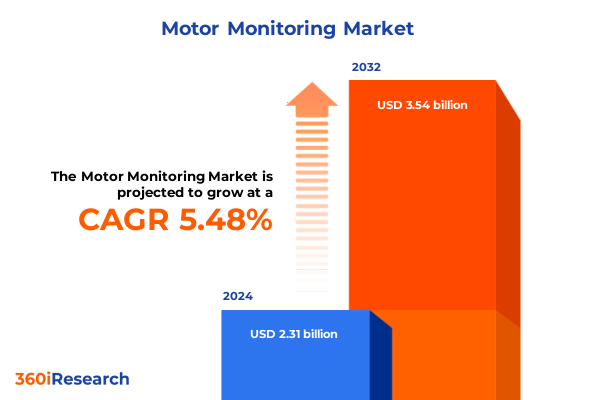

The Motor Monitoring Market size was estimated at USD 2.42 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 5.58% to reach USD 3.54 billion by 2032.

Setting the Stage for Advanced Motor Monitoring Solutions That Propel Reliability and Operational Excellence in Industrial Applications

Motor monitoring has evolved from a niche operational enhancement to a critical enabler of reliability and efficiency for mission-critical assets across diverse industries. In this era of digital transformation, understanding how sensors, analytics, and software platforms converge to deliver proactive maintenance is essential for business leaders seeking to minimize unplanned downtime and maximize asset lifespan. This introduction frames the core themes of our executive summary: the technological drivers, regulatory dynamics, and the segmentation nuances that inform strategic decision-making in motor monitoring.

By setting the context for advanced condition monitoring, this section underscores the importance of real-time insights into vibration, temperature, ultrasound, current, and other performance metrics. It also highlights how emerging IIoT architectures are reshaping traditional maintenance paradigms. As organizations transition from reactive to predictive and prescriptive maintenance, motor monitoring solutions are positioned at the intersection of operational resilience and digital innovation. The narrative that follows will guide readers through transformative shifts, regulatory headwinds, deep segmentation insights, and actionable recommendations to harness the full potential of these technologies.

Uncovering the Pivotal Technological and Operational Shifts Reshaping the Motor Monitoring Landscape for Enhanced Predictive Maintenance

The motor monitoring landscape is undergoing transformative shifts driven by the integration of artificial intelligence, edge computing, and expanded sensor modalities. AI-driven predictive maintenance systems now analyze vast streams of real-time data to identify subtle degradation patterns and forecast failures with unprecedented accuracy, reducing downtime and extending asset life significantly. Machine learning models are evolving from static, threshold-based alerts to self-optimizing algorithms that continuously refine their predictions based on fresh sensor inputs and contextual factors such as environmental conditions and historical maintenance records.

Edge computing has emerged as a pivotal enabler of faster decision-making by processing data at or near the source, thereby minimizing latency and reducing dependency on centralized cloud resources. This shift empowers maintenance teams to react to anomalies within milliseconds, which is critical in mission-critical operations where seconds can translate into substantial cost savings. Furthermore, the proliferation of wireless sensors has expanded deployment flexibility, enabling remote monitoring in previously inaccessible or hazardous environments. As businesses continue to prioritize digital resilience, the convergence of AI, edge architectures, and advanced sensor technologies is redefining the motor monitoring paradigm for the next decade.

Examining the Broad Cumulative Implications of 2025 United States Tariffs on Motor Monitoring Components and Supply Chains

Recent U.S. trade policy has introduced a baseline 10% tariff on all imports, alongside targeted duties on specific sectors, to promote domestic manufacturing and supply chain resilience. In parallel, a proposed 25% tariff on imported auto parts signaled by early May 2025 has raised alarms within the automotive supply chain, with industry associations warning of potential price hikes and reduced sales volume if these measures proceed. Together, these trade actions are reshaping procurement strategies and cost structures for motor monitoring components.

Tariffs on electronic components, including pressure, proximity, and current sensors, have triggered a 3–5% increase in production costs, thereby raising the price of critical hardware used in condition monitoring systems. Supply chain disruptions and higher landed costs have prompted some manufacturers to explore alternative sourcing or to accelerate reshoring efforts. For instance, major industrial automation firms have increased U.S. production capacity in Tennessee and Mississippi, channeling over $120 million into local facilities to mitigate tariff exposure and secure uninterrupted delivery of monitoring equipment.

Despite these headwinds, the broader trend toward domestic manufacturing presents opportunities for innovation in local R&D and tighter supplier collaboration. Companies that proactively adapt their supply chains, optimize component sourcing, and leverage government incentives for semiconductor production will be better positioned to navigate tariff volatility while supporting the continued adoption of motor monitoring technologies.

Unveiling In-Depth Segmentation Insights That Illuminate Strategic Opportunities Across Motor Monitoring Offerings, Techniques, and End-Use Industries

Deep segmentation analysis reveals the multifaceted nature of the motor monitoring ecosystem, which spans hardware sensors, software platforms, and services. Offering insights begin with hardware, where motor current, temperature, ultrasound, and vibration sensors form the foundational data-capture layer. Temperature sensing bifurcates into contact and non-contact technologies, while vibration monitoring further differentiates between wired and wireless solutions. Services, including aftermarket support, consulting, and integration, complement these physical assets, while software modules for diagnostics, performance management, and predictive analytics transform raw data into actionable intelligence.

Technique-based segmentation underscores the analytical methods that underpin condition monitoring. Acoustic analysis, current signature analysis, thermal imaging-both fixed and handheld-ultrasound systems, whether online or portable, and vibration analysis collectively form a toolkit tailored to specific failure modes. Motor type segmentation differentiates AC motors-both induction and synchronous-from DC motors, encompassing brushed and brushless variants. Deployment models range from cloud-enabled online monitoring to mobile, portable platforms, affording organizations the agility to adapt to on-premises constraints or leverage scalable remote infrastructures.

End-use segmentation highlights the cross-industry applicability of motor monitoring solutions. From automotive assembly lines and chemical processing plants to energy utilities, manufacturing facilities, and oil & gas operations, condition monitoring technologies deliver critical insights to enhance safety, compliance, and efficiency. Such granular segmentation allows solution providers and end-users alike to calibrate offerings and investments to the distinct requirements of each application environment.

This comprehensive research report categorizes the Motor Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technique

- Motor Type

- Deployment Type

- End Use

Decoding Key Regional Variations and Adoption Patterns That Shape the Global Motor Monitoring Ecosystem

Regional dynamics further inform strategic deployments of motor monitoring solutions. In the Americas, maturation of predictive maintenance practices is driving integration of multi-sensor platforms and cloud-native analytics, supported by robust 5G networks that enable real-time data flows across sprawling industrial campuses. North American refiners and manufacturers are particularly focused on reliability gains and total cost of ownership reductions, fueling investments in both hardware and software enhancements.

Europe, Middle East & Africa present a heterogeneous landscape where legacy infrastructure coexists with advanced Industry 4.0 pilot projects. Regulatory imperatives around energy efficiency and safety push demand for thermal imaging and ultrasound analysis, while digital twins and edge computing gain traction in process industries. In the Middle East, strategic oil & gas installations are leveraging centralized condition monitoring centers, whereas European machine shops favor wireless vibration sensors that facilitate flexible diagnostics.

Asia-Pacific leads in volume adoption, driven by rapid industrialization and government-backed smart manufacturing initiatives. Fixed and handheld thermal imaging devices are widely deployed in power generation, while ultrasonic and current signature techniques are increasingly standard in heavy manufacturing. The region’s cost-sensitive markets also embrace portable monitoring kits, democratizing access to predictive maintenance in small and medium-sized enterprises. Together, these regional insights underscore the need for tailored go-to-market strategies that align with local priorities and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Motor Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Pioneering Strategies and Innovations of Leading Providers in Motor Monitoring Technologies

A cadre of industry leaders has emerged at the forefront of motor monitoring innovation. ABB has integrated generative AI into its Genix Asset Performance Management Suite, unveiling the Genix APM Copilot to streamline contextualized data flows and offer role-based prescriptive insights for turbines, compressors, and drives. Siemens’ Senseye platform, enhanced with generative AI capabilities, achieves up to 50% reduction in unplanned downtime and supports a conversational maintenance interface that democratizes access to analytics across skill levels.

Emerson continues to unify its condition monitoring offerings under AMS Machine Works version 1.8, breaking down data silos and incorporating edge AI analytics for vibration, ultrasound, and route-based inputs within a single secure platform. Simultaneously, SKF is scaling its Enlight AI and Pulse solutions, pairing automated machine learning with robust sensor networks to deliver real-time anomaly detection and cloud-based remote diagnostics for thousands of rotating assets.

These leading companies are not only advancing sensor and analytics technologies but also forging partnerships, expanding local production capacities, and aligning service offerings with evolving customer requirements. Their strategic investments in R&D, M&A, and ecosystem collaboration set a high bar for competitors and underscore the rapid pace of innovation in motor monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motor Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Danaher Corporation

- Emerson Electric Co.

- Fortive Corporation

- General Electric Company

- Honeywell International Inc.

- National Instruments Corporation

- Nidec Corporation

- Rockwell Automation Inc.

- Siemens AG

- SKF AB

- WEG Electric Corp.

Deploying Actionable Strategic Imperatives That Drive Operational Resilience and Innovation in Motor Monitoring Programs

To capitalize on the momentum in motor monitoring, industry leaders should adopt a multi-pronged strategy that balances technological innovation with operational pragmatism. Investment in edge computing architectures will ensure rapid anomaly detection while reducing data-transfer latency and cybersecurity exposure. Concurrently, organizations must cultivate AI and data science expertise, either in house or through strategic partnerships, to translate sensor data into prescriptive maintenance directives.

Supply chain resilience requires diversified sourcing strategies, including near-shoring critical sensor manufacturing and qualifying secondary suppliers for semiconductor and rare-earth components. Proactive engagement with policymakers and trade associations can also influence tariff dialogues and ensure that industry needs are represented. Similarly, standardizing on modular software platforms with open APIs will facilitate seamless integration across enterprise asset management, ERP, and digital twin solutions.

Finally, embedding condition monitoring best practices within organizational processes-through targeted training, collaborative workshops, and cross-functional governance-will amplify ROI. By aligning maintenance, operations, and IT leadership around shared KPIs for uptime, safety, and cost reduction, companies can cultivate a culture of continuous improvement and sustain competitive advantages in an increasingly data-driven industrial landscape.

Detailing the Comprehensive Hybrid Research Methodology That Underpins Our Motor Monitoring Market Study

This research integrates both primary and secondary methodologies to deliver comprehensive insights into the motor monitoring landscape. Secondary research involved extensive review of industry publications, regulatory filings, company reports, and trade association databases to capture macro-economic trends, tariff policy developments, and emerging technology trajectories. Key data points were triangulated across multiple reputable sources to ensure accuracy and objectivity.

Primary research included in-depth interviews with senior executives, field technicians, system integrators, and end-users across automotive, energy, manufacturing, and oil & gas sectors. These qualitative dialogues provided first-hand perspectives on solution performance, deployment hurdles, and value realization. Quantitative surveys were deployed to over 150 organizations to validate adoption rates, technology preferences, and investment priorities.

An econometric model was constructed to map the interdependencies of tariff effects, sensor adoption, and cost-benefit analyses. Segmentation frameworks were rigorously tested through pilot case studies, while regional adoption patterns were benchmarked using proprietary market intelligence platforms. This hybrid approach ensured that findings are both data-driven and enriched by practical experience.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motor Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motor Monitoring Market, by Offering

- Motor Monitoring Market, by Technique

- Motor Monitoring Market, by Motor Type

- Motor Monitoring Market, by Deployment Type

- Motor Monitoring Market, by End Use

- Motor Monitoring Market, by Region

- Motor Monitoring Market, by Group

- Motor Monitoring Market, by Country

- United States Motor Monitoring Market

- China Motor Monitoring Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Key Insights Demonstrating How Sensor Innovation, Policy Shifts, and Strategic Actions Converge to Shape Motor Monitoring Success

Motor monitoring has emerged as a linchpin for operational excellence, harnessing innovations in sensors, AI, and edge computing to transform maintenance from a reactive necessity into a strategic capability. The cumulative effects of U.S. tariff adjustments, accelerating IIoT adoption, and evolving industry segmentation underscore the dynamic interplay between policy, technology, and market demand. As global players continue to refine their sensor portfolios, software suites, and service offerings, the industry stands at a critical juncture where strategic alignment will determine market leadership.

Organizations that proactively integrate advanced analytics, diversify supply chains, and tailor solutions to regional nuances will secure robust competitive positions. Meanwhile, solution providers who invest in generative AI, open-architecture platforms, and extensive partner ecosystems will shape future innovation waves. This conclusion underscores the imperative for decision-makers to leverage the insights presented herein to inform investment, procurement, and partnership strategies in motor monitoring.

Empower Your Strategic Vision with Direct Access to a Comprehensive Motor Monitoring Market Research Report through Personalized Consultation

Are you ready to leverage comprehensive insights and strategic guidance tailored to your organization’s motor monitoring initiatives? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive copy of the complete market research report. By partnering directly with Ketan, you will gain access to bespoke analyses, an interactive executive briefing, and priority updates on emerging trends and tariff developments. Engage now to drive innovation, optimize maintenance strategies, and solidify your competitive advantage in an increasingly dynamic industrial environment. Don’t miss the opportunity to inform your next strategic decision with depth, clarity, and authority from our dedicated research and advisory team; connect with Ketan Rohom today and unlock the full potential of motor monitoring technologies.

- How big is the Motor Monitoring Market?

- What is the Motor Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?