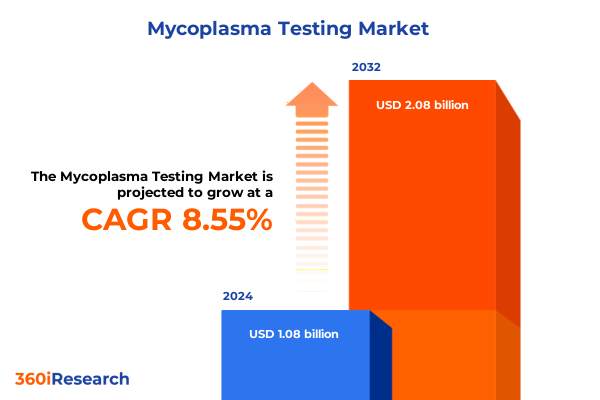

The Mycoplasma Testing Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.28 billion in 2026, at a CAGR of 8.56% to reach USD 2.08 billion by 2032.

Understanding the Critical Imperative of Mycoplasma Testing for Ensuring Cell Culture Integrity and Protecting Biopharmaceutical Development Pipelines

Mycoplasma contamination represents one of the most insidious threats to cell culture integrity, undermining research outcomes and jeopardizing biopharmaceutical development pipelines. These minute bacterial pathogens lack a cell wall, enabling them to evade many common detection methods and persist within laboratories undetected. Over the past decade, heightened awareness of contamination events has galvanized the scientific community to prioritize robust testing protocols. In parallel, the increasing complexity of biologics such as monoclonal antibodies and cell and gene therapies has underscored the need for rigorous quality control measures at every stage of production.

The ripple effects of undetected mycoplasma go far beyond individual lab experiments. They can lead to compromised data, delayed drug development milestones, increased resource expenditures, and regulatory setbacks. Governments and regulatory bodies have responded by updating compendial standards to mandate routine screening and validation of raw materials and production batches. As a result, stakeholders across diagnostic laboratories, contract research organizations, academic institutions, and pharmaceutical manufacturers are adopting comprehensive testing strategies to safeguard their investments and uphold scientific integrity.

Transitioning to a landscape where proactive detection is the norm requires an understanding of both traditional and emerging methodologies. Culture-based techniques continue to serve as a gold standard, while molecular approaches offer speed and sensitivity. This report delves into the critical imperatives driving market evolution and the technological advances poised to redefine best practices for ensuring contamination-free cell culture environments.

Revolutionary Technological Advancements and Evolving Regulatory Frameworks Redefining the Mycoplasma Testing Ecosystem Worldwide

The landscape of mycoplasma detection has evolved dramatically, driven by advances in molecular diagnostics and heightened regulatory scrutiny. Traditional culture methods, while reliable, can require up to 28 days for definitive results, prompting adoption of polymerase chain reaction assays that deliver accurate detection within hours. Real-time PCR platforms equipped with multiplexing capabilities now enable simultaneous screening for multiple mycoplasma species, mitigating the risk of false negatives and streamlining laboratory workflows. Digital PCR and next-generation sequencing tools further expand detection thresholds, offering quantitative data on contamination levels with unprecedented precision.

Regulatory frameworks have shifted in tandem with technological breakthroughs. Innovative assay validation guidelines from pharmacopeias emphasize risk-based approaches that validate both sensitivity and specificity under worst-case conditions. Quality authorities now require documentation covering method development, assay robustness, and cross-laboratory reproducibility. This dual focus on technology and compliance has spurred collaborations between diagnostics providers, academic researchers, and biopharma manufacturers to co-develop novel detection platforms that meet stringent regulatory criteria.

Moreover, the rise of integrated automation systems is reshaping laboratory operations. Fully automated sampling, extraction, amplification, and data analysis modules minimize human error and accelerate throughput. This convergence of digitalization and high-throughput screening is creating a paradigm in which contamination control is proactive rather than reactive. The result is a more resilient ecosystem, one that balances the need for speed, accuracy, and compliance across diverse research and production environments.

Assessing the Far-Reaching Impact of Recent United States Tariff Measures on Mycoplasma Testing Supply Chains and Cost Structures

Recent United States tariff measures have introduced a new layer of complexity into the global supply chains supporting mycoplasma testing. Duties imposed on imported laboratory instruments and diagnostic reagents have elevated the total landed cost for culture plates, PCR kits, and specialized enzymes. As suppliers navigate tariff schedules ranging from 5% to 25%, many are reassessing their global sourcing strategies to mitigate cost pressures and delivery risks. In response, domestic manufacturers are ramping up capacity, driven by the opportunity to serve a market seeking tariff-exempt products from U.S. facilities.

These measures have also prompted laboratory managers to adopt inventory hedging strategies and longer procurement cycles. With the potential for additional duty hikes, stakeholders are increasingly negotiating fixed-price contracts and establishing buffer stocks of critical consumables. While this approach offers short-term protection against price volatility, it can lead to elevated holding costs and strains on cold-chain logistics, particularly for temperature-sensitive reagents.

The cumulative impact of these tariff-driven shifts extends to testing turnaround times and budget planning. Many organizations are exploring service-based models that bundle equipment installation, maintenance, and reagent supply with predictable pricing. This as-a-service approach transfers inventory and compliance risks to suppliers, enabling end users to focus resources on core research and development activities. Ultimately, the tariff landscape is accelerating the adoption of innovative procurement and partnership models that promise greater supply chain resilience and fiscal predictability.

Deep-Dive Analysis of Diverse Test Types Sample Origins and End-User Applications Shaping the Mycoplasma Testing Market Landscape

Market segmentation for mycoplasma testing reveals nuanced drivers that inform product development and service offerings across different laboratory contexts. Based on test type, traditional culture methods remain indispensable for regulatory submissions while PCR assays gain traction in high-throughput environments, and serological assays support retrospective contamination investigations. Meanwhile, sample type differentiation underscores the importance of adaptable protocols: blood matrices require specialized extraction kits to overcome inhibitors, throat swabs demand robust amplification reagents to detect low-abundance pathogens, and urine samples call for filtration steps to concentrate mycoplasma cells prior to analysis.

End-user dynamics further refine product positioning. Diagnostic laboratories prioritize assay sensitivity and throughput to meet clinical demand, hospitals emphasize rapid confirmatory testing to inform patient management, pharmaceutical companies integrate contamination screening into raw-material qualification workflows, and research institutes focus on method flexibility to support exploratory studies. Product segmentation delineates core offerings as kits for complete workflow solutions, reagents for custom protocol development, and services that encompass both consulting and installation and maintenance of automated platforms.

Application-based insights highlight distinct requirements across clinical diagnostics, pharmaceutical, and research segments. Within clinical diagnostics, confirmatory testing workflows demand rigorous validation while routine screening benefits from cost-efficient, rapid assays. Pharmaceutical applications span drug screening assays to vaccine research platforms that must uphold sterility and regulatory compliance. In research settings, drug development studies rely on quantitative contamination metrics to inform cell-line stability assessments, and epidemiological investigations leverage high-sensitivity assays to track mycoplasma prevalence in population samples. Finally, the pathogen type distinction between Mycoplasma genitalium and Mycoplasma pneumoniae drives assay design, as these species exhibit divergent growth characteristics and molecular targets that dictate primer and probe selection.

This comprehensive research report categorizes the Mycoplasma Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Test Type

- Sample Type

- Pathogen Type

- End User

- Application

Regional Dynamics Influencing Mycoplasma Testing Adoption Highlighting Key Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping mycoplasma testing adoption and innovation trajectories. In the Americas, established biopharmaceutical clusters driving cell and gene therapy research have created concentrated demand for high-throughput PCR and automation solutions. Regulatory agencies in North America have issued stringent guidance on contamination control for biologics, reinforcing the need for validated assays and frequent monitoring. Latin American research initiatives are expanding, fostering opportunities for localized reagent production and shared services models that leverage centralized testing facilities.

Europe, the Middle East, and Africa exhibit a mosaic of regulatory harmonization and emerging markets. In Western Europe, harmonized pharmacopeial standards and cross-border supply chains enable streamlined access to advanced testing platforms. The Gulf Cooperation Council countries are investing in state-of-the-art diagnostic infrastructure to support expanding healthcare coverage, while North Africa’s growing biotech research hubs seek partnerships to establish local manufacturing of diagnostic consumables. Across the region, evolving quality mandates and the rise of public-private research collaborations drive demand for adaptive testing solutions.

Asia-Pacific is witnessing rapid growth propelled by government initiatives to bolster life sciences and precision medicine. China’s ambitious biotechnology roadmap has fueled expansion of domestic diagnostic manufacturers, while Japan’s focus on regenerative medicine elevates stringent contamination control protocols. India’s burgeoning contract research organization sector and Southeast Asia’s increasing diagnostic penetration underscore the importance of cost-effective and scalable testing platforms. Collaboration between regional players and global vendors is fostering knowledge transfer and driving competitive pricing models tailored to local laboratory environments.

This comprehensive research report examines key regions that drive the evolution of the Mycoplasma Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players Innovations Strategic Collaborations and Competitive Differentiators in the Mycoplasma Testing Industry

Major players in the mycoplasma testing arena are leveraging innovation, strategic alliances, and targeted acquisitions to fortify their market positions. Thermo Fisher Scientific stands out with its integrated workflow solutions that combine automated extraction instruments with real-time PCR detection modules, catering to high-throughput laboratory environments. Merck KGaA has expanded its reagent portfolio through acquisitions of niche biotechnology firms, enabling comprehensive contamination testing kits optimized for sensitive cell-based applications.

Lonza has introduced modular automation platforms that seamlessly integrate with existing laboratory information management systems, streamlining data capture and compliance reporting. Roche Diagnostics, known for its robust instrument lifecycle services, offers bundled maintenance agreements and remote monitoring capabilities that ensure uninterrupted assay performance. QIAGEN has differentiated its product suite with probe-based multiplex assays that deliver both qualitative and quantitative insights, appealing to research institutes focused on epidemiological surveillance.

Smaller specialized firms are also gaining traction by focusing on emerging detection technologies and niche service offerings. Companies with expertise in consulting and installation and maintenance services are forming partnerships with global reagent suppliers to deliver end-to-end solutions. Meanwhile, academic spin-outs are pioneering rapid isothermal amplification platforms that promise simplified workflows for resource-limited settings. Competitive dynamics continue to evolve as players refine their strategic value propositions around speed, sensitivity, and total cost of ownership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mycoplasma Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bio-Rad Laboratories Inc.

- Charles River Laboratories International Inc.

- Danaher Corporation

- Lonza Group AG

- Merck KGaA

- Minerva Biolabs GmbH

- Promega Corporation

- PromoCell GmbH

- QIAGEN N.V.

- Roche Holding AG

- Sartorius AG

- Thermo Fisher Scientific Inc.

Strategic Imperatives and Best Practice Roadmaps Empowering Industry Leaders to Optimize Mycoplasma Testing Workflows and Supply Chain Resilience

To maintain competitive advantage and operational resilience, industry leaders must pursue a multifaceted strategic roadmap for mycoplasma control. Investing in rapid PCR-based assay development will address the growing demand for same-day contamination results, enabling accelerated decision-making in both clinical and production settings. Strengthening local manufacturing capabilities for critical reagents can mitigate the impact of import tariffs and reduce lead times, while fostering partnerships with regional contract research organizations can extend service coverage and support scale-up initiatives.

Diversifying supply chain networks is essential to balance cost efficiencies against geopolitical risks. Engaging multiple qualified suppliers for key consumables and instruments helps prevent bottlenecks in inventory availability and buffer against sudden tariff adjustments. Implementing advanced data management systems that integrate testing results with laboratory information management platforms will enhance traceability, support regulatory compliance, and facilitate real-time performance analytics.

Finally, embedding robust quality assurance frameworks across all stakeholder operations-from raw material sourcing to end-user training-ensures consistent adherence to compendial standards. Collaborative engagements with regulatory authorities and participation in industry consortia can accelerate standardization of best practices and drive consensus on emerging detection methodologies. By adopting this proactive and holistic strategy, organizations can safeguard research integrity, streamline workflows, and sustain long-term growth in the evolving mycoplasma testing landscape.

Comprehensive Research Methodology Integrating Quantitative Analytical Techniques and Expert Validation for Robust Mycoplasma Testing Market Intelligence

The research methodology underpinning this analysis combines comprehensive secondary data review with targeted primary research to ensure depth and accuracy. Secondary sources include peer-reviewed publications, regulatory compendia, technical white papers, and corporate disclosures, providing a robust foundation for understanding market dynamics and technological trends. This background research informed the development of segmentation frameworks and regional categorizations.

Primary research involved structured interviews with key opinion leaders across diagnostic laboratories, pharmaceutical manufacturers, automation platform providers, and regulatory agencies. These discussions yielded firsthand insights into evolving testing requirements, procurement challenges, and validation practices. Survey data from end users was triangulated with supplier perspectives to reconcile demand-side priorities with product availability and service capabilities.

Quantitative analyses of reagent and instrument use patterns were conducted using anonymized procurement data, highlighting relative adoption rates of culture methods, PCR assays, and emerging technologies. Qualitative assessments drew upon expert validation panels to review draft findings, ensuring alignment with real-world laboratory operations and compliance protocols. All data was subjected to quality checks and cross-referenced against publicly available regulatory updates to maintain methodological rigor and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mycoplasma Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mycoplasma Testing Market, by Product

- Mycoplasma Testing Market, by Test Type

- Mycoplasma Testing Market, by Sample Type

- Mycoplasma Testing Market, by Pathogen Type

- Mycoplasma Testing Market, by End User

- Mycoplasma Testing Market, by Application

- Mycoplasma Testing Market, by Region

- Mycoplasma Testing Market, by Group

- Mycoplasma Testing Market, by Country

- United States Mycoplasma Testing Market

- China Mycoplasma Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Conclusive Insights Reinforcing the Strategic Value of Rigorous Mycoplasma Testing as a Pillar of Biopharmaceutical Quality Assurance and Research Excellence

In conclusion, rigorous mycoplasma testing is an indispensable pillar of quality assurance across biopharmaceutical development, clinical diagnostics, and academic research. The interplay of advanced molecular detection methods, evolving regulatory mandates, and supply chain considerations has reshaped industry expectations for speed, sensitivity, and reliability. Technological innovations such as digital PCR, automation platforms, and multiplex assays are setting new benchmarks for contamination monitoring, while regulatory authorities continue to refine guidelines that enforce comprehensive validation and risk-based testing regimens.

Supply chain dynamics, particularly in light of recent tariff implementations, underscore the importance of strategic sourcing, local manufacturing, and smart inventory management. Market segmentation insights reveal that diverse test types, sample origins, end-user needs, and application requirements demand a versatile and integrated testing ecosystem. Regional variations further highlight the need for tailored approaches that consider local regulatory landscapes and infrastructure maturity.

As leading players forge partnerships, expand capabilities, and prioritize customer-centric service models, industry stakeholders are presented with an opportunity to redefine standards for mycoplasma control. By embracing a proactive blend of cutting-edge technologies, collaborative quality frameworks, and resilient procurement strategies, organizations can safeguard scientific integrity, accelerate time-to-value, and enhance patient outcomes. This synthesis of insights provides a clear roadmap for navigating the complex but critical domain of mycoplasma testing.

Drive Strategic Growth Today by Securing Comprehensive Mycoplasma Testing Insights and Engaging with Ketan Rohom to Fuel Your Organization’s Competitive Edge

Elevate your decision-making by gaining exclusive access to in-depth analysis and critical insights within the Mycoplasma Testing market. Ketan Rohom, Associate Director, Sales & Marketing, is ready to guide you through the extensive research findings and demonstrate how this intelligence can be tailored to your organization’s needs. Engage directly with Ketan to discuss how proprietary data on emerging technologies, regulatory shifts, and regional dynamics can accelerate your strategic initiatives. Secure a personalized consultation today and equip your team with the knowledge to outpace competitors, optimize testing workflows, and fortify supply chain resilience. Reach out to Ketan Rohom to explore customized engagement options and drive measurable impact with expertly curated market intelligence.

- How big is the Mycoplasma Testing Market?

- What is the Mycoplasma Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?