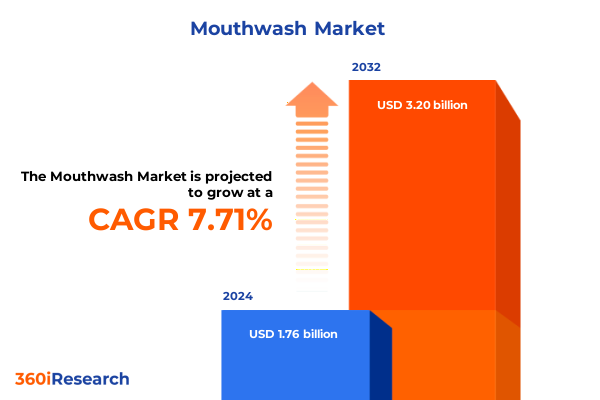

The Mouthwash Market size was estimated at USD 1.86 billion in 2025 and expected to reach USD 1.97 billion in 2026, at a CAGR of 8.01% to reach USD 3.20 billion by 2032.

Discovering the transformative growth catalysts driving the dynamic mouthwash sector as consumers prioritize oral health, natural formulations, and convenience packaging

The mouthwash category has emerged as a pivotal segment within the broader oral care industry, driven by rising global awareness around oral hygiene and preventive health measures. Consumers are increasingly viewing mouthwash not only as an adjunct to brushing and flossing routines but also as a daily wellness ritual that contributes to fresher breath, reduced plaque, and overall oral comfort. This shift is underpinned by mounting research linking oral health to systemic well-being, which has catalyzed product innovation and heightened marketing efforts across key regions.

In parallel, evolving consumer preferences for cleaner labels and natural ingredients have prompted manufacturers to expand portfolios beyond traditional synthetic formulations. This trend is compounded by younger demographics seeking products that align with their environmental and ethical values. Meanwhile, established brands continue to leverage their heritage and clinical endorsements to reinforce efficacy claims, fostering a dynamic competitive landscape. As oral care professionals and end users alike place greater emphasis on prevention and holistic health, the mouthwash market is poised for sustained transformation fueled by innovation, shifting consumer expectations, and cross-functional collaboration between dental associations and manufacturers.

Identifying the paradigm shifts reshaping the mouthwash market amid regulatory changes, eco-conscious trends, and digital innovation

Regulatory evolutions and heightened consumer scrutiny have converged to reshape the mouthwash landscape, elevating ingredient transparency and environmental accountability to the forefront. Stricter guidelines on antimicrobial agents and alcohol content have compelled brands to reformulate legacy products, while sustainability mandates are driving packaging redesigns to reduce single-use plastics and lower carbon footprints. In tandem, digital platforms have emerged as powerful channels for product discovery, enabling tailored marketing campaigns and direct consumer engagement that were previously unattainable through traditional retail outlets.

Moreover, the acceleration of e-commerce has disrupted conventional distribution paradigms, prompting incumbent players to forge partnerships with online retailers, subscription services, and omnichannel pharmacy networks. Personalization has also become a key differentiator, with bespoke mouthwash formulations and subscription-based refill models gaining traction among consumers seeking curated experiences. Taken together, these shifts signify a fundamental reordering of product development priorities and go-to-market strategies, requiring brands to adopt agile innovation processes and data-driven decision making to maintain relevance in an increasingly competitive arena.

Examining the far-reaching repercussions of 2025 United States tariffs on mouthwash supply chains, import costs, and competitive positioning

The introduction of new import duties on key raw materials and finished mouthwash products by the United States in 2025 has materially altered cost structures and supply chain dynamics. Sourcing of essential oils, flavoring agents, and proprietary actives from traditional hubs such as Europe and Asia has become more complex, prompting manufacturers to reassess supplier networks and negotiate longer-term contracts to mitigate price volatility. In response, some regional producers have accelerated investments in domestic formulation and manufacturing facilities to minimize exposure to cross-border tariff impacts and safeguard margin stability.

These adjustments have rippled through distribution channels, with wholesalers and retailers reevaluating inventory strategies to balance cost increases against demand elasticity. Brands have deployed more frequent promotional initiatives to preserve shelf velocity, while selectively absorbing a portion of the tariff-induced cost escalation to maintain competitive pricing. Concurrently, strategic alliances with logistics providers specializing in nearshore distribution have gained prominence, offering expedited delivery times and reduced freight premiums. Collectively, these measures underscore the industry’s adaptive capacity in the face of protectionist trade policies and reinforce the imperative for scenario-based planning in today’s volatile operating environment.

Unveiling critical market segmentation revelations across ingredient, formulation, product type, packaging, distribution channels, and end user perspectives

Insight into the mouthwash market’s segmentation reveals nuanced performance variations across multiple dimensions. When exploring ingredient preferences, consumers have shown an elevated appetite for products leveraging naturally derived extracts, driven by essential oils and herbal formulations, yet synthetic actives remain indispensable for antimicrobial efficacy and flavor consistency. Formulation type further differentiates consumer choice, with alcohol-based rinses sustaining a loyal base focused on clinical-grade protection, while alcohol-free variants attract a growing cohort prioritizing gentleness and sensitivity management.

Divergence extends to product types, where cosmetic mouthwashes offering whitening benefits and breath freshening effects coexist alongside therapeutic variants engineered for gum health and cavity prevention. Packaging formats also play a crucial role in purchase decisions, as multi-use bottles crafted from glass or plastic provide cost effective solutions for everyday use, whereas single-dose sachets cater to on-the-go convenience and travel compliance. Distribution channels continue to evolve in parallel, as mouthwash reaches consumers through convenience outlets, expanding online retail platforms, traditional pharmacy and drugstore establishments, and large-format supermarkets and hypermarkets. Finally, consumer age segments illustrate distinct usage patterns: adults account for the majority of routine mouthwash consumption, while pediatric formulations, often milder and featuring fruit-infused tastes, are tailored specifically to children’s oral care needs.

This comprehensive research report categorizes the Mouthwash market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient

- Formulation

- Product Type

- Packaging

- Distribution Channel

- End User

Highlighting regional dynamics influencing the mouthwash marketplace across the Americas, Europe Middle East and Africa, and Asia Pacific markets

Regional markets display divergent growth trajectories influenced by demographic shifts, regulatory regimes, and local oral care habits. In the Americas, mature markets lean heavily on cosmetic mouthwash benefits, particularly whitening and breath freshness, supported by robust retail infrastructures and widespread consumer familiarity with established brands. Meanwhile, emerging Latin American markets are characterized by rapid urbanization, rising incomes, and a growing emphasis on preventive health, sparking increased adoption of both therapeutic and natural mouthwash variants.

Across Europe, the Middle East, and Africa, regulatory frameworks are among the most stringent globally, compelling manufacturers to maintain rigorous compliance standards while navigating diverse cultural preferences. Consumers in Western Europe often seek premium formulations with clinical validation, whereas pockets of the Middle East and Africa are showing heightened interest in herbal and essential oil-based mouth rinses that align with traditional oral care practices. In the Asia-Pacific region, dynamic population centers such as China, India, and Southeast Asia are driving exponential demand growth, underpinned by digital commerce expansion, innovative local brands, and a strong affinity for natural botanical ingredients that resonate with regional wellness philosophies.

This comprehensive research report examines key regions that drive the evolution of the Mouthwash market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading mouthwash brands and their strategic initiatives to capture market share, innovate formulations, and optimize distribution networks

Leading industry participants have pursued multifaceted strategies to capture market share and drive top-line growth. International household brands have fortified their portfolios by introducing new lines infused with plant-based actives and probiotic extracts, while simultaneously scaling up sustainable packaging initiatives to meet evolving consumer expectations. Strategic collaborations with dental professionals and academic institutions have bolstered clinical credibility, enabling premium pricing and reinforced endorsement in both prescription and over-the-counter channels.

Regional specialists are capitalizing on local ingredient expertise, formulating products around indigenous herbal extracts and leveraging distribution partnerships to penetrate under-served markets. Several market leaders have accelerated digital transformation efforts, incorporating direct-to-consumer subscription models, interactive packaging technologies, and mobile applications designed to support user compliance and track oral health outcomes. Ultimately, the competitive landscape is defined by a balance of heritage brand recognition, formulation innovation, and nimble channel strategies that collectively dictate success across diverse geographies and consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mouthwash market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Haleon plc

- Himalaya Global Holdings Ltd.

- JNTL Consumer Health (India) Private Limited

- Kao Corporation

- Kenvue Brands LLC

- Lion Corporation

- Reckitt

- Sunstar Incorporated

- The Humble Co. AB

- Uniray Life Sciences

Delivering targeted strategic recommendations for industry leaders to navigate volatility, capitalize on emerging trends, and fortify market positioning

Industry leaders seeking sustained growth must prioritize investment in naturally derived formulations that resonate with health-conscious demographics and differentiate brands in crowded marketplaces. Concurrently, commitment to packaging innovation-particularly the adoption of refillable multi-use systems and compostable single-dose units-will be essential to meet escalating sustainability benchmarks without sacrificing product integrity. Supply chain resilience should be fortified through diversified sourcing strategies, enabling swift adaptation to shifting tariff policies and logistical disruptions.

At the channel level, amplifying e-commerce capabilities and integrating omnichannel fulfillment will unlock new consumer touchpoints while enhancing data capture for personalized marketing initiatives. Regional market nuance requires tailored go-to-market approaches, combining premium positioning in mature territories with value-oriented offerings in cost-sensitive regions. Cross-functional collaboration between R&D, regulatory affairs, and commercial teams will facilitate accelerated product launches and ensure alignment with evolving compliance landscapes. By embracing these strategic imperatives, companies can navigate a volatile environment, capture emerging opportunities, and solidify leadership in the mouthwash domain.

Detailing the rigorous research framework encompassing primary interviews, secondary data analysis, and advanced quantitative methodologies driving insights

This analysis is underpinned by a robust research framework incorporating both qualitative and quantitative methodologies. Primary insights were derived from in-depth interviews with senior executives across manufacturing, formulation development, and distribution sectors, complemented by structured discussions with clinical experts and leading dental practitioners. These engagements provided nuanced perspectives on evolving regulatory landscapes, ingredient innovation pathways, and channel disruption patterns.

Secondary research sources included peer-reviewed journals, trade publications, patent databases, and government regulatory filings to validate emerging ingredient technologies and compliance mandates. Quantitative modeling leveraged time-series analysis and scenario forecasting to evaluate tariff impacts and segment performance trajectories. Data triangulation techniques were applied throughout to reconcile disparate data points and ensure analytical rigor. The integration of these diverse methods yields a comprehensive, internally consistent view of the mouthwash market, equipping decision-makers with the depth and breadth of insight required to formulate effective strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mouthwash market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mouthwash Market, by Ingredient

- Mouthwash Market, by Formulation

- Mouthwash Market, by Product Type

- Mouthwash Market, by Packaging

- Mouthwash Market, by Distribution Channel

- Mouthwash Market, by End User

- Mouthwash Market, by Region

- Mouthwash Market, by Group

- Mouthwash Market, by Country

- United States Mouthwash Market

- China Mouthwash Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing the comprehensive market analysis on mouthwash trends, challenges, and strategic imperatives to inform executive decisions

In summation, the mouthwash market stands at the intersection of evolving consumer expectations, regulatory realignment, and supply chain recalibration. Heightened demand for natural ingredients and eco-friendly packaging, coupled with digital channel proliferation, continues to redefine competitive benchmarks. The 2025 United States tariffs have further underscored the importance of supply chain agility and localized manufacturing capabilities.

Equipped with deep segmentation insights, regional intelligence, and a clear understanding of leading players’ strategic approaches, industry stakeholders are better positioned to navigate this dynamic terrain. Strategic investment in formulation innovation, sustainability measures, and omnichannel distribution will be critical levers for growth. By embedding data-driven decision making into their operational and commercial frameworks, organizations can harness emerging trends, mitigate risk, and achieve sustained leadership in the global mouthwash arena.

Engage with Ketan Rohom to unlock customized mouthwash market intelligence that drives strategic growth objectives and competitive advantage

Are you ready to elevate your mouthwash portfolio with comprehensive, data-driven intelligence tailored to your strategic growth objectives? Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide your team through a customized research partnership that delivers actionable insights, unparalleled market clarity, and a roadmap to outpace competitors. Engage today to secure exclusive early access to proprietary analysis on ingredient innovation, regulatory shifts, and consumer behavior trends that will shape the future of oral care. Reach out now to transform your market understanding into strategic advantage and unlock the next level of success in the mouthwash sector.

- How big is the Mouthwash Market?

- What is the Mouthwash Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?