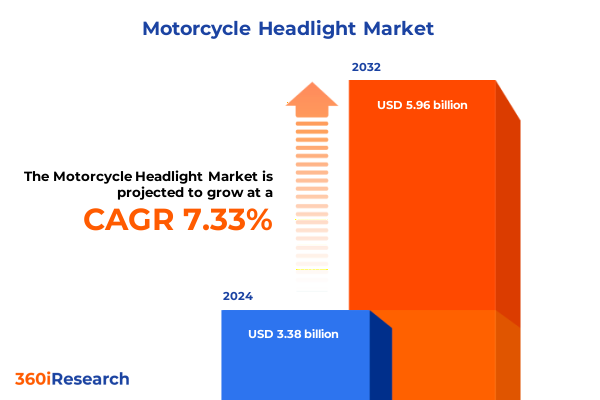

The Motorcycle Headlight Market size was estimated at USD 3.63 billion in 2025 and expected to reach USD 3.92 billion in 2026, at a CAGR of 7.33% to reach USD 5.96 billion by 2032.

Illuminating the Path Forward with a Comprehensive Overview of the Motorcycle Headlight Market Dynamics and Emerging Industry Imperatives

Motorcycle headlight systems have evolved into sophisticated combinations of light sources, optical designs, and regulatory safeguards that are integral to rider safety and vehicle aesthetics. The convergence of advanced materials, innovative lighting technologies, and stringent performance standards has transformed headlight functionality, with manufacturers continuously refining luminous efficiency and durability. In this context, professional stakeholders require a clear understanding of how emerging trends and industry imperatives are reshaping product development and market positioning.

Against this backdrop, this report introduces a holistic view of the motorcycle headlight sector, illustrating key technological, regulatory, and consumer-driven factors that underpin current market dynamics. By exploring the interplay between lamp types, material selection, system architectures, and end-user behaviors, decision-makers are equipped with the insights necessary to navigate evolving challenges and capitalize on growth avenues.

Mapping the Technological and Consumer Paradigm Shifts Reshaping the Motorcycle Headlight Landscape and Driving Unprecedented Market Evolution

In recent years, the motorcycle headlight landscape has undergone significant transformation propelled by rapid technological innovation and shifting consumer expectations. High-intensity light-emitting diode systems have surged in popularity due to their energy efficiency and compact form factors, while adaptive projector technologies are redefining the standards for glare control and beam pattern precision. Concurrently, riders increasingly seek personalized styling options, driving manufacturers to integrate modular components and color-adjustable light sources into premium lighting assemblies.

These technological shifts are complemented by heightened regulatory oversight focused on safety performance and environmental sustainability. New regulations mandate more stringent photometric requirements and lifecycle assessments, prompting industry players to adopt eco-friendly materials and advanced manufacturing processes. As a result, companies that proactively align with emerging safety protocols and environmental benchmarks are gaining a competitive edge, setting a new bar for innovation and compliance.

Assessing the Ripple Effect of Recent United States Tariff Measures on Motorcycle Headlight Manufacturing Supply Chains and Cost Structures

The introduction of heightened United States tariffs in early 2025 has created a ripple effect across motorcycle headlight supply chains, influencing cost structures and procurement strategies. Import duties on critical raw materials such as optical-grade plastics and specialized lamp modules have increased the landed cost of components, compelling original equipment manufacturers and aftermarket suppliers to reassess sourcing arrangements. This has led many to explore nearshoring options and develop partnerships with alternative suppliers to maintain supply continuity and mitigate expense escalation.

Simultaneously, the tariff landscape has incentivized investment in localized assembly capabilities within North America. Manufacturers are enhancing their domestic production footprints to offset import surcharges and reduce lead times. While these measures introduce upfront capital commitments, the long-term benefits include improved supply chain resilience, lower inventory carrying costs, and a strengthened ability to adapt swiftly to future policy changes.

Uncovering Distinct Customer Segments through Lamp Type Material Technology Vehicle Type and End User Perspectives for Targeted Innovation

Understanding the nuances of lamp type differentiation reveals that traditional halogen options-spanning configurations like H4, H7, and H9-continue to serve entry-level and budget-conscious segments, yet they face mounting pressure from LED variants. Chip-on-board and surface-mounted LED formats deliver marked improvements in luminous efficiency and operational lifespan, while xenon assemblies featuring dual-beam and single-beam designs persist in premium product tiers where superior brightness is paramount. Recognizing these distinctions is essential for aligning product portfolios with evolving consumer priorities.

Material considerations play an equally critical role in headlight performance and durability. Glass solutions, available as quartz for high-temperature tolerance or tempered for impact resistance, contrast with plastic alternatives such as acrylic and polycarbonate, which offer weight savings and design flexibility. These material choices influence optical clarity, scratch resistance, and overall unit weight, guiding manufacturers in optimizing their offerings for specific motorcycle classes.

On the technology front, projector systems-ranging from single- to bi-directional and adaptive configurations-provide precise beam control and uniform illumination, making them well-suited for high-end systems. Reflector-based designs, encompassing conventional and multi-reflector architectures, remain prevalent due to their cost-effectiveness, with emerging laser reflector subtypes enhancing beam focus in niche performance models. Mapping these technological pathways enables stakeholders to identify opportunities for differentiation.

Vehicle type segmentation further refines market understanding by distinguishing off-road models-such as enduro and motocross variants-from on-road categories including cruiser, sports, and touring motorcycles. Each segment imposes unique lighting requirements tied to riding environment, aesthetic preferences, and regulatory mandates, informing targeted product development. Finally, end-user perspectives underscore the dual influence of new bike manufacturers and the replacement market, the latter comprised of authorized dealers, DIY enthusiasts, and general repair shops. This segmentation framework highlights channels and decision factors critical to effective go-to-market strategies.

This comprehensive research report categorizes the Motorcycle Headlight market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lamp Type

- Material

- Technology

- Vehicle Type

- End User

Examining Key Regional Drivers and Unique Market Dynamics across the Americas Europe Middle East Africa and Asia-Pacific Motorcycle Headlight Industries

Regional market dynamics vary considerably across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions, each shaped by distinct regulatory frameworks, consumer behaviors, and industrial ecosystems. In North and South America, a mature aftermarket and strong emphasis on customization have driven widespread adoption of LED conversion kits and premium xenon assemblies, supported by robust distribution networks and a high level of rider safety awareness. Conversely, European markets prioritize regulatory compliance and environmental considerations, accelerating the transition to energy-efficient adaptive projector systems amid stringent headlight performance standards.

In Asia-Pacific, the region’s role as a global manufacturing hub underpins a diverse product landscape where cost competitiveness and rapid innovation cycles coexist. Manufacturers leverage economies of scale to produce affordable reflector-based designs for emerging markets, while simultaneously investing in advanced modular LED platforms to address growing demand in developed economies. Meanwhile, the Middle East and Africa region exhibits selective uptake of high-performance lighting solutions in markets with strong adoption rates among touring and adventure riders, driven by expansive road networks and long-distance riding cultures.

This comprehensive research report examines key regions that drive the evolution of the Motorcycle Headlight market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Pioneering Advancements and Strategic Partnerships Driving Competitive Differentiation in the Motorcycle Headlight Sector

A cohort of leading firms is shaping the competitive environment through sustained investment in research and development, strategic partnerships, and targeted acquisitions. Global lighting specialists known for legacy expertise in automotive optics are extending their capabilities into two-wheeler applications, integrating proprietary LED chip designs and sensor-driven adaptive modules to enhance performance. Collaboration between component suppliers and motorcycle OEMs has resulted in co-developed platforms that streamline integration and accelerate time-to-market for next-generation headlight assemblies.

In parallel, emerging players with agile operational models are capturing niche segments by offering customizable, plug-and-play solutions tailored to aftermarket enthusiasts. These companies differentiate themselves through online configurators, rapid prototyping services, and community-driven product feedback loops. The infusion of digital engagement and direct-to-consumer channels is compelling incumbent manufacturers to adopt similar strategies, intensifying competitive differentiation and driving continual innovation across the landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motorcycle Headlight market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alchemy Parts

- BAAK

- BikeMaster

- BMW AG

- Denso Corporation

- Fiem Industries Ltd

- Hella GmbH & Co KGaA

- Hyundai Mobis

- Ichikoh Industries

- Koito Manufacturing Co Ltd

- Koninklijke Philips NV

- Lumax Industries Ltd

- Magneti Marelli

- Minda Industries Ltd

- Morimoto Lighting

- NAOEVO

- OSRAM Licht AG

- PIAA Corporation

- Robert Bosch GmbH

- Stanley Electric Co Ltd

- TRUX ACCESSORIES

- Valeo

- Varroc Engineering Ltd

- ZKW Group GmbH

Delivering Actionable Strategic Recommendations to Navigate Emerging Challenges Optimize Operations and Capitalize on Opportunities within the Motorcycle Headlight Market

Industry leaders looking to secure a competitive vantage point should prioritize continuous investment in advanced lighting technologies, particularly adaptive LED projector systems that enhance rider safety and aesthetic flexibility. By aligning R&D roadmaps with emerging regulatory requirements and leveraging modular design principles, companies can reduce time-to-market and address a diverse range of vehicle types without extensive retooling. This approach fosters agility amid evolving performance standards and tariff-induced supply chain shifts.

Moreover, establishing a resilient and diversified supplier network is critical in mitigating the impact of import duties and geopolitical uncertainties. Nearshoring component production and forging strategic alliances with regional manufacturers can alleviate cost pressures and minimize lead time variability. Simultaneously, brands can cultivate aftermarket engagement by offering tailored solutions through authorized dealers and direct channels that cater to both DIY enthusiasts and professional repair shops, thereby maximizing reach and driving incremental revenue streams.

Outlining the Robust Research Approach Emphasizing Multi-Source Data Collection Rigorous Analysis and Frameworks Ensuring Insightful and Reliable Market Intelligence

This analysis is grounded in a multi-phased research framework that combines primary and secondary data sources to ensure robust and unbiased insights. Primary research included structured interviews with engineering leaders at motorcycle OEMs, in-depth discussions with component suppliers, and surveys of aftermarket stakeholders such as dealers, repair shops, and end users. These engagements provided direct perspectives on technology adoption drivers, material preferences, and channel dynamics.

Supplementing these findings, secondary research encompassed a review of regulatory documents, patent filings, technical whitepapers, and industry publications to map the evolution of lighting standards and material innovations. Competitive benchmarking leveraged financial reports, strategic partnership announcements, and product launch data to profile key players. Analytical frameworks-ranging from SWOT assessments to supply chain mapping-were applied to synthesize qualitative and quantitative inputs, yielding a comprehensive understanding of market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motorcycle Headlight market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motorcycle Headlight Market, by Lamp Type

- Motorcycle Headlight Market, by Material

- Motorcycle Headlight Market, by Technology

- Motorcycle Headlight Market, by Vehicle Type

- Motorcycle Headlight Market, by End User

- Motorcycle Headlight Market, by Region

- Motorcycle Headlight Market, by Group

- Motorcycle Headlight Market, by Country

- United States Motorcycle Headlight Market

- China Motorcycle Headlight Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Insights and Strategic Implications to Empower Stakeholders in Shaping the Future Trajectory of the Motorcycle Headlight Industry

Throughout this report, we have explored the technological transformations, tariff impacts, and segmentation intricacies that define the motorcycle headlight industry today. By examining the interplay of lamp types, materials, system architectures, and end-user behaviors, stakeholders gain clarity on where opportunities for differentiation and value creation lie. The regional analysis further underscores the importance of tailoring strategies to local regulations, consumer preferences, and manufacturing ecosystems.

Strategic recommendations highlight the necessity of agile innovation processes, resilient supply chain structures, and targeted market engagement to thrive amid evolving industry imperatives. As manufacturers and suppliers navigate a landscape shaped by advanced lighting technologies and policy shifts, the insights presented here offer a roadmap for informed decision-making. Armed with this knowledge, industry participants can confidently steer future initiatives toward sustainable growth and competitive advantage.

Contact Associate Director of Sales and Marketing to Acquire Comprehensive Motorcycle Headlight Market Intelligence Report for Strategic Business Growth

To gain deeper insights into the evolving dynamics of the motorcycle headlight market and position your organization at the forefront of industry innovation, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. He can provide immediate access to a comprehensive market intelligence report that covers technological advancements, tariff implications, segmentation analyses, regional trends, and strategic recommendations tailored to your specific needs.

Engaging with Ketan will ensure you receive personalized guidance on leveraging the findings to optimize product development, refine go-to-market strategies, and capitalize on emerging opportunities in both OEM and aftermarket channels. Don’t miss the chance to secure critical intelligence that empowers data-driven decisions and fosters sustainable growth in a competitive landscape; contact Ketan today to acquire the definitive motorcycle headlight market report.

- How big is the Motorcycle Headlight Market?

- What is the Motorcycle Headlight Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?