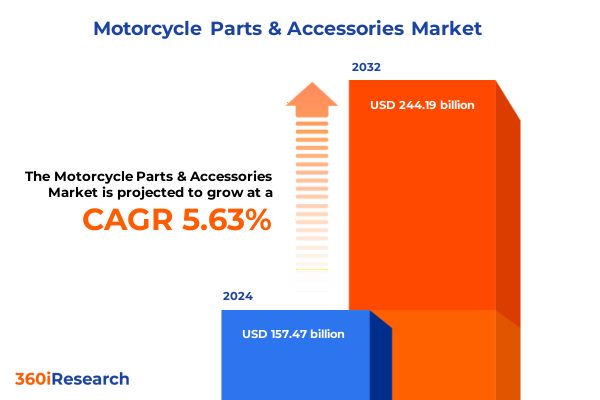

The Motorcycle Parts & Accessories Market size was estimated at USD 18.70 billion in 2025 and expected to reach USD 19.45 billion in 2026, at a CAGR of 5.39% to reach USD 27.01 billion by 2032.

Unveiling the Dynamics Shaping the Motorcycle Parts & Accessories Realm for Strategic Decision-Making and Growth Acceleration

The motorcycle parts and accessories landscape has undergone a remarkable metamorphosis in recent years, driven by evolving consumer preferences, technological breakthroughs, and shifting regulatory frameworks. Riding enthusiasts now demand more than mere functionality; they seek personalized experiences that blend performance, aesthetics, and sustainability. This heightened expectation has prompted manufacturers and distributors to reimagine their product portfolios, integrating advanced materials, smart connectivity features, and modular designs. Meanwhile, digital transformation across the value chain has accelerated procurement, customization, and aftersales support, forging stronger bonds between brands and riders.

Against this backdrop, the importance of a deep, nuanced understanding of market dynamics cannot be overstated. Decision-makers must navigate the interplay between legacy supply networks and emerging players, anticipate regulatory developments, and align innovation roadmaps with consumer sentiment. This executive summary distills the core trends, structural shifts, and competitive forces shaping the motorcycle parts and accessories market, equipping industry leaders with the insights needed to chart a confident course through an era defined by rapid change and boundless opportunity.

Exploring How Electrification Digitalization and Sustainability Are Redefining Product Development and Distribution Strategies

The motorcycle parts and accessories sector has experienced transformative shifts as electrification, digitalization, and sustainability converge to redefine product development and go-to-market strategies. The proliferation of electric motorcycles has catalyzed demand for novel cooling system solutions and high-performance electrical components. These changes extend beyond traditional ICE platforms, as the surge in connected motorcycles invites a new generation of sensors, ECUs, and power management modules designed for seamless integration with mobile apps and cloud-based analytics.

Simultaneously, environmental imperatives have spurred the adoption of eco-friendly materials and manufacturing processes. Recycled composites for frames and chassis, low-emission coatings for exhaust components, and biodegradable lubricants are no longer fringe innovations but core expectations. This shift has triggered partnerships between OEMs and material science specialists, fostering a collaborative ecosystem where sustainability and performance coexist.

On the distribution front, digital channels have leapt forward, enabling aftermarket and OEM-focused players to leverage AI-driven recommendation engines and nano-targeted marketing campaigns. These platforms enhance customer engagement by predicting maintenance needs and suggesting compatible accessories, thereby increasing average transaction values and fostering brand loyalty. Consequently, businesses that embrace these transformative shifts stand to gain a competitive edge through agility and customer-centric innovation.

Analyzing the Multifaceted Consequences of 2025 U.S. Tariffs on Supplier Networks Cost Structures and Competitive Advantage

The introduction of new tariff structures in the United States during 2025 has exerted a complex influence on the motorcycle parts and accessories market. These duties, targeting a wide range of imported components-from engine parts to performance enhancers-have compelled both domestic manufacturers and global suppliers to reevaluate their supply chains. In response, many businesses have diversified their sourcing strategies, relocating production to tariff-exempt jurisdictions or pursuing bilateral agreements that mitigate import costs.

This reconfiguration has not been without its challenges. Lead times have extended as multi-country supply routes complicate logistics, while quality consistency remains a focal concern. In parallel, elevated input costs have prompted some distributors to absorb margins to maintain competitive pricing, compressing profitability across the aftermarket channel. Yet, this environment has also catalyzed opportunities for domestic manufacturers to capture market share by emphasizing “Made in America” certifications and lean production methodologies.

Ultimately, the cumulative impact of these tariffs has underscored the importance of supply chain resilience. Organizations that have adopted advanced analytics to model tariff scenarios and optimize inventory buffers have navigated the transition more smoothly. Moreover, proactive engagement with policymakers and industry coalitions has yielded clearer guidance, enabling companies to recalibrate sourcing strategies with greater confidence.

Decoding the Complex Interplay Among Product Performance Personalization Distribution Channels and User Priorities

Assessing product type behaviors reveals that accessories-ranging from aesthetic enhancements and luggage solutions to performance upgrades and security attachments-continue to capture consumer imagination, reflecting riders’ desire for personalization. Simultaneously, core functional components such as brake systems, electrical and engine modules, and suspension assemblies are evolving rapidly with integrated sensor technologies and lightweight materials enhancing reliability and ride quality. The intricate subsegments within brake components, electrical and electronics, and engine parts underscore the nuanced performance expectations across rider demographics.

Motorcycle type segmentation further illuminates divergent trajectories: while sport and touring motorcycles remain bastions of high-margin performance accessories, electric and commuter-oriented scooters are driving growth for compact battery systems, modular charging infrastructure, and urban-friendly security accessories. Off-road dirt bikes and adventure tourers, meanwhile, sustain demand for rugged frames, high-torque drivetrain parts, and advanced suspension elements engineered to withstand extreme conditions.

Installation type distinctions highlight the interplay between aftermarket and OEM channels, with aftermarket suppliers leveraging agnostic compatibility and rapid innovation cycles, while OEM partners focus on seamless integration and warranty-backed reliability. Offline sales persist in specialized retail environments where hands-on consultations and on-the-spot customizations matter most, yet online platforms are steadily capturing share by offering extensive catalogs, virtual fitting tools, and expedited delivery.

From a user perspective, commercial clients invest heavily in fleet maintenance solutions emphasizing durability and cost efficiency, whereas individual riders prioritize aesthetic appeal, performance tuning, and advanced safety features. These segmentation insights chart a landscape where product development, distribution strategies, and marketing narratives must be tailored to distinct customer profiles to maximize engagement and profitability.

This comprehensive research report categorizes the Motorcycle Parts & Accessories market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Motorcycle Type

- Installation Type

- Sales Channel

- End-User

Unraveling Regional Growth Drivers and Consumer Preferences Across Mature and Emerging Markets

Regional dynamics within the Americas reflect a mature market characterized by robust aftermarket networks and deep-rooted motorcycle culture. North American riders drive demand for premium brake components and performance-enhancing accessories, while Latin American markets showcase growing appetite for affordable crash protection and electrical modules, buoyed by expanding urban mobility needs.

In Europe, Middle East, and Africa, regulatory harmonization across the European Union has accelerated the adoption of low-emission exhaust components and cutting-edge cooling systems. Meanwhile, the Middle East’s luxury motorcycle segment fuels demand for bespoke aesthetic accessories and high-performance frames. Africa’s emerging markets, though price-sensitive, present promising growth for rugged engine components and durable tires suited to diverse terrains.

Asia-Pacific stands at the forefront of electrification, with China and India spearheading commuter electric motorcycle adoption. This wave drives rapid innovation in battery packs, charging accessories, and lightweight transmission modules. Simultaneously, Southeast Asian tourism hubs support aftermarket growth for high-capacity luggage systems and advanced suspension technologies.

These regional variances emphasize the need for agile market entry strategies that align product portfolios with local regulatory frameworks, evolving consumer preferences, and infrastructure readiness, enabling stakeholders to capitalize on distinct growth pockets across the globe.

This comprehensive research report examines key regions that drive the evolution of the Motorcycle Parts & Accessories market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Innovation Alliances Vertical Integration and Regional Adaptation Drive Competitive Edge

Leading players in the motorcycle parts and accessories market are distinguished by their commitment to innovation, vertical integration, and strategic partnerships. Global component manufacturers continually invest in R&D centers focused on advanced materials and smart sensor integration, collaborating with technology startups to bring next-generation cooling systems and electronic control modules to market.

OEM alliances have become increasingly strategic, enabling select suppliers to co-develop proprietary systems that optimize performance and ensure seamless compatibility. At the same time, aftermarket specialists differentiate through curated product ecosystems that offer cross-brand interoperability, leveraging digital twins and augmented reality tools to enhance customer customization experiences.

Furthermore, nimble regional players are carving niche positions by tailoring products to localized use cases, such as off-road suspension systems for African terrains or urban-centric security modules for densely populated Asian cities. These companies prioritize lean manufacturing and rapid product iteration, allowing them to swiftly adapt to emerging trends and regulatory changes without the inertia often encountered by larger incumbents.

Collectively, these strategies underscore how a balanced focus on innovation, collaboration, and market-specific adaptation is essential for maintaining competitiveness and driving long-term value creation in the motorcycle parts and accessories ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motorcycle Parts & Accessories market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AltRider, LLC

- Bajaj Auto Ltd.

- Big Bike Parts

- Cobra USA. Inc.

- DAYTONA CORPORATION

- Ducati Motor Holding S.p.A

- Eicher Motors Limited

- Endurance Technologies Limited

- Harley-Davidson, Inc

- HENAN MODERN INDUSTRIAL CO., LIMITED

- Hero MotoCorp Ltd.

- Honda Motor Co., Ltd.

- Kawasaki Motors Europe N.V.

- Lear Corporation

- Magna International Inc

- MV Agusta Motor S.p.A.

- Piaggio & C. S.p.A.

- Polaris Industries Inc.

- RevZilla Motorsports, LLC by Comoto Holdings, LLC

- Sahara Seats

- Suzuki Motor Corporation

- Triumph Motorcycles Limited

- TS TECH CO., LTD

- TVS Motor Company

- Vega Auto Accessories Pvt. Ltd

- Viva Royal Trading Co., LTD.

- Yamaha Motor Co., Ltd.

- YF PROTECTOR Co., Ltd

Prioritizing Supply Chain Resilience Modular Platforms and Digital Engagement to Propel Market Leadership

Industry leaders must prioritize end-to-end supply chain visibility by deploying advanced analytics and AI-driven scenario planning to anticipate disruptions and optimize inventory positioning. Engaging proactively with policymakers and trade bodies will be critical to shaping future tariff policies and regulatory standards in a way that supports sustainable growth.

Strategic investment in modular product platforms can unlock scalable customization while reducing time-to-market. By leveraging digital twins and virtual reality tools, companies can enhance customer engagement and shorten feedback loops, fostering co-creation opportunities that align product roadmaps with rider aspirations.

Building robust partnerships across the value chain-from material suppliers specializing in eco-friendly composites to technology innovators in IoT sensor systems-will enable businesses to deliver differentiated solutions that resonate with both commercial fleets and individual enthusiasts. Complementing this, cultivating omnichannel ecosystems that blend immersive offline experiences with AI-enhanced digital touchpoints will drive conversion and nurture brand loyalty.

Ultimately, organizations that embrace a holistic strategy-one that unites operational resilience, product agility, and customer-centric innovation-will be well positioned to lead the motorcycle parts and accessories market through its next phase of growth.

Detailing a Robust Research Framework Integrating Expert Interviews Secondary Analysis Case Studies and Scenario Modeling

This research employs a multi-faceted methodology combining qualitative expert interviews, rigorous secondary data review, and comparative case studies to ensure comprehensive coverage of market dynamics. Primary insights were gathered through in-depth conversations with R&D heads, supply chain managers, and marketing directors across leading component manufacturers and aftermarket specialists, offering a frontline view of innovation pipelines and distribution strategies.

Secondary research encompassed a thorough analysis of publicly available regulatory filings, patent databases, industry white papers, and technical journals, cross-referenced to validate emerging trends and product advancements. Comparative case studies of successful collaboration models and regional rollouts provided actionable benchmarks, while scenario planning exercises highlighted potential tariff and regulatory impacts on supply networks.

The segmentation framework integrates granular analysis of product type, motorcycle category, installation approach, distribution channel, and end-user profiles, ensuring insights are tailored to distinct market needs. Regional outlooks synthesize economic indicators, infrastructure readiness assessments, and consumer preference surveys to map growth trajectories across the Americas, Europe Middle East Africa, and Asia-Pacific.

By triangulating diverse data sources and analytical techniques, this methodology delivers a robust foundation for strategic decision-making without relying on a single information channel.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motorcycle Parts & Accessories market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motorcycle Parts & Accessories Market, by Product Type

- Motorcycle Parts & Accessories Market, by Motorcycle Type

- Motorcycle Parts & Accessories Market, by Installation Type

- Motorcycle Parts & Accessories Market, by Sales Channel

- Motorcycle Parts & Accessories Market, by End-User

- Motorcycle Parts & Accessories Market, by Region

- Motorcycle Parts & Accessories Market, by Group

- Motorcycle Parts & Accessories Market, by Country

- United States Motorcycle Parts & Accessories Market

- China Motorcycle Parts & Accessories Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Strategic Imperatives to Navigate Market Complexity and Drive Sustainable Growth Trajectories

The motorcycle parts and accessories market stands at an inflection point where technological innovation, shifting consumer behaviors, and regulatory forces converge. Success hinges on the ability to harness digital tools, embrace sustainable materials, and foster collaborative ecosystems that drive product differentiation. As tariff landscapes evolve, supply chain resilience and strategic sourcing will become indispensable sources of competitive advantage.

Segment-specific strategies-whether targeting high-performance sport bike enthusiasts, urban commuters, or commercial fleet operators-must be underpinned by deep segmentation insights and local market intelligence. Regional nuances will dictate the pace of electrification, the appetite for customization, and distribution channel optimization.

Industry leaders who align their R&D investments with emerging trends, cultivate partnerships with startups and material innovators, and leverage omnichannel engagement models will not only weather the challenges of a dynamic environment but also unlock new avenues for growth. The insights contained in this executive summary illuminate a pathway for decision-makers aiming to capture value and shape the future of motorcycle mobility.

Secure Comprehensive Motorcycle Parts & Accessories Intelligence with Ketan Rohom to Propel Strategic Growth and Market Leadership

To explore advanced insights into the global motorcycle parts and accessories market and obtain tailored data-driven strategies, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report today This exclusive opportunity will empower your team with the critical knowledge needed to drive innovation and unlock growth potential

- How big is the Motorcycle Parts & Accessories Market?

- What is the Motorcycle Parts & Accessories Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?