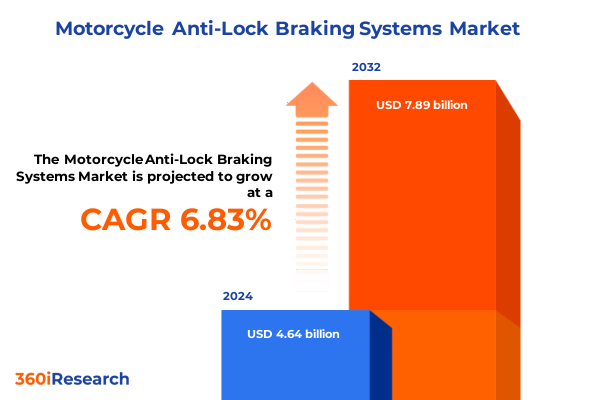

The Motorcycle Anti-Lock Braking Systems Market size was estimated at USD 4.95 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 6.88% to reach USD 7.89 billion by 2032.

Exploring the Evolution and Critical Importance of Motorcycle Anti-Lock Braking Systems in Enhancing Rider Safety and Industry Advancement

Motorcycle anti-lock braking systems (ABS) have transformed rider safety, emerging as a critical technology in reducing accident severity and enhancing control under diverse riding conditions. Initially introduced to the motorcycle sector in the early 1990s, ABS has evolved from rudimentary wheel-speed sensing to sophisticated integrated systems that can anticipate and mitigate wheel lock events in real time. This evolution reflects growing consumer demand for advanced safety features, underpinned by regulatory mandates in key markets that elevate braking assistance from an optional extra to a near-standard requirement.

As global road safety campaigns intensify and zero-fatality targets gain prominence, ABS adoption has expanded rapidly, with leading two-wheel manufacturers embedding these systems into both entry-level and premium models. The convergence of microelectronic advancements, sensor miniaturization, and enhanced computing power within electronic control units has enabled the development of cornering ABS and integrated control variants capable of maintaining stability during lean angles. These technological breakthroughs are redefining performance benchmarks, driving a shift in rider expectations toward proactive safety rather than reactive response.

Against this backdrop, the motorcycle ABS market is at an inflection point, characterized by heightened collaboration among OEMs, Tier 1 suppliers, and regulatory bodies. Advancements in connectivity and predictive analytics promise further enhancements in brake-by-wire architectures, paving the way for future integrations with advanced rider assistance systems and vehicle-to-everything communication frameworks. This introduction establishes the foundational context, outlining how safety imperatives, technological progress, and regulatory environments are coalescing to shape the trajectory of motorcycle ABS solutions.

Analyzing the Technological and Regulatory Forces Reshaping the Motorcycle ABS Landscape and Redefining Industry Standards Globally

The motorcycle ABS sector is undergoing transformative shifts as emerging technologies and regulatory frameworks converge to reshape the landscape. At the forefront, cornering ABS systems equipped with multi-axis inertial measurement units are redefining what constitutes safe braking in dynamic riding scenarios. By continuously monitoring lean angles and wheel slip, these systems can modulate brake pressure across all wheels, even during aggressive cornering maneuvers-capabilities that were previously unattainable with conventional ABS architectures.

Simultaneously, regulatory bodies worldwide are tightening safety standards, mandating ABS installation on increasingly diverse segments of two-wheelers. Europe’s stringent UNECE regulations have been complemented by parallel requirements in key Asian markets, while several U.S. states have introduced incentive programs to accelerate adoption. These mandates are accelerating product roadmaps, compelling manufacturers to prioritize ABS variants that balance performance with cost-effectiveness, thereby driving deeper integration within electronic control systems.

In tandem, the electrification trend is introducing new challenges and opportunities. Electric motorcycles, with their unique torque delivery and regenerative braking profiles, demand bespoke ABS algorithms and hardware calibrations. Manufacturers and suppliers are responding by investing in R&D collaborations focused on brake-by-wire solutions that seamlessly integrate mechanical braking components with electric propulsion controls. As the market evolves, the interplay between regulatory drivers, technological convergence, and evolving powertrain architectures is setting the stage for a new era of safety-centric innovation in motorcycle braking.

Assessing the Far-Reaching Effects of United States 2025 Tariff Measures on Motorcycle Anti-Lock Braking System Supply Chains and Cost Structures

The United States’ decision in early 2025 to implement revised import tariffs on motorcycle components has introduced new complexities for ABS supply chains and cost structures. Affected by increased duties on imported braking modules and control electronics, suppliers have experienced margin pressures that have reverberated through OEM manufacturing schedules. In response, key stakeholders have embarked on strategic sourcing initiatives, exploring nearshoring options and strengthening partnerships with domestic component producers to mitigate the cost impact and ensure continuity of supply.

These tariff measures have also led to a reassessment of procurement strategies. Manufacturers are now evaluating total landed cost metrics more rigorously, factoring in duties alongside logistics expenses and inventory holding risks. This heightened scrutiny has, in some cases, incentivized the consolidation of supplier bases and the renegotiation of long-term contracts. While short-term implications include price adjustments for end consumers, the long-term effect may drive greater investment in local production capabilities and technology transfers aimed at reducing reliance on tariff-exposed imports.

Moreover, the tariff landscape has spurred collaboration between industry associations and policymakers, fostering dialogue on balancing domestic manufacturing objectives with competitive pricing imperatives. As the sector adapts to these trade policy shifts, stakeholders are keenly focused on agile supply chain configurations, risk diversification, and the potential for co-development agreements that localize critical ABS components. This convergence of trade policy and strategic supply chain management is thus reshaping cost paradigms and reinforcing the impetus for supply resilience in the motorcycle ABS ecosystem.

Unveiling Critical Segmentation Dynamics by Technology Bike Type and Brake Configuration to Unlock Nuanced Perspectives on ABS Market Diversity

Critical segmentation analysis reveals that variations in ABS technology, brake channel architecture, and motorcycle type profoundly influence adoption patterns and feature prioritization. When examining technology tiers, conventional ABS systems remain prevalent in entry-level models due to their proven reliability and cost efficiency, while cornering ABS offerings, subdivided into six-axis and intelligent IMU-based configurations, are increasingly integrated into premium and performance-focused bikes. Cornering systems with integrated control architectures leverage advanced sensor fusion to deliver superior stability, driving their selection by brands aiming to differentiate through enhanced safety credentials.

Brake type segmentation further underscores the interplay between system complexity and application context. Combined channel ABS solutions optimize weight and packaging constraints for urban and commuter motorcycles, whereas two-channel and three-channel configurations provide greater modulation and redundancy for higher-displacement machines and sport-oriented models. This divergence in brake architecture aligns closely with the underlying motorcycle type segmentation, where cruisers and touring bikes typically favor combined or two-channel systems for balanced performance, and supersport and adventure sport variants adopt three-channel setups to meet aggressive braking demands.

Turning to motorcycle typologies, manufacturers are tailoring ABS variants in accordance with riding profiles. Off-road and dual-sport machines often incorporate robust conventional ABS tuned for variable terrain, while sport-oriented categories partitioned into adventure sport and supersport distinguish themselves through high-fidelity cornering control. Standard and touring segments benefit from integrated safety suites, marrying ABS with traction control and rider assistance features. These segmentation insights not only illuminate current market preferences but also guide product roadmaps, as suppliers and OEMs align technical specifications with distinct rider expectations and operational environments.

This comprehensive research report categorizes the Motorcycle Anti-Lock Braking Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Brake Type

- Technology

- Motorcycle Type

- End‑Use

- Distribution Channel

Examining Regional Variations Across Americas Europe Middle East Africa and Asia Pacific to Illuminate Key Drivers and Market Dynamics

Regional dynamics in the motorcycle ABS sector exhibit significant variation across the Americas, Europe Middle East & Africa, and Asia-Pacific, each shaped by distinct regulatory climates, infrastructure developments, and consumer behaviors. In the Americas, proactive safety advocacy and incentive programs have catalyzed ABS uptake on commuter and sport motorcycles, although price sensitivity in developing markets continues to influence the prevalence of conventional systems. North American OEMs increasingly emphasize integrated electronic control units that support both ABS and emerging rider assistance features, reflecting expectations for connected vehicle technologies.

European regulations, recognized for their rigor, have long mandated ABS on most motorcycle categories, prompting widespread industry alignment with UNECE standards. The Middle East and Africa region is witnessing growing investments in road safety infrastructure and training, which, combined with rising premium motorcycle imports, is driving a shift toward advanced cornering ABS solutions. Manufacturers operating in these territories are prioritizing modular system designs that accommodate local homologation requirements while preserving economies of scale.

Asia-Pacific represents the fastest-growing landscape for motorcycle ABS, driven by significant two-wheeler registrations in India and Southeast Asia alongside evolving safety mandates. Local suppliers are forging joint ventures with global Tier 1 players to co-develop IMU-based ABS tailored for emerging market conditions, balancing cost constraints with performance demands. Meanwhile, Japan and South Korea continue to lead in advanced control integration, supplying cutting-edge hardware to both domestic and export-focused manufacturers. Through these varied regional trajectories, stakeholders are harnessing geographic insights to optimize product portfolios and align investments with market-specific growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Motorcycle Anti-Lock Braking Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovators Driving Growth and Technological Excellence in the Motorcycle Anti-Lock Braking System Sector

Leading technology providers and OEM partners are shaping the motorcycle ABS sector through strategic investments and innovation pipelines. A number of Tier 1 systems suppliers have expanded their R&D centers to accelerate IMU sensor refinement and microcontroller processing capabilities, while forging alliances with electronic braking module specialists to streamline system integration. Concurrently, select OEMs have begun in-house development of brake-by-wire architectures, leveraging partnerships with software firms to customize ABS algorithms for specific riding profiles and performance benchmarks.

Collaborative efforts between established manufacturers and start-up ventures are also gaining traction. These partnerships typically focus on co-development agreements for next-generation control units that integrate ABS with traction control, electronic suspension adjustment, and telematics platforms. This convergence of mechanical and digital expertise is fostering a wave of modular ABS solutions that can be rapidly scaled across diverse motorcycle lines, enabling faster time to market and reduced engineering overhead.

On the aftermarket front, independent service providers and parts distributors are recognizing the value of retrofit ABS kits, particularly for popular mid-range models with legacy braking systems. By certification partnerships with approved Tier 1 suppliers, these aftermarket players ensure compliance with safety standards and deliver installation accessories tailored to a broad spectrum of motorcycle platforms. Collectively, these corporate strategies underscore a dynamic competitive landscape where technological leadership, supply chain agility, and cross-industry collaboration are key determinants of success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motorcycle Anti-Lock Braking Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Brembo S.p.A.

- Continental AG

- dSPACE GmbH

- Hitachi Astemo, Ltd.

- HL Mando Corp.

- J.Juan N.A. S.L.

- KYB Corporation

- Nisshinbo Holdings Inc.

- Nissin Kogyo Co., Ltd.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Shimano Inc.

- Showa Corporation

- ZF Friedrichshafen AG

Delivering Strategic and Tactical Recommendations to Equip Industry Leaders with Roadmaps for Maximizing Performance and Competitive Edge in ABS Solutions

Industry leaders can capitalize on emergent safety and connectivity trends by prioritizing investment in sensor fusion and algorithmic refinement for cornering ABS platforms. Further, establishing strategic sourcing partnerships that diversify production locations will mitigate tariff exposure and reinforce supply chain resilience. Emphasizing modular design architectures allows rapid customization of ABS configurations to align with distinct regional requirements, ensuring models can adapt swiftly to evolving homologation standards.

To secure early-mover advantages, stakeholders should engage in joint development initiatives with electric motorcycle OEMs, collaboratively addressing unique regenerative braking dynamics and brake-by-wire integration. Augmenting these technical partnerships with shared pilot programs will accelerate validation cycles and deepen insights into rider behavior across varying terrains. Additionally, building alliances with data analytics firms can unlock real-time performance monitoring, enabling proactive feature enhancements and predictive maintenance offerings that reinforce brand reputation and customer loyalty.

Finally, investing in targeted training programs for dealer networks and aftermarket installers will elevate system understanding and installation quality, promoting consistent end-user experiences. Coupling these initiatives with robust marketing campaigns that articulate the safety, performance, and value proposition of advanced ABS variants will drive consumer awareness and adoption. By executing a multifaceted strategy encompassing R&D, supply chain optimization, and go-to-market enhancements, industry leaders can effectively navigate complexities and accelerate the transition to next-generation motorcycle braking solutions.

Unpacking the Comprehensive Research Methodology Underpinning Data Collection Analysis and Validation Processes for ABS Market Intelligence

This analysis is grounded in a comprehensive research framework combining primary and secondary methodologies. Initially, extensive secondary research was conducted across technical whitepapers, industry journals, and public safety regulations to map the historical evolution of ABS technologies and identify key regulatory milestones. Primary research consisted of in-depth interviews with design engineers, procurement managers, and safety compliance experts across leading OEMs and Tier 1 suppliers, facilitating nuanced understanding of current challenges and investment priorities.

Data triangulation was applied to reconcile insights from proprietary industry databases, financial disclosures, and interview feedback, ensuring the consistency and reliability of the findings. Qualitative inputs were systematically coded and analyzed alongside quantitative metrics related to production volumes, tariff impacts, and regional adoption rates. This integrated approach enabled the development of detailed segmentation analyses and regional profiles, reflecting both macroeconomic drivers and micro-level operational considerations.

Quality assurance protocols included iterative review cycles with subject matter advisors, validation of statistical assumptions, and cross-referencing against international safety standards. The research process adhered to strict confidentiality and data governance principles, guaranteeing that all proprietary inputs were responsibly managed. Through this rigorous methodology, stakeholders can be confident in the integrity of the insights and the strategic relevance of the recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motorcycle Anti-Lock Braking Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motorcycle Anti-Lock Braking Systems Market, by Brake Type

- Motorcycle Anti-Lock Braking Systems Market, by Technology

- Motorcycle Anti-Lock Braking Systems Market, by Motorcycle Type

- Motorcycle Anti-Lock Braking Systems Market, by End‑Use

- Motorcycle Anti-Lock Braking Systems Market, by Distribution Channel

- Motorcycle Anti-Lock Braking Systems Market, by Region

- Motorcycle Anti-Lock Braking Systems Market, by Group

- Motorcycle Anti-Lock Braking Systems Market, by Country

- United States Motorcycle Anti-Lock Braking Systems Market

- China Motorcycle Anti-Lock Braking Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Consolidate Understanding and Chart Future Directions for Motorcycle ABS Innovations

This executive summary has distilled the essential developments shaping the motorcycle ABS domain, highlighting how cornering ABS innovations, tariff dynamics, and differentiated segmentation models are collectively advancing industry capabilities. Key findings underscore the strategic interplay between technology sophistication and regulatory imperatives, revealing a clear trajectory toward integrated brake-by-wire systems and seamless connectivity. Regional analyses further clarify how market maturity and policy frameworks influence adoption patterns, guiding manufacturers in prioritizing resource allocations and product rollouts.

Moving forward, stakeholders must reconcile the dual imperatives of cost management and differentiation. By leveraging multi-axis sensing technologies, diversifying sourcing strategies, and fostering cross-sector collaborations, industry participants can navigate trade policy shifts and maintain competitive agility. The confluence of evolving rider expectations, stringent safety mandates, and rapid powertrain innovations presents a fertile landscape for next-generation ABS solutions. Decision-makers are thus positioned to capitalize on these trends, translating the insights detailed in this summary into actionable initiatives that will define the future of motorcycle braking safety.

Engage Directly with Ketan Rohom Associate Director Sales and Marketing to Secure Exclusive Insights and Purchase the In-Depth Motorcycle ABS Research Report

Ketan Rohom, the Associate Director of Sales and Marketing, stands ready to facilitate your access to this indispensable motorcycle ABS market research report. Engaging with him will ensure you receive tailored guidance on how the insights can directly inform your strategic planning, product development initiatives, and investment decisions. Reach out today to secure your copy of this comprehensive analysis and gain a decisive advantage in navigating the evolving anti-lock braking system landscape.

- How big is the Motorcycle Anti-Lock Braking Systems Market?

- What is the Motorcycle Anti-Lock Braking Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?