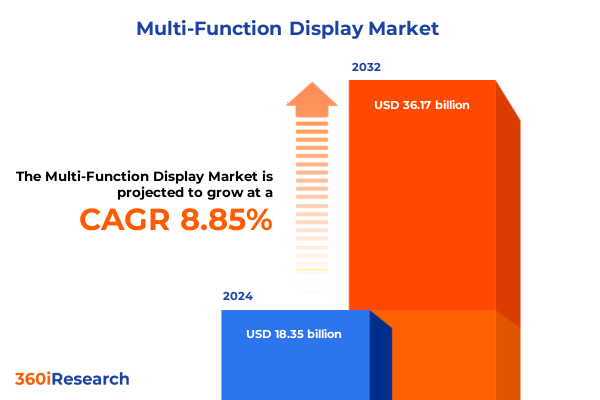

The Multi-Function Display Market size was estimated at USD 19.92 billion in 2025 and expected to reach USD 21.63 billion in 2026, at a CAGR of 8.89% to reach USD 36.17 billion by 2032.

Exploring the Critical Role of Multi-Function Displays and Their Impact on Operational Efficiency Across Aerospace, Automotive, and Industrial Sectors

Multi-function displays consolidate multiple information sources into a single screen, enhancing operational efficiency and safety across automotive, aviation, and marine sectors. These integrated interfaces have become indispensable in modern cockpits and dashboards, where real-time situational awareness is critical for decision-making and risk mitigation.

In 2024, the airborne segment held a dominant position in the global MFD market, capturing over 45 percent of total market share. This dominance underscores the critical role MFDs play in flight operations, where the seamless display of navigation, engine, and system data is paramount for both commercial and military aircraft.

As vehicles and aircraft become increasingly connected and autonomous, the demand for advanced display technologies that provide real-time telemetry and analytics continues to accelerate. Manufacturers are prioritizing high-resolution, multi-touch interfaces that support customizable layouts, thereby enabling operators to tailor information presentation to specific mission profiles and driving scenarios.

Charting the Dramatic Technological and Market Shifts That Are Redefining How Multi-Function Displays Transform Cockpit, Dashboard, and Industrial Interfaces

The display technology landscape has undergone a seismic transformation as AMOLED panels have overtaken conventional TFT LCDs, driven by rapid cost declines and performance enhancements. In 2024, smartphone AMOLED shipments rose by 26 percent year-over-year to 784 million units, surpassing TFT LCD volumes for the first time and signaling a broader shift toward self-emissive technologies in mobile and vehicular interfaces.

Beyond smartphones, rigid and flexible OLED variants are reshaping cockpit and dashboard design by delivering thinner form factors, superior contrast ratios, and deeper color gamuts. Flexible AMOLED adoption surged from 28 percent of the smartphone display market in 2022 to 40 percent in 2024, reflecting manufacturers’ eagerness to integrate curved and conformable displays into next-generation multi-function systems.

Looking further ahead, next-generation emissive displays such as micro-LED and quantum-dot electroluminescent panels are emerging as contenders for high-brightness, high-resolution applications. These technologies promise ultra-long lifespans and unparalleled pixel density, which are essential for avionics and head-up display integration, ultimately redefining user interactions and information delivery modalities in critical environments.

Examining the Comprehensive Effects of Newly Imposed United States Tariffs on Electronics and Their Cumulative Impact on Multi-Function Display Supply Chains

In April 2025, the United States enacted a baseline 10 percent duty on all imports, with escalated rates targeting specific countries-China at 34 percent, the European Union at 20 percent, Japan at 24 percent, Taiwan at 32 percent, and Vietnam at 46 percent. These measures have substantially increased the landed cost of flat-panel displays and critical electronic components used in multi-function systems.

Early industry feedback has indicated that manufacturers and integrators are passing much of these incremental costs downstream, with average unit prices for commercial display modules rising by approximately ten percent. This dynamic has led to project delays and budget overruns, particularly in large-scale aerospace and automotive programs where display volumes and customization requirements are highest.

The administration’s broadening national security probe into semiconductor and display supply chains has further complicated procurement strategies. While aimed at bolstering domestic manufacturing, these policies have introduced significant uncertainty, prompting many system vendors to diversify component sourcing to alternative geographies, including South Korea, Mexico, and Southeast Asia, as a hedge against potential tariff escalations.

Unraveling Segmentation Insights That Reveal How Technology Types, Display Sizes, Touch Methods, Resolutions, and Applications Shape Multi-Function Displays

Technology segmentation reveals a clear ascendancy of self-emissive panels, with OLED variants-both flexible and rigid-outpacing traditional TFT LCD categories such as IPS, TN, and VA. Flexible OLED’s ability to conform to curved dashboards and instrument clusters has catalyzed its rapid adoption, while rigid configurations continue to underpin primary flight displays in commercial aircraft.

Display size segmentation highlights that under-five-inch screens remain prevalent in portable and handheld applications, including supplemental flight and navigation aides, whereas mid-range panels between five and ten inches dominate vehicle dashboards and secondary cockpit overlays. Above-ten-inch modules are increasingly featured in head-up displays and large-format industrial control panels, where enhanced readability and multi-window capability are essential.

Touch technology segmentation underscores capacitive interfaces as the design standard for passenger vehicles and consumer avionics due to their high sensitivity and support for multi-touch gestures, while resistive touchscreens retain a critical niche in industrial and military environments where gloved operation and liquid resistance are paramount. Infrared touch systems continue to excel in rugged, outdoor-facing installations where durability and touch-object agnosticism are required.

Resolution segmentation points to a widening embrace of high-definition (HD) and ultra-high-definition (UHD) standards in advanced cockpit and marine applications, driven by the need for crisp, high-contrast visualization of complex navigation and sensor data. Standard-definition (SD) displays, meanwhile, persist in cost-sensitive control room deployments and legacy retrofits.

Application segmentation confirms the automotive sector’s lead in display integration, spanning electric vehicles, passenger cars, and commercial trucks, closely followed by commercial aviation platforms where multi-function systems unify flight management, communication, and surveillance data. Industrial automation, marine navigation, and military aviation each present unique interface requirements, demanding tailored solutions to meet diverse environmental and regulatory standards.

This comprehensive research report categorizes the Multi-Function Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Display Size

- Touch Technology

- Resolution

- Application

Highlighting How the Americas, EMEA, and Asia-Pacific Regions Each Exhibit Distinct Trends That Influence Multi-Function Display Adoption Across Key Industries

The Americas exhibit robust demand for multi-function displays, anchored by North America’s leadership in aerospace and automotive production. The United States alone captured more than 37 percent of the global MFD market in 2024, driven by strong investments from major OEMs and Tier 1 suppliers integrating cutting-edge cockpit and dashboard interfaces. In Canada and Latin America, the commercial vehicle and industrial automation sectors are gradually adopting digital instrument clusters and control panels, reflecting broader digitalization trends in manufacturing.

EMEA markets display a distinctive emphasis on stringent safety regulations and environmental compliance, which have propelled multi-function display adoption in military aviation and defense applications across Europe. Germany and France, in particular, have invested in retrofit programs for legacy fleets, while the Middle East and Africa underscore rapid infrastructure expansion in commercial aviation, supported by regional carriers upgrading cockpit systems to enhance operational reliability.

Asia-Pacific remains the fastest-growing region, characterized by large-scale manufacturing hubs in China, Japan, and South Korea. China’s rapidly expanding consumer electronics and electric vehicle industries have driven surging display volumes, while India’s defense modernization initiatives and Southeast Asia’s smart city projects are spurring demand for integrated display solutions. Elevated R&D spending and favorable government incentives continue to position Asia-Pacific as a pivotal engine for future MFD innovation.

This comprehensive research report examines key regions that drive the evolution of the Multi-Function Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Multi-Function Display Manufacturers Leverage Innovation, Partnerships, and Strategic Investments to Drive Market Leadership and Growth

The competitive landscape is dominated by a diverse array of specialized manufacturers and defense contractors strategically aligning their offerings to capture burgeoning opportunities. Leading suppliers such as Rockwell Collins, SAAB, BAE Systems, and Thales leverage deep avionics expertise to deliver high-reliability electronic flight displays and heads-up systems, underscoring their pivotal roles in military and commercial aviation programs.

Garmin Ltd. stands out with its substantial market share in 2023, having captured approximately 15 percent by harnessing advanced avionics platforms and extending its reach into marine and automotive segments through modular, upgradeable display architectures. Honeywell Aerospace has accelerated its investment in AR-capable heads-up displays, recently co-developing satellite control systems that integrate seamlessly with multi-function interfaces to support next-generation autonomous navigation in both civilian and defense contexts.

Barco and Raymarine capitalize on the marine and industrial sectors, delivering ruggedized, high-brightness panels optimized for harsh environmental conditions. Meanwhile, Northrop Grumman and Universal Avionics Systems focus on military and space applications, driving innovation in helmet-mounted displays and multi-vehicle command and control stations. This constellation of competitors continually refines product portfolios through strategic partnerships, acquisitions, and cross-industry collaborations to maintain technological leadership and supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multi-Function Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aspen Avionics, Inc.

- Astronautics Corporation of America

- Avidyne Corporation

- BAE Systems plc

- Barco N.V.

- Continental AG

- DENSO Corporation

- Garmin Ltd.

- Honeywell International, Inc.

- L3Harris Technologies, Inc.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Rockwell Collins Inc.

- Saab AB

- Teledyne Technologies Incorporated

- Thales Group S.A.

- Universal Avionics Systems Corporation

- Valeo S.A.

- Visteon Corporation

Actionable Recommendations to Guide Industry Leaders in Innovating, Optimizing Supply Chains, and Navigating Future Display Technologies

To stay ahead in this dynamic environment, manufacturers should prioritize flexible OLED and micro-LED integration, enabling ultra-thin, high-contrast displays that can conform to curved instrument panels and support augmented reality overlays. Strategic alliances with semiconductor foundries and lens-coating specialists can mitigate tariff exposure by localizing critical component fabrication and reducing dependence on high-duty jurisdictions.

Moreover, investing in modular software frameworks that allow rapid reconfiguration of display layouts can accelerate time-to-market for new vehicle and aircraft platforms. By adopting global touchscreen standards-favoring capacitive solutions for consumer-grade interfaces and infrared or resistive technologies for mission-critical operations-OEMs can address diverse end-user preferences while optimizing total cost of ownership.

Finally, proactive engagement with regulatory bodies and active participation in standards committees will ensure alignment with emerging safety and interoperability requirements. This approach will not only enhance certification efficiency but also cultivate trust among tier 1 integrators and end customers, positioning innovators for long-term success in the competitive multi-function display arena.

Detailing a Comprehensive Methodology Employing Primary Expert Interviews, Secondary Data Synthesis, and Multi-Layer Validation to Guarantee Insight Reliability

Our research methodology commenced with comprehensive secondary data collection, encompassing industry white papers, patent filings, regulatory frameworks, and financial disclosures from leading original equipment manufacturers. This phase was complemented by primary expert interviews with senior engineers, procurement managers, and strategic planners at OEMs and integrators to validate emerging trends and tariff impacts.

Quantitative data analysis employed advanced statistical modeling to dissect shipment volumes, technology adoption rates, and regional consumption patterns. These insights were cross-verified through multi-layer validation, involving reconciliation with publicly reported Omdia and TrendForce datasets and alignment with governmental trade statistics to ensure methodological rigor and reliability.

The final stage integrated scenario planning workshops with subject-matter experts, facilitating the exploration of potential disruptors such as supply chain realignment, regulatory shifts, and technological breakthroughs. The synthesis of qualitative and quantitative findings produced a robust, actionable framework that underpins our market insights and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multi-Function Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multi-Function Display Market, by Technology

- Multi-Function Display Market, by Display Size

- Multi-Function Display Market, by Touch Technology

- Multi-Function Display Market, by Resolution

- Multi-Function Display Market, by Application

- Multi-Function Display Market, by Region

- Multi-Function Display Market, by Group

- Multi-Function Display Market, by Country

- United States Multi-Function Display Market

- China Multi-Function Display Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways on How Technology, Market Dynamics, and Regulatory Developments Will Drive the Next Generation of Multi-Function Displays

The convergence of self-emissive panel technologies, evolving touch interfaces, and shifting geopolitical trade policies underscores a transformative era for multi-function displays. Flexible OLED and micro-LED innovations are poised to redefine form factors and visual performance, while regional dynamics-from tariff-induced supply chain diversification to targeted government incentives-will chart the competitive landscape’s contours.

Market participants who adeptly navigate technology segmentation, embrace modular design principles, and forge resilient partnerships will capture emerging opportunities across automotive, aviation, and industrial domains. The imperative for agility extends to proactive regulatory engagement and sustained investment in R&D to anticipate future display requirements.

Ultimately, the multi-function display market’s trajectory will be shaped by the interplay of technological ingenuity, strategic supply chain management, and regulatory foresight. Organizations that harness these levers will solidify their leadership positions and drive the next wave of innovation in integrated display systems.

Connect with Ketan Rohom to Unlock Exclusive Access to the Multi-Function Display Market Research Report and Propel Strategic Decision-Making

To explore how these insights can inform your strategic initiatives and secure a competitive advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing, and gain exclusive access to our comprehensive market research report on Multi-Function Displays.

- How big is the Multi-Function Display Market?

- What is the Multi-Function Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?