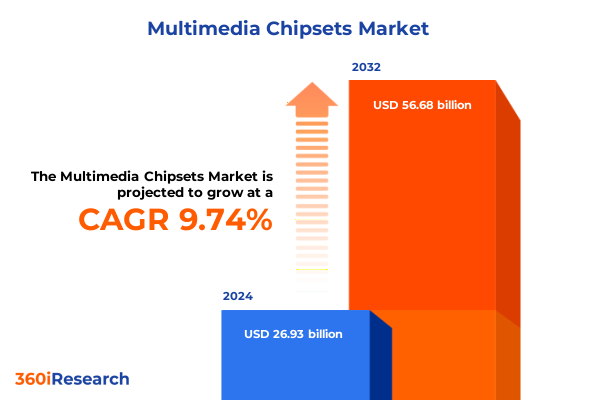

The Multimedia Chipsets Market size was estimated at USD 29.56 billion in 2025 and expected to reach USD 32.45 billion in 2026, at a CAGR of 9.74% to reach USD 56.68 billion by 2032.

Navigating the Rapid Evolution of Multimedia Chipsets in an Era Defined by Complex Connectivity Demands and Performance Innovations

In the rapidly converging world of digital media, multimedia chipsets have become the linchpin enabling seamless integration of high-definition video, immersive audio, and real-time data processing. Developers and manufacturers are under increasing pressure to deliver high-performance silicon that can support artificial intelligence workloads, 5G connectivity, and edge-computing capabilities-all within stringent power and thermal budgets. As the complexity of use cases expands, the role of multimedia chipsets has evolved from a specialized component to a cornerstone of product differentiation across multiple device categories.

Against this backdrop, industry stakeholders are rethinking design philosophies to balance architectural flexibility with optimized performance. The transition toward heterogeneous systems-on-chip that combine digital signal processors, graphics accelerators, and AI engines is redefining expectations for processing efficiency. Meanwhile, growing end-user demand for seamless user experiences is accelerating innovation cycles, driving chipmakers to explore advanced process nodes, packaging techniques, and software-hardware co-optimization. This introduction sets the stage for an in-depth exploration of the critical forces reshaping the multimedia chipset ecosystem and outlines the strategic considerations for maintaining competitive edge.

Understanding the Transformative Shifts Reshaping the Multimedia Chipset Landscape Through Emerging Technologies and Strategic Industry Alliances

The multimedia chipset industry is undergoing a profound metamorphosis, propelled by breakthroughs in machine learning, rising bandwidth requirements, and an intensifying focus on system-level integration. One of the most consequential shifts has been the migration from fixed-function accelerators to programmable architectures, enabling on-the-fly adaptability to diverse workloads such as video encoding, audio signal processing, and neural inference. This flexibility has unlocked new opportunities for platform differentiation but also introduced complexity in toolchain development and IP integration.

Concurrently, strategic collaborations between chipset designers, foundries, and ecosystem partners have escalated in both scale and sophistication. Joint ventures are emerging to co-develop specialized modules for automotive infotainment systems and AR-enabled wearable devices, accelerating time to market while sharing the R&D burden. Moreover, the convergence of traditional computing paradigms with secure elements and embedded GPUs has given rise to heterogeneous compute fabrics that can seamlessly switch contexts between data-intensive graphics tasks and latency-sensitive sensor fusion operations. These transformative shifts underscore the critical need for a holistic approach to silicon design, one that harmonizes performance targets with cost structures and sustainability goals.

Analyzing the Far-Reaching Consequences of 2025 United States Tariffs on Multimedia Chipset Supply Chains and Manufacturer Strategies

In early 2025, the United States government implemented a series of tariffs targeting imported semiconductor components, including key multimedia chipset subassemblies. This policy change has reverberated throughout the supply chain, compelling OEMs and foundry partners to reassess their sourcing strategies. While some organizations have opted to absorb incremental costs in the short term, others are accelerating efforts to localize production and establish redundant manufacturing pipelines. These dynamics have elevated the importance of supply chain transparency and risk mitigation planning.

Moreover, the tariff environment has catalyzed a reevaluation of product roadmaps, particularly for devices with tight margins such as smart home cameras and wearable health monitors. Manufacturers have responded by optimizing bill-of-materials through functional consolidation and by intensifying negotiations with regional suppliers. In parallel, industry consortia are lobbying for tariff relief or the creation of specialized free trade zones dedicated to semiconductor packaging and testing. Taken together, these developments highlight the cumulative impact of U.S. tariffs on cost structures, innovation cycles, and strategic partnerships within the multimedia chipset sector.

Unveiling Critical Insights Across Device Type, Chipset Architectures, Connectivity Standards, and Industry Verticals to Guide Strategic Positioning

A granular examination of device categories reveals distinct drivers underpinning adoption patterns and technology priorities. In automotive applications, advanced driver assistance systems, infotainment consoles, and telematics units are each demanding specialized processing capabilities, prompting tier suppliers to tailor multimedia accelerators for real-time sensor fusion and ultra-low latency communication. By contrast, consumer electronics players are channeling resources into camera modules, set-top boxes, tablets, and television platforms that balance high-resolution video playback with efficient power management. Smartphone manufacturers continue to differentiate across Android and iOS ecosystems by integrating proprietary video codecs and neural processing units, while the wearable segment is witnessing a rapid rise in AR-enabled glasses, fitness trackers, and smartwatches that require ultra-compact chip solutions.

At the silicon architecture level, digital signal processors are evolving to handle complex audio, communication, and video workloads within a single fabric. Field programmable gate arrays, spanning low-, mid-, and high-density classes, are carving out applications in rapid prototyping and niche verticals. Graphics processing units are bifurcating into discrete accelerators for premium gaming consoles and integrated cores for mainstream devices, while systems-on-chip designed for automotive, IoT, and mobile use cases continue to benefit from modular IP blocks. Connectivity standards further fragment the market: established 4G and nascent 5G modems coexist alongside multiple Bluetooth generations-from Bluetooth 2 through Bluetooth 5-and a spectrum of Wi-Fi variants including 802.11ac, ax, g, and n. Across industries, end-user requirements span OEM and tier-supplier relationships in automotive, commercial and residential deployments in consumer segments, aerospace, energy, healthcare, and manufacturing in industrial domains, as well as equipment vendors and service providers in the telecom sector. These layered segmentation insights illuminate the multifaceted value propositions and technology levers that companies can employ to sharpen their competitive positioning.

This comprehensive research report categorizes the Multimedia Chipsets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Chipset Type

- Connectivity Standard

- End User Industry

Exploring Region-Specific Dynamics in the Americas, Europe Middle East and Africa, and Asia-Pacific to Identify Growth Drivers and Challenges

Regional dynamics are shaping distinct opportunity landscapes within the Americas, EMEA, and Asia-Pacific geographies. In the Americas, robust investments in automotive electronics and next-generation consumer devices are spurring demand for multimedia chipsets that can seamlessly integrate with 5G networks and autonomous driving platforms. Companies in this region are also leveraging sophisticated design houses and fab partnerships to accelerate prototyping and advanced packaging initiatives.

Meanwhile, Europe, the Middle East, and Africa are characterized by a heightened regulatory focus on data privacy and energy efficiency. This environment has prompted chipset developers to innovate in secure media processing and power-conscious architectures, particularly for applications in smart city infrastructure and telecom backhaul. Conversely, Asia-Pacific remains the world’s leading manufacturing hub, with an unparalleled concentration of foundry capacity and electronics assembly. Rapid 5G rollouts, expanding consumer electronics penetration, and government-backed semiconductor programs are collectively driving a resilient ecosystem for multimedia chipsets. By understanding these regional nuances, industry participants can tailor market entry strategies to align with localized requirements and growth catalysts.

This comprehensive research report examines key regions that drive the evolution of the Multimedia Chipsets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovation Trajectories of Leading Multimedia Chipset Developers and Their Ecosystem Partnerships

Leading chipmakers are distinguishing themselves through a blend of proprietary IP, scale advantages, and ecosystem collaborations. Qualcomm continues to pioneer heterogeneous SoC designs that combine DSP cores with neural accelerators, while Nvidia is expanding its reach into edge AI with GPU architectures optimized for multimedia inference tasks. MediaTek’s integrated approach for smartphones and smart home products has gained traction in emerging markets, and Intel has renewed focus on discrete GPU innovations and automotive-grade silicon following strategic partnerships with Tier 1 OEMs.

In parallel, smaller players such as Xilinx and AMD are asserting their presence through flexible FPGA and high-performance GPU roadmaps, respectively. Samsung’s LSI division is leveraging its foundry capabilities to deliver bespoke camera and modem subsystems, and Broadcom is reinforcing its leadership in connectivity standards with advanced Bluetooth and Wi-Fi chipsets. These companies are also forging alliances with software providers, end-equipment manufacturers, and AI framework developers to ensure seamless ecosystem integration. The cumulative effect of these strategic movements is a dynamic competitive landscape where agility and IP differentiation are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multimedia Chipsets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actions Semiconductor Co, Ltd

- Advanced Micro Devices Inc.

- Allwinner Technology Co, Ltd

- Amlogic Inc.

- Apple Inc.

- Broadcom Inc.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- Marvell Technology Group Ltd

- MediaTek Inc.

- Novatek Microelectronics Corp

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Realtek Semiconductor Corp

- Rockchip Electronics Co, Ltd

- Samsung Electronics Co., Ltd.

- Sigma Designs, Inc.

- Sony Corporation

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Toshiba Corporation

- Xilinx Inc.

Driving Future Growth Through Tactical Recommendations for Multimedia Chipset Industry Leaders Embracing Agility and Collaborative Innovation

To thrive in this evolving environment, industry leaders should prioritize the adoption of heterogeneous computing frameworks that facilitate seamless workload distribution across DSPs, GPUs, and AI engines. By embedding modular IP blocks, organizations can accelerate product customization and respond more nimbly to shifting application requirements. It is equally vital to cultivate collaborative partnerships across the software stack, ensuring that drivers, middleware, and optimization tools are aligned with underlying silicon capabilities.

Supply chain diversification must also become a strategic imperative. Firms should identify alternative sources for wafer fabrication, packaging, and testing, while implementing end-to-end traceability systems to detect and address disruptions in real time. Engaging proactively with regulatory bodies can streamline compliance processes, particularly in regions imposing data security and energy efficiency mandates. Finally, embedding sustainability considerations into chipset design-such as low-power modes and eco-friendly materials-will not only reduce operational costs but also resonate with environmentally conscious consumers and enterprise clients alike.

Detailing the Comprehensive Research Methodology Incorporating Qualitative and Quantitative Analyses for Robust Multimedia Chipset Market Insights

This research integrates both qualitative and quantitative methodologies to ensure a comprehensive and balanced perspective on the multimedia chipset domain. Primary data was collected through in-depth interviews with senior executives, design engineers, and supply chain specialists across device manufacturers, semiconductor fabs, and software ecosystem participants. These conversations provided nuanced insights into emerging design paradigms, procurement strategies, and operational challenges.

Secondary data sources encompassed technical white papers, patent databases, regulatory filings, and trade association reports, enabling triangulation of market drivers and technology adoption patterns. Quantitative analysis incorporated historical shipment volumes, technology node migration trends, and component mix ratios to validate thematic findings. Rigorous data validation protocols were applied, including cross-referencing multiple independent sources and engaging an expert review panel to challenge key assumptions. This multi-tiered research framework underpins the credibility and depth of the strategic insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multimedia Chipsets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multimedia Chipsets Market, by Device Type

- Multimedia Chipsets Market, by Chipset Type

- Multimedia Chipsets Market, by Connectivity Standard

- Multimedia Chipsets Market, by End User Industry

- Multimedia Chipsets Market, by Region

- Multimedia Chipsets Market, by Group

- Multimedia Chipsets Market, by Country

- United States Multimedia Chipsets Market

- China Multimedia Chipsets Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Strategic Implications to Empower Stakeholders in the Multimedia Chipset Ecosystem with Actionable Knowledge

Pulling together the investigation’s core findings reveals a multimedia chipset sector at the crossroads of technological innovation and geostrategic realignment. Heterogeneous architectures are setting new performance benchmarks, while US tariff policies are reshaping supply chain strategies and accelerating localization efforts. Segmentation analysis has uncovered granular differentiators in device categories, chipset types, connectivity standards, and end-user industries, each presenting unique value propositions and challenges. Regional perspectives further highlight that localized regulatory, manufacturing, and infrastructure landscapes will dictate the pace and direction of adoption.

Key industry players are responding with targeted IP development and collaborative ecosystems, underscoring the necessity for agile product roadmaps and resilient partnerships. The actionable recommendations provided herein offer a strategic blueprint for harnessing these trends-advocating for a balanced approach to ecosystem engagement, supply chain diversification, regulatory alignment, and sustainability integration. This synthesized perspective equips stakeholders with the actionable knowledge required to navigate market complexities, capture emerging opportunities, and secure competitive advantage in the multimedia chipset arena.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Multimedia Chipset Market Research Insights and Secure Your Competitive Advantage Today

To secure comprehensive insights that can inform your strategic roadmap and optimize your competitive posture, connect with Associate Director, Sales & Marketing Ketan Rohom today. By engaging directly with Ketan Rohom, you gain privileged access to in-depth analysis covering the most critical factors shaping the multimedia chipset arena-from technological breakthroughs and tariff ramifications to regional nuances and supplier dynamics. Ketan’s expertise will guide you through tailored data deliverables, executive briefings, and consultative support designed to accelerate your decision-making process and drive measurable outcomes. Take the first step toward equipping your organization with the actionable intelligence necessary to outpace rivals and capitalize on emerging opportunities-reach out now to explore customized subscription options and licensing agreements that align with your strategic imperatives.

- How big is the Multimedia Chipsets Market?

- What is the Multimedia Chipsets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?