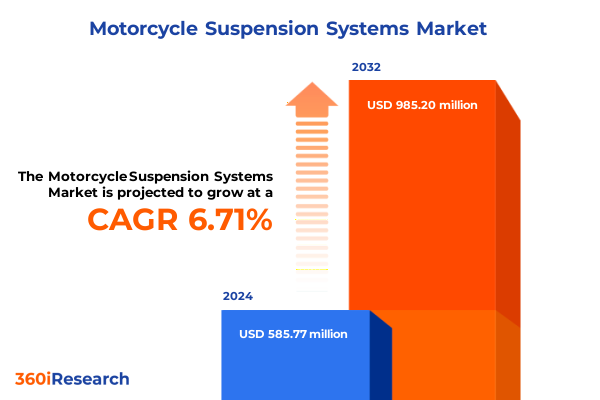

The Motorcycle Suspension Systems Market size was estimated at USD 625.20 million in 2025 and expected to reach USD 668.38 million in 2026, at a CAGR of 6.71% to reach USD 985.20 million by 2032.

Setting the Stage for an In-Depth Exploration of Motorcycle Suspension Systems and Their Crucial Role in Riding Performance and Safety

Motorcycle suspension systems serve as the unsung heroes of both daily commuting and high-performance riding, acting as the critical interface between a rider and the road. By mitigating the impacts of uneven surfaces, these systems not only enhance comfort but also preserve handling precision, braking stability, and overall vehicle safety. The intricate engineering behind modern suspensions incorporates advanced materials, fluid dynamics, and electronic controls to meet the diverse needs of urban commuters, off-road adventurers, and touring enthusiasts alike.

As the two-wheeler industry marches forward, the role of suspension technology has expanded from mere shock absorption to an integral enabler of rider confidence and adaptability. Electrically adjustable damping, predictive maintenance sensors, and adaptive ride modes are becoming mainstream as manufacturers seek to differentiate their offerings. In this context, understanding suspension innovations, market dynamics, and the drivers shaping future adoption is imperative for decision-makers aiming to capitalize on evolving performance and regulatory requirements.

Unveiling the Disruptive Technological and Consumer Trends Reshaping the Motorcycle Suspension Market and Steering Its Future Trajectory

In the past decade, the motorcycle suspension landscape has undergone a series of transformative shifts driven by technological breakthroughs and changing consumer expectations. Electrically adjustable suspension modules that once appeared in premium segments are now permeating mid-range models, offering riders real-time adaptability across urban and off-road conditions. This democratization of intelligent damping has been propelled by advancements in sensor miniaturization and cost-efficient actuator designs.

Simultaneously, a growing emphasis on sustainable materials and manufacturing processes has led to the emergence of lightweight composite springs and corrosion-resistant coatings. Beyond environmental considerations, these innovations reduce unsprung mass and enhance fatigue life, translating to improved handling and reduced long-term maintenance. Consequently, OEMs and aftermarket suppliers are reevaluating traditional steel-based components in favor of polymer-infused or hybrid material assemblies.

Moreover, the rapid integration of connectivity solutions has enabled remote diagnostics and over-the-air suspension firmware updates, fostering predictive maintenance ecosystems. As a result, dealers and fleet managers can anticipate wear-related failures, optimize service intervals, and reduce downtime. Collectively, these developments signal a paradigm shift from passive components to dynamic, data-driven systems that respond to real-world riding conditions and rider preferences.

Assessing the Multidimensional Effects of New United States Tariffs Imposed in 2025 on Motorcycle Suspension Supply Chains and Industry Dynamics

The introduction of revised United States tariff measures in early 2025 has created significant ripple effects throughout the motorcycle suspension supply chain. Raw material levies on specialized alloys and hydraulic fluids have driven up sourcing costs, while import duties on finished fork assemblies and shock absorbers have necessitated recalibrations of pricing strategies. As a direct consequence, manufacturers have embarked on localized production initiatives or pursued alternative trade partnerships to alleviate financial burdens and maintain competitive margins.

Importantly, these tariff-induced cost pressures have also spurred innovation among suppliers seeking to offset price escalations. Some have accelerated the adoption of additive manufacturing techniques to produce precision components domestically, thereby reducing dependence on tariff-exposed imports. Others have leveraged economies of scale by consolidating production of electronic control units within North America and forging deeper collaborations with domestic OEMs.

In parallel, aftersales channels have experienced shifts in inventory management as dealers stockpile critical suspension parts in anticipation of potential duty increases. This precautionary behavior has prompted logistic planners to optimize warehousing footprints and refine demand forecasting models. Moving forward, companies with agile sourcing strategies and the ability to pivot between global and local suppliers will be best positioned to mitigate ongoing tariff uncertainties and sustain supply continuity.

Deep Insights into Segmentation by Suspension Type Component and Vehicle Class That Drive Diverse Opportunities within the Market Landscape

A thorough examination of segmentation by suspension type reveals a landscape defined by nuanced performance demands and electronic integration requirements. Air suspension offerings, encompassing both manually adjusted and electronically controlled variants, continue to appeal to riders seeking adjustable ride heights and variable damping. In contrast, mono shock configurations-available in electronically controlled, pneumatic, and hydraulic designs-command a strong presence among sport and touring models for their superior response characteristics and packaging efficiency. Telescopic forks, differentiated by air spring and coil spring technologies, remain ubiquitous in commuter and mid-segment motorcycles due to their proven reliability and cost-effective manufacture. Meanwhile, twin shock systems, offered in hydraulic and pneumatic forms, deliver classic styling cues for cruiser enthusiasts, and upside-down forks-available in open bath and cartridge formats-are increasingly adopted in performance-oriented bikes for their enhanced stiffness and heat dissipation.

Expanding the segmentation dialogue to component orientation, front fork assemblies and rear shock absorbers each serve distinct performance functions and maintenance requirements. Front systems focus on steering precision, dive control, and lateral rigidity, whereas rear shocks prioritize rider comfort, traction balance, and load-bearing adaptability. The interplay between these components underscores the need for harmonized tuning to deliver cohesive handling and ride quality across diverse riding scenarios.

Exploring vehicle type segmentation further illustrates targeted design philosophies and market potential niches. Commuter models, including scooter and standard variants, emphasize user-friendly suspension settings and low-cost servicing. Cruiser segments balance hydraulic and pneumatic characteristics to deliver smooth highway cruising experiences, while off-road categories-spanning dual sport, enduro, and motocross applications-demand robust, high-travel suspension with rapid rebound control. Sport motorcycles prioritize electronic damping algorithms for high-speed stability and cornering precision, and touring machines, covering both adventure and long-distance use cases, integrate electronic preload adjustment and spring rates optimized for variable rider and luggage loads. Such layered segmentation insights illuminate the diverse value propositions that suspension specialists must navigate and address.

This comprehensive research report categorizes the Motorcycle Suspension Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Suspension Type

- Component

- Vehicle Type

Comparative Examination of Regional Dynamics across the Americas Europe Middle East & Africa and Asia-Pacific Shaping Suspension Strategies

An in-depth look at the Americas region highlights a mature market characterized by strong aftermarket activity and an enthusiastic embrace of electronically controlled suspension systems. Riders in North America increasingly demand customization and remote adjustment features, prompting suppliers to develop modular control units and smartphone-enabled tuning platforms. Latin American markets, while more price-sensitive, are exhibiting gradual uptake of upgraded fork assemblies that offer improved durability under challenging road conditions.

Turning to Europe, the Middle East, and Africa, the suspension segment is shaped by stringent regulatory standards and premium OEM adoption of lightweight materials. European manufacturers lead in the integration of adaptive damping systems and predictive maintenance sensors, largely driven by legislative emphasis on vehicle safety and emissions. In the Middle East, high ambient temperatures and long highway distances are driving demand for heat-resistant hydraulic fluids and reinforced shock bodies. African markets present opportunities for cost-effective, robust suspension kits capable of enduring rough terrain, with aftermarket installers playing a pivotal role in customizing ride ergonomics.

In the Asia-Pacific realm, a heterogeneous mix of high-growth economies and established motorcycle cultures defines regional dynamics. Southeast Asian riders favor telescopic forks in commuter motorcycles due to their affordability and ease of repair. Conversely, Japan and Australia demonstrate increasing adoption of advanced upside-down forks and electronically managed rear shocks, especially on premium sport and touring models. Manufacturers in this region are leveraging strong domestic supply chains to innovate with composite materials and real-time ride analytics, positioning themselves as pioneers in next-generation suspension solutions.

This comprehensive research report examines key regions that drive the evolution of the Motorcycle Suspension Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Manufacturers Highlighting Innovations Collaborations and Competitive Moves Influencing the Suspension Space

Leading suspension manufacturers are differentiating through investments in proprietary electronic control algorithms and partnerships with OEMs on integrated ride mode platforms. Tier-one suppliers are expanding R&D centers to refine magnetorheological dampers and to develop lightweight, high-strength composite springs. At the same time, specialist firms are capturing niche segments by offering retrofit kits that incorporate digital connectivity and adjustable preload settings designed for popular cruiser and touring models.

Notably, collaboration between suspension experts and technology companies has accelerated the commercialization of predictive maintenance functions. By embedding microelectromechanical sensors within fork legs and shock reservoirs, these alliances enable real-time monitoring of component wear and fluid condition. Consequently, both OEMs and end users benefit from reduced unplanned service events and optimized maintenance intervals, reinforcing brand loyalty and driving aftermarket revenues.

Competitive dynamics also reflect geographic diversification strategies, with several players establishing regional manufacturing hubs to navigate tariff landscapes and to ensure proximity to key markets. This localized approach not only alleviates cost pressures but also fosters deeper collaboration with regional distributors and service networks. As such, companies that balance global scale with local agility are setting the benchmark for operational resilience and market responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Motorcycle Suspension Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andreani Group SpA

- Betor Industria Tecnica SL

- BITUBO Srl

- Continental AG

- Dah Ken Industrial Co Ltd

- DNM Suspension Co Ltd

- Elka Suspension Inc

- Endurance Technologies Ltd

- Fox Factory Holding Corp

- Gabriel India Limited

- Hagon Shocks Limited

- K-Tech Suspension Limited

- KYB Corporation

- Marzocchi S.p.A

- Mupo Srl

- Nitron Racing Systems Ltd

- Paoli Industrial Srl

- Penske Racing Shocks

- Progressive Suspension Inc

- Race Tech Inc

- Showa Corporation

- Tenneco Inc

- WP Suspension GmbH

- YSS Suspension

- ZF Friedrichshafen AG

Strategic Imperatives and Tactical Approaches Industry Leaders Can Embrace to Capitalize on Emerging Suspension System Trends and Market Shifts

Industry leaders should prioritize the development of modular suspension platforms that seamlessly integrate both mechanical and electronic subsystems, enabling rapid customization for diverse ride modes. By adopting open architecture control units with standardized communication protocols, OEMs and aftermarket specialists can foster an ecosystem of third-party app developers, creating value-added features that enhance rider engagement and brand differentiation.

Furthermore, investing in additive manufacturing for prototype and low-volume production can accelerate time to market and reduce tooling expenditures. This approach supports rapid iteration of fork leg geometries and shock body designs optimized for weight savings and fatigue resistance. In parallel, establishing strategic partnerships with material science innovators will allow companies to incorporate advanced composites and surface treatments that improve long-term reliability under varied environmental stresses.

Finally, navigating regulatory and tariff challenges requires an agile supply chain strategy that leverages dual-sourcing arrangements and nearshore manufacturing footprints. Leaders should implement digital twin simulations to model cost scenarios under different duty structures and to optimize inventory positioning across global distribution centers. Such proactive measures will ensure continuity of supply and reinforce competitive positioning amid ongoing trade policy uncertainties.

Rigorous and Transparent Methodological Framework Applied to Gather Validate and Analyze Critical Data in Motorcycle Suspension Research

The research underlying this report employed a multifaceted framework encompassing primary interviews with OEM engineers, aftermarket specialists, and industry consultants. Secondary data sources included regulatory filings, patent databases, and technical white papers focused on suspension materials and actuator technologies. Market dynamics were validated through cross-referencing public financial disclosures and press releases detailing product launches and strategic investments.

Quantitative analysis integrated unit shipment data from vehicle registration databases and aftermarket sales figures aggregated by specialty distributors. Meanwhile, qualitative assessments drew upon field trials conducted with leading motorcycle clubs under different ride conditions, providing firsthand insights into performance differentials across suspension variants. This combined methodological approach ensured robust, triangulated findings that accurately reflect both macro trends and micro-level consumer preferences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Motorcycle Suspension Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Motorcycle Suspension Systems Market, by Suspension Type

- Motorcycle Suspension Systems Market, by Component

- Motorcycle Suspension Systems Market, by Vehicle Type

- Motorcycle Suspension Systems Market, by Region

- Motorcycle Suspension Systems Market, by Group

- Motorcycle Suspension Systems Market, by Country

- United States Motorcycle Suspension Systems Market

- China Motorcycle Suspension Systems Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Synthesis of Core Findings Reinforcing the Significance of Adaptive Innovation and Collaboration in Motorcycle Suspension Evolution

Bringing together the core findings, it is evident that motorcycle suspension systems are transitioning from passive shock absorbers to intelligent, adaptive platforms that enhance safety, comfort, and performance. Stakeholders who embrace modular electronic integration, sustainable materials, and agile manufacturing practices will be well positioned to lead in a landscape marked by evolving rider expectations and fluctuating trade environments.

Ultimately, the path forward hinges on collaboration across OEMs, technology partners, and service networks to deliver seamless, data-driven suspension experiences. By aligning product development with regulatory shifts and consumer demand, industry participants can unlock new value propositions and drive sustained growth.

Engage with Ketan Rohom to Secure Expert Insights and Comprehensive Analytics on Motorcycle Suspension Systems Through a Detailed Market Research Report

The depth and breadth of insight captured in this analysis underscore the critical importance of timely, actionable data for stakeholders looking to lead market evolution. Readers are invited to reach out to Ketan Rohom, Associate Director, Sales & Marketing, to access the comprehensive report, engage in tailored consultations, and secure a powerful competitive edge through expert guidance and bespoke strategic recommendations.

- How big is the Motorcycle Suspension Systems Market?

- What is the Motorcycle Suspension Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?