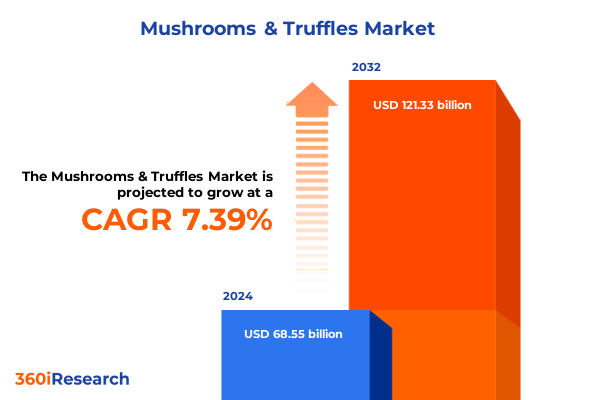

The Mushrooms & Truffles Market size was estimated at USD 73.36 billion in 2025 and expected to reach USD 78.56 billion in 2026, at a CAGR of 7.45% to reach USD 121.33 billion by 2032.

An Engaging Overview of How Culinary, Health, and Sustainability Trends Are Driving the Modern Mushrooms and Truffles Market to New Heights

The global appetite for mushrooms and truffles has expanded far beyond niche culinary circles, catalyzed by a convergence of gastronomic innovation, wellness-focused consumer behavior, and heightened sustainability consciousness. In recent years, mushrooms have transcended their role as simple accompaniments, emerging as star ingredients in plant-based menus, functional food products, and nutraceutical formulations. Simultaneously, truffles continue to captivate premium dining establishments and discerning consumers driven by their distinctive aroma and perceived status. As a result, the overall sector is witnessing a renaissance in product development, distribution strategies, and marketing approaches that align with evolving consumer priorities.

This introduction examines how these external drivers interact to reshape industry dynamics. Culinary creativity is challenging producers to develop novel strains and preserve organoleptic qualities, while research into bioactive compounds boosts interest among health-oriented audiences. Furthermore, environmental considerations, including reduced land use and circular waste management, are influencing investment in sustainable cultivation techniques. By understanding these intersecting trends, stakeholders can position themselves to harness emerging opportunities, anticipate potential disruptions, and craft robust strategies that address both current demand and future growth trajectories.

Examining the Fundamental Transformations Reshaping the Mushrooms and Truffles Industry Through Innovation and Evolving Consumer Preferences

The mushrooms and truffles landscape has undergone fundamental shifts driven by advances in cultivation technology, changing consumer preferences, and strategic collaborations across the value chain. Innovations such as precision climate control, vertical farming, and automation have dramatically improved yield consistency and product quality. These breakthroughs allow cultivators to optimize growing conditions for species ranging from button and oyster mushrooms to the most delicate truffle varieties.

Equally significant is the evolution of consumer demand. The rise of plant-based diets, coupled with a growing awareness of the gut-health properties of certain mushroom species, has prompted foodservice providers and packaged goods manufacturers to integrate these ingredients into mainstream offerings. In parallel, collaborations between research institutions and commercial growers are unlocking new applications-from pharmaceutical grades of medicinal mushrooms to truffle-infused cosmetics. As supply chains adapt to accommodate these innovations, established players and new entrants alike must navigate a more complex ecosystem where agility, collaboration, and technological investment determine competitive advantage.

Evaluating the Far Reaching Consequences of the 2025 United States Tariff Adjustments on Imports and Domestic Mushrooms and Truffles Competitiveness

The imposition of revised United States tariffs in 2025 represents a watershed moment for both importers and domestic producers of mushrooms and truffles. By raising duties on key import categories, policymakers have sought to protect local growers from the pricing pressures exerted by lower-cost exports. While this adjustment offers a short-term relief to domestic producers, it simultaneously introduces challenges for downstream manufacturers and distributors that rely on cost-effective imports of button mushrooms, shiitake mushrooms, and various truffle grades.

Moreover, the tariff environment has prompted numerous market participants to reassess sourcing strategies and supply-chain efficiencies. Import-dependent companies are exploring nearshoring options, including partnerships with North American cultivators, to mitigate duty impact. At the same time, domestic growers are scaling capacity and investing in premium certifications to capture higher-value segments. Ultimately, the 2025 tariff changes have not only altered price structures but also stimulated strategic realignments, reinforcing the importance of supply flexibility and diversified procurement models in securing long-term competitiveness.

Delving into Diverse Segmentation Layers to Uncover Critical Insights Across Product, Category, Type, Channel, Application, and End User Dynamics

A nuanced segmentation framework reveals disparate growth vectors across multiple market dimensions, offering clarity for targeted strategies. Product type analysis differentiates between traditional mushrooms-such as button, chanterelle, oyster, and shiitake varieties-and the more exotic truffles, including black, burgundy, summer, and winter species. Each segment exhibits unique supply-chain dynamics, price sensitivity, and application potential. Meanwhile, category segmentation spans canned, dried, fresh, and frozen formats, reflecting diverse consumer preferences from convenience-oriented shoppers to culinary professionals seeking peak freshness.

Type segmentation further distinguishes between conventional and organic offerings, where organic certification often commands premium pricing but entails stricter quality controls. Distribution channel breakdown highlights the interplay between offline retail-encompassing convenience stores, specialty food shops, and supermarkets & hypermarkets-and online retail, which includes brand websites and major e-commerce platforms. This dimension underscores the digital transformation affecting convenience, ordering flexibility, and brand loyalty. Additionally, application segmentation captures the breadth of end uses, covering cosmetics & personal care products, culinary preparations ranging from gourmet dishes to soups & stews, and pharmaceutical formulations harnessing bioactive compounds. Finally, end-user segmentation bifurcates commercial demand-driven by cafés, bistros, and full-service restaurants-and household consumption, where home cooking trends and at-home dining experiences are reshaping purchasing behavior. Together, these segmentation layers provide a comprehensive view of market dynamics, enabling stakeholders to pinpoint high-potential niches and adapt offerings accordingly.

This comprehensive research report categorizes the Mushrooms & Truffles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Category

- Type

- Distribution Channel

- Application

- End-User

Mapping Regional Demand Trends and Emerging Opportunities Across the Americas, Europe, Middle East, Africa, and Asia Pacific for Mushrooms and Truffles

Regional demand patterns for mushrooms and truffles diverge significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific, each influenced by distinctive culinary traditions, regulatory frameworks, and shopper behaviors. In the Americas, North American consumers are embracing mushrooms for plant-based diets, while Latin American markets demonstrate a strong affinity for fresh and frozen formats, propelled by both retail expansion and increasing consumer awareness of functional foods.

In Europe Middle East & Africa, truffles maintain their status as a premium ingredient, especially within Mediterranean cuisines, and stringent food safety regulations drive compliance investments among producers and importers. Meanwhile, Middle Eastern and African markets are emerging as growth corridors for dried and canned mushrooms, largely due to evolving retail infrastructures and rising urbanization.

Turning to Asia-Pacific, the region continues to dominate global production, particularly of button and shiitake mushrooms, and exhibits robust domestic consumption underpinned by traditional culinary practices. Online retail channels have expanded rapidly, catering to a growing middle class seeking convenience and product traceability. By understanding these regional nuances, market participants can tailor pricing models, product assortments, and promotional activities to resonate with local preferences and regulatory expectations.

This comprehensive research report examines key regions that drive the evolution of the Mushrooms & Truffles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players and Their Strategic Moves That Shape the Competitive Landscape in Mushrooms and Truffles World

Competitive dynamics within the mushrooms and truffles sector are defined by both established agricultural conglomerates and emerging specialty growers, each pursuing distinct differentiation strategies. Leading companies are investing heavily in proprietary cultivation techniques, traceability platforms, and value-added product lines. Some have forged strategic alliances with culinary institutions to bolster brand prestige, while others prioritize sustainability certifications to appeal to eco-conscious consumers.

In parallel, nimble startups are leveraging advanced biotechnological methods to cultivate rare truffle strains year-round, reducing reliance on wild foraging and enabling more consistent supply. They also harness direct-to-consumer digital channels to cultivate brand loyalty and collect real-time feedback. Meanwhile, ingredient suppliers are forming partnerships with pharmaceutical and personal care firms to develop mushroom-derived extracts, diversifying revenue streams beyond the traditional foodservice and retail markets. Collectively, these competitive maneuvers highlight a marketplace in flux, where success hinges on the ability to integrate innovation, brand narrative, and operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mushrooms & Truffles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agro Dutch Industries Ltd.

- Arotz Foods S.A.

- Bonduelle Group

- CMP Mushroom Group

- Conservas Ferrer S.A.

- Drinkwater's Mushrooms Ltd.

- Fresh Valley Farms

- Giorgio Fresh Co.

- Hirano Mushroom LLC

- Laumont Truffles

- Marivone Paris

- Mitra Agro

- Modern Mushroom Farms

- Monaghan Mushrooms Ltd.

- Monterey Mushrooms, Inc.

- Okechamp S.A.

- Sabatino Tartufi

- Scelta Mushrooms BV

- South Mill Champs

- The Mushroom Company

- TruffleHunter Ltd.

- Urbani Tartufi

- Weikfield Foods Pvt. Ltd.

Crafting Pragmatic and Forward Thinking Recommendations for Industry Leaders to Thrive in the Evolving Mushrooms and Truffles Ecosystem

To thrive amid intensifying competition and evolving consumer demands, industry leaders must adopt a multi-pronged approach grounded in innovation, partnerships, and operational agility. First, companies should accelerate R&D investments in novel cultivation methods-such as controlled-environment agriculture and fungal tissue culture-that improve yield consistency and unlock new species for commercial production. Simultaneously, forging collaborations with academic institutions and biotech firms can expedite the development of high-value bioactive compounds for pharmaceutical and personal care applications.

Next, organizations should optimize supply-chain resilience by diversifying sourcing across regions and channels. Engaging with strategic partners in North America and Asia-Pacific can mitigate tariff impacts and logistical risks, while strengthening direct-to-consumer distribution models enhances market responsiveness. Additionally, embracing digital traceability solutions will reinforce quality assurance and build trust among end users. Lastly, crafting differentiated brand narratives around sustainability, health benefits, and provenance will resonate with both commercial buyers and household shoppers. By integrating these recommendations into strategic roadmaps, leaders can secure a competitive edge and capitalize on emerging opportunities across the mushrooms and truffles ecosystem.

Outlining a Robust and Transparent Research Methodology Ensuring Reliability and Depth in the Mushrooms and Truffles Market Analysis

This study employs a rigorous, multi-stage research methodology designed to ensure data integrity and analytical depth. Primary research involved interviews with industry stakeholders spanning cultivators, distributors, and end-users to capture first-hand perspectives on consumption patterns, pricing dynamics, and technological adoption. These qualitative insights were complemented by quantitative data gathered through supply-chain audits and proprietary internal databases, focusing on production volumes, import-export flows, and distribution metrics.

Secondary research encompassed extensive reviews of trade publications, peer-reviewed journals, and government reports to contextualize market developments within broader agricultural, economic, and regulatory trends. Furthermore, competitive benchmarking and company profiling were conducted to map strategic initiatives, innovation pipelines, and partnership networks. Finally, triangulation techniques were applied to validate findings across sources, ensuring consistency and robustness. By integrating both qualitative and quantitative analyses within this transparent framework, the methodology delivers a comprehensive foundation for actionable insights without reliance on external forecasting models or market sizing estimates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mushrooms & Truffles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mushrooms & Truffles Market, by Product Type

- Mushrooms & Truffles Market, by Category

- Mushrooms & Truffles Market, by Type

- Mushrooms & Truffles Market, by Distribution Channel

- Mushrooms & Truffles Market, by Application

- Mushrooms & Truffles Market, by End-User

- Mushrooms & Truffles Market, by Region

- Mushrooms & Truffles Market, by Group

- Mushrooms & Truffles Market, by Country

- United States Mushrooms & Truffles Market

- China Mushrooms & Truffles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Core Takeaways and Future Outlook to Empower Stakeholders with Actionable Insights in the Dynamic Mushrooms and Truffles Industry

In synthesizing the key findings, it becomes evident that the mushrooms and truffles sector stands at an inflection point, shaped by advancing cultivation technologies, dynamic consumer preferences, and evolving trade policies. The segmented analysis underscores distinct opportunities within product categories-from fresh shiitake mushrooms to premium truffle varieties-as well as the strategic importance of distribution channels and application areas. Regional insights further illuminate how demand varies across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique growth catalysts and challenges.

Looking ahead, stakeholders equipped with these insights can navigate complexities related to tariff adjustments, supply-chain resilience, and competitive innovation. The combined impact of emerging cultivation methods and cross-sector collaborations positions the industry for sustained evolution. As market participants refine their strategies around product development, distribution optimization, and brand differentiation, they will be well-placed to capitalize on shifting consumer paradigms. Ultimately, this executive summary lays the groundwork for informed decision-making, strategic planning, and continued value creation in the vibrant mushrooms and truffles ecosystem.

Connect Directly with Associate Director to Secure Your Comprehensive Mushrooms and Truffles Market Research Report and Stay Ahead of Industry Trends

Engaging with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, offers a direct pathway to secure a comprehensive Mushrooms and Truffles market research report tailored to your strategic needs. By collaborating with Ketan, you gain personalized guidance on accessing detailed analysis, exclusive insights, and priority support for integrating findings into your business planning. His expertise in matching research deliverables to stakeholder objectives ensures you receive a report that addresses the nuances of product innovation, tariff impacts, segmentation dynamics, and regional trends.

You are encouraged to reach out to Ketan to discuss customized report packages, licensing arrangements, and potential add-on services such as bespoke data tables or executive briefings. His role as Associate Director, Sales & Marketing positions him to streamline the procurement process and coordinate with research analysts to meet tight deadlines. Early engagement with Ketan also opens opportunities for volume discounts and extended consultation hours to optimize the value of your investment.

Don’t miss the chance to leverage this comprehensive market intelligence resource. Connect with Ketan Rohom today to advance your strategic initiatives and maintain a competitive edge in the dynamic Mushrooms and Truffles sector.

- How big is the Mushrooms & Truffles Market?

- What is the Mushrooms & Truffles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?