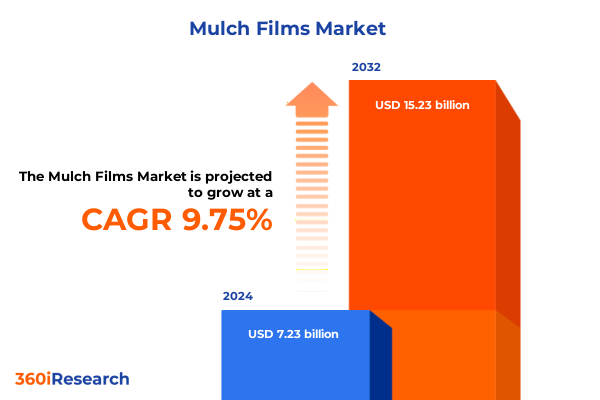

The Mulch Films Market size was estimated at USD 7.95 billion in 2025 and expected to reach USD 8.66 billion in 2026, at a CAGR of 9.72% to reach USD 15.23 billion by 2032.

Gaining Momentum Through Sustainable Innovation and Technological Advancements Redefines the Role of Mulch Films in Modern Agriculture

Gaining Momentum Through Sustainable Innovation and Technological Advancements Redefines the Role of Mulch Films in Modern Agriculture

Agricultural mulch films serve as a critical enabler for crop protection, moisture conservation, and yield optimization across a wide array of horticultural and row crop applications. These thin plastic sheeting solutions, typically deployed on soil surfaces between planting and harvest, reduce water evaporation, suppress weed growth, and improve soil temperature regulation. As growers contend with increasingly unpredictable weather patterns and stringent resource constraints, mulch films have become instrumental in enhancing both productivity and environmental stewardship.

Beyond traditional polyolefin variants such as low-density polyethylene, the sector is witnessing a decisive shift toward biodegradable alternatives, motivated by growing concerns over plastic residues in agricultural soils. Scientific evaluations reveal that polyethylene mulch films, even when collected after a growing season, can leave persistent fragments that accumulate over time, whereas biodegradable options composed of polylactic acid and starch-based polymers show potential for in-situ degradation under optimal conditions, thus mitigating microplastic contamination in soils. Nevertheless, field trials indicate that true biodegradation remains challenging under real-world humidity and temperature cycles, underscoring the importance of rigorous material testing and formulation refinement to ensure environmental performance without compromising agronomic efficacy.

Moreover, market drivers extend beyond environmental impact. Advances in film extrusion technologies, including both cast and blown techniques, have led to materials with tailored barrier properties, UV stabilization, and mechanical strength that extend service life through severe climate conditions and repeated handling. As a result, mulch films not only safeguard crops from weed competition but also optimize irrigation practices, reduce labor costs, and contribute to resource-efficient cultivation systems. In this evolving context, the convergence of sustainability imperatives and production innovations is defining a new era for the mulch films industry, setting the stage for transformative shifts in the landscape.

Emerging Sustainability Priorities and Advanced Production Technologies Are Reshaping the Global Mulch Films Landscape for Enhanced Agricultural Efficiency

Emerging Sustainability Priorities and Advanced Production Technologies Are Reshaping the Global Mulch Films Landscape for Enhanced Agricultural Efficiency

Sustainability has ascended as the foremost catalyst in the mulch films arena. Regulatory developments within the European Union, including the inclusion of soil-biodegradable products in the updated Fertilising Products Regulation, now authorize certified biodegradable mulch films to carry the CE mark, facilitating seamless trade across the European Economic Area and incentivizing further investment in soil-safe formulations. This legislative endorsement underscores the transition from conventional polyethylene sheeting toward next-generation bio-based materials that promise in-situ degradation without leaving harmful residues.

At the same time, material science breakthroughs continue to expand the performance envelope of both traditional and alternative polymers. The advent of multi-layer co-extruded films enables manufacturers to integrate distinct polymer layers with specialized functionalities, ranging from enhanced moisture barrier layers to UV-resistant and biodegradable outer skins. Automation and digitalization of film extrusion lines further drive quality consistency and operational efficiency, leveraging real-time process monitoring and AI-driven predictive maintenance to minimize downtime and material waste. Consequently, producers can deliver bespoke solutions tailored to diverse agronomic requirements while aligning with circular economy principles through energy-efficient production methods.

In parallel, shifts in end-user demand-driven by consumer awareness of plastic pollution and corporate sustainability pledges-are influencing the sourcing and design of mulch films. Biodegradable platforms based on polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are gaining traction, as they offer a route to lower carbon footprints when integrated into comprehensive waste management infrastructures. Meanwhile, the integration of recycled-content resins and development of mono-material film structures support enhanced recyclability at end of life, laying the groundwork for closed-loop systems that reconcile performance with environmental responsibility.

Escalating Trade Measures and Reciprocal Levies Are Disrupting Supply Chains and Cost Structures in The United States Mulch Film Industry

Escalating Trade Measures and Reciprocal Levies Are Disrupting Supply Chains and Cost Structures in the United States Mulch Film Industry

In early 2025, sweeping tariff measures reentered the U.S. trade policy landscape, imposing a baseline 10% tariff on all imported polyolefin and polymer films, followed by incremental increases targeting major suppliers such as China, Canada, and Mexico. Chinese exports of plastic resins and finished films now face duties of up to 145%, although a temporary 90-day enforcement pause currently moderates this rate to roughly 30%. Simultaneously, non-USMCA-compliant goods from Canada and Mexico are subject to a 25% duty, exacerbating cost pressures for agricultural film producers that rely on cross-border sourcing of LDPE, EVA, and LLDPE materials.

These measures have triggered a strategic realignment within the supply chain. U.S. manufacturers are prioritizing USMCA-compliant suppliers to minimize tariff exposure, even as prolonged lead times and stockpiling strategies become more prevalent to hedge against future tariff volatility. At the same time, the cost of chemical additives such as UV stabilizers and anti-oxidants, often sourced from international markets, has increased, prompting a reoptimization of film formulations and a renewed focus on domestic raw material processing. The unpredictability of reciprocal levy rollbacks and scheduled tariff escalations further complicates procurement planning and underscores the need for agile sourcing and in-house compounding capabilities.

Beyond commodity pricing, these evolving trade dynamics carry broader implications for investment strategies and capacity expansions. Manufacturers are accelerating automation investments to offset rising labor and material costs, while exploring nearshoring options to consolidate production within tariff-exempt jurisdictions. As a result, the U.S. mulch films industry stands at a crossroads, balancing cost containment against the imperative to innovate in response to evolving trade policies and geopolitical risks.

Diverse Product Types Materials Technologies And Source Profiles Uncover New Growth Pathways Within The Mulch Films Ecosystem

Diverse Product Types Materials Technologies And Source Profiles Uncover New Growth Pathways Within The Mulch Films Ecosystem

The mulch films market is defined by a complex array of product types spanning biodegradable formulations, conventional black, transparent clear, colored variants, and UV-stabilized sheeting. Each type is evolving through the integration of bio-resin platforms-such as polylactic acid and starch-based biopolymers-to meet sustainability targets without sacrificing crop protection efficacy. These innovative blends are increasingly designed to degrade under specific soil conditions, while offering agronomic performance on par with traditional films.

Material choices extend across ethylene vinyl acetate, low-density polyethylene, and linear low-density polyethylene, each selected for its unique balance of flexibility, tensile strength, and processability. Advanced multi-layer technologies-encompassing both blown and cast film processes-enable the creation of monolayer and multilayer structures, with some multilayer designs featuring three and five-layer configurations to optimize barrier, mechanical, and degradative properties. Meanwhile, thickness categories from low to high micron gauges allow growers to tailor film durability and retrieval characteristics to local collection capabilities.

Source profiles offer another axis of differentiation. Virgin polymers continue to dominate yield-critical applications, while recycled content films-sourced from post-consumer and post-industrial streams-address circularity objectives and regulatory mandates for recycled plastic usage. The interplay of these segments, combined with the ability to customize formulations across type, material, technology, thickness, and source, is driving targeted innovation and opening new pathways for value creation in diverse agricultural contexts.

This comprehensive research report categorizes the Mulch Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Technology

- Thickness

- Source

Regional Dynamics Across The Americas Europe Middle East Africa And Asia Pacific Reveal Critical Opportunities For Mulch Film Adoption And Innovation

Regional Dynamics Across The Americas Europe Middle East Africa And Asia Pacific Reveal Critical Opportunities For Mulch Film Adoption And Innovation

In the Americas, the demand for high-performance agricultural films is buoyed by extensive row crop acreage and strong adoption rates of precision irrigation systems. Producers are increasingly seeking durable UV-blocking black films to extend seasonal windows in northern latitudes, while in Latin America, clear and colored mulch films support greenhouse and specialty crop cultivation. The integration of recycled resins is advancing in North America, propelled by state-level mandates and voluntary take-back initiatives that facilitate closed-loop collection of used films.

Across Europe, Middle East, and Africa, regulatory frameworks are shaping market evolution. The EU’s Single-Use Plastics Directive and updated Fertilising Products Regulation have accelerated the uptake of certified biodegradable mulch films, particularly in Southern and Western Europe where retrieval and recycling remain challenging. Investments in compostable film infrastructure in countries such as Italy and France have fostered regional leadership in soil-biodegradable product development. In the Middle East and North Africa, the focus on water conservation is driving demand for advanced film technologies that enhance moisture retention and reflectivity to mitigate extreme heat stress.

Asia-Pacific presents a mosaic of growth scenarios, from the large-scale agribusiness operations in Australia that rely on multi-layer polyethylene films to smallholder farms in Southeast Asia adopting thin degradable films to reduce labor requirements. In China and India, government incentives for plastic pollution control are spurring local production of compostable films, while rapidly modernizing supply chains in the region are enabling the import of technologically advanced sheeting solutions. Across all these regions, the interplay of regulation, climatic conditions, and farm scale is creating divergent yet complementary opportunities for the next generation of mulch films.

This comprehensive research report examines key regions that drive the evolution of the Mulch Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Driving Sustainability Innovation Operational Excellence And Strategic Collaborations In The Mulch Films Market

Leading Industry Players Are Driving Sustainability Innovation Operational Excellence And Strategic Collaborations In The Mulch Films Market

BASF has been at the forefront of integrating biodegradable polymers into agricultural film applications, helping to define new standards for soil-safe materials. With its active participation in the development of European standards such as EN 17033, the company ensures that certified biodegradable mulch films meet stringent ecotoxicity, dimensional, and mechanical criteria, creating a foundation for broader market acceptance and regulatory alignment. Through targeted R&D collaborations, BASF continues to optimize film formulations for both performance and end-of-life biodegradation.

Taghleef Industries stands out for its expansive global footprint and investment in biobased film production. The recent introduction of BoPLA ranges based on NatureWorks’ Ingeo PLA polymers underscores its commitment to supply compostable solutions that satisfy industrial composting standards. This strategic move not only diversifies its product portfolio but also leverages its innovation centers to accelerate the commercial rollout of sustainable film variants tailored for fresh produce and horticulture applications.

Berry Global has leveraged vertical integration to secure cost efficiencies and supply chain resilience for its agricultural films segment. By pioneering lightweighting techniques and incorporating recycled content through its Sustane® polyester resins, the company is advancing circular economy objectives while maintaining critical film properties such as tear resistance and UV stabilization. Its acquisition strategies and closed-loop recycling partnerships exemplify how scale and strategic collaborations can drive both environmental impact reduction and competitive positioning.

Dow brings deep expertise in polymer science and global manufacturing scale to the mulch films industry. Its agricultural films portfolio spans mulch, greenhouse, and silage sheeting, benefitting from the company’s robust chemical intermediates and performance materials divisions. Dow’s integrated business model and emphasis on process innovation have enabled the rapid adaptation of specialty resins that balance biodegradability, mechanical performance, and cost efficiency, reinforcing its role as a pivotal supplier in evolving trade and regulatory environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mulch Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agriplast Tech India Private Limited

- Ampacet Corporation

- Armando Álvarez Group S.A.

- BASF SE

- Berry Global Inc.

- BioFlexx Polymers, Inc.

- Exxon Mobil Corporation

- Growflex Polyfilms LLP

- Iris Polymers Industries Private Limited

- Kothari Group

- Kuraray Co., Ltd.

- Marusan Industry Co., Ltd.

- Novamont S.p.A.

- Orion Plastics Corporation

- Plastika Kritis S.A.

- Quality Packaging Supply Corporation

- RKW Group GmbH & Co. KG

- Shalimar Group

- Taghleef Industries S.A.

- The Dow Chemical Company

Strategic Initiatives And Sustainable Practices That Industry Leaders Should Adopt To Capitalize On Market Shifts In The Mulch Films Sector

Strategic Initiatives And Sustainable Practices That Industry Leaders Should Adopt To Capitalize On Market Shifts In The Mulch Films Sector

To navigate the evolving trade and regulatory environment, industry leaders should formalize dynamic sourcing strategies that prioritize tariff-exempt and USMCA-compliant suppliers. By diversifying raw material inputs and reinforcing nearshore production capabilities, companies can mitigate the impact of fluctuating duties while maintaining consistent supply for critical extrusion operations. Furthermore, investing in in-house compounding and additive blending will reduce dependency on volatile international chemical markets and improve response times to formulation changes.

Embracing multi-layer extrusion and co-extrusion technologies offers a competitive advantage through the ability to fine-tune film performance characteristics. Companies should seek partnerships with equipment providers that deliver advanced control systems and AI-enabled process analytics, ensuring precise layering, minimal material waste, and rapid scaling of new film recipes. Such collaborations not only enhance product quality but also drive operational savings by reducing downtime and improving yield rates of high-value films.

Finally, forging alliances across the value chain-ranging from agricultural cooperatives to waste management entities-will be essential for establishing viable end-of-life solutions. By integrating with composting networks, take-back programs, and recycling initiatives, manufacturers can demonstrate circular economy credentials and build trust with end-users and regulators alike. Aligning product development roadmaps with region-specific collection and disposal infrastructures will accelerate the adoption of biodegradable and recycled-content films, reinforcing sustainability commitments and unlocking new market segments.

Comprehensive Research Methodology Combining Primary Insight Validation Secondary Data Triangulation And Rigorous Analytical Techniques

Comprehensive Research Methodology Combining Primary Insight Validation Secondary Data Triangulation And Rigorous Analytical Techniques

This research leverages a multi-tiered approach that begins with extensive secondary data gathering from regulatory publications, academic journals, and industry-specific trade reports to establish a foundational understanding of market dynamics and technological developments. Authoritative sources such as European Commission regulations, United States trade policy announcements, and key scientific studies inform the core analytical framework.

The secondary insights are validated through primary interviews and surveys conducted with leading film manufacturers, agricultural extension specialists, and material scientists. These engagements provide real-world perspectives on evolving procurement strategies, production bottlenecks, and end-user requirements. Through rigorous triangulation, qualitative findings are cross-referenced with quantitative data sets to ensure both accuracy and relevance.

Advanced analytical models are then applied to dissect segmentation performance across type, material, technology, thickness, and source categories. Regional analyses integrate geopolitical and policy variables to capture the distinct drivers shaping adoption patterns in the Americas, EMEA, and Asia-Pacific. Finally, scenario planning and sensitivity analyses test the resilience of key strategic recommendations under alternate trade policy and regulatory trajectories, ensuring actionable insights that withstand market uncertainties.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mulch Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mulch Films Market, by Type

- Mulch Films Market, by Material

- Mulch Films Market, by Technology

- Mulch Films Market, by Thickness

- Mulch Films Market, by Source

- Mulch Films Market, by Region

- Mulch Films Market, by Group

- Mulch Films Market, by Country

- United States Mulch Films Market

- China Mulch Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Final Reflections On Technological Evolution Sustainability Imperatives And Market Dynamics Shaping The Future Of Mulch Films In Global Agriculture

Final Reflections On Technological Evolution Sustainability Imperatives And Market Dynamics Shaping The Future Of Mulch Films In Global Agriculture

The mulch films industry stands at the nexus of technological innovation and environmental responsibility. As sustainable materials gain traction under evolving legislative frameworks, manufacturers are compelled to refine bio-resin formulations and invest in advanced extrusion technologies to balance agronomic performance with ecological stewardship. Trade tensions and tariff realignments have underscored the imperative for agile supply chains, prompting a reevaluation of sourcing strategies and nearshore manufacturing investments.

Segmentation insights reveal that the interplay of film type, material, technology, thickness, and source profiles offers significant levers for competitive differentiation. Meanwhile, regional dynamics highlight the importance of regulatory alignment and infrastructure development to unlock the full potential of biodegradable and recycled-content films. By studying the practices of leading companies, peers can identify replicable strategies-ranging from multi-layer co-extrusion adoption to circular economy collaborations-that drive both growth and sustainability.

In conclusion, the mulch films landscape will continue to evolve in response to climate imperatives, consumer expectations, and policy shifts. Companies that embrace integrated innovation roadmaps, forge cross-sector partnerships, and maintain adaptive supply chain architectures will be best positioned to capture emerging opportunities. In this dynamic environment, strategic foresight and operational agility emerge as the defining attributes for industry leaders prepared to shape the next chapter of sustainable agriculture.

Engage Directly With Our Research Expert To Unlock In-Depth Insights And Elevate Your Strategic Decision Making In The Mulch Films Sector

Ready to access the full strategic analysis of trends, drivers, and opportunities shaping the mulch films sector? Reach out to Associate Director, Sales & Marketing, Ketan Rohom, to explore tailored insights that will support your decision-making and accelerate your growth initiatives in this evolving market. Secure a comprehensive research report today and position your organization for competitive advantage.

- How big is the Mulch Films Market?

- What is the Mulch Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?