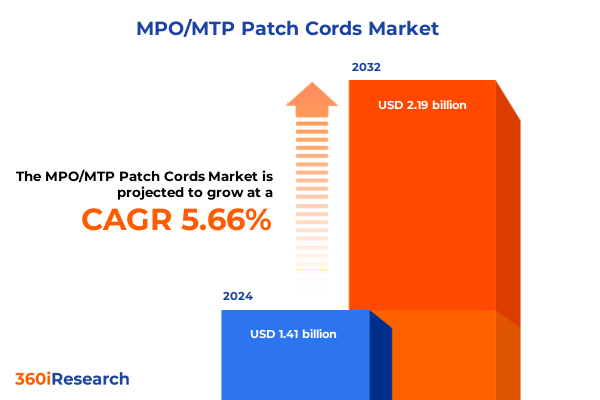

The MPO/MTP Patch Cords Market size was estimated at USD 1.41 billion in 2024 and expected to reach USD 1.49 billion in 2025, at a CAGR of 5.66% to reach USD 2.19 billion by 2032.

Setting the Stage for Future-Ready MPO/MTP Patch Cord Innovations Transforming High-Speed Network Connectivity Worldwide

In an era defined by exponential data growth and relentless demand for bandwidth, fiber optic connectivity lies at the heart of modern communication networks. The Multi-Fiber Push-On/Multi-Fiber Termination Push-On patch cord, commonly known as MPO/MTP, has emerged as a critical enabler of high-density, high-speed data transmission across cloud infrastructures, data centers, and telecom networks. This executive summary introduces the fundamental role of MPO/MTP patch cords in addressing today’s emerging challenges, highlighting their ability to deliver low insertion loss, ease of deployment, and seamless scalability.

As enterprises pursue digital transformation initiatives, technologies such as 400G and 800G networking, edge computing, and artificial intelligence training clusters are placing unprecedented pressure on cabling architectures. Moreover, the proliferation of 5G, Internet of Things, and smart city applications is expanding the footprint of fiber networks beyond traditional data center environments. Therefore, understanding the multifaceted dynamics shaping the MPO/MTP patch cord landscape is essential for decision-makers seeking to future-proof their connectivity strategies. This summary will guide readers through the landscape of transformative shifts, regulatory impacts, segmentation insights, and regional drivers that collectively define today’s MPO/MTP market.

Navigating the Tidal Wave of Technological Advancements That Are Redefining MPO/MTP Patch Cord Performance and Design

Over the past few years, MPO/MTP technology has undergone significant evolution to meet the demands of next-generation networks. First, manufacturers have embraced high-core-count designs-moving beyond the traditional 12- and 24-fiber configurations to 32-core and above-to support denser cabling topologies while optimizing rack space. Simultaneously, the introduction of next-generation pre-terminated solutions, including breakout and fan-out variants, has simplified installation workflows by enabling plug-and-play deployment without the need for field splicing.

Furthermore, material innovations such as bend-insensitive fiber and low-smoke zero-halogen jacket formulations have enhanced cable performance in tight-bend and environmentally sensitive applications. Advances in connector technology, including refined ferrule polishing techniques and integrated dust-protection features, have driven down insertion loss and return loss figures, ensuring reliable signal integrity even in the most demanding high-speed networking scenarios. Consequently, network architects can now confidently deploy MPO/MTP interconnects across hyperscale data centers, edge compute facilities, and telecom aggregation sites with minimal performance trade-offs.

Assessing the Ripple Effects of 2025 United States Tariff Changes on Global Supply Chains and Cost Structures for MPO/MTP Patch Cords

The United States’ 2025 tariff adjustments have sent shockwaves throughout the global fiber optic supply chain, raising raw material and component costs for MPO/MTP patch cords. With key inputs such as precision-machined connector ferrules and specialized polymer jacketing subject to increased duties, manufacturers and distributors have had to pivot quickly to mitigate margin erosion. Many have resorted to proactive inventory accumulation ahead of tariff deadlines, while others have renegotiated supplier contracts or explored alternative raw-material sources.

Moreover, tariff exclusions granted to certain network equipment categories have provided temporary relief, enabling critical telecom projects to proceed without full cost pass-through. Nevertheless, the overarching impact remains a reevaluation of sourcing strategies, with organizations increasingly considering nearshoring to Mexico and Southeast Asia to diversify production footprints. As a result, strategic partnerships and regional manufacturing hubs are becoming central to supply-chain resilience, ensuring continuity in the face of potential future trade disruptions.

Uncovering Critical Insights Across Product Types, Core Configurations, Installation Environments, and Application-Specific Demands in MPO/MTP Markets

When examining the MPO/MTP market through multiple lenses, each segmentation axis reveals distinct performance attributes and adoption drivers. Based on type, breakout configurations are gaining traction for link aggregation in dense server racks, while fan-out variants simplify transitions between MPO trunks and LC terminations. Trunk MPO/MTP offerings remain indispensable for high-throughput backbone links due to their scalability and ease of mass deployment.

Core number considerations further differentiate solutions: 8-fiber cables address specialized low-latency applications, 12- and 24-fiber variants strike a balance between density and manageability, and 32-core and above configurations serve hyperscale deployments demanding maximum fiber counts per module. Simultaneously, environmental factors dictate installation settings; indoor rated cords prioritize flame retardancy and flexibility, whereas outdoor options deliver enhanced UV resistance and water-blocking features for aerial, direct burial, or duct applications.

Material characteristics also guide selection: armored sheath types offer mechanical protection in hazardous pathways, whereas non-armored jackets cater to controlled data center environments where weight and bend radius are primary concerns. Fiber type differentiation between multimode and single-mode underpins transmission reach decisions, with multimode preferred for short-haul data center fabrics and single-mode for long-distance aggregation and metro networks.

Polarity management via Type A, B, and C methods ensures proper connector mapping and signal continuity across complex topologies, while end-use segmentation highlights the critical role of MPO/MTP patch cords in cloud infrastructure expansions, data center modernization, high-speed enterprise networking, and optical communication systems. Finally, channel dynamics shape purchasing behavior: offline sales channels maintain strong relationships with system integrators and enterprise accounts, whereas online platforms-both brand websites and e-commerce marketplaces-are rapidly emerging as convenient avenues for rapid order fulfillment and aftermarket support.

This comprehensive research report categorizes the MPO/MTP Patch Cords market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Core Number Type

- Installation Setting

- Sheath Type

- Fiber Type

- Polarity Type

- End-Use

- Sales Channel

Exploring Distinct Demand Dynamics and Growth Drivers Across Americas, EMEA, and Asia-Pacific MPO/MTP Ecosystems

Across the Americas, expansive hyperscale data center investments and nationwide smart city initiatives are driving robust MPO/MTP patch cord deployments. Leading cloud service providers and colocation operators are upgrading to 400G/800G architectures, necessitating high-density fiber assemblies and streamlined installation workflows. Consequently, North America serves as a bellwether for emerging infrastructure trends and equipment compatibility standards.

In Europe, Middle East & Africa, regulatory frameworks around environmental safety and energy efficiency are shaping cable jacket formulations and material choices. Telecom carriers in Europe are actively deploying fiber to the premises to meet stringent connectivity mandates, while Middle Eastern governments are leveraging fiber backhaul for 5G rollout plans. Meanwhile, many African markets are in the nascent stages of fiber expansion, presenting potential for accelerated growth as infrastructure funding matures.

Asia-Pacific remains the fastest-growing region, with China, Japan, South Korea, and India spearheading large-scale data center builds and nationwide 5G infrastructure projects. The region’s emphasis on digital ecosystems, industrial automation, and artificial intelligence applications is further amplifying demand for advanced MPO/MTP solutions. In this context, local manufacturing capabilities and component standardization initiatives are critical to meeting cost, quality, and lead-time objectives.

This comprehensive research report examines key regions that drive the evolution of the MPO/MTP Patch Cords market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Steering Innovation, Strategic Partnerships, and Competitive Positioning in the MPO/MTP Patch Cord Sector

A cohort of established fiber optics specialists and emerging innovators are shaping the competitive MPO/MTP patch cord environment. Leading global manufacturers have intensified their focus on product diversification, introducing modular interconnect systems that support rapid reconfiguration and minimize service disruptions. Concurrently, strategic acquisitions and joint ventures are enhancing supply chain integration, extending capabilities in connector polishing, cable extrusion, and testing.

Technology alliances between connector vendors and high-performance switch and router manufacturers are streamlining interoperability certifications, reducing deployment cycles for end users. Some market participants are leveraging digital platforms to offer cable configurators and performance analytics tools, enabling customers to specify custom core counts, sheath types, and polarity schemes with confidence.

Environmental sustainability is also rising to prominence, with companies integrating recycled materials into cable jackets and pursuing certifications for reduced carbon footprints. As a result, procurement teams are increasingly evaluating suppliers not only on technical performance and cost metrics but also on ESG commitments and traceability throughout the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the MPO/MTP Patch Cords market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10Gtek, Inc.

- Accu-Connect LLC

- Amphenol Corporation

- Anfkom Telecom

- Belden Inc.

- CommScope Inc.

- Corning Incorporated

- FiberNet Technologies LLC

- Fiberstore Inc.

- FS.COM INC.

- Fujikura Ltd.

- Karono

- Legrand S.A.

- Molex LLC by Koch, Inc

- Nexans S.A.

- OFS Inc. by Furukawa Electric Company

- Panduit Corporation

- Precision Optical Technologies, Inc.

- Prysmian Group

- Radiall S.A.

- Shenzhen Optico Communication Co.,Ltd

- Sumitomo Electric Industries, Ltd.

- Superior Essex, Inc.

- TE Connectivity Ltd.

- Wesco International, Inc.

Strategic Imperatives and Best Practices for Industry Leaders Seeking to Optimize Market Position and Maximize ROI in MPO/MTP Solutions

Industry leaders should seize the opportunity to diversify manufacturing footprints by establishing regional assembly hubs and dual-sourcing models that mitigate geopolitical risks and tariff exposure. Investing in high-core-count solutions and modular connector architectures will cater to evolving data center topologies, while partnerships with switch and transceiver vendors can fast-track interoperability validation.

To capture digital-first buyers, organizations should enhance online configurator capabilities and integrate real-time inventory visibility across brand websites and e-commerce channels. Adopting sustainable materials and transparent ESG reporting will resonate with corporate procurement mandates and end-user expectations, fostering brand preference in competitive bids. Furthermore, prioritizing automated insertion loss testing and predictive maintenance services can differentiate offerings by reducing operational overhead for network operators.

Ultimately, aligning product roadmaps with emerging applications-such as AI training clusters, edge micro-data centers, and 5G small cell backhaul-will unlock new revenue streams. By embedding actionable insights into strategic planning, industry leaders can refine pricing strategies, optimize inventory levels, and accelerate time-to-revenue in a rapidly evolving connectivity landscape.

Detailing Rigorous Research Approaches, Data Validation Techniques, and Analytical Frameworks Underpinning the MPO/MTP Patch Cord Study

The foundation of this report rests on a rigorous research methodology that combines qualitative and quantitative approaches. Primary data was gathered through in-depth interviews with network architects, procurement executives, system integrators, and infrastructure specialists across North America, EMEA, and Asia-Pacific. These insights were complemented by observations from leading trade shows, industry conferences, and technical workshops.

Secondary research encompassed a comprehensive review of supplier catalogs, white papers, standards organization publications, and regulatory filings. Wherever possible, information was cross-validated through multiple reputable sources and vendor disclosures to ensure high levels of accuracy and consistency.

Analytical frameworks such as segmentation analysis, Porter’s Five Forces, and SWOT were applied to evaluate market attractiveness, competitive intensity, and supply chain dynamics. Data triangulation techniques were employed to reconcile discrepancies and project credible directional trends. Finally, scenario planning exercises explored potential trade policy shifts, technology adoption rates, and sustainability regulations to inform strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our MPO/MTP Patch Cords market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- MPO/MTP Patch Cords Market, by Type

- MPO/MTP Patch Cords Market, by Core Number Type

- MPO/MTP Patch Cords Market, by Installation Setting

- MPO/MTP Patch Cords Market, by Sheath Type

- MPO/MTP Patch Cords Market, by Fiber Type

- MPO/MTP Patch Cords Market, by Polarity Type

- MPO/MTP Patch Cords Market, by End-Use

- MPO/MTP Patch Cords Market, by Sales Channel

- MPO/MTP Patch Cords Market, by Region

- MPO/MTP Patch Cords Market, by Group

- MPO/MTP Patch Cords Market, by Country

- Competitive Landscape

- List of Figures [Total: 36]

- List of Tables [Total: 723 ]

Concluding Perspectives on Market Evolution, Emerging Opportunities, and Future-Proof Strategies for MPO/MTP Patch Cord Stakeholders

As digital transformation accelerates, MPO/MTP patch cords will remain a pivotal element in shaping high-speed network infrastructures. The convergence of hyperscale computing requirements, 5G rollouts, and sustainability imperatives underscores the need for agile, high-performance fiber interconnect solutions. Organizations equipped with deep segmentation insights and robust supply chain strategies will be best positioned to navigate geopolitical uncertainties and evolving technical standards.

Looking ahead, the ability to integrate advanced materials, automate testing processes, and deliver seamless online procurement experiences will distinguish market leaders. By remaining vigilant to tariff developments, regional growth trajectories, and emerging applications, stakeholders can craft resilient roadmaps that balance cost, performance, and environmental stewardship. In this dynamic ecosystem, proactive collaboration across the value chain will unlock the full potential of MPO/MTP technology in powering the next generation of digital connectivity.

Connect Directly with Ketan Rohom to Secure In-Depth MPO/MTP Patch Cord Insights and Accelerate Competitive Advantage

Elevate your strategic planning and operational readiness by securing the comprehensive MPO/MTP Patch Cord report curated by industry veteran Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Drawing on rigorous analysis of technological trends, tariff impacts, segmentation nuances, and regional dynamics, this report delivers the actionable intelligence needed to stay ahead of shifting market forces and drive meaningful growth. Reach out today to gain exclusive access to in-depth company profiles, strategic recommendations, and proprietary research methodology that will empower your organization to optimize supply chains, refine product portfolios, and capitalize on emerging opportunities in the high-speed connectivity landscape. Don’t let critical insights slip through your grasp-connect with Ketan Rohom to embark on a data-driven path toward market leadership.

- How big is the MPO/MTP Patch Cords Market?

- What is the MPO/MTP Patch Cords Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?