEA and Asia-Pacific zones. In the Americas, robust infrastructure spending, highway rehabilitation projects and municipal development programs drive demand for versatile wheel graders with advanced control systems. The presence of established local manufacturing hubs also provides competitive pricing and aftersales support ecosystems that bolster market penetration.

Within EMEA, regulatory pressures for lower emissions and noise reduction propel adoption of stage V compliant engines and hybrid powertrain solutions. Public–private partnerships in Europe’s road network expansions and large-scale mining operations in Africa further shape equipment specifications, with greater interest in resilient crawler models that can handle challenging terrains and ensure operator safety in remote locations.

Asia-Pacific exhibits the fastest pace of growth, fueled by rapid urbanization, extensive highway construction programs and significant mining investments across Australia and Southeast Asia. Market participants in this region exhibit strong preference for high-horsepower wheel graders capable of maintaining high output rates on long-haul road projects, while emerging markets prioritize cost-effective, easy-to-maintain configurations that support local fleet operators.

This comprehensive research report examines key regions that drive the evolution of the Motor Graders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting industry leaders whose strategic alliances and technological breakthroughs are redefining competition across the global motor grader arena

Competitive analysis highlights a blend of legacy OEMs and agile newcomers competing across technology, service and pricing dimensions. Established global players continue to leverage brand reputation and comprehensive dealer networks to retain leadership, investing heavily in R&D to integrate AI-driven grading assistance and electrified powertrains that meet aggressive emissions targets. Concurrently, emerging equipment manufacturers are carving out specialized niches by offering modular machine designs, subscription-based telematics packages and flexible financing options that lower entry barriers for fleet operators.

Strategic alliances and joint ventures between component specialists and OEMs further intensify competition, enabling rapid co-development of next-generation drivetrain systems and advanced operator assistance technologies. As a result, the competitive arena is increasingly defined not only by hardware performance but also by digital service ecosystems and lifecycle support models that drive customer loyalty and recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motor Graders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BEML Limited

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Infracore Co., Ltd.

- Guangxi LiuGong Machinery Co., Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- Irmash LLC

- JCB Ltd.

- Komatsu Ltd.

- Mahindra & Mahindra Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Sakai Heavy Industries, Ltd.

- Sany Heavy Industry Co., Ltd.

- SDLG

- Shantui Construction Machinery Co., Ltd.

- Terex Corporation

- Volvo Construction Equipment

- XCMG Group Co., Ltd.

Crafting strategic pathways and operational best practices that industry leaders can adopt to capitalize on emerging opportunities in the motor grader market

To thrive amid these evolving market conditions, industry leaders must adopt a multifaceted strategy. Prioritizing investment in electrified and hybrid powertrain options will address stricter emissions regulations while unlocking new revenue from sustainability-focused infrastructure projects. Complementing this, expanding digital service platforms-encompassing predictive maintenance analytics and remote performance optimization-will enhance value propositions and enable deeper customer engagement.

Operationally, diversifying manufacturing footprints to adjacent regions can cushion tariff impacts and improve supply chain resilience. In parallel, cultivating partnerships with technology startups and academic research centers can accelerate innovation cycles, particularly in the areas of automation and human–machine interface design. Finally, recalibrating financing models to include outcome-based contracts and usage-based leasing can attract a broader spectrum of end users and solidify long-term market share growth.

Detailing the research framework integrating primary interviews, secondary data and rigorous validation techniques underlying this motor grader market analysis

This analysis is underpinned by a robust research methodology synthesizing qualitative and quantitative inputs. Primary data were gathered through structured interviews with equipment OEM executives, distribution partners and key end users spanning construction, agriculture and mining sectors. Complementary secondary research incorporated technical journals, industry white papers and regulatory filings to validate market drivers and technology trends.

Rigorous validation was achieved through cross-verification of interview insights against publicly available procurement records and equipment registration databases. Advanced analytical techniques, including gap analysis and scenario planning, were employed to ensure the reliability and relevance of conclusions drawn. This integrated framework guarantees that the findings accurately reflect current market realities and anticipate emerging shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motor Graders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motor Graders Market, by Type

- Motor Graders Market, by Engine Power

- Motor Graders Market, by Application

- Motor Graders Market, by End User

- Motor Graders Market, by Region

- Motor Graders Market, by Group

- Motor Graders Market, by Country

- United States Motor Graders Market

- China Motor Graders Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing critical insights while highlighting the strategic imperatives that will shape future trajectories and competitive advantage in motor grader sector

This executive summary has articulated the key forces shaping the motor grader landscape-from emerging technologies and tariff impacts to nuanced segmentation and regional dynamics. The synthesized insights underscore the urgency of embracing electrification, digitalization and strategic supply chain adjustments to secure competitive advantage. Furthermore, the analysis highlights that success in this market will depend on the ability to deliver holistic solutions encompassing hardware performance, digital services and flexible financing.

As the industry moves forward, stakeholders are encouraged to leverage the strategic imperatives identified here-ranging from targeted R&D investments and geographic diversification to collaborative innovation partnerships-to navigate the complex interplay of regulatory, technological and market factors. By doing so, organizations can position themselves at the forefront of the next wave of growth in the motor grader sector.

Engage with Ketan Rohom to access an in-depth motor grader market report featuring actionable insights, tailored analysis and strategic guidance

For organizations seeking unparalleled clarity and depth in navigating the complexities of the global motor grader market, engaging directly with Ketan Rohom will facilitate access to a meticulously crafted research report. This comprehensive deliverable synthesizes actionable insights drawn from primary industry interviews, secondary data evaluations and rigorous validation processes to support informed decision making.

By partnering with Ketan Rohom, stakeholders will benefit from tailored analysis that aligns with specific operational priorities, strategic objectives and emerging market dynamics. The report also includes customized strategic guidance designed to optimize technology adoption, regulatory compliance and competitive positioning.

Secure your copy today to unlock the full spectrum of market intelligence and strategic foresight needed to maintain a leadership edge in the evolving motor grader landscape

- How big is the Motor Graders Market?

- What is the Motor Graders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?