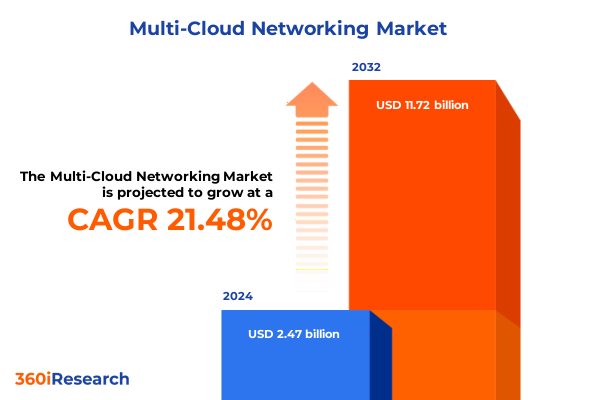

The Multi-Cloud Networking Market size was estimated at USD 3.16 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 20.70% to reach USD 11.82 billion by 2032.

Laying the Foundation for Understanding the Multi-Cloud Networking Revolution and Its Strategic Importance to Modern Enterprises

The evolution of information technology has ushered in an era where multi-cloud networking stands at the forefront of enterprise connectivity strategies. As organizations strive to meet demands for agility, scalability, and resilience, the ability to interlink diverse cloud environments seamlessly has become critical. This foundational shift is driven by the need to avoid vendor lock-in, optimize performance across geographic regions, and support an array of modern workloads-from real-time analytics to distributed application development.

Against this backdrop, network architects and technology leaders are prioritizing interoperability, automation, and security to harness the full potential of multi-cloud deployments. Enterprises are no longer satisfied with static, siloed networks; they require networking fabrics that can adapt dynamically to shifting traffic patterns, evolving security threats, and fluctuating capacity requirements. By establishing a clear framework for understanding the principles and value propositions of multi-cloud networking, stakeholders can align investment decisions with long-term digital transformation goals.

This executive summary lays the groundwork for recognizing how multi-cloud networking redefines connectivity paradigms, influences organizational structures, and shapes vendor selection. As you delve deeper into the subsequent sections, you will gain a holistic view of technological shifts, regulatory impacts, segmented demands, and strategic actions essential for navigating the complexities of today’s interconnected cloud ecosystems.

Unraveling the Transformative Shifts Reshaping Multi-Cloud Networking from AI-Driven Automation to Edge Security Architectures

The multi-cloud networking domain is undergoing far-reaching transformations propelled by the convergence of artificial intelligence, advanced security frameworks, and edge computing innovations. Artificial Intelligence for IT Operations (AIOps) has matured from a futuristic concept to a core operational imperative, enabling predictive maintenance, anomaly detection, and automated remediation across sprawling cloud networks. By embedding machine-learning models directly into network operations, organizations can reduce downtime and optimize resource utilization in real time.

In tandem, Zero Trust architectures and Secure Access Service Edge (SASE) platforms are reshaping the security perimeter to align with the distributed nature of multi-cloud deployments. The rise of unified cloud networking and security stacks ensures continuous verification of users and devices, regardless of their location, thereby mitigating risks associated with remote access and lateral threat propagation. Furthermore, network infrastructure automation-underpinned by Infrastructure as Code (IaC) and programmable interfaces-has become indispensable for maintaining consistency, accelerating provisioning, and minimizing human error in dynamic cloud environments.

Moreover, emerging edge-to-cloud AI integration is blurring the boundaries between centralized data centers and localized compute resources. This trend allows enterprises to execute real-time inferencing at the edge while leveraging cloud-based training pipelines for sophisticated AI models, delivering sub-millisecond responsiveness for critical applications. Looking ahead, autonomic cloud networks powered by agentic AI promise self-configuring, self-healing, and policy-driven connectivity that anticipates workload demands and security threats with minimal human intervention. These shifts collectively signal a new era of resilient, intelligent networking architectures designed to meet escalating enterprise requirements.

Examining the Cumulative Effects of 2025 United States Reciprocal Tariffs on Multi-Cloud Networking Infrastructure and Costs

In April 2025, the United States implemented a suite of reciprocal tariffs that have reverberated across the multi-cloud networking supply chain. Equipment imports from China now face duties as high as 34 percent, while Taiwan and South Korea see levies of 32 and 25 percent respectively, atop a baseline 10 percent tariff on all goods. Consequentially, manufacturers and cloud providers are confronting heightened procurement costs for routers, switches, and gateway devices integral to inter-cloud connectivity.

Despite exemptions for key items such as servers, switches, routers, and firewalls designed to protect foundational data center infrastructure, ancillary components remain subject to significant surcharges. For example, the exclusion of Ethernet and fiber-optic cables from tariff relief has prompted supply shortages and cost escalations, compelling enterprises to re-evaluate capital expenditure projections and inventory strategies. Leading networking vendors-including Cisco Systems, Hewlett Packard Enterprise, and Juniper Networks-have signaled intentions to pass through unmitigable tariff burdens to customers, with surcharges estimated in the range of 10 to 15 percent on hardware invoices.

Beyond direct pricing implications, these tariffs have disrupted global logistics and manufacturing footprints. Some vendors are actively considering reshoring or expanding assembly operations within the United States to mitigate future tariff exposure. Cloud operators are similarly exploring alternative sourcing from non-affected regions and negotiating long-term contracts to lock in pricing. As a result, strategic planning for multi-cloud deployments now necessitates a nuanced understanding of trade policy dynamics, balancing cost optimization against the imperative for resilient, high-performance networking infrastructure.

Deriving Strategic Insights from a Comprehensive Multi-Dimensional Segmentation Framework Covering Components Deployment Models and Verticals

A robust segmentation framework unveils nuanced insights into how different solution components, deployment paradigms, connectivity models, organizational scales, and industry verticals shape multi-cloud networking adoption and priorities. Within the component dimension, networking hardware-encompassing gateways, routers, and switches-carries distinct capital and operational considerations compared to software offerings such as Network Functions Virtualization, SD-WAN, and security software. The interplay between these technology layers determines integration complexity, upgrade cycles, and vendor differentiation.

Deployment models further refine market behavior. Solutions delivered as cloud managed services enable rapid scalability and lower upfront investment, while hybrid approaches blend on-premise control with cloud agility. Pure on-premise implementations, though less prevalent, continue to serve organizations with stringent data sovereignty or performance requirements. Connectivity types-differentiating inter-cloud links that bridge multiple public clouds from intra-cloud transports confined to a single provider-highlight the criticality of network orchestration and routing policies.

Organizational size also emerges as a pivotal factor. Large enterprises often prioritize customizability, extensive feature sets, and global support, whereas small and medium-sized enterprises emphasize ease of deployment, predictable cost structures, and pre-configured security profiles. Finally, verticals such as Banking, Financial Services and Insurance; Healthcare and Life Sciences; Information Technology and Telecom; and Retail and Consumer Goods each impose unique regulatory, performance, and integration demands on multi-cloud networking strategies.

This comprehensive research report categorizes the Multi-Cloud Networking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Connectivity Type

- Vertical

- Deployment Model

- Organization Size

Unlocking Regional Dynamics in Multi-Cloud Networking by Analyzing Trends Across Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics exert a powerful influence on multi-cloud networking strategies, driven by regulatory environments, infrastructure maturity, and cloud provider footprints. In the Americas, the United States stands as a dominant market with a dense concentration of hyperscale data centers and advanced fiber-optic backbones. Latin American countries, while still developing multi-cloud ecosystems, are increasingly partnering with global cloud providers to enhance digital services and consumer experiences.

Across Europe, Middle East & Africa, GDPR and other data privacy regulations shape cloud networking requirements, impelling enterprises to adopt hybrid and localized solutions that ensure compliance. Western Europe benefits from high-capacity undersea cables and robust terrestrial networks, whereas the Middle East and Africa are witnessing accelerated investments in cloud-edge nodes to serve rapidly growing digital populations.

In the Asia-Pacific region, national cloud initiatives and digital infrastructure programs are propelling multi-cloud adoption. Countries like Japan, Australia, and Singapore are home to strategic hyperscale campuses, while emerging markets in Southeast Asia and India focus on expanding local connectivity and reducing latency for critical applications. The confluence of dynamic regulatory frameworks, government-backed cloud initiatives, and growing enterprise digital transformation budgets underscores Asia-Pacific as a vital arena for multi-cloud networking innovation.

This comprehensive research report examines key regions that drive the evolution of the Multi-Cloud Networking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Market Leaders and Innovative Disruptors Shaping the Future of Multi-Cloud Networking Solutions Across Cloud Ecosystems

Leading enterprises and emerging disruptors are collectively advancing the multi-cloud networking landscape through differentiated solutions and strategic partnerships. Established vendors such as Cisco Systems and Hewlett Packard Enterprise continue to integrate security and programmability into their flagship routing and switching portfolios, while fortifying alliances with key cloud platforms to deliver native inter-cloud connectivity.

Cloud-native innovators-exemplified by Amazon Web Services, Microsoft Azure, and Google Cloud-are expanding pre-architected transit gateways, optimizing egress policies, and embedding observability toolsets that cater to global distributed applications. At the same time, network virtualization specialists like VMware and Juniper Networks are championing software-defined overlays that abstract physical topologies, simplify policy enforcement, and enable rapid service chaining.

Security vendors including Palo Alto Networks and Fortinet are reshaping the perimeter through Secure Access Service Edge offerings, blending advanced threat prevention with centralized orchestration. Meanwhile, niche challengers are leveraging agentic AI and intent-based networking to deliver autonomous optimization, positioning themselves as catalysts for next-generation network operations. This confluence of market leaders and agile challengers is intensifying the pace of innovation, ultimately empowering organizations to construct resilient, high-performance, and secure multi-cloud fabrics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multi-Cloud Networking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC by Alphabet Inc.

- Alibaba Group Holding Limited

- Cisco Systems, Inc.

- Broadcom, Inc.

- International Business Machines Corporation

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

- Arista Networks, Inc.

- Cloudflare, Inc.

- F5, Inc.

- Akamai Technologies, Inc.

- Cloud Software Group, Inc.

- AT&T Inc.

- Alkira, Inc.

- Aryaka Networks, Inc.

- Aviatrix, Inc.

- Equinix, Inc.

- Illumio, Inc.

- Infoblox, Inc.

- Megaport Limited

- Nutanix, Inc.

- Verizon Communications Inc.

- Versa Networks, Inc.

- Zscaler, Inc.

Delivering Actionable Recommendations to Empower Industry Leaders to Navigate and Capitalize on the Multi-Cloud Networking Evolution

To thrive in the rapidly evolving multi-cloud networking environment, industry leaders must adopt a proactive, integrated approach. Organizations should prioritize the deployment of unified network management platforms that offer end-to-end visibility and policy consistency across diverse cloud and on-premise environments. By leveraging AI-driven analytics and automated orchestration, teams can accelerate mean time to resolution for network incidents and continuously optimize capacity allocations.

Security must be woven into every layer of the network fabric. Implementing Zero Trust principles and converged SASE frameworks will safeguard distributed workloads and remote access scenarios. Simultaneously, enterprises should establish robust inter-cloud connectivity strategies, balancing direct private links with carrier-neutral exchanges to ensure predictable performance and cost efficiency.

Given the complexity of multi-cloud ecosystems, investing in talent development is essential. Upskilling network and security engineers in areas such as programmable interfaces, cloud-native APIs, and agentic AI toolsets will equip teams to manage and innovate effectively. Finally, forging strategic partnerships with managed service providers and technology integrators can accelerate deployments, mitigate integration risks, and deliver customized support models aligned with organizational objectives.

Outlining a Rigorous Research Methodology Combining Primary and Secondary Approaches for In-Depth Multi-Cloud Networking Analysis

This comprehensive analysis is underpinned by a rigorous methodology that blends primary and secondary research to deliver actionable insights. Primary research involved in-depth interviews with senior network architects, cloud operations leaders, and technology decision-makers across a diverse range of industries. These discussions illuminated real-world deployment challenges, emerging priorities, and future roadmap considerations.

Secondary research encompassed a thorough review of whitepapers, technical documentation, public filings, and reputable industry publications. This phase ensured the integration of the latest technology developments, policy updates, and vendor announcements. Data validation was achieved through a cross-functional review process, engaging subject-matter experts in cloud networking, security, and regulatory compliance to ensure accuracy and relevance.

Finally, the findings were synthesized into thematic segments, enabling a multi-dimensional examination of market dynamics. This structured approach ensured that insights span technological innovations, policy impacts, segment-specific requirements, and regional nuances, thereby equipping stakeholders with a holistic understanding of the multi-cloud networking landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multi-Cloud Networking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multi-Cloud Networking Market, by Offering

- Multi-Cloud Networking Market, by Connectivity Type

- Multi-Cloud Networking Market, by Vertical

- Multi-Cloud Networking Market, by Deployment Model

- Multi-Cloud Networking Market, by Organization Size

- Multi-Cloud Networking Market, by Region

- Multi-Cloud Networking Market, by Group

- Multi-Cloud Networking Market, by Country

- United States Multi-Cloud Networking Market

- China Multi-Cloud Networking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Highlighting the Strategic Imperatives and Forward-Looking Considerations in Multi-Cloud Networking Landscapes

The shift toward multi-cloud networking represents a pivotal juncture in enterprise infrastructure, where agility and resilience converge with emerging technologies. As organizations grapple with the interplay of AI-powered operations, evolving security paradigms, and complex regulatory environments, the imperative for cohesive, intelligent network architectures has never been greater.

Looking forward, enterprises must remain vigilant to agentic AI’s potential to automate network orchestration and threat mitigation, while also anticipating the impact of evolving trade policies and regional regulatory shifts on connectivity strategies. The integration of edge computing and cloud-native services promises to unlock new performance frontiers, yet it also introduces complexities that demand careful planning and skilled execution.

By synthesizing technological innovations with strategic foresight, decision-makers can transform networking from a cost center into a driver of digital growth. Embracing unified management frameworks, prioritizing security at the perimeter and beyond, and cultivating a culture of continuous learning will position organizations to harness the full promise of the multi-cloud era.

Contact Ketan Rohom Associate Director Sales & Marketing to Secure Your Copy of the Comprehensive Multi-Cloud Networking Market Research Report Today

To explore the full breadth of these insights and strengthen your organization’s competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan possesses deep expertise in guiding enterprises through the intricacies of multi-cloud networking research, ensuring you receive tailored analysis aligned with your strategic objectives. Contact him today to secure your comprehensive market research report, unlock actionable intelligence, and position your business at the forefront of innovation and growth in the multi-cloud era

- How big is the Multi-Cloud Networking Market?

- What is the Multi-Cloud Networking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?