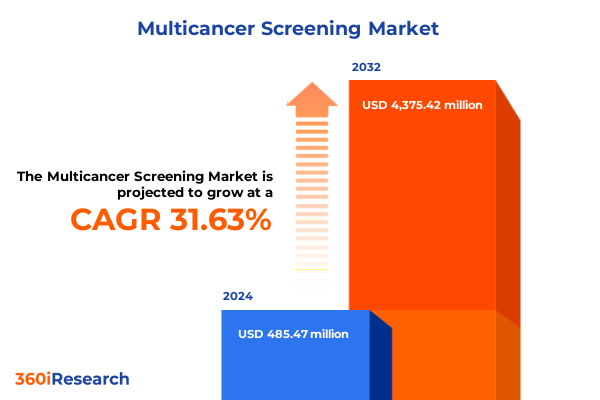

The Multicancer Screening Market size was estimated at USD 630.87 million in 2025 and expected to reach USD 822.84 million in 2026, at a CAGR of 31.87% to reach USD 4,375.42 million by 2032.

Revolutionizing Cancer Detection with Multi-Cancer Screening: Uniting Genomics, Liquid Biopsy, and AI to Transform Early Intervention Outcomes

The global oncology landscape is undergoing an unprecedented transformation, driven by a convergence of technological breakthroughs and an increasing imperative to detect cancer at its earliest, most treatable stages. In recent years, conventional screening methods have fallen short of addressing the multifaceted nature of cancer initiation and progression, leaving significant gaps in surveillance for cancers without established single-organ tests. This gap underscores the urgent need for integrated multicancer screening solutions that can deliver broad-spectrum detection capabilities within a single assay.

Emerging molecular diagnostic tools are now poised to revolutionize early cancer detection by harnessing advances in genomics, liquid biopsy, and artificial intelligence. These techniques promise to identify molecular signatures of malignancy before clinical symptoms arise, offering the potential to significantly improve patient outcomes and reduce healthcare costs. The momentum behind this shift is fueled by robust clinical evidence demonstrating that earlier detection correlates with higher survival rates and lower treatment complexity. Moreover, as healthcare systems worldwide adopt value-based care models, the emphasis on proactive interventions that mitigate downstream resource burdens has never been stronger. These trends collectively set the stage for multi-cancer screening to become a cornerstone of modern oncology practice.

Emerging Molecular Diagnostics and AI-Driven Liquid Biopsies Are Catalyzing a Paradigm Shift in Multi-Cancer Screening and Personalized Oncology Practices

Over the past two years, the multicancer screening landscape has been revolutionized by a series of transformative shifts in technology and clinical practice. Next-generation sequencing platforms have achieved unprecedented throughput and cost-efficiency, enabling comprehensive analysis of circulating tumor DNA and cell-free RNA biomarkers across dozens of cancer types simultaneously. A study of cfRNA-based liquid biopsy demonstrated a 92% predictive accuracy and 83% sensitivity for five major cancers, including colorectal, lung, breast, prostate, and pancreatic, with the ability to detect Stage I disease at rates up to 80%. This performance marks a decisive leap beyond single-analyte tests, opening pathways for widespread adoption of multi-cancer early detection.

Concurrently, artificial intelligence and advanced bioinformatics have become integral to multicancer assay development, refining the interpretation of complex biomarker profiles and differentiating malignant signals from benign background noise with high specificity. Integrative machine learning models now process multi-omic inputs-such as DNA methylation patterns, fragmentomics, and proteomic signatures-creating robust, data-driven classifiers that reduce false positive rates. This synergy between high-resolution molecular data and AI-enabled analytics is not only enhancing diagnostic precision but also accelerating biomarker discovery and validation processes, thereby compressing timelines from research findings to clinical deployment.

Unpacking the Far-Reaching Consequences of 2025 U.S. Trade Tariffs on Diagnostics: Supply Chain Disruptions, Rising Costs, and Innovation Dilemmas for Oncological Testing

In 2025, the United States implemented an array of tariffs on imported pharmaceutical ingredients, laboratory equipment, and diagnostic supplies that have substantially reshaped the economic landscape for multi-cancer screening. A landmark survey by the Biotechnology Innovation Organization revealed that nearly 90% of U.S. biotech firms rely on imported components for at least half of their FDA-approved products, with 94% anticipating surging manufacturing costs if tariffs target EU imports, potentially delaying regulatory submissions by up to two years. These findings underscore the fragile interdependence of global supply chains and the acute vulnerability of emerging diagnostic workflows.

Specific tariff measures-such as 20–25% duties on active pharmaceutical ingredients sourced from China and India, 15% levies on sterile packaging and analytical instruments, and 25% tariffs on large-scale manufacturing machinery-have introduced immediate inflationary pressures on assay production costs and delivery timelines. Simultaneously, the administration’s imposition of a 10% global tariff on healthcare imports beginning in April 2025 intensified cost challenges for medical device providers and diagnostic laboratories. As a result, companies are reevaluating vendor agreements, exploring onshoring strategies, and accelerating integration of domestic manufacturing capabilities to hedge against future trade policy shifts. These adaptive measures are redefining the competitive dynamics of the multi-cancer screening market.

Decoding Market Dynamics through Multifaceted Segmentation: Test Types, Cancer Categories, Technologies, Payment Models, Applications, and End User Profiles

Insight into the market segmentation for multi-cancer screening reveals a landscape defined by differentiated test modalities, targeted cancer categories, advanced analytical platforms, diverse reimbursement vehicles, specialized use cases, and a spectrum of end users. Based on Test Type, the field encompasses comprehensive gene panel assays that interrogate genomic variants across multiple loci, laboratory-developed tests designed for bespoke clinical and research applications, and liquid biopsy platforms that noninvasively capture circulating analytes. Each test type offers unique trade-offs in sensitivity, specificity, and clinical utility.

Examining Cancer Type segmentation, core focus areas include breast, colorectal, leukemia, lung, non-specific multi-organ, and prostate cancers. These areas reflect both clinical need and prevalence, driving prioritization in assay design and validation protocols. From a Technology standpoint, mass spectrometry, microarray, next-generation sequencing, and polymerase chain reaction underpin diverse diagnostic strategies, with sequencing and PCR leading for mutation detection and fragment analysis.

Payment Source segmentation underscores the role of government subsidies, private health insurance, and out-of-pocket payment models in shaping market accessibility. Meanwhile, Application segmentation spans diagnostic screening, prognostics, and research, with diagnostic screening further subdivided into early detection and risk assessment, prognostics covering patient monitoring, therapy selection, and treatment efficacy assessment, and research including biomarker discovery and genetic research. Finally, End User segmentation highlights ambulatory surgical centers, diagnostic centers, hospitals, research institutions, and specialty clinics, each with distinct procurement drivers and volume dynamics. Understanding these interrelated strata is essential for identifying growth vectors and tailoring value propositions.

This comprehensive research report categorizes the Multicancer Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Cancer Type

- Technology

- Payment Source

- Application

- End User

Comparative Regional Adoption of Multi-Cancer Screening: Market Drivers and Barriers Across the Americas, EMEA, and Asia-Pacific Healthcare Ecosystems

Regional analysis of multi-cancer screening adoption reveals distinct growth trajectories driven by varying healthcare infrastructure, regulatory landscapes, and funding mechanisms. In the Americas, particularly in the United States, robust venture capital investment, supportive reimbursement policies, and high adoption rates of novel diagnostics have positioned the region as a global innovation hub. Partnerships between test developers and electronic health record providers have streamlined ordering workflows, exemplified by the recent integration of a leading multi-cancer blood test into a major U.S. EHR system, enabling over 160,000 clinicians to seamlessly order assays within routine care pathways.

Within Europe, the Middle East, and Africa (EMEA), healthcare authorities are cautiously advancing pilot programs to evaluate clinical utility and cost-effectiveness under national health mandates. Large-scale trials, such as the United Kingdom’s NHS pilot of a next-generation multi-cancer early detection test with more than 140,000 participants, are gathering real-world evidence ahead of potential programmatic rollout. Meanwhile, in Asia-Pacific, significant investments in genomic research infrastructures-paired with rising incidence of key cancers-are catalyzing demand for screening solutions. Successful studies in Spain and emerging collaborations in Australia underscore the region’s commitment to precision oncology, while rapid expansion of sequencing capacity in China is supporting domestic assay development and validation efforts.

This comprehensive research report examines key regions that drive the evolution of the Multicancer Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Innovators Shaping the Multi-Cancer Screening Frontier: Strategic Investments, Collaborations, and Clinical Development Highlights

Leading organizations at the forefront of multi-cancer screening are differentiating through strategic investments in clinical validation, manufacturing scale-up, and distribution networks. One prominent player has committed $50 billion to expand U.S. manufacturing and R&D facilities, underscoring a shift toward domestic onshoring in response to potential trade levies and national security priorities. Similarly, a global biotechnology firm announced a $2 billion investment to enhance its fill-finish capacity and integrate AI-driven automation at its North Carolina site to ensure continual supply of advanced diagnostic reagents under tariff-induced constraints.

Early detection specialists are also forging key commercial collaborations to integrate multi-cancer assays into clinical workflows. A notable partnership between a top multi-cancer test provider and an EHR vendor aims to reduce operational barriers and accelerate clinician adoption. Concurrently, research-driven enterprises are piloting novel liquid biopsy platforms that leverage cell-free RNA for enhanced sensitivity in early-stage disease. These strategic moves, coupled with targeted enrollment in large-scale Medicare studies to assess real-world impact, are setting benchmarks for clinical utility, reimbursement acceptance, and market traction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multicancer Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANPAC Bio-Medical Science Co., Ltd.

- Burning Rock Biotech Limited

- Caris Life Sciences

- Coyne Medical Ltd.

- Delfi Diagnostics, Inc.

- Elypta AB

- EpiCypher, Inc.

- Epigenomics AG

- Exact Sciences Corporation

- Foundation Medicine, Inc.

- Freenome Holdings, Inc.

- Fulgent Genetics, Inc.

- Gene Solutions

- Grail, LLC by Illumina, Inc.

- Guangzhou AnchorDx Medical Co., Ltd.

- Guardant Health, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Lucence Health Inc.

- Micronoma, Inc.

- MiRXES Pte Ltd.

- Myriad Genetics, Inc.

- Natera, Inc.

- Naveris, Inc.

- NeoGenomics Laboratories

- OneTest

- Siemens Healthineers AG

- StageZero Life Sciences. Ltd.

Strategic Imperatives for Industry Leaders to Harness Technological Advances, Optimize Reimbursement Pathways, and Mitigate Trade-Related Supply Chain Risks

Industry leaders should prioritize the establishment of standardized clinical protocols and data harmonization frameworks to ensure reproducibility and facilitate regulatory approval pathways. By engaging with payers early through value demonstration studies-such as real-world outcome analyses in diverse Medicare populations-organizations can de-risk reimbursement discussions and secure coverage policies that underpin scalable adoption. It is also critical to invest in flexible manufacturing strategies, including regional production hubs and modular fill-finish capabilities, to mitigate the impact of evolving trade policies and safeguard supply chain continuity.

To maximize clinical impact, companies must cultivate cross-sector collaborations with academic centers, integrated health systems, and patient advocacy groups to drive inclusive trial enrollment and equitable access initiatives. Embracing advanced data analytics and AI-driven quality assurance tools will further streamline R&D workflows and refine diagnostic algorithms. Finally, proactive engagement with regulatory bodies to co-develop evidence frameworks for multi-cancer assay performance can accelerate time to market and strengthen stakeholder confidence in this innovative screening paradigm.

Robust and Transparent Methodological Framework Combining Secondary Research, Expert Interviews, and Quantitative Analysis to Ensure Market Intelligence Validity

This analysis is grounded in a multilayered methodology that combines comprehensive secondary research, quantitative data synthesis, and qualitative expert consultations. Secondary research encompassed peer-reviewed literature, regulatory filings, company press releases, and industry surveys, ensuring a broad and reliable foundation of technical, clinical, and commercial intelligence. Quantitative insights were derived from survey data and import/export tariff schedules to assess cost impacts and market drivers.

In parallel, in-depth interviews with key opinion leaders, clinical researchers, and senior executives provided nuanced perspectives on emerging technologies, adoption barriers, and strategic imperatives. Data triangulation was employed to validate findings, with cross-reference to global health organization reports, trial registries, and financial disclosures. This rigorous approach ensures that conclusions reflect both macroeconomic trends and ground-level operational realities, delivering actionable insights for stakeholders seeking to navigate the dynamic multi-cancer screening ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multicancer Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multicancer Screening Market, by Test Type

- Multicancer Screening Market, by Cancer Type

- Multicancer Screening Market, by Technology

- Multicancer Screening Market, by Payment Source

- Multicancer Screening Market, by Application

- Multicancer Screening Market, by End User

- Multicancer Screening Market, by Region

- Multicancer Screening Market, by Group

- Multicancer Screening Market, by Country

- United States Multicancer Screening Market

- China Multicancer Screening Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Multicancer Screening Insights to Illuminate Strategic Pathways for Early Detection, Patient Outcomes, and Industry Growth Trajectories

The evolution of multi-cancer screening represents a critical inflection point in oncology, offering a paradigm shift from reactive treatment to proactive disease interception. Technological innovations in sequencing, liquid biopsy, and AI are converging to broaden the spectrum of detectible malignancies while enhancing diagnostic precision and operational efficiency. Simultaneously, geopolitical forces-most notably U.S. trade tariffs-are reshaping supply chains and cost structures, prompting strategic pivots toward regional manufacturing resilience.

Segmentation analysis highlights the importance of tailored value propositions across test modalities, cancer categories, and end-user settings, while regional trends underscore the interplay between investment climates and adoption trajectories. Leading companies are leveraging substantial capital investments, clinical collaborations, and regulatory engagement to set new benchmarks for assay performance and market penetration. As the field advances, proactive stakeholder alignment on standards, reimbursement frameworks, and equitable access will be instrumental in realizing the full potential of multi-cancer early detection. Together, these insights chart a roadmap for stakeholders to deliver on the promise of earlier intervention and improved patient outcomes.

Partner with Associate Director Ketan Rohom to Secure Comprehensive Multi-Cancer Screening Market Intelligence and Drive Informed Decision-Making

To explore how this comprehensive analysis of multicancer screening can inform your strategic priorities and drive competitive advantage, schedule a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. Through this partnership, you will gain direct access to detailed insights, bespoke data visualizations, and expert guidance tailored to your organization’s goals, ensuring you capitalize on the evolving multi-cancer detection landscape and position your offerings for maximum impact.

- How big is the Multicancer Screening Market?

- What is the Multicancer Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?