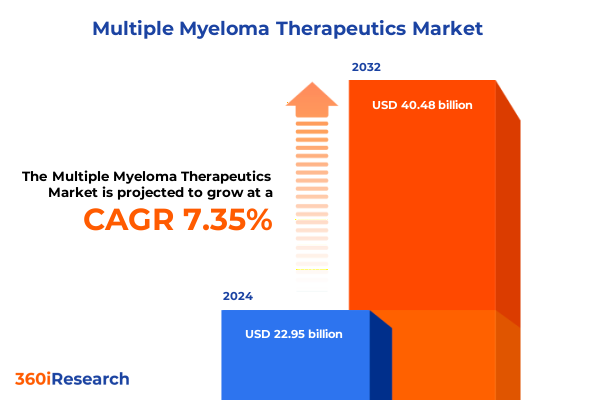

The Multiple Myeloma Therapeutics Market size was estimated at USD 24.60 billion in 2025 and expected to reach USD 26.38 billion in 2026, at a CAGR of 7.36% to reach USD 40.48 billion by 2032.

Unveiling the Transformative Advances and Unmet Needs Driving Innovation in Multiple Myeloma Therapeutic Strategies, Pipeline Dynamics, and Patient Centricity

Multiple myeloma persists as a formidable hematologic malignancy characterized by clonal proliferation of plasma cells within the bone marrow. Over the past decade, therapeutic innovation has accelerated, transitioning the treatment paradigm from traditional chemotherapy backbones to targeted and immune-based strategies that extend survival and enhance quality of life. Despite these advances, an enduring need remains for therapies that address high-risk disease subtypes, overcome relapsed and refractory settings, and mitigate cumulative toxicity associated with long-term treatment.

Moreover, patient centricity has emerged as a critical driver in multiple myeloma management, prompting developers and clinicians to optimize convenience, tolerability, and adherence through novel dosing regimens and subcutaneous or oral formulations. In parallel, the rise of biomarker-guided approaches and minimal residual disease (MRD) monitoring is redefining criteria for treatment response, enabling deeper remissions and informing adaptive therapeutic sequencing. Consequently, the convergence of scientific breakthroughs, evolving regulatory frameworks, and heightened patient expectations is reshaping how stakeholders view value in a market increasingly defined by complex regimens and personalized care pathways.

In addition to clinical innovations, digital health tools and remote monitoring platforms are gaining traction, facilitating earlier detection of adverse events and enhancing patient engagement. As the field moves toward curative aspirations, the interplay of next-generation cell therapies, bispecific antibodies, and combination strategies underscores a transformative era that demands a holistic understanding of emerging opportunities and unmet needs. This analysis outlines the critical context for stakeholders seeking to navigate an increasingly sophisticated multiple myeloma therapeutic landscape, spotlighting the forces that will drive future growth and define competitive advantage.

Examining How Breakthrough Cellular Therapies Emerging Bispecific Antibodies and Novel Combinations Are Redefining Multiple Myeloma Treatment Paradigms

The advent of chimeric antigen receptor T cell (CAR-T) therapies has marked a watershed moment in multiple myeloma, offering durable responses in heavily pretreated patients. Since the initial regulatory approvals of idecabtagene vicleucel and ciltacabtagene autoleucel, manufacturers have leveraged manufacturing refinements to reduce turnaround times, while exploring allogeneic platforms to enhance accessibility. In tandem, bispecific T-cell engagers targeting BCMA and other antigens have progressed rapidly, with several constructs demonstrating robust efficacy and manageable safety profiles in early-phase trials.

Furthermore, the resurgence of histone deacetylase inhibitors is driven by next-generation molecules designed to improve selectivity and reduce off-target effects. This has rejuvenated interest in combination regimens that exploit epigenetic modulation to enhance tumor vulnerability. Likewise, immunomodulatory drugs remain foundational, with ongoing efforts to optimize dosing and mitigate cytopenias through novel formulations. Monoclonal antibodies against CD38 and SLAMF7 continue to serve as backbone agents, yet developers are investigating subcutaneous administration and antibody-drug conjugates to refine therapeutic index and patient convenience.

In addition, proteasome inhibitors have entered an era of diversification beyond bortezomib, as emerging oral and next-generation agents aim to address mechanisms of resistance. These transformative shifts collectively underscore a movement toward more personalized, mechanism-driven approaches. As a result, stakeholders must closely monitor the dynamic interplay of cellular therapies, immunomodulatory strategies, and targeted modalities, recognizing that the convergence of these innovations will define the next wave of therapeutic breakthroughs in multiple myeloma.

Analyzing the Ripple Effect of Recent US Tariff Measures on Supply Chains Manufacturing Costs and Access to Multiple Myeloma Therapies in 2025

Recent policy measures have imposed higher tariffs on critical chemical intermediates and active pharmaceutical ingredients imported into the United States, prompting manufacturers to reassess supply chain configurations. Over the past year, cumulative tariffs have elevated costs for raw materials essential to advanced therapeutics, including CAR-T vector components and monoclonal antibody production. Consequently, downstream pricing pressures have intensified, compelling developers to explore domestic manufacturing or nearshoring strategies to mitigate tariff exposure and preserve margin structures.

In response, companies are forging partnerships with regional contract manufacturing organizations to diversify input sources and insulate operations against geopolitical fluctuations. Moreover, inventory management protocols have been enhanced to buffer against potential disruptions, balancing just-in-time delivery models with strategic stockpiling to ensure steady access for treatment centers. However, these adjustments have inherently increased working capital requirements and operational overhead, particularly for smaller biotech firms with limited scaling capacity.

Additionally, regulatory agencies have acknowledged these supply chain challenges, offering expedited reviews for facility inspections and import licensing to support continuity of complex biologic manufacturing. While such interventions have alleviated some logistical burdens, the aggregate effect of escalating tariffs continues to warrant proactive risk assessments. Stakeholders must therefore adopt a holistic approach, integrating tariff analysis into strategic planning to safeguard therapeutic availability and maintain equitable patient access across the United States.

Unraveling Critical Market Segmentation Driven by Drug Classes Administration Modes Distribution Channels and Product Types Shaping Therapeutic Access

The multiple myeloma therapeutics market can be dissected through multiple lenses that reveal nuanced patterns of adoption, efficacy, and patient preference. When considering drug classes, innovators and established players alike are accelerating development in advanced cellular therapies, while traditional modalities-such as immunomodulatory drugs and monoclonal antibodies-continue to hold substantial therapeutic value. Within proteasome inhibitors, distinctions arise among bortezomib legacy formulations and newer entrants like carfilzomib and ixazomib, each exhibiting differing toxicity profiles and administration requirements that shape prescribing behavior.

Turning to mode of administration, intravenous regimens remain prominent in hospital settings, yet the shift toward oral agents has empowered patients with greater flexibility and reduced clinic visits. Subcutaneous formulations of monoclonal antibodies further underscore this evolution, balancing clinical efficacy with streamlined delivery. These dynamics intricately link to distribution channel preferences: hospital pharmacies continue to dominate for inpatient and complex regimens, while retail outlets facilitate easier access to oral generics and maintenance therapies. Specialty pharmacies, however, have emerged as critical enablers for high-cost biologics and require coordinated patient support services to optimize adherence and reimbursement pathways.

From a product-type perspective, branded therapies account for the bulk of recent approvals and represent the innovation frontier, whereas generic alternatives maintain a vital role in cost containment and accessibility, particularly for widely used backbone agents. The interplay among these segmentation dimensions highlights the strategic choices manufacturers face in positioning their portfolios, tailoring value propositions, and navigating reimbursement landscapes to capture share in an increasingly stratified environment.

This comprehensive research report categorizes the Multiple Myeloma Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Mode Of Administration

- Product Type

- Distribution Channel

Highlighting Regional Dynamics and Strategic Drivers Influencing Multiple Myeloma Therapeutic Adoption Across Americas EMEA and Asia Pacific Markets

Regional variances exert a profound influence on the uptake and diffusion of multiple myeloma therapies worldwide. In the Americas, the United States leads with robust reimbursement frameworks, strong clinical trial networks, and a high adoption rate for cutting-edge modalities such as CAR-T and bispecific antibodies. However, cost containment pressures from payers have accelerated negotiations on outcomes-based contracting and rebate structures, influencing launch strategies and pricing models.

Within the Europe, Middle East & Africa region, centralized European Medicines Agency approvals streamline market entry across member states, yet individual reimbursement decisions introduce variability in access timelines. Countries with well-established health technology assessment bodies often demand comprehensive real‐world evidence and health economic analyses, prompting manufacturers to invest in post-launch studies. Emerging markets in the Middle East and Africa are gradually integrating novel treatment paradigms, albeit at a slower pace due to infrastructure and resource constraints.

In the Asia-Pacific sphere, a mosaic of mature and emerging markets shapes demand for multiple myeloma therapies. Japan’s advanced regulatory pathways and willingness to reimburse high-priced biologics mirror trends seen in Western markets, while China’s evolving pricing reforms and domestic biomanufacturing capacity create unique competitive dynamics. Other Asia-Pacific nations are balancing affordability with innovation, with governments exploring bulk procurement models and tiered pricing to expand patient access. These regional insights underscore the importance of differentiated market entry strategies tailored to the regulatory, economic, and clinical landscapes of each geography.

This comprehensive research report examines key regions that drive the evolution of the Multiple Myeloma Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators Advancements Collaborations and Competitive Strategies Driving Multiple Myeloma Therapeutic Development

Industry leaders have pursued a diverse array of strategic initiatives to maintain momentum in multiple myeloma research and commercialization. Bristol Myers Squibb and bluebird bio, for example, have collaborated to optimize CAR-T manufacturing through automated platforms that aim to reduce vein-to-vein timelines and enhance scalability. Meanwhile, Janssen’s partnership with Legend Biotech has set the precedent for co-development of next-generation cell therapies, leveraging shared expertise in vector design and patient management protocols.

GSK’s focus on bispecific antibody constructs has positioned it competitively against established monoclonal antibody portfolios, emphasizing triaging high-risk populations and refining dosing schedules to minimize cytokine release syndrome. Takeda and Amgen have similarly expanded their footprints through acquisitions of biotech innovators with proprietary immunomodulatory compounds and novel ADC platforms. Such M&A activity underscores a trend toward vertical integration, enabling companies to control critical stages of the value chain and accelerate time-to-market.

In parallel, several mid-tier and emerging biotech firms are carving niches in epigenetic modulation and small-molecule inhibitors, fueled by venture capital and public markets. These organizations often pursue agile trial designs and strategic licensing deals to access global distribution channels. Collectively, these company-level dynamics reflect a competitive landscape defined by collaboration, vertical integration, and portfolio diversification as essential strategies for sustained leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multiple Myeloma Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Adaptimmune Therapeutics plc

- Amgen Inc.

- Arcellx, Inc.

- AstraZeneca plc

- Bluebird Bio, Inc.

- Bristol-Myers Squibb Company

- Cellectis S.A.

- Daiichi Sankyo Company, Limited

- Genmab A/S

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Ichnos Sciences

- Ionis Pharmaceuticals, Inc.

- iTeos Therapeutics

- Johnson & Johnson Services, Inc.

- Karyopharm Therapeutics Inc.

- Merck & Co., Inc.

- Novartis AG

- Oncopeptides AB

- Poseida Therapeutics, Inc.

- Precision BioSciences, Inc.

- Regeneron Pharmaceuticals, Inc.

- Roche Holding AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Enhance Multiple Myeloma Treatment Portfolios and Market Positioning

To capitalize on the dynamic therapeutic landscape, industry stakeholders should prioritize the integration of novel modalities into holistic treatment pathways that emphasize durability of response and patient convenience. Specifically, investing in cellular therapy infrastructure and partnerships with contract manufacturers can reduce production bottlenecks and improve patient throughput. In parallel, establishing robust real-world evidence platforms will strengthen value demonstrations to payers and support outcomes-based agreements that align pricing with therapeutic efficacy.

Furthermore, diversifying portfolios across drug classes and formulations can mitigate risk associated with single-modality dependence. By combining early-stage investments in bispecifics and next-generation small molecules with established backbone therapies, organizations can tailor offerings to distinct patient segments and differentiate clinically. Concurrently, enhancing distribution strategies through specialty pharmacy networks and digital adherence tools will optimize patient engagement and support sustained treatment adherence, particularly in maintenance settings.

Finally, stakeholders must maintain a forward-looking posture by monitoring policy shifts-such as tariff adjustments and reimbursement reforms-that influence supply chain and pricing dynamics. By embedding scenario planning and risk management protocols into strategic roadmaps, companies can proactively address external disruptions. Collectively, these recommendations will empower leaders to bolster competitive positioning, drive sustainable growth, and ultimately improve outcomes for patients living with multiple myeloma.

Detailing Rigorous Research Methodology Data Sources and Analytical Frameworks Underpinning Insights in the Multiple Myeloma Therapeutics Landscape

This analysis synthesizes insights derived from a rigorous multi-stage research methodology integrating both primary and secondary data sources. Initially, in-depth interviews were conducted with a cross-section of stakeholders, including KOLs in hematology-oncology, senior executives at pharmaceutical and biotech firms, payers, and patient advocacy groups. These qualitative insights were complemented by a structured review of public filings, regulatory databases, peer-reviewed journals, and real-world evidence repositories to validate emerging trends and quantify adoption patterns.

Subsequently, the findings were triangulated through data synthesis techniques, enabling cross-validation of market drivers, competitive strategies, and segment dynamics. Analytical frameworks-such as Porter’s Five Forces and SWOT analyses-were applied to ascertain competitive intensity and identify critical barriers to entry. Pricing and reimbursement landscapes were mapped using country-specific health technology assessment guidelines and payer policy documents.

Finally, an expert advisory panel comprising clinical researchers, pharmacoeconomists, and supply chain specialists reviewed the preliminary conclusions to ensure robustness and relevance. This comprehensive approach ensures that the insights presented reflect the most current developments and strategic imperatives shaping the multiple myeloma therapeutics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multiple Myeloma Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multiple Myeloma Therapeutics Market, by Drug Class

- Multiple Myeloma Therapeutics Market, by Mode Of Administration

- Multiple Myeloma Therapeutics Market, by Product Type

- Multiple Myeloma Therapeutics Market, by Distribution Channel

- Multiple Myeloma Therapeutics Market, by Region

- Multiple Myeloma Therapeutics Market, by Group

- Multiple Myeloma Therapeutics Market, by Country

- United States Multiple Myeloma Therapeutics Market

- China Multiple Myeloma Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Learnings and Forward Looking Perspectives to Empower Informed Decision Making in the Multiple Myeloma Therapeutics Sector

Through a comprehensive exploration of therapeutic innovations, supply chain dynamics, and strategic market segmentation, this analysis has highlighted the multifaceted forces driving progress in multiple myeloma care. The convergence of advanced cellular therapies, bispecific antibodies, and next-generation small molecules underscores a shift toward deeper, more durable responses, while the evolution of administration modes and distribution channels reflects a growing emphasis on patient convenience and access.

At the same time, external pressures-such as evolving tariff policies and payer cost-containment measures-highlight the importance of adaptive strategies that address manufacturing resilience and health economics. Regional insights reveal that tailored entry tactics and localized evidence generation are essential for navigating disparate reimbursement landscapes and infrastructure challenges. Moreover, a spotlight on leading companies confirms that collaboration, vertical integration, and portfolio diversification are pivotal to sustaining competitive advantage.

Looking ahead, stakeholders must leverage real-world data and foster innovative partnerships to bridge persistent unmet needs and accelerate the translation of scientific breakthroughs into meaningful patient outcomes. Collectively, the insights presented herein provide a strategic blueprint for decision-makers seeking to navigate the complexity of the multiple myeloma therapeutics market, enabling informed investments and optimized patient care strategies.

Connect with Ketan Rohom to Secure Exclusive Multiple Myeloma Therapeutics Market Intelligence Report to Drive Strategic Growth and Competitive Advantage

To explore tailored insights, secure tailored analytics, and drive strategic decision making, reach out to Ketan Rohom, the Associate Director of Sales & Marketing, to obtain your exclusive copy of the Multiple Myeloma Therapeutics Market Research Report. Unlock actionable intelligence to refine your strategic roadmap and stay ahead in an increasingly competitive landscape by partnering directly with Ketan Rohom today

- How big is the Multiple Myeloma Therapeutics Market?

- What is the Multiple Myeloma Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?