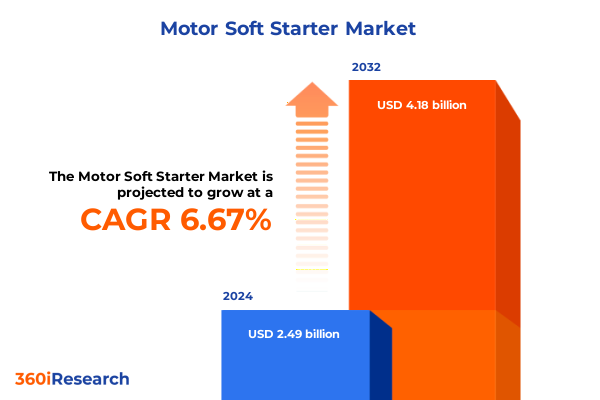

The Motor Soft Starter Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.83 billion in 2026, at a CAGR of 6.69% to reach USD 4.18 billion by 2032.

Navigating the Evolving Motor Soft Starter Market Dynamics Amid Rampant Digitalization, Stricter Efficiency Mandates, and Shifting Industrial Demands

Motor soft starters play a pivotal role in modern industrial operations by seamlessly controlling the electrical surge experienced during motor startup, thereby extending equipment lifespan and optimizing energy consumption. As manufacturing processes become increasingly automated, the need for precise, reliable, and efficient motor control solutions has never been greater. With regulatory bodies worldwide raising energy efficiency standards and end users demanding smarter, more connected industrial assets, soft starters have evolved well beyond basic current-limiting devices.

In recent years, the advent of digitalization and Industry 4.0 has introduced transformative capabilities to soft starter systems, including real-time analytics, remote diagnostics, and adaptive load management. These innovations are reshaping the competitive landscape, compelling manufacturers to integrate advanced electronics, communication protocols, and intuitive user interfaces into their product lines. Furthermore, growing emphasis on sustainability has driven procurement teams to prioritize solutions that reduce carbon footprints while delivering cost savings through decreased energy usage and predictive maintenance strategies.

Against this backdrop of technological evolution and tightening regulations, stakeholders across utilities, oil and gas, pharmaceuticals, and other capital-intensive industries are reassessing their motor control architectures. Suppliers must not only demonstrate technical excellence but also craft holistic value propositions encompassing lifecycle services, digital platforms, and modular offerings. This introduction sets the stage for a comprehensive examination of the trends, forces, and insights defining the motor soft starter market in 2025 and beyond.

Examining the Transformative Technological, Regulatory, and Geopolitical Supply Chain Shifts Reshaping the Global Motor Soft Starter Industry Landscape

The motor soft starter industry is experiencing a profound shift driven by converging forces across technology, regulation, and geopolitics. Technologically, the integration of Internet of Things frameworks with soft starter platforms enables remote monitoring and advanced analytics, allowing operators to predict component wear, optimize performance, and reduce downtime. Power semiconductor advancements, including insulated-gate bipolar transistors and silicon carbide components, offer higher switching speeds and thermal resilience, fostering more compact and efficient designs.

Simultaneously, regulatory bodies have heightened their focus on energy consumption and grid stability. Stricter efficiency standards-ranging from IE3 mandates for low-voltage motors to future guidelines targeting grid-responsive devices-are compelling manufacturers to innovate both hardware and embedded software. In tandem, initiatives to decarbonize industrial operations are elevating the importance of solutions capable of dynamically optimizing motor torque curves and minimizing reactive power draw.

On the geopolitical front, supply chain resilience has emerged as a strategic imperative. Manufacturers are reevaluating sourcing strategies to mitigate risks associated with single-origin dependencies, while major markets are promoting localization through incentives and procurement policies. Combined with burgeoning demand for electrification in emerging economies, these shifts are redrawing traditional trade flows and forging new competitive battlegrounds. Moving forward, companies that can swiftly adapt to these dynamic forces while delivering robust, connected, and compliant soft starter solutions will secure the greatest market traction.

Uncovering the Cumulative Economic and Operational Impact of New and Existing United States Tariffs on Motor Soft Starters in 2025

In 2025, U.S. trade policy continues to impose significant cost pressures on imported motor soft starters and their constituent components. The 25% duties under Section 301 remain in force against electronic control modules and semiconductor-based power devices originating from China, effectively raising landed costs and compressing margins for downstream equipment manufacturers. This duty layer is compounded by Section 232 aluminum and steel tariffs, which have endured despite periodic exclusions and negotiations, impacting raw materials used in heat sinks, enclosures, and busbars.

Beyond direct cost escalations, tariff uncertainty has introduced operational complexity. Companies must allocate additional resources to customs classification disputes, duty mitigation strategies, and compliance processes. As a result, many original equipment manufacturers and distributors are exploring nearshoring alternatives in Mexico and the southern United States to lower tariff exposure and shorten lead times. At the same time, components sourced from Europe and Asia-Pacific suppliers carry lower or no U.S. import duties but may incur longer transit times and potential bottlenecks.

This cumulative tariff burden not only heightens supply chain volatility but also drives investment in domestic assembly and localized manufacturing partnerships. Stakeholders that proactively adjust sourcing footprints, negotiate better terms with suppliers, and leverage duty drawback and bonded warehouse solutions will be best positioned to mitigate cost increases while safeguarding operational continuity in the evolving tariff environment.

Delving into Critical Market Segmentation Dimensions Revealing Unique Perspectives on Starter Type, Voltage Classifications, Distribution Channels, and End Use Industries

The motor soft starter market unfolds across diverse dimensions that influence product demand and competitive positioning. By type, electronic soft starters are gaining momentum, particularly among end users seeking seamless integration with digital control systems and sophisticated diagnostic capabilities. Conversely, thyristor-based designs retain prominence in legacy-heavy industries where high overload tolerance and cost-effectiveness remain paramount. This dichotomy underscores the importance of modular architecture and adaptable control algorithms to address varied performance requirements.

Voltage classification further stratifies the landscape: low-voltage soft starters dominate in discrete manufacturing and small-scale processing plants, medium-voltage devices serve sectors with higher power demands such as oil and gas infrastructure, and high-voltage configurations are critical for large-scale mining operations and utility applications. Manufacturers are investing in scalable platforms that can be tailored to specific voltage tiers without extensive reengineering, thereby optimizing production efficiency and reducing time to market.

Distribution channels also show contrasting trajectories. Traditional offline networks led by specialized distributors and system integrators continue to thrive in regions with stringent certification requirements and on-site service expectations. At the same time, online procurement portals and e-commerce platforms are disrupting established channels, offering rapid quotation, configurator tools, and digital after-sales support. Finally, end use industry demands-from high-precision requirements in pharmaceuticals to rugged performance in pulp and paper-shape product roadmaps, driving suppliers to offer customized firmware, nuisance tripping protection, and advanced motor health monitoring tailored to sector-specific challenges.

This comprehensive research report categorizes the Motor Soft Starter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Voltage

- Distribution Channel

- End Use Industry

Exploring Distinct Regional Dynamics and Growth Drivers Shaping the Motor Soft Starter Market across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics exert a profound influence on motor soft starter deployment and innovation pathways. In the Americas, the United States leads in adopting energy-efficient solutions driven by regulatory incentives and expansive infrastructure modernization efforts, while Latin American markets present growth opportunities fueled by industrialization and agricultural mechanization. Service ecosystems in the Americas emphasize rapid technical support and integrated maintenance agreements to address uptime imperatives.

Across Europe, Middle East, and Africa, stringent energy directives and a strong push toward renewable integration have elevated the role of soft starters in grid stabilization and demand management projects. The Middle East’s petrochemical investments and Africa’s burgeoning mining activities create pockets of high-voltage application requirements, prompting global suppliers to establish regional manufacturing hubs and specialized training centers. Furthermore, inter-regional trade agreements and localization policies are reshaping supply networks.

Asia-Pacific remains a hotbed of industrial expansion, with China and India driving massive capacity additions in automotive, steel, and chemical processing. Southeast Asia’s emergence as a manufacturing alternative underscores the need for flexible soft starter solutions adaptable to diverse power grids and tropical operating conditions. As digital infrastructure matures across the region, opportunities to integrate predictive maintenance platforms and edge-compute analytics are attracting significant vendor investment.

This comprehensive research report examines key regions that drive the evolution of the Motor Soft Starter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Imperatives That Drive Innovation, Market Positioning, and Competitive Advantage in Motor Soft Starters

The competitive arena for motor soft starters is defined by a mix of global titans and agile specialists, each vying to differentiate through innovation, service excellence, and strategic partnerships. ABB distinguishes itself through its consolidated digital ecosystem, embedding advanced analytics and cybersecurity features into its Ability-branded soft starters, which enables clients to leverage unified data streams across asset portfolios. Siemens, meanwhile, capitalizes on its SINAMICS series, offering seamless integration with its extensive automation and PLC frameworks while rolling out digital twin capabilities for virtual commissioning.

Schneider Electric leverages its EcoStruxure architecture to offer cloud-enabled performance monitoring and lifecycle services, reinforcing its position in sectors demanding green credentials and stringent compliance. Rockwell Automation, via its Allen-Bradley line, showcases close alliances with system integrators, delivering tailored firmware and quick-start configuration that accelerate deployment in complex manufacturing environments. Eaton rounds out the top tier by emphasizing modularity and global service networks, providing pre-engineered starter modules suited for rapid assembly and local support.

Mid-tier and regional players are carving niches through cost-effective designs, specialized application knowledge, and aftermarket enhancements. Collectively, these competitive dynamics heighten the importance of strategic R&D investments, collaborative ecosystems, and customer-centric service models, shaping the future trajectories of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motor Soft Starter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Danfoss A/S

- Eaton Corporation plc

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- WEG S.A.

- Yaskawa Electric Corporation

- Zhejiang CHINT Electrics Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Market Risks in the Motor Soft Starter Sector

To thrive in the evolving motor soft starter market, industry leaders should prioritize the seamless integration of digital and mechanical expertise, investing in the development of IoT-enabled platforms that deliver predictive maintenance and real-time performance optimization. Cultivating strategic partnerships with semiconductor suppliers and automation integrators can accelerate time to market for innovative topologies while diversifying the supply base to mitigate tariff exposure.

Furthermore, companies must enhance their domestic manufacturing and assembly footprints to capitalize on nearshore incentives and reduce lead times. Leveraging flexible production cells and modular design approaches will enable rapid customization for different voltage classes and industry-specific load profiles. At the commercial level, strengthening after-sales service offerings, including remote diagnostics, extended warranties, and condition-based maintenance contracts, can generate recurring revenue streams and deepen customer relationships.

Finally, staying ahead of regulatory developments by engaging with standards organizations and energy agencies will allow suppliers to influence upcoming efficiency and grid-interactive mandates. By embracing agile product roadmaps, robust ESG frameworks, and comprehensive cybersecurity measures, market participants can not only navigate current uncertainties but also shape the future of motor control solutions in a decarbonizing industrial landscape.

Outlining Robust Research Methodology Integrating Primary Interactions, Secondary Analysis, and Quantitative Data Triangulation for Credible Market Insights

This study’s insights derive from an exhaustive research approach that integrates both primary and secondary data sources. Primary research consisted of structured interviews with executives and technical leaders from equipment manufacturers, system integrators, and end users across key industries, facilitating a nuanced understanding of real-world application challenges and decision criteria. Supplementary surveys captured quantitative perspectives on buying behaviors, feature prioritization, and service preferences.

Secondary research encompassed analysis of corporate filings, trade association reports, government energy usage databases, and regional tariff schedules, offering historic context and validating trend trajectories. Data triangulation techniques ensured consistency between qualitative feedback and published statistics, while internally developed models allowed for the segmentation of market variables by type, voltage class, distribution channel, and end use industry.

Finally, findings were peer-reviewed by an advisory panel of industry experts, each contributing domain-specific insights and corroborating the study’s conclusions. This rigorous methodology guarantees that the report’s perspectives reflect current market realities and equip decision-makers with credible, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motor Soft Starter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motor Soft Starter Market, by Type

- Motor Soft Starter Market, by Voltage

- Motor Soft Starter Market, by Distribution Channel

- Motor Soft Starter Market, by End Use Industry

- Motor Soft Starter Market, by Region

- Motor Soft Starter Market, by Group

- Motor Soft Starter Market, by Country

- United States Motor Soft Starter Market

- China Motor Soft Starter Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Findings and Strategic Implications to Illuminate Future Pathways for Stakeholders in the Motor Soft Starter Ecosystem

In conclusion, the motor soft starter market stands at a crossroads defined by technological innovation, policy-driven efficiency imperatives, and ever-evolving supply chain dynamics. The proliferation of digital platforms and predictive analytics is redefining value propositions, compelling suppliers to enhance their offerings with advanced diagnostics, modular scalability, and grid-interactive capabilities. At the same time, sustained U.S. tariffs and complex geopolitical landscapes are reshaping sourcing strategies and incentivizing nearshoring investments.

Diverse segmentation profiles-from electronic versus thyristor-based designs to voltage-class tailored solutions-present targeted opportunities for players ready to align their product roadmaps with nuanced end use requirements. Regionally, growth hotspots in the Americas, EMEA, and Asia-Pacific offer distinct market entry triggers shaped by regulatory mandates, infrastructure spending, and industrial expansion.

As competition intensifies among global leaders and agile challengers, success will hinge on strategic R&D partnerships, robust after-sales service ecosystems, and proactive engagement with regulatory developments. Armed with the insights outlined in this report, stakeholders can chart a course toward sustained growth, operational resilience, and market-leading innovation in the motor soft starter domain.

Empowering Your Strategic Decisions with a Comprehensive Motor Soft Starter Market Report—Engage with Our Associate Director to Secure Your Copy Today

The comprehensive exploration of the motor soft starter landscape presented in this report only scratches the surface of the actionable insights and strategic intelligence available. To translate these findings into competitive advantage, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who can tailor a detailed briefing and facilitate access to the full research report. Unlock the depth and rigor of our analysis to empower your next strategic move-connect with Ketan Rohom today to secure your copy and stay ahead of market evolution.

- How big is the Motor Soft Starter Market?

- What is the Motor Soft Starter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?