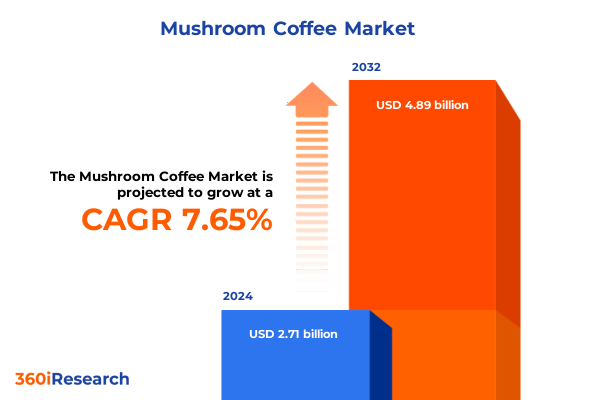

The Mushroom Coffee Market size was estimated at USD 2.71 billion in 2024 and expected to reach USD 2.91 billion in 2025, at a CAGR of 7.65% to reach USD 4.89 billion by 2032.

Emerging Mushroom Coffee Phenomenon That Is Redefining Consumer Health Trends and Shaping the Next Wave of Functional Beverage Innovations

The rise of mushroom coffee marks a pivotal moment in the beverage industry, blending time-honored coffee rituals with scientifically supported adaptogenic benefits. By infusing traditional coffee with medicinal fungi, manufacturers have created a compelling hybrid that resonates with today’s health-conscious consumers. Early adopters have lauded reports of enhanced cognitive clarity, stress reduction, and immune system support, driving the product from niche health stores into mainstream retail channels. Against a backdrop of growing demand for functional beverages, mushroom coffee has emerged as a beacon for those seeking daily rituals that deliver both enjoyment and well-being.

Underpinning this pursuit of wellness is a wave of innovation in extraction and blending methods, honed to preserve the delicate bioactive compounds within mushrooms while maintaining a familiar coffee taste profile. Parallel investments in optimized cultivation-from wild-harvested forest yields to controlled indoor farming-have bolstered supply chain resilience. Meanwhile, evolving regulatory frameworks are establishing clear parameters for health claims and labeling, fostering greater consumer confidence. As stakeholders gear up for expanded market penetration, this introduction sets the stage for an in-depth exploration of the transformative forces redefining mushroom coffee production and consumption.

How Evolving Wellness Trends and Technological Advances Are Catalyzing a Paradigm Shift in Mushroom Coffee Production and Consumption

Across the mushroom coffee landscape, shifting consumer priorities toward holistic health and cognitive function have sparked a renaissance in product development. As stress management and immune resilience rise to the forefront of wellness discourse, adaptogenic mushrooms such as lion’s mane, reishi, and cordyceps have seized public attention. Brands are responding by investing in advanced hot-water, dual-solvent extraction techniques that maximize potency while minimizing flavor deviations. This technological leap has enabled the creation of diverse formats-ranging from roast-and-ground blends to micronized powders-ultimately broadening consumer appeal.

Moreover, collaborative efforts between mycological experts and coffee technologists are giving rise to innovative ready-to-drink formulations, cold brews, and specialty concentrates. Research and development teams are leveraging data analytics to refine flavor profiles and optimize dosages, ensuring consistent user experiences. Simultaneously, private-label entrants and established roasters alike are forging strategic alliances with mushroom cultivators to secure high-quality raw materials. Together, these trends illustrate a dynamic intersection of science and gastronomy, setting the stage for future breakthroughs in both product efficacy and consumer engagement.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Mushroom and Coffee Component Supply Chains and Pricing Dynamics

In early 2025, updated United States tariff measures applied incremental duties to imported coffee beans and fungal extracts, reshaping cost structures across the supply chain. Imports of green coffee from key origin markets saw a modest uptick in duties, while powdered mushroom concentrates faced a separate tariff adjustment. These changes introduced new complexities for manufacturers who rely on global sourcing networks to balance quality, price, and consistency. As production costs crept upward, companies responded by renegotiating supplier agreements and exploring domestic cultivation options to mitigate exposure to fluctuating international duties.

The cumulative impact of these tariff revisions has been twofold: manufacturers are contending with margin pressures, and downstream distributors are recalibrating pricing strategies to maintain competitiveness. In response, forward-looking brands have accelerated efforts to vertically integrate, investing in own-brand mushroom farms and forging exclusive partnerships with regional coffee cooperatives. At the same time, supply chain teams have implemented dual-sourcing plans and inventory buffering to absorb potential trade friction. Moving beyond duty-related headwinds, the industry is increasingly focused on resilient supply chains as a strategic imperative for sustained growth.

Illuminating Consumer Segmentation Through In-Depth Analysis of Product Forms, Mushroom Varieties, Sourcing, Caffeine Content, Packaging, and Distribution

Consumer preferences in the mushroom coffee space are remarkably diverse, spanning multiple dimensions of product experience and sourcing ethics. From the tactile ritual of ground blends to the quick convenience of instant formulations, each product form caters to distinct lifestyle needs and occasions. Meanwhile, demand patterns for mushroom varieties reflect specific functional priorities: chaga and reishi have become synonymous with immune support, lion’s mane is prized for cognitive clarity, cordyceps for sustained energy, and turkey tail for its wellness synergy. Together, these preferences underscore the necessity for tailored product roadmaps.

Underneath these choices lies an equally complex sourcing landscape, differentiated between cultivated and wild-harvested mushrooms. Indoor and outdoor cultivation practices offer controlled environments for consistent quality, while forest wild harvest and regulated wild harvest deliver unique phytonutrient profiles appealing to premium-segment customers. Within this sourcing framework, consumers are also discerning between caffeinated and decaffeinated options, signaling a broader appetite for personalized caffeine consumption. Packaging formats further segment the market, with demand distributed across single-serve coffee pods, resealable containers and packets, and portable sachets designed for on-the-go lifestyles. Finally, distribution strategies align with shopper behaviors: offline purchases span specialty stores and supermarkets & hypermarkets, while online channels split between direct-to-consumer brand websites and third-party eCommerce platforms, each channel warranting its own marketing and logistics approach.

This comprehensive research report categorizes the Mushroom Coffee market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Mushroom Type

- Source

- Caffeine Content

- Packaging Outlook

- Distribution Channel

Exploring Regional Nuances and Growth Drivers Across the Americas, EMEA Markets, and Asia-Pacific Hubs Shaping the Mushroom Coffee Landscape

Regional dynamics illustrate that the Americas remain at the forefront of mushroom coffee adoption, where robust retail infrastructure and a mature eCommerce ecosystem have fueled rapid expansion of specialty beverage aisles. In North America, early evangelists in the wellness space have paved the way for mainstream acceptance, while Latin American markets are witnessing grassroots interest tied to local herbal traditions.

In Europe, Middle East & Africa, growth is being driven by Western European hubs where health-focused retailers and digital marketplaces contribute to rising visibility. The United Kingdom and Germany are notable centers for product innovation and consumer education, supported by stringent regulatory standards that foster trust in product claims. Meanwhile, emerging markets in the Middle East are exploring functional beverage categories as part of broader wellness agendas.

Asia-Pacific markets combine deep ethnobotanical heritage with cutting-edge convenience culture. Consumer familiarity with medicinal fungi in China and Japan underpins strong receptivity, while Southeast Asian economies are rapidly embracing modern packaged blends. Across these regions, omnichannel distribution and localized formulation strategies are proving essential for resonating with varied cultural preferences and consumption rituals.

This comprehensive research report examines key regions that drive the evolution of the Mushroom Coffee market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Innovative Collaborations Among Leading Brands Driving Advancement of Mushroom Coffee Industry Innovation

The competitive arena of mushroom coffee features a spectrum of innovators and established players deploying a range of strategic initiatives. Brands like Four Sigmatic have distinguished themselves through premium dual-extraction processes and direct brand storytelling focused on cognitive health. Laird Superfood has leveraged celebrity co-creation and sustainable sourcing commitments to build lifestyle appeal, whereas newer entrants such as Mud/Wtr offer coffee-free alternatives that position mushrooms at center stage. Meanwhile, companies like Ryze and Rasa are forging their own paths with specialized adaptogen blends tailored to stress management and sleep quality.

Collaboration is another defining theme, with firms partnering across the value chain to secure raw materials and share R&D insights. Strategic alliances between coffee roasters and mycological farms are enabling exclusive ingredient access, while private-label agreements have accelerated channel diversification in retail and foodservice. Additionally, several market leaders are pursuing acquisitions of regional mushroom cultivators and investment in proprietary extraction facilities, underscoring the premium placed on quality control and supply resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mushroom Coffee market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Four Sigmatic Inc

- Ryze Superfoods LLC

- Aces Intact Pvt Ltd

- Brewy

- ECO-TASTE

- La Republica Superfoods

- Gorilly Goods

- Laird Superfood, Inc.

- Mahogany Organics Private Limited

- MUD\WTR

- Mushroom Cups International

- Namhya Foods

- NeuRoast LLC

- Nutra-Industry CO., Ltd

- NutraCap Labs

- Om Mushroom Superfood By M2 Ingredients

- Pella Nutrition

- Pure Harmony Foods

- Rheal Superfoods

- Sayan Health, Inc

- Shroomi

- Sollo Food Inc

- Super U

- Waka Coffee Inc.

- Z Natural Foods

- Real Mushroom

Strategic Initiatives and Actionable Insights That Industry Leaders Can Implement to Capitalize on Emerging Opportunities in the Mushroom Coffee Market

To harness emerging opportunities, industry leaders should prioritize continuous investment in research and development to refine extraction techniques and amplify key bioactive compounds. Establishing strategic partnerships with both domestic cultivators and international coffee cooperatives will help mitigate tariff-related risks and ensure a diversified raw material base. Concurrently, integrating advanced traceability systems and sustainable farming practices can reinforce brand integrity and meet stringent consumer expectations around transparency.

Portfolio diversification across the full segmentation spectrum-ranging from ground and instant formats to specialized mushroom varieties and caffeine profiles-will be crucial for addressing evolving consumer needs. Tailoring packaging to convenience-driven segments and optimizing distribution strategies for both brick-and-mortar and digital channels can unlock growth levers across distinct shopper cohorts. Leaders should also leverage advanced analytics to decode consumption trends and personalize marketing outreach.

Finally, proactive engagement with policymakers to advocate balanced trade frameworks, coupled with collaborative innovation ecosystems, will enhance industry resilience. By championing responsible sourcing, championing robust quality standards, and co-developing next-generation functional beverages, forward-thinking organizations can solidify their competitive positions.

Comprehensive Research Methodology Showcasing Robust Data Collection, Multi-Tier Analysis, and Expert Validation for Unprecedented Insights into Mushroom Coffee

This research is underpinned by a rigorous blend of primary and secondary methodologies designed to ensure holistic and reliable insights. Primary data was collected through in-depth interviews with executive decision-makers, supply chain experts, and leading mycologists, as well as comprehensive surveys of product developers and distribution partners. Expert panel sessions were convened to validate preliminary findings and provide qualitative context on evolving consumer preferences and regulatory landscapes.

Complementing these efforts, secondary research encompassed exhaustive desk reviews of industry white papers, regulatory filings, scientific journals, and corporate publications. Historical trade data and tariff schedules were analyzed to quantify policy impacts, while advanced analytical frameworks were employed to triangulate differing data sets. Throughout the process, a stringent quality-assurance protocol was applied, involving multi-tiered reviews and data validation checks to uphold the highest standards of accuracy and relevance.

By combining empirical evidence with domain expertise, this methodology yields an unparalleled depth of insight into the mushroom coffee market, equipping stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mushroom Coffee market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mushroom Coffee Market, by Product Form

- Mushroom Coffee Market, by Mushroom Type

- Mushroom Coffee Market, by Source

- Mushroom Coffee Market, by Caffeine Content

- Mushroom Coffee Market, by Packaging Outlook

- Mushroom Coffee Market, by Distribution Channel

- Mushroom Coffee Market, by Region

- Mushroom Coffee Market, by Group

- Mushroom Coffee Market, by Country

- Competitive Landscape

- List of Figures [Total: 32]

- List of Tables [Total: 783 ]

Wrapping Up Key Discoveries and Future Outlook to Guide Decision-Making for Stakeholders in the Dynamic World of Mushroom Coffee

The insights presented throughout this summary converge on a clear narrative: mushroom coffee has transcended its niche origins to become a dynamic category at the interface of functional beverages, wellness innovation, and consumer lifestyle trends. From the diversity of product forms and sourcing models to the regional nuances shaping adoption, the industry reflects a sophisticated ecosystem driven by health-oriented demand and technological progress.

Key findings underscore the critical importance of supply chain resilience in light of tariff shifts, the value of proprietary extraction processes for product differentiation, and the need for nuanced segmentation strategies that cater to both convenience seekers and wellness purists. Forward-looking companies that embrace strategic partnerships, sustainable sourcing, and data-driven marketing will be best positioned to capitalize on growth opportunities.

As consumer expectations continue to evolve, the ability to combine rigorous scientific validation with compelling brand storytelling will determine success. Ultimately, the fusion of coffee culture and medicinal mycology offers a fertile ground for innovation, inviting stakeholders to chart new frontiers in functional beverage development.

Take the Next Step Toward Market Leadership by Securing Expert Intelligence on Mushroom Coffee Trends and Gain Competitive Edge Today

To gain immediate access to comprehensive insights, novel strategies, and actionable data tailored to your organization’s needs, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Secure your copy of this in-depth research report today to stay ahead in the evolving landscape of mushroom coffee and empower your team with the critical intelligence required to fuel growth and innovation.

- How big is the Mushroom Coffee Market?

- What is the Mushroom Coffee Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?