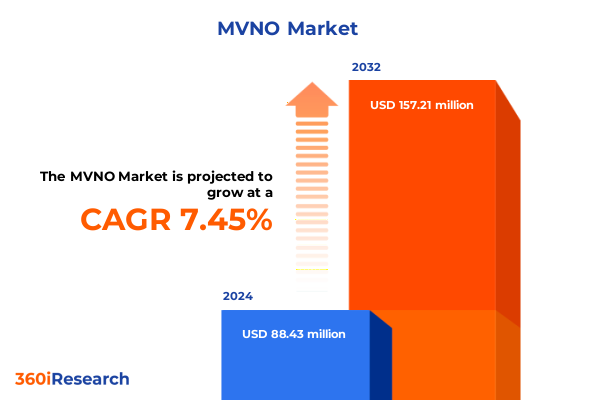

The MVNO Market size was estimated at USD 94.32 million in 2025 and expected to reach USD 103.92 million in 2026, at a CAGR of 7.57% to reach USD 157.21 million by 2032.

Foundational perspective on emerging trends and competitive dynamics driving rapid transformation in the MVNO sector

As the mobile virtual network operator sector continues to evolve at an unprecedented pace, the need for a cohesive overview of its current state and trajectory has never been more pressing. This introduction lays the groundwork for exploring core drivers, market dynamics, and strategic opportunities that shape the MVNO ecosystem. Traditionally serving niche markets and underserved segments, MVNOs have expanded their reach by capitalizing on regulatory shifts and growing consumer demand for flexible, cost-effective mobile services.

By analyzing the convergence of advanced network technologies, shifting consumer behaviors, and innovative distribution models, this introduction sets the stage for a comprehensive examination of how MVNOs are redefining value propositions. It underscores the imperative for stakeholders-ranging from mobile network operators and MVNOs to industry investors and regulators-to align on the transformational potential of these entities. With this context established, the report delves into the most compelling trends and insights driving the competitive landscape.

How network virtualization eSIM adoption and digital distribution innovations are reshaping service models and partnership dynamics

Over recent years, the MVNO landscape has undergone transformative shifts as network virtualization, cloud-native architectures, and eSIM technologies have converged to redefine service delivery. These advances have enabled operators to minimize capital expenditures on infrastructure while maximizing agility in launching tailored packages for diverse customer segments. Consequently, the traditional boundaries between network operators and resellers have blurred, fostering a more collaborative ecosystem where partners can co-create value.

Furthermore, digital distribution methodologies have gained prominence, with direct-to-consumer portals and integrated mobile applications streamlining customer acquisition and retention. This digital-first approach is complemented by evolving partnerships with third-party ecommerce platforms, authorized resellers, and company-owned retail stores, ensuring brands can engage end users through multiple touchpoints. In tandem, value added services such as mobile health applications and digital payments have emerged as critical differentiators, demonstrating how MVNOs can enhance revenue streams beyond conventional voice and data offerings. By embracing these paradigm shifts, industry players are poised to deliver more personalized, context-aware experiences that resonate with today’s mobile-savvy consumers.

Examining how new 2025 US import duties on network gear and devices are influencing procurement strategies and pricing models

The introduction of cumulative US tariffs in 2025, particularly those targeting network infrastructure components and consumer devices, has exerted notable pressure on MVNO operations. As tariffs on imported 4G and 5G equipment increased, wholesalers and network operators faced heightened costs that ultimately cascaded downstream. This environment has compelled MVNOs to renegotiate lease agreements with host networks, optimize inventory management, and explore local sourcing alternatives to mitigate margin erosion.

Despite these headwinds, some operators have leveraged the tariff-driven cost pressures as a catalyst for innovation. By revisiting procurement strategies and exploring partnerships with domestic equipment suppliers, MVNOs have identified opportunities to secure more favorable pricing and reduce dependency on heavily taxed imports. Additionally, incremental tariff adjustments have prompted a deeper evaluation of pricing plans-encouraging the adoption of flexible pay-as-you-go and unlimited subscription models to balance consumer affordability with sustainable unit economics. These adaptive measures highlight the sector’s resilience and ongoing commitment to delivering competitive mobile services amid evolving trade policies.

Actionable segmentation analysis revealing nuanced opportunities across service types distribution channels pricing strategies and vertical applications

Delving into service type segmentation reveals distinct areas of growth and differentiation within the MVNO market. Data services, spanning legacy 2G through advanced 5G networks, have seen surging demand for higher speeds and bandwidth-intensive applications, while traditional SMS channels remain relevant for both application-to-person and person-to-person communications. Concurrently, value added services such as mobile health and digital financial solutions underscore the role of MVNOs in enabling vertical-specific offerings. Voice services also continue to drive engagement, whether via traditional public switched telephone networks or VoIP platforms, by catering to both cost-sensitive and quality-focused customer groups.

Distribution channel segmentation further illuminates the complexity of go-to-market strategies. Direct sales operations, encompassing field and telesales teams, coexist alongside digital storefronts on official websites and third-party ecommerce platforms. Meanwhile, partnerships with authorized and unauthorized resellers, as well as franchised and company-owned retail outlets, create a multilayered ecosystem where channel performance and cost structures vary significantly. In the pricing plan domain, consumers are presented with a spectrum of choices-from standard and unlimited monthly subscriptions to flexible pay-as-you-go data and voice bundles, and from family-oriented postpaid plans to individual prepaid scratch cards and e-top-ups. Finally, end user verticals such as banking, insurance, government, healthcare, manufacturing, and retail (across both brick-and-mortar and ecommerce contexts) highlight the breadth of enterprise and consumer opportunities. By offering application-specific solutions for enterprise mobility, IoT services including connected cars and smart metering, machine-to-machine communications for asset tracking and fleet management, and home automation and security, MVNOs can customize offerings to align with unique operational requirements and user experiences.

This comprehensive research report categorizes the MVNO market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Pricing Plan

- Distribution Channel

- End User Vertical

- Application

Comparative view of Americas EMEA and Asia-Pacific MVNO landscapes revealing differentiated regulatory technology and growth drivers

Regionally, the Americas have emerged as a dynamic MVNO market characterized by robust competition, diverse consumer preferences, and progressive regulatory frameworks. Operators in North and South America leverage advanced network deployments and digital-first distribution, while emerging economies drive innovative partnerships and value added service offerings. In Europe, Middle East, and Africa, the landscape is shaped by varied regulatory environments and a mix of established and nascent MVNO models, where operators tailor services to address fragmentation across mature markets and high-growth regions.

Across the Asia-Pacific, escalating smartphone penetration and expanding 5G infrastructure have fueled a surge in both consumer and enterprise MVNO adoption. In mature markets like Japan and Australia, operators focus on premium service bundles and specialized IoT solutions. Conversely, fast-growing economies in Southeast Asia and South Asia underscore low-cost, high-volume strategies, with a strong emphasis on mobile financial services and digital health. These regional insights illuminate how market maturity, regulatory conditions, and technology investments converge to create distinct competitive and collaborative dynamics in each geography.

This comprehensive research report examines key regions that drive the evolution of the MVNO market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into leading MVNO operators showcasing innovative partnerships diversified offerings and digital platform differentiation

Leading companies in the MVNO domain are distinguished by their strategic alliances with major network operators, innovative service portfolios, and customer-centric distribution models. Key players have embraced platform-as-a-service offerings to streamline onboarding for new MVNO brands, while others have invested in proprietary digital solutions for billing, customer relationship management, and analytics. Several top-tier operators have also formed joint ventures to co-develop IoT and enterprise mobility services, leveraging combined expertise to penetrate specialized vertical markets.

In addition, regional specialists have gained traction by focusing on niche segments-such as mobile banking in Latin America or healthcare monitoring in Europe-and by forging partnerships with fintech and telemedicine providers. These collaborations enable MVNOs to deliver end-to-end solutions that extend beyond basic connectivity. Companies that have successfully diversified their channel mix, integrating direct-to-consumer digital platforms with reseller networks and retail partnerships, have achieved meaningful brand differentiation and customer loyalty. As the competitive environment intensifies, the ability to innovate across technology, partnership, and distribution spheres remains a hallmark of top performers.

This comprehensive research report delivers an in-depth overview of the principal market players in the MVNO market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boost Mobile, LLC

- BOUYGUES TELECOM SA.

- Charter Communications, Inc.

- Ciena Corporation.

- Circles.Life

- Cisco Systems, Inc.

- Cricket Wireless , LLC.

- Giffgaff Limited

- Google LLC

- KDDI Corporation

- Lebara Group B.V.

- Lenovo

- Lycamobile Group Holdings Limited

- MASMOVIL IBERCOM, S.A.

- Microsoft Corporation

- Red Pocket Mobile

- Straight Talk

- Talkmobile Limited

- Telenor Group

- Tesco Mobile Limited

- Ting Inc. by DISH Wireless L.L.C.

- TracFone Wireless, Inc.

- T‑Mobile USA, Inc.

- VEON LTD

- Virgin Media O2 Limited

Strategic partnership technology and procurement recommendations for sustainable differentiation and resilient MVNO growth

Industry participants seeking sustainable growth should prioritize strategic partnerships and modular technology adoption. Building alliances with both network operators and fintech, healthcare, or enterprise software providers can unlock new revenue streams and enhance value added services. In parallel, investing in cloud-native billing and customer relationship management platforms will facilitate rapid service launches and seamless scalability. Embracing eSIM and remote SIM provisioning technologies can streamline customer activation processes and reduce churn by offering greater flexibility across devices and regions.

Furthermore, a balanced channel strategy that blends digital direct-to-consumer experiences with trusted reseller and retail partnerships will optimize customer reach and cost efficiency. Tailoring pricing plans to reflect evolving consumer preferences-such as unlimited subscriptions, family bundles, and usage-based top-ups-will drive greater customer acquisition and retention. Finally, continuously monitoring trade policy developments and diversifying procurement sources will safeguard margins against tariff-induced cost volatility and ensure resilience in supply chains.

Comprehensive primary and secondary research approach integrating stakeholder interviews quantitative surveys and regulatory analysis

This analysis synthesizes insights derived from a combination of primary and secondary research methodologies. Primary research included in-depth interviews with industry executives, network operators, MVNO brand managers, and key channel partners, providing first-hand perspectives on strategic challenges and opportunities. Quantitative surveys of end users and enterprise customers were conducted to capture evolving service preferences, adoption drivers, and pain points across consumer and business segments.

Secondary research involved a thorough review of public filings, regulatory documents, industry white papers, and technology vendor reports. Data was cross-validated with open-source market intelligence from credible telecommunications associations and government agencies. Comparative analysis techniques were applied to evaluate regional market structures, tariff impacts, and service adoption trends. This rigorous approach ensures that the report’s findings are grounded in real-world evidence and reflect the current state of MVNO innovation and market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our MVNO market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- MVNO Market, by Service Type

- MVNO Market, by Pricing Plan

- MVNO Market, by Distribution Channel

- MVNO Market, by End User Vertical

- MVNO Market, by Application

- MVNO Market, by Region

- MVNO Market, by Group

- MVNO Market, by Country

- United States MVNO Market

- China MVNO Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Synthesis of strategic insights underscoring technological agility regulatory adaptation and customer-centric diversification

In conclusion, the MVNO market stands at a pivotal juncture where technological advancements, regulatory developments, and shifting consumer expectations converge to create unprecedented opportunities. Operators that can deftly navigate tariff headwinds, leverage advanced segmentation strategies, and cultivate strategic partnerships will be best positioned to capture value in both consumer and enterprise domains. The insights outlined herein underscore the importance of embracing digital distribution channels, modular technology platforms, and flexible pricing to drive differentiation and customer loyalty.

As market participants adapt to evolving landscapes and competitive pressures, the ability to align internal capabilities with external trends will determine success. By prioritizing innovation, operational agility, and proactive policy monitoring, industry leaders can chart a clear path toward sustainable growth and long-term profitability. The journey ahead promises continued transformation, and stakeholders who engage with these insights stand ready to lead in the next era of mobile virtual network operations.

Connect with Associate Director of Sales & Marketing to secure your premium MVNO market research report and gain strategic competitive advantage

Engaging with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, will unlock exclusive access to unmatched industry insights and a comprehensive understanding of the MVNO market. His expertise and in-depth knowledge will guide you through the report’s key findings and strategic recommendations, ensuring you can make data-driven decisions and capitalize on emerging opportunities. Reach out to him to secure your copy today and gain a competitive edge in navigating the evolving MVNO landscape

- How big is the MVNO Market?

- What is the MVNO Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?