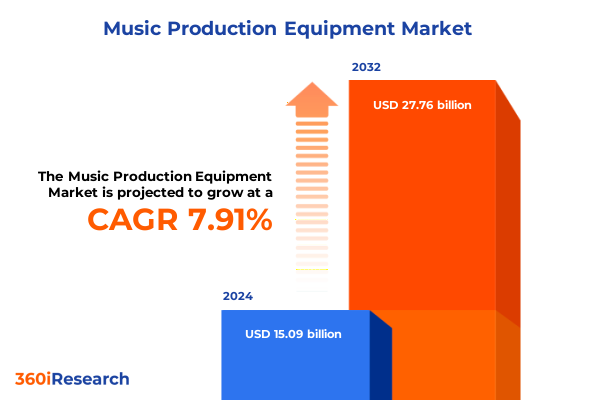

The Music Production Equipment Market size was estimated at USD 16.31 billion in 2025 and expected to reach USD 17.60 billion in 2026, at a CAGR of 7.88% to reach USD 27.76 billion by 2032.

Establishing the Context for Today’s Music Production Equipment Landscape by Highlighting Key Drivers, Innovations, and Stakeholder Dynamics

At the core of today’s creative ecosystem, music production equipment no longer functions merely as audio signal generators or processors but as catalysts for artistic expression. The proliferation of software-based tools, coupled with advancements in digital signal processing and compact hardware modules, has democratized access to high-quality production capabilities. From bedroom producers to major recording facilities, the expectation of seamless, intuitive workflows underpins purchasing decisions and shapes product roadmaps. Consequently, stakeholders across the supply chain have had to pivot toward solutions that balance performance with affordability, while fostering community-driven innovation through open platforms and developer ecosystems.

Moreover, the delineation between hardware and software has become increasingly blurred. Manufacturers are integrating cloud connectivity into audio interfaces to enable remote collaboration, while software developers are offering hardware-grade emulations that replicate analog warmth. This convergence demands strategic alignment between R&D, marketing, and support functions to meet evolving user preferences. As creative professionals and enthusiasts navigate a landscape replete with options, clear differentiation through user-centric design, robust after-sales service, and forward-thinking feature sets will be pivotal for competitive positioning within a rapidly transforming marketplace.

Exploring the Transformative Shifts Redefining Music Production Equipment through Digital Integration, AI Adoption, and Holistic Hybrid Workflow Innovations

Over the past several years, the music production equipment landscape has undergone a profound digital metamorphosis. Software-based digital audio workstations (DAWs) now serve as the backbone of studio workflows, offering extensive plugin libraries that emulate vintage analog hardware characteristics. Cloud-based collaboration platforms have further accelerated this shift by enabling distributed teams to work on shared sessions in real time, eliminating geographical constraints. At the same time, the line between desktop and rackmount audio interfaces has shifted, as manufacturers optimize connectivity options to support both studio and mobile setups, catering to creators who demand versatility across various recording environments.

Concurrently, artificial intelligence has emerged as a game-changing force in production processes. Intelligent mastering assistants leverage machine learning algorithms to analyze audio content and apply context-aware processing, while AI-driven virtual instruments can generate realistic articulations that adapt to user inputs. These technologies are not meant to replace human ingenuity but to augment creative decision-making, allowing producers to experiment more freely without being bogged down by technical minutiae. This symbiosis of human artistry and algorithmic assistance is redefining productivity benchmarks and catalyzing new genre explorations.

In addition to digital and AI-driven innovations, there has been a resurgence of interest in modular hardware and sustainable design practices. Manufacturers are revisiting analog circuitry to deliver tactile interfaces that deliver warmth and character, while also embracing recyclable materials and energy-efficient components. The rising demand for compact, Bluetooth-enabled studio monitors and control surfaces highlights the importance of ergonomics and user experience in product development. As hybrid analog-digital workflows become the norm, companies that can seamlessly bridge these paradigms will emerge as leaders in a market characterized by experimentation and rapid feature evolution.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Music Production Equipment Supply Chains, Component Costs, and Industry Strategies

In early 2025, the United States implemented a series of tariff measures targeting imported electronic components and finished audio equipment. These levies, designed to protect domestic manufacturing, have affected a broad spectrum of hardware categories, from condenser microphone capsules to digital signal processors. While the stated objective was to stimulate local production, the immediate consequence has been an uptick in landed costs, forcing distributors and retailers to reevaluate pricing models. This development has created a ripple effect throughout the value chain, presenting both challenges and strategic opportunities for in-country and international stakeholders alike.

Faced with elevated input costs, equipment manufacturers have been compelled to refine their supply chain strategies. Some have diversified sourcing by securing alternative suppliers in Southeast Asia, Mexico, and Eastern Europe, while others have strengthened existing relationships with North American circuit board assemblers. This pivot toward supplier diversification aims to mitigate risk exposure to any single region and minimize lead times. Parallel to these adjustments, companies are negotiating volume-based agreements and exploring component standardization to benefit from economies of scale. Nonetheless, certain specialized parts, particularly bespoke analog circuitry, remain vulnerable to scarcity, prompting some brands to temporarily limit production or reprioritize high-margin product lines.

In response to these market pressures, leading players have adopted a combination of pricing and value-enhancement tactics. Tiered pricing schemes that offer entry-level bundles with basic accessories have emerged to maintain affordability for emerging studios, while premium packages now include software subscriptions and extended warranties to reinforce perceived value. Simultaneously, initiatives like virtual training sessions and community-driven support forums are being leveraged to cultivate brand loyalty during a period of cost sensitivity. Ultimately, the net impact of the 2025 tariff adjustments will hinge on the adaptability of the ecosystem, as stakeholders align product roadmaps and customer engagement strategies to offset pricing headwinds and preserve growth trajectories.

Uncovering Deep Segmentation Insights across Equipment Types, Distribution Channels, End Users, and Application Domains for Strategic Market Positioning

Demand in music production equipment varies by category, revealing nuanced user requirements. Audio interfaces manifest as compact desktop units for home setups or rackmount designs for expanded studio configurations. Digital audio workstations bifurcate into bundled software suites for newcomers and plugin-centric environments for professional sound sculpting. Headphone selections span closed-back models for tracking isolation and open-back types for mixing clarity. Microphones diversify across condenser variants for detailed capture, dynamic models for rugged applications, and ribbon types for warm tonal coloration. MIDI controllers extend from keyboard layouts to pad-focused designs and specialized wind controllers. Both analog consoles and digital mixers afford mixing engineers tactility or recallable workflows, while monitor and synthesizer options address acoustic considerations and creative preferences through hardware modules and software instruments.

Channel segmentation highlights a coexistence of offline and online pathways. General electronics outlets provide broad accessibility for mainstream audiences, while specialty music stores afford expert demonstrations that instill buyer confidence. In the digital realm, manufacturer websites enable direct engagement and personalized configuration options, whereas third-party e-commerce platforms leverage competitive pricing and extensive catalogs. End-user segmentation reveals that educational institutions focus on resilient, budget-conscious gear; home studios prioritize multifunctional setups supporting creative exploration; live venues require equipment optimized for robust performance conditions; and professional studios invest in high-precision components to uphold rigorous audio standards. Application-based demand spans broadcasting environments, live sound reinforcement, mastering studios, mixing suites, and recording chambers, each imposing unique reliability and feature requirements that shape product development and support services.

This comprehensive research report categorizes the Music Production Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Distribution Channel

- End User

- Application

Illuminating Regional Market Dynamics across the Americas, EMEA, and Asia-Pacific to Guide Tailored Equipment Strategies and Investments

In the Americas, robust demand for versatile production setups is driven by a vibrant independent artist community and an expanding podcasting sector. The United States remains a pivotal market, propelled by innovation hubs in Los Angeles, Nashville, and New York that catalyze high-end hardware adoption. Meanwhile, Canada’s growing network of urban home studios has elevated the need for mid-range audio interfaces and compact monitor solutions. Across Latin America, cost efficiency and durability are paramount, prompting suppliers to introduce entry-level bundles and locally adaptable after-sales support initiatives. Major metro centers in Brazil and Mexico have witnessed the emergence of hybrid project studios, blending analog warmth with digital flexibility to meet region-specific genre preferences and budget considerations.

Europe, the Middle East, and Africa (EMEA) showcase diverse regional preferences shaped by historical ties to classical recording practices and burgeoning electronic music scenes. In Western Europe, premium condenser microphones and high-resolution monitor systems dominate professional studios, while emerging markets in Eastern Europe prioritize modular, affordable gear. The Middle East and North Africa are witnessing increased investment in live sound solutions, driven by expanding festival circuits and venue refurbishment projects. In parallel, the Asia-Pacific region demonstrates a dual trajectory: mature markets in Japan and Australia gravitate toward boutique analog instruments and advanced digital workstations, whereas Southeast Asian nations, characterized by youthful creators, lean towards accessible software plugin bundles and portable audio devices. Across all territories, regional distribution networks are adapting through localized e-commerce platforms and strategic partnerships with key retailers to address logistical challenges and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Music Production Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape Highlighting Leading Manufacturers, Innovative Startups, and Emerging Collaboration Patterns in Music Gear Industry

The competitive arena for music production equipment is anchored by legacy manufacturers that continuously refine core product lines through incremental innovations. Universal Audio has solidified its reputation with analog emulation hardware that seamlessly integrates with DAW environments, while Avid’s flagship audio editing consoles and control surfaces drive workflows in high-end post-production suites. Japanese giants like Yamaha and Roland leverage decades of synthesis expertise to deliver hardware instruments and digital interfaces renowned for reliability. Meanwhile, Focusrite and PreSonus have capitalized on the growing entry-level segment by offering value-driven audio interfaces and bundled software, broadening accessibility for burgeoning content creators. Microphone specialists such as Shure and Neumann maintain dominance through robust transducer design and extensive variant portfolios catering to broadcast, live, and studio contexts.

Concurrently, a wave of agile market entrants and collaboration ventures is reshaping innovation dynamics. Software developers like Ableton and Native Instruments partner with hardware vendors to forge integrated control surfaces that inherently map to digital audio workstations, reducing friction for end users. Startups in Europe and North America are exploring novel form factors-such as clip-on mobile recording modules and AI-driven mixing assistants-that challenge conventional equipment paradigms. Strategic alliances between technology firms and content platforms are emerging, aiming to bundle hardware offerings with online learning resources and royalty management services. As the industry matures, success will hinge on balancing brand heritage with nimble adaptation to shifting user behaviors, fostering ecosystems that transcend singular product transactions in favor of sustained engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Music Production Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AKG Acoustics

- Allen & Heath Ltd

- Audio-Technica Corporation

- Avid Technology Inc.

- Behringer Music Group

- Bose Corporation

- Electro-Voice Bosch Communications Systems

- Georg Neumann GmbH

- L-Acoustics Group

- LOUD Technologies Inc.

- Meyer Sound Laboratories Inc.

- PreSonus Audio Electronics Inc.

- QSC LLC

- Roland Corporation

- RØDE Microphones Pty Ltd

- Sennheiser electronic GmbH & Co. KG

- Shure Incorporated

- Sony Corporation

- Steinberg Media Technologies GmbH

- Yamaha Corporation

Actionable Recommendations Enabling Industry Leaders to Tackle Tariff Challenges, Fast-track Innovation, and Capitalize on Evolving Consumer Demands

Actionable recommendations enabling industry leaders to tackle tariff challenges, fast-track innovation, and capitalize on evolving consumer demands require a twofold approach that integrates operational agility with customer-centric initiatives. Companies should begin by diversifying component sourcing and forging strategic alliances with regional manufacturers to mitigate policy-driven supply disruptions. Embracing modular design principles can streamline production pivots, while sustained investment in artificial intelligence and machine learning capabilities will differentiate product offerings through features like adaptive signal processing and predictive maintenance alerts. Furthermore, embedding sustainable manufacturing practices-including the adoption of recycled materials and energy-efficient components-will resonate with environmentally conscious end users and enhance brand equity.

In tandem, cultivating robust digital ecosystems is essential for deepening engagement and driving repeat revenue. Leveraging content-driven marketing initiatives, such as targeted webinars and interactive tutorials, can demystify complex feature sets and accelerate user proficiency. Enhancing after-sales service via virtual support platforms and extended warranty options will alleviate purchase hesitations during periods of cost sensitivity. Finally, exploring collaborative partnerships with music education institutions and leading content platforms will broaden market reach and foster a culture of co-creation. By harmonizing supply chain resilience with proactive customer engagement strategies, organizations can secure a competitive advantage and thrive amidst ongoing market flux.

Outlining a Rigorous Mixed-Methodology Approach Integrating Primary Interviews, Secondary Analysis, and Data Triangulation for Research Integrity

This report is underpinned by a rigorous mixed-methodology framework that integrates both primary and secondary research to ensure comprehensiveness and accuracy. Primary data were collected through in-depth interviews with a cross-section of industry stakeholders, including equipment manufacturers, distribution channel executives, studio engineers, and end-user representatives. These qualitative exchanges were supplemented by structured surveys targeting professional studios, live sound venues, and educational institutions to capture usage patterns and investment drivers. Concurrently, secondary sources such as trade publications, company annual reports, patent filings, and conference proceedings provided contextual depth, enabling the validation of emerging trends and the identification of technology adoption curves.

To reinforce data integrity, findings from disparate sources were triangulated through a multi-stage validation process. Quantitative insights were cross-referenced with financial disclosures and publicly available sales data, while anecdotal evidence from user interviews was corroborated through third-party case studies. Geographic analysis leveraged regional distribution data to map supply chain movements and end-user demand disparities across the Americas, EMEA, and Asia-Pacific. Furthermore, iterative peer reviews by subject-matter experts ensured methodological consistency and mitigated potential biases. This meticulous approach fosters a cohesive narrative that not only elucidates current market dynamics but also establishes a credible foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Music Production Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Music Production Equipment Market, by Equipment Type

- Music Production Equipment Market, by Distribution Channel

- Music Production Equipment Market, by End User

- Music Production Equipment Market, by Application

- Music Production Equipment Market, by Region

- Music Production Equipment Market, by Group

- Music Production Equipment Market, by Country

- United States Music Production Equipment Market

- China Music Production Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Imperatives to Forge a Clear Path Forward in the Evolving Music Production Equipment Sector

In summary, the music production equipment landscape is being reshaped by a confluence of digital innovations, artificial intelligence integration, and evolving supply chain dynamics influenced by 2025 tariff policies. Segmentation analysis underscores the importance of aligning product offerings with discrete user requirements, whether in educational settings, home studios, professional environments, or live performance contexts. Regional insights further reveal nuanced market behaviors across the Americas, EMEA, and Asia-Pacific, necessitating tailored distribution and go-to-market approaches. The competitive terrain remains dynamic, with established manufacturers and disruptive entrants engaging in partnerships that blur the boundaries between hardware, software, and service ecosystems.

Moving forward, success in this sector will be predicated upon an organization’s ability to synthesize these multifaceted trends into coherent strategies. Firms that embrace supply chain agility, champion sustainable design, and cultivate value-added ecosystems are poised to secure long-term customer loyalty. As the industry continues to iterate on hybrid analog-digital workflows and deploy machine learning enhancements, stakeholders must remain vigilant and adaptable. By leveraging the insights and recommendations outlined herein, decision-makers can confidently navigate imminent market shifts and capitalize on growth avenues that promise to redefine the future of music production.

Driving Engagement through a Direct Invitation to Collaborate with Ketan Rohom for Tailored Market Research Insights and Strategic Acquisition Paths

To explore these findings in greater depth and align your strategic roadmap with the latest market intelligence, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, Ketan can guide you toward the precise insights and data your organization requires to make informed decisions. Discover how this comprehensive research report can equip you with actionable knowledge on segmentation, regional nuances, tariff impacts, and competitive positioning. Engage today to secure a competitive edge and unlock new growth opportunities within the vibrant sphere of music production equipment.

- How big is the Music Production Equipment Market?

- What is the Music Production Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?