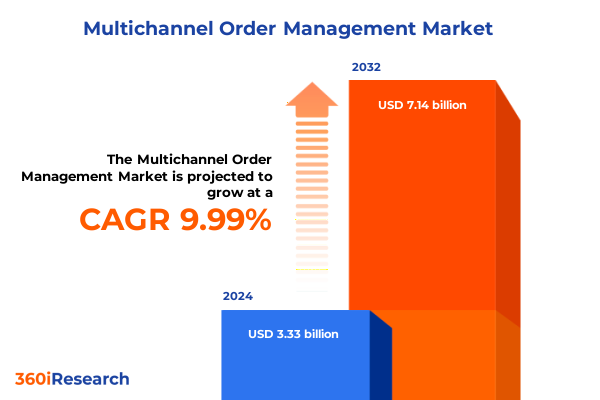

The Multichannel Order Management Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 4.01 billion in 2026, at a CAGR of 10.04% to reach USD 7.14 billion by 2032.

Unlocking Strategic Imperatives and Future-Ready Approaches to Multichannel Order Management in a Rapidly Evolving Digital Commerce Environment

In an era defined by accelerating digitization and rapidly shifting consumer expectations, mastering multichannel order management has moved from a tactical advantage to an essential strategic imperative. Organizations are increasingly faced with the challenge of delivering seamless experiences across an expanding array of touchpoints, where the frictionless orchestration of orders, inventory, and fulfillment directly impacts brand loyalty and revenue performance.

As digital storefronts, brick-and-mortar locations, social commerce channels, and third-party marketplaces converge, companies must not only integrate disparate systems but also align internal processes, partner networks, and customer communications. This convergence places a premium on real-time visibility, cross-functional collaboration, and the ability to scale operations dynamically in response to peak demands and evolving business models. As a result, enterprises are investing in flexible platforms and agile frameworks that support end-to-end order lifecycle orchestration, enabling personalized experiences and efficient resource utilization.

Looking ahead, the organizations that succeed will be those that view multichannel order management as a strategic advantage rather than a back-office function. By embedding advanced capabilities such as event-driven workflows, predictive analytics, and automated exception handling, leaders can reduce operational complexity and proactively address disruptions. This foundational shift transforms order management from a source of constraint into a catalyst for innovation, setting the stage for the in-depth analyses that follow.

Navigating Transformative Shifts in Order Management Through Emerging Technologies Integration and Changing Consumer Expectations Across Multiple Channels

The landscape of multichannel order management is undergoing transformative shifts driven by the convergence of cloud-native architectures, artificial intelligence, and enhanced data interoperability standards. Traditional monolithic platforms are giving way to modular, microservices-based solutions that allow organizations to assemble customized capabilities, integrate selectively with best-of-breed technologies, and respond swiftly to changing market conditions. This shift not only accelerates time to value but also reduces the risks associated with large-scale implementations.

Moreover, the adoption of advanced AI and machine learning algorithms is reshaping demand forecasting, inventory optimization, and order routing processes. By analyzing real-time signals-ranging from social media sentiment to logistics partner performance-enterprises can anticipate disruptions, optimize shipment networks, and dynamically adjust fulfillment strategies. This intelligence-driven approach fosters resilience, enabling businesses to maintain service levels even in the face of unforeseen events.

Another critical shift lies in the growing emphasis on composable commerce frameworks, where APIs and event-driven architectures become the glue that binds customer experiences to back-end operations. This trend empowers organizations to innovate rapidly, launching new sales channels, subscription models, or value-added services with minimal impact on core systems. As ecosystem partnerships deepen, seamless data exchange among retailers, logistics providers, and financial institutions further enhances the agility and scalability of order management processes.

Assessing the Combined Effects of 2025 United States Tariffs on Multichannel Order Management Strategies and Supply Chain Resilience

The introduction of new United States tariffs in 2025 has had a multifaceted impact on global supply chains and, by extension, on multichannel order management strategies. Increased duties on imported goods have prompted many organizations to reevaluate sourcing decisions, adjust product portfolios, and renegotiate supplier agreements. These shifts have led to extended replenishment lead times and heightened the importance of buffer inventory strategies to mitigate potential stockouts.

Consequently, risk management and cost transparency have become paramount. Companies are incorporating duty calculations into their order orchestration engines to ensure accurate landed cost estimations. This capability allows for more informed pricing decisions, protecting margins while preserving competitiveness in digital channels. Additionally, organizations are adopting scenario modeling tools that simulate the financial effects of tariff escalations, empowering procurement and supply chain teams to explore alternative logistics routes, nearshore suppliers, or alternate production partners.

From a customer experience standpoint, maintaining consistent service levels in the face of tariff-driven cost pressures demands nimble fulfillment strategies. Some enterprises have experimented with distributed inventory networks, relocating stock closer to strategic demand centers to reduce both transportation costs and exposure to fluctuating duties. Meanwhile, others have leveraged dynamic pricing engines to pass through selective cost increases while preserving loyalty through targeted promotions and fulfillment guarantees.

Gaining Valuable Segmentation Insights to Tailor Component, Deployment Mode, Industry Vertical, and Organization Size Strategies for Diverse Stakeholders

Understanding the diverse needs of stakeholders requires a nuanced segmentation framework that spans multiple dimensions of the multichannel order management ecosystem. By examining the market through the lens of component, we see that the services portfolio extends beyond standard implementation into specialized consulting practices and ongoing support engagements, while software offerings bifurcate into perpetual and subscription licensing models that cater to both long-term planning and scalable, pay-as-you-go deployments.

Delving into deployment preferences, organizations are gravitating towards cloud environments, whether in shared public clouds or fortified private clouds, to harness elasticity and reduce infrastructure overhead. Hybrid configurations emerge as a middle ground, blending cloud agility with on-premises control, and enterprise customers often opt for self-managed installations to meet stringent security mandates, whereas smaller businesses favor cloud-native simplicity and managed services.

A vertical-specific perspective reveals that financial institutions rely heavily on robust, audit-ready order processes, while healthcare providers prioritize compliance and traceability from clinic to pharmaceutical distribution. Manufacturing firms in automotive, consumer goods, and electronics sectors pursue just-in-time strategies that depend on real-time order tracking, and retailers from e-commerce pure plays to specialty boutiques require omnichannel fulfillment capabilities that support everything from buy-online-pickup-in-store to direct-to-consumer subscriptions.

Finally, organization size plays a decisive role in solution selection, with large enterprises demanding advanced customization, global support networks, and high-volume transaction handling, and small to mid-sized enterprises seeking streamlined configurations, faster time-to-value, and pragmatic feature sets that align with leaner budgets.

This comprehensive research report categorizes the Multichannel Order Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Industry Vertical

- Deployment Mode

Delving Into Regional Dynamics to Illuminate Critical Trends and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics significantly influence multichannel order management priorities, driven by differences in digital infrastructure maturity, consumer expectations, and regulatory environments. In the Americas, established e-commerce leaders continue to push the envelope on delivery speed and last-mile innovations, leveraging a dense logistics network to meet same-day and next-day delivery promises.

Turning to Europe, the Middle East, and Africa, organizations face a kaleidoscope of regulatory frameworks-from data privacy mandates in the European Union to evolving customs procedures across African trade blocs. These complexities spur investments in middleware solutions that ensure localized compliance while enabling pan-continental visibility. Furthermore, the shift toward cross-border e-commerce necessitates sophisticated duty and tax management, making real-time landed cost calculations indispensable.

In the Asia-Pacific region, explosive growth in mobile commerce and social selling channels amplifies the need for integrated order orchestration capabilities. Markets with high consumer expectations for instant fulfillment are driving partnerships between retailers and local logistics startups, while regulatory nuances in markets like Japan and Australia require adaptable software architectures that can accommodate multi-currency pricing and regional courier integrations.

Across all regions, sustainability concerns and evolving consumer values are elevating the importance of green logistics and carbon footprint transparency, compelling industry leaders to integrate eco-friendly shipping options and materials tracking directly into their order management workflows.

This comprehensive research report examines key regions that drive the evolution of the Multichannel Order Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Multichannel Order Management Solution Providers to Highlight Innovations Strategic Partnerships and Competitive Differentiators

The competitive landscape for order management solutions is characterized by a dynamic mix of established enterprise platforms and disruptive newcomers. Leading providers differentiate themselves through comprehensive feature suites that encompass everything from order capture and inventory visibility to exception management and business intelligence. These providers continually invest in research and development to embed machine learning-driven demand forecasting, intelligent order routing, and automated carrier selection within their core offerings.

Strategic partnerships have become another avenue for differentiation, with solution providers integrating closely with major ERP vendors, transportation management systems, and emerging e-commerce platforms. These alliances streamline implementation, reduce integration risk, and create synergistic value propositions for joint customers. At the same time, cloud-native specialists are gaining traction by offering lightweight, API-first platforms that enable rapid extensibility and lower total cost of ownership for mid-market and high-growth enterprises.

Innovation in user experience is also a key battleground, as companies recognize that intuitive configuration interfaces, role-based dashboards, and low-code customization tools accelerate adoption and reduce reliance on IT resources. The most forward-thinking vendors complement their product roadmaps with robust professional services practices, offering consulting, training, and curated best-practice playbooks to ensure customers realize full value quickly.

Ultimately, the leading order management providers are those that marry technical excellence with a deep understanding of industry-specific workflows, demonstrating the ability to co-innovate with customers and adapt at the pace of commerce.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multichannel Order Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Blue Yonder Group, Inc.

- Cognizant Technology Solutions Corporation

- Descartes Systems Group Inc.

- Epicor Software Corporation

- HCL Technologies Limited

- IBM Corporation

- Infor, Inc.

- Infosys Limited

- Körber AG

- Manhattan Associates, Inc.

- Microsoft Corporation

- Oracle Corporation

- Radial, Inc.

- Salesforce, Inc.

- SAP SE

- Shopify Inc.

- Tata Consultancy Services Limited

- The Sage Group plc

- Zoho Corporation Private Limited

Delivering Actionable Recommendations to Industry Leaders for Optimizing Multichannel Order Fulfillment Enhancing Collaboration and Driving Growth Momentum

To navigate the complexities of today’s multichannel landscape, industry leaders should prioritize the following strategic actions: First, embrace a composable architecture that allows you to integrate best-of-breed capabilities-such as AI-powered forecasting or dynamic pricing engines-without the constraints of monolithic platforms. This flexibility accelerates innovation cycles and minimizes technical debt.

Next, foster cross-functional collaboration by establishing unified governance processes that span supply chain, IT, marketing, and customer service. Shared KPIs and transparent data dashboards help break down silos, ensuring that order exceptions are resolved swiftly and that demand signals are accurately translated into replenishment decisions.

In parallel, develop a robust risk management framework that incorporates tariff modeling, multi-sourcing strategies, and dynamic contingency plans. By simulating potential disruption scenarios, you can proactively adjust inventory buffers and logistics routes to maintain service levels under volatile conditions.

Finally, invest in talent and change management. Equip your workforce with the skills needed to configure low-code platforms, interpret predictive analytics, and manage external partner networks. Cultivate a culture of continuous improvement where feedback loops from customer service and operations teams inform iterative enhancements to your order orchestration processes.

Unveiling Rigorous Research Methodologies Employed to Deliver Robust Multichannel Order Management Insights and Ensure Data Driven Decision Making

Our research methodology is grounded in a multi-dimensional approach that blends quantitative analysis with qualitative insights. We initiated the study with an exhaustive survey of decision-makers across retail, manufacturing, financial services, and healthcare verticals, capturing current priorities, emerging pain points, and technology adoption plans. This primary data collection was complemented by in-depth interviews with solution architects, logistics executives, and compliance specialists to understand the nuances of operational challenges and success factors.

To validate these findings, we conducted a comprehensive analysis of publicly available annual reports, product release notes, and patent filings to map innovation trends and vendor roadmaps. Supply chain performance benchmarks, carrier rate indices, and tariff schedules were also integrated to quantify the cost and risk implications of various order management strategies.

Throughout the study, we maintained rigorous data cleansing and triangulation protocols, cross-referencing multiple data sources to ensure accuracy and consistency. Our proprietary scoring model evaluated solution providers on criteria such as functionality breadth, integration ease, partner ecosystem strength, and customer satisfaction metrics, producing a holistic vendor performance framework.

Finally, scenarios were stress-tested against macroeconomic variables-such as exchange rate fluctuations and regulatory shifts-to assess the resilience of leading practices. This blended methodology ensures that our insights are both deeply informed by practitioner experiences and validated by empirical data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multichannel Order Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multichannel Order Management Market, by Component

- Multichannel Order Management Market, by Organization Size

- Multichannel Order Management Market, by Industry Vertical

- Multichannel Order Management Market, by Deployment Mode

- Multichannel Order Management Market, by Region

- Multichannel Order Management Market, by Group

- Multichannel Order Management Market, by Country

- United States Multichannel Order Management Market

- China Multichannel Order Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Drawing Powerful Conclusions on Multichannel Order Management Evolution and Strategic Imperatives for Future Readiness and Competitive Edge

The evolution of multichannel order management reflects a broader shift toward agile, customer-centric supply chain strategies. Organizations that adopt composable architectures and integrate AI-driven orchestration are better positioned to meet rising consumer expectations for speed, flexibility, and transparency. The impact of external forces, such as the recent tariff changes, underscores the need for resilient networks and dynamic risk management capabilities.

Segmentation analysis reveals that no one-size-fits-all solution exists; instead, success hinges on tailoring strategies to specific component preferences, deployment modes, industry requirements, and organizational scales. Regional nuances further emphasize the importance of localized compliance, cross-border logistics expertise, and cultural considerations in crafting effective fulfillment models.

Looking ahead, the vendors that will dominate the market are those who combine technological leadership with deep vertical expertise and customer-centric service models. By fostering strategic partnerships, emphasizing experience design, and providing consultative support, these providers empower customers to transform their order operations from a cost center into a strategic growth engine.

In conclusion, multichannel order management is at a pivotal junction where the right blend of technology, process excellence, and organizational alignment can deliver significant competitive advantages. As digital commerce continues to expand, the organizations that harness these insights will unlock new opportunities and drive sustainable growth.

Seizing Opportunities With a Personalized Call to Action to Engage With Ketan Rohom and Secure a Comprehensive Market Research Report Today

To capitalize on the opportunities that lie ahead, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore how our comprehensive research can inform and accelerate your strategic initiatives. By collaborating with Ketan Rohom, you will gain access to tailored insights, in-depth analysis, and personalized guidance designed to empower your organization with a competitive edge. Take the next step toward optimizing your multichannel order management approach and driving sustained growth by securing a full copy of the report. Reach out today to unlock a deeper understanding of market dynamics, emerging technologies, and actionable best practices that will shape the future of your operations and elevate your industry standing.

- How big is the Multichannel Order Management Market?

- What is the Multichannel Order Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?