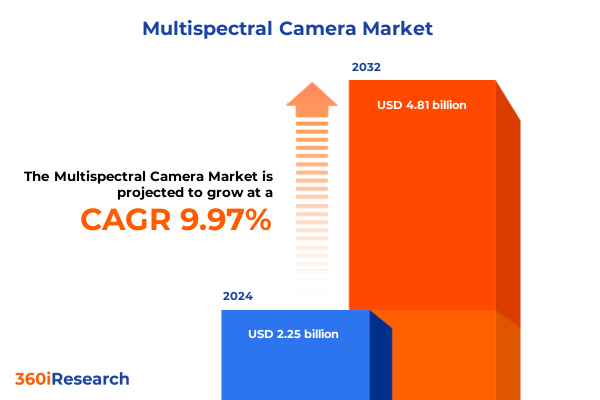

The Multispectral Camera Market size was estimated at USD 2.46 billion in 2025 and expected to reach USD 2.69 billion in 2026, at a CAGR of 10.05% to reach USD 4.81 billion by 2032.

Unveiling the Essential Role of Multispectral Camera Systems in Transforming Imaging Capabilities Across Diverse Industry Sectors

The evolution of multispectral camera systems marks a turning point in imaging technology, enabling unprecedented visibility across wavelengths beyond what the human eye can perceive. From capturing subtle variations in vegetation health to enhancing situational awareness in defense and security, these advanced imaging solutions have become indispensable tools for both commercial and government organizations. As multiple industries seek deeper analytical capabilities, multispectral cameras positioned on platforms ranging from unmanned aerial vehicles to stationary installations have unlocked new dimensions of data-driven decision making.

Against this backdrop of rapid technological advancement, the introduction of more compact sensors and the convergence of spectral imaging with artificial intelligence are fundamentally reshaping what is possible. What was once confined to high-cost, specialist applications has now become accessible to a broader spectrum of users-from precision agriculture researchers conducting soil and plant analysis to infrastructure inspection teams monitoring critical assets. This expansion of use cases underscores the vital role that multispectral cameras play as the eyes of next-generation intelligence, where spectral diversity meets real-time analytics to reveal insights that traditional imaging simply cannot.

How Artificial Intelligence, Miniaturization, and Advanced Sensor Fusion Are Redefining the Landscape of Multispectral Imaging Innovation

Recent years have witnessed a host of transformative shifts that are setting the stage for the next wave of innovation in multispectral imaging. First, the integration of artificial intelligence and machine learning into camera systems has enabled automated interpretation of complex spectral data, vastly improving the speed and accuracy of applications such as crop health analysis and environmental monitoring. In parallel, the push toward miniaturization and cost reduction has brought sensor technology into the reach of smaller research institutions and emerging agritech ventures, creating a wider user base for advanced imaging solutions.

Moreover, the proliferation of unmanned aerial vehicles equipped with multispectral payloads has catalyzed the adoption of remote sensing in industries like precision agriculture, forestry, and disaster assessment, delivering high-resolution, multi-band data over expansive areas with unprecedented efficiency. In parallel, the commercialization of hyperspectral methods alongside multispectral approaches has begun to blur traditional boundaries, allowing users to tailor spectral granularity to the specific needs of each mission. Edge computing is also emerging as a critical enabler, with AI vision models running directly on drones and field cameras to provide real-time analytics without reliance on continuous cloud connectivity.

In addition to these advances, the trend toward advanced sensor fusion is unlocking new levels of situational awareness. By combining data from multispectral, thermal, and high-resolution RGB sensors into unified datasets, solution providers can deliver a richer contextual view for applications such as power line inspection, where fused imagery enhances defect detection even under challenging lighting conditions. Collectively, these shifts are defining a new frontier for multispectral imaging-one where intelligent, connected, and modular solutions converge to meet an expanding array of analytical challenges.

Assessing the Complex Web of New U.S. Tariffs and Their Far-Reaching Effects on Multispectral Imaging Equipment Costs and Supply Chains

The U.S. government’s 2025 tariff landscape presents a complex array of levies affecting multispectral imaging equipment at multiple levels. A baseline 10% duty has been applied to broad categories of imported electronics, with steeper country-specific surcharges reaching 34% for items from China, 24% for Japanese imports, 20% for European Union goods, and an especially high 46% rate on Vietnamese products. On top of these new tariffs, cameras and related optics-long exempt from import duties-now face significant costs, forcing many manufacturers to reevaluate global supply chains and adjust end-user pricing.

In April 2025, the USTR finalized a four-year review under Section 301, raising duties on polysilicon and solar wafer imports from China to 50% and certain tungsten components to 25%, signaling continued scrutiny of technology supply chains and potential spillover effects on imaging sensors that rely on these materials. Camera makers have already begun passing these additional import costs to U.S. buyers: one leading manufacturer reported a price jump of over 30% for flagship devices before settling at a new, permanently higher list price. Nor are tariff exemptions offering relief-while smartphones and certain display technologies received temporary reprieves, imaging devices remain fully subject to these new levies, with no clear timeline for relief.

The cumulative effect is evident across the value chain. Component suppliers face higher raw input costs, subsystem integrators must absorb or pass on steeper bills for sensor arrays and optical filters, and end users are already seeing elevated prices for both portable and payload-class systems. In response, many organizations are exploring alternative sourcing strategies, shifting assembly operations to lower-tariff regions or accelerating investments in domestic production facilities to mitigate future duties and preserve competitive pricing.

Examining Market Dynamics Through Component Analysis, Platform Categories, Spectral Band Insights, Lens Variations, Application Scope, and End-User Sector Trends

Component-level considerations remain foundational to understanding where performance gains and cost pressures intersect. Data storage and communication interfaces, image processing and control electronics, optical filters, and sensor arrays each play distinct roles in determining system throughput and fidelity, dictating investment priorities for both developers and end users. Transitioning to platform-based segmentation, it becomes clear that airborne installations demand strict weight and power budgets, whereas ground-based or stationary setups allow for higher throughput and more extensive cooling systems to support uncooled and cooled sensor architectures.

Spectral band selection further refines system capabilities: long-wave infrared excels in thermal anomaly detection, mid-wave infrared delivers robust material discrimination in industrial settings, short-wave infrared offers moisture and vegetation insights, and visible light remains a cost-effective baseline for context and guidance. Lens variants such as fixed and zoom options balance optical precision against operational flexibility, influencing both payload integration complexity and field-of-view requirements. Category distinctions between payload and portable formats highlight contrasting design goals-compact, battery-operated units for rapid deployment versus larger, platform-mounted devices for continuous monitoring with advanced cooling.

From an application standpoint, environmental monitoring and industrial infrastructure inspection leverage spectral imaging to detect anomalies in water bodies, pipelines, and power grids, while natural resource management and precision agriculture rely on multispectral indices to optimize crop health and yield. Research and academic institutions utilize these systems for experimental studies in material science and biology, whereas security and surveillance deployments emphasize high-speed analytics and real-time decision support. End-user industries further diversify demand: aerospace and defense drive high-performance, mission-critical solutions, agriculture and forestry adopt lower-weight drone-based sensors, automotive and transportation explore road-surface and structural assessments, energy companies focus on emissions and thermal monitoring, healthcare entities investigate novel diagnostic modalities, and mining firms apply spectral analysis to mineralogy studies.

This comprehensive research report categorizes the Multispectral Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Product Type

- Spectral Bands

- Lens Type

- Category

- Application

- End-User Industry

Analyzing Regional Growth Drivers and Adoption Patterns Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Across the Americas, momentum is propelled by strong defense budgets and a thriving agritech sector that leverages drone-based multispectral solutions for large-scale crop monitoring. North American research institutions also lead in developing AI-driven analytics platforms, fostering a robust ecosystem of component suppliers and system integrators. Meanwhile, Europe, the Middle East & Africa present a mosaic of adoption patterns: leading Western European nations prioritize infrastructure resilience and environmental regulation compliance, while select Gulf Cooperation Council countries invest heavily in desert agriculture and smart-city initiatives, driving uptake in portable and stationary solutions.

In Asia-Pacific, rapid growth is fueled by a confluence of factors: expanding precision agriculture practices in India and China, government-backed space and satellite programs in Japan and Australia, and a vibrant commercial drone industry in Southeast Asia. Regional partnerships and cross-border research collaborations are accelerating applications in forestry management and disaster response, underscoring the strategic importance of multispectral imaging in addressing population density, climate change, and food security challenges. These divergent regional drivers collectively shape a dynamic global market, demanding tailored go-to-market strategies and localized support models to capture opportunity across each territory’s unique ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Multispectral Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Pioneering Cutting-Edge Multispectral Imaging Solutions and Technologies

Leading technology providers are forging the path with differentiated offerings that balance performance, integration, and application-specific features. FLIR Systems has bolstered its multispectral portfolio by embedding AI and machine learning capabilities directly onto its sensor modules, enabling edge inference for applications from industrial inspection to perimeter security. Headwall Photonics continues to set the standard for customization, offering tunable hyperspectral engines alongside field-ready multispectral configurations for clients in defense, environmental research, and food processing.

Specialized innovators are also making notable strides. MicaSense, now part of a leading drone manufacturer, has advanced sensor fusion architectures that seamlessly combine multispectral and thermal data, catering to precision agriculture and vegetation analysis workflows. Cubert GmbH, with roots in academic research, has commercialized compact snapshot multispectral cameras that deliver rapid capture and analysis for mobile and handheld applications, expanding access to imaging insights beyond traditional fixed-installation environments. Meanwhile, Resonon and Bayspec focus on niche end-user segments-industrial quality control and laboratory research-providing turnkey solutions with software platforms that simplify spectral data interpretation and integration into enterprise analytics pipelines.

This competitive landscape is further enriched by emerging players and strategic partnerships that amplify R&D capabilities. Collaborations between optical filter specialists and semiconductor foundries are driving next-generation sensor arrays, while alliances between drone OEMs and camera vendors are lowering integration barriers and accelerating time to deployment for aerial imaging solutions. Such ecosystem-level synergies underscore the market’s dynamic nature, where leadership hinges on both technological innovation and the ability to foster a cohesive, end-to-end solution offering.

This comprehensive research report delivers an in-depth overview of the principal market players in the Multispectral Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgEagle Aerial Systems Inc.

- Basler AG

- BaySpec, Inc.

- Carl Zeiss AG

- CHN Spec Technology (Zhejiang) Co., Ltd

- Collins Aerospace

- Eoptic Inc.

- Exosens SA

- Hamamatsu Photonics K.K.

- Hensoldt AG

- JAI A/S

- L3Harris Technologies, Inc.

- Leonardo DRS, Inc.

- LightPath Technologies Inc.

- Lytid SAS

- Parrot SA

- Raptor Photonics Ltd

- RTX Corporation

- Salvo Technologies Inc.

- Sentera Inc.

- SILIOS Technologies SA

- Sony Corporation

- Spectral Devices Inc.

- Spectricity NV

- SZ DJI Technology Co., Ltd.

- TECNO MOBILE LIMITED

- Teledyne Technologies Incorporated

- Thales Group

- Torontech Inc.

Prioritizing Strategic Initiatives to Navigate Market Disruptions and Capitalize on Emerging Opportunities in Multispectral Imaging

Industry leaders should focus on diversifying supply chains to mitigate ongoing tariff pressures and geopolitical uncertainties, exploring partnerships with regional manufacturing hubs to maintain price competitiveness and ensure uninterrupted access to critical components. Investing in modular sensor designs and software-defined payloads can enable rapid configuration changes, meeting the evolving needs of applications from defense reconnaissance to environmental conservation with minimal hardware rework.

To capitalize on expanding demand in underserved markets, organizations are advised to develop targeted training and support programs that lower the barrier to adoption for non-expert users. Creating intuitive, cloud-connected analytics platforms with tiered subscription models can foster recurring revenue streams while ensuring users continuously benefit from software enhancements and data-driven insights. Additionally, scaling up edge computing capabilities-by integrating purpose-built AI accelerators within camera modules-will empower real-time decision making in remote or bandwidth-constrained environments, setting competitive differentiation in service-level agreements.

Finally, forging cross-industry alliances-such as teaming with geospatial intelligence firms, software integrators, and hardware OEMs-will unlock new use cases and expand solution footprints. By adopting this collaborative approach, organizations can co-develop specialized applications, accelerate time to market, and share the burden of regulatory compliance across regions, ultimately maximizing the return on investment in multispectral imaging technologies.

Implementing a Rigorous Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Triangulation for Market Insights Reliability

The insights presented in this report are grounded in a robust research framework that began with extensive secondary research, including analysis of industry publications, government tariff notices, and technology supplier white papers. Key information sources encompassed USTR tariff announcements, technical journals detailing sensor fusion and AI integration, and market intelligence from specialty imaging news outlets.

Primary research efforts involved in-depth interviews with product managers, R&D executives, and end users across aerospace, agriculture, and environmental monitoring sectors. These conversations validated emerging trends, tariff impacts, and feature requirements directly from stakeholders actively deploying multispectral solutions in the field. Responses were anonymized to preserve confidentiality and were triangulated with secondary data points to ensure consistency and accuracy.

Finally, data triangulation techniques were employed to reconcile differing viewpoints and highlight consensus on critical market drivers, disruptive forces, and adoption barriers. The resulting analysis reflects a balanced perspective that integrates qualitative insights with quantitative observations, designed to deliver actionable, reliable intelligence for decision makers evaluating strategic investments in multispectral camera technologies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Multispectral Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Multispectral Camera Market, by Components

- Multispectral Camera Market, by Product Type

- Multispectral Camera Market, by Spectral Bands

- Multispectral Camera Market, by Lens Type

- Multispectral Camera Market, by Category

- Multispectral Camera Market, by Application

- Multispectral Camera Market, by End-User Industry

- Multispectral Camera Market, by Region

- Multispectral Camera Market, by Group

- Multispectral Camera Market, by Country

- United States Multispectral Camera Market

- China Multispectral Camera Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Charting the Path Forward for Accelerated Innovation and Adoption of Multispectral Imaging Solutions

Drawing together the themes explored throughout this report, it is clear that multispectral camera technology is entering a phase of rapid maturation, driven by AI-powered analytics, sensor fusion, and the expanding role of edge computing. Geopolitical factors, notably the evolving U.S. tariff regime, introduce complexity but also catalyze strategic realignments in supply chains and local manufacturing initiatives. Segmentation insights reveal that no single dimension-be it component, platform, or spectral band-dominates the narrative; instead, value is created through thoughtful integration of these elements to meet specific application requirements.

Regionally, mature markets in North America and Europe will continue to drive innovation in defense and industrial use cases, while high-growth economies across Asia-Pacific embrace drone-based and satellite-enabled imaging to tackle agricultural and environmental challenges. Leading companies and agile newcomers alike are staking their positions through differentiated solutions and strategic partnerships, ensuring that future growth is underpinned by collaborative ecosystems rather than isolated offerings.

As organizations consider their next steps, the emphasis should be on flexibility, software-enabled services, and scalable architectures that can adapt to emerging use cases and regulatory landscapes. By synthesizing these insights, stakeholders can chart a clear path forward-one that bridges technological possibility with practical deployment considerations, ultimately harnessing the full potential of multispectral imaging.

Connect with Ketan Rohom to Access Exclusive Multispectral Camera Market Research and Elevate Your Strategic Decision-Making Process Today

For a deep dive into the multispectral camera market’s most pressing insights and opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report and gain the competitive advantage you need

- How big is the Multispectral Camera Market?

- What is the Multispectral Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?