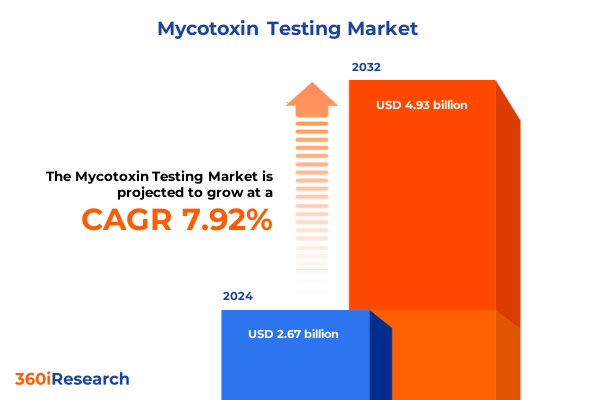

The Mycotoxin Testing Market size was estimated at USD 2.88 billion in 2025 and expected to reach USD 3.09 billion in 2026, at a CAGR of 7.93% to reach USD 4.93 billion by 2032.

Setting the Stage for Informed Decisions through a Comprehensive Overview of Mycotoxin Testing and Its Critical Importance for Food Safety and Quality Control

The integrity of global food and feed systems hinges critically on the accurate detection and management of mycotoxin contaminants. This analysis begins by framing the multifaceted nature of mycotoxin testing, which spans a broad array of chemical classes produced by fungi that can compromise health and trade. Setting the context, it assesses the drivers that have pushed safety protocols to the forefront of quality assurance, namely heightened regulatory scrutiny, expanding consumption of diverse agricultural commodities, and mounting vigilance around international supply chains.

Building on this overview, the introduction articulates how the convergence of scientific innovation and evolving stakeholder demands shapes testing paradigms. It underscores the necessity of adopting versatile analytical platforms capable of delivering precise, high-throughput, and cost-effective results. By situating the reader in a landscape defined by both opportunity and complexity, this section lays the groundwork for exploring the transformative themes, policy impacts, and market segmentation that follow in subsequent chapters.

Navigating the Evolving Mycotoxin Testing Landscape as Advanced Technologies, Stringent Regulations, and Emerging Contaminants Redefine Industry Practices

Significant technological breakthroughs and regulatory expansions have converged to redefine how laboratories approach mycotoxin testing. As advanced chromatographic and mass spectrometric platforms become more accessible, they are complemented by the rise of rapid immunoassays that facilitate near-instant risk screening. This shift is underpinned by increasing demands for real-time data flow, driving integration between analytical instruments and digital quality management systems.

Meanwhile, landmark policy reforms around the world are establishing more stringent permissible limits and diversified lists of regulated toxins. Such regulatory intensification has compelled laboratories to broaden their testing portfolios, incorporating novel fungal metabolites and modified mycotoxin species. In parallel, molecular biology tools have started to play a pivotal role in predictive mycotoxin risk assessment, enabling stakeholders to anticipate contamination events before toxins accumulate.

Together, these convergent forces are catalyzing a reconfiguration of industry practices. Laboratories that embrace hybrid workflows-combining high-resolution confirmatory testing with streamlined field-portable screening-are reaping operational efficiencies, while also delivering laboratories and producers the agility needed to navigate an increasingly complex safety environment.

Assessing the Ripple Effects of United States 2025 Tariff Policies on Mycotoxin Testing So as to Identify Challenges and Opportunities in International Trade

United States tariff policies enacted in 2025 have introduced a novel layer of complexity to the mycotoxin testing ecosystem. The imposition of additional duties on imported analytical instruments, reagents, and test kits has increased the total landed cost for laboratories that rely on global supply chains. Consequently, some organizations are recalibrating procurement strategies by seeking locally manufactured components or by renegotiating supplier contracts to mitigate margin pressure.

Transitioning from higher input costs, laboratories are also experiencing delays in equipment delivery, as import processing times have extended under new customs procedures. These logistical bottlenecks have prompted certain testing facilities to re-evaluate inventory management practices and adopt leaner on-site stock levels. At the same time, the tariffs have stimulated domestic production initiatives, resulting in emerging opportunities for local instrument manufacturers to capture a greater share of the market and for reagent suppliers to develop cost-competitive formulations.

Ultimately, the cumulative impact of the 2025 tariff measures highlights the interdependence of regulatory actions and operational agility. Stakeholders that proactively adapt by optimizing supply chains, diversifying procurement sources, and leveraging strategic partnerships will be best positioned to sustain continuity in testing services and maintain resilience in the face of shifting trade dynamics.

Uncovering Key Segmentation Dimensions That Drive Mycotoxin Testing Strategies Across Techniques, Toxin Types, Sample Matrices, and End User Applications

Examining the market through a technique-based lens reveals a spectrum of analytical approaches, ranging from enzyme immunoassays to advanced mass spectrometry. Enzyme linked immunosorbent assays remain foundational, with both Direct ELISA and Sandwich ELISA formats widely applied for initial screening. High performance liquid chromatography techniques, divided into fluorescence-based and UV-detection configurations, deliver enhanced separation capabilities, while liquid chromatography coupled with mass spectrometry offers both high-resolution and triple quadrupole workflows for definitive identification. Polymerase chain reaction techniques, including quantitative PCR and reverse transcriptase PCR, are gaining traction for their ability to detect the genetic potential for toxin production, and rapid test kits such as fluorescence polarization immunoassays and lateral flow assays enable on-site, expedited decision-making.

Shifting focus to toxin specificity, the analytical agenda spans multiple mycotoxin classes, from the prevalence of aflatoxin and fumonisin monitoring to growing scrutiny of ochratoxin, trichothecenes, and zearalenone. This breadth reflects regulatory mandates as well as evolving regional consumption patterns that necessitate customized testing panels. In this context, a variety of sample matrices-from animal feed and animal-based feeds in mash, pellet, and premix forms to major cereals and grains including barley, maize, oats, rice, and wheat-demand tailored extraction and analysis workflows. Dairy derivatives such as cheese, milk, and yogurt, as well as fruits and vegetables including apples, grapes, and tomatoes, further diversify laboratory method development.

End users span compound feed producers and large-scale feed mills, dedicated soil and water testing laboratories in environmental monitoring, food and beverage processors across bakery, beverages, and dairy lines, pharmaceutical quality control and drug formulation sectors, and research institutes driving innovation. Each segment imposes unique sensitivity, throughput, and compliance requirements, underscoring the importance of a versatile testing toolkit and specialized service offerings.

This comprehensive research report categorizes the Mycotoxin Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Technique

- Toxin Type

- Sample Type

- End User

Illuminating Regional Dynamics and Market Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Shaping Mycotoxin Testing Priorities

Regional dynamics exert a profound influence on priorities, investments, and regulatory frameworks in mycotoxin testing. Across the Americas, harmonization efforts under U.S. Food and Drug Administration guidance and cooperation with Canadian and Latin American authorities have reinforced a unified approach to permissible limits, while end users increasingly leverage risk-based sampling to optimize resource allocation. Industry players in North and South America are also capitalizing on innovations in data analytics to refine predictive control measures for mycotoxin outbreaks in staple crops.

In Europe, the Middle East, and Africa, European Union regulations continue to set rigorous benchmarks for maximum residue levels, compelling laboratories to expand multi-mycotoxin screening panels and validate methods in accordance with stringent accreditation protocols. Meanwhile, Middle Eastern feed producers are integrating advanced detection technologies to comply with import requirements from EU and Asian markets, and African stakeholders are collaborating with development agencies to enhance local testing capacity and bolster food security.

Turning to the Asia-Pacific region, national standards such as China’s GB 2761 and Japan’s ministry guidelines on mycotoxins have prompted laboratory upgrades to support high-throughput liquid chromatography and mass spectrometry platforms. Rapid industrial growth coupled with greater multinational trade flows has created an imperative for agile testing solutions that can address diverse commodity profiles and climatic influences on fungal proliferation. Consequently, market participants are forging strategic alliances with regional distributors and research institutions to drive localized innovation and ensure compliance across a mosaic of regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Mycotoxin Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Strategic Collaborations, and Competitive Positioning in the Global Mycotoxin Testing Market Landscape

Industry leaders are intensifying R&D efforts to introduce next-generation analytical platforms that offer enhanced sensitivity and multiplexing capabilities. Major instrument manufacturers have entered into strategic partnerships with reagent suppliers to co-develop proprietary test kits that streamline sample preparation and reduce turnaround time. Meanwhile, specialist companies are investing in software-driven data management systems to enable real-time monitoring of test results and facilitate regulatory reporting.

Strategic acquisitions and collaborations have also reshaped the competitive terrain. Several global players have expanded their footprint in emerging markets through joint ventures, bolstering local capacity while adapting solutions to regional commodity characteristics and regulatory requirements. Technology innovators are differentiating through patent-protected assays and automation modules designed for high-throughput screening, and select research-focused entities are forging alliances with academic institutions to explore novel biomarkers for mycotoxin exposure.

Collectively, these developments underscore a concerted move toward integrated solutions that merge analytical precision with operational efficiency. Companies that prioritize end-to-end service offerings-encompassing instrumentation, consumables, and digital analytics-are solidifying their market positions and setting new benchmarks for quality assurance in mycotoxin testing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mycotoxin Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AES Laboratories Pvt. Ltd.

- ALS Limited

- AsureQuality Limited

- Bio-Check Ltd.

- Bureau Veritas SA

- Charm Sciences Inc.

- EnviroLogix Inc.

- Eurofins Scientific SE

- Fera Science Ltd.

- IEH Laboratories & Consulting Group

- Intertek Group plc

- LGC Limited

- Microbac Laboratories Inc.

- Mérieux NutriSciences Corporation

- Neogen Corporation

- R J Hill Laboratories Limited

- R-Biopharm AG

- Romer Labs Division Holding GmbH

- SGS SA

- Symbio Laboratories

- Trilogy Analytical Laboratory

- UNIQA S.A.

- VICAM LP

Actionable Strategic Imperatives for Industry Leaders to Strengthen Mycotoxin Testing Capabilities, Enhance Compliance, and Foster Sustainable Market Growth

To navigate the complex convergence of technological, regulatory, and trade pressures, industry leaders should consider investing in integrated testing ecosystems that combine high-resolution confirmatory instruments with portable screening devices, thereby enabling seamless transitions between laboratory and field-based workflows. Equally crucial is the development of robust partnerships across the supply chain, from substrate suppliers to data analytics providers, to ensure continuity of reagents and uninterrupted access to the latest testing protocols.

Furthermore, organizations are advised to enhance in-house capabilities by implementing advanced training programs that equip analysts with expertise in both immunoassay and chromatographic techniques. Adopting cloud-based laboratory information management systems can drive transparency, enabling stakeholders to visualize compliance metrics, track deviations, and generate audit-ready documentation with minimal manual intervention. Finally, a proactive approach to regulatory engagement-such as participating in standards committees and contributing to method validation initiatives-will enable firms to anticipate policy changes and align product pipelines with emerging safety mandates.

By embracing these strategic imperatives, companies can strengthen resilience against tariff-induced supply chain disruptions, position themselves at the vanguard of analytical innovation, and uphold the highest standards of consumer protection and quality assurance.

Explaining Rigorous Research Methodology Combining Secondary Data, Primary Insights, and Triangulation Techniques to Ensure Accuracy and Reliability of Findings

This analysis integrates a multi-tiered research methodology designed to ensure both comprehensiveness and accuracy. It commenced with an extensive secondary study of peer-reviewed journals, regulatory publications, industry white papers, and patent filings to map current analytical technologies and policy frameworks. Publicly available data from food safety authorities and global trade databases provided context on regulatory thresholds and tariff measures.

To validate and enrich these insights, primary research was conducted through in-depth interviews with laboratory directors, quality assurance managers, equipment manufacturers, and regulatory experts across key geographic markets. These discussions elicited firsthand perspectives on operational challenges, procurement strategies, and future technology adoption timelines. Data triangulation was applied by cross-referencing quantitative findings with anecdotal evidence from supply chain stakeholders, ensuring consistency and mitigating bias.

Analytical rigor was maintained through iterative reviews of methodology assumptions, sample size considerations, and data normalization techniques. While every effort was made to capture a representative cross-section of market participants, readers should note that market dynamics may evolve rapidly in response to policy shifts, technological breakthroughs, or trade developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mycotoxin Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mycotoxin Testing Market, by Testing Technique

- Mycotoxin Testing Market, by Toxin Type

- Mycotoxin Testing Market, by Sample Type

- Mycotoxin Testing Market, by End User

- Mycotoxin Testing Market, by Region

- Mycotoxin Testing Market, by Group

- Mycotoxin Testing Market, by Country

- United States Mycotoxin Testing Market

- China Mycotoxin Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Concluding Insights on the Critical Role of Mycotoxin Testing in Safeguarding Supply Chains, Protecting Public Health, and Driving Industry Innovation

Synthesizing the insights from technological evolution, shifting regulatory landscapes, tariff implications, and market segmentation underscores the central role of mycotoxin testing as both a safeguard and a catalyst for innovation. Laboratories that harness modular analytical platforms, augmented by rapid immunoassays, are best positioned to deliver precise, timely results that support proactive risk management. Equally, organizations that align procurement and inventory strategies to evolving trade policies will maintain continuity and cost efficiency.

As regional regulatory bodies continue to refine permissible limits and testing guidelines, stakeholders must remain agile by nurturing partnerships with technology providers, investing in staff expertise, and engaging in standards development. The intersection of end-user diversity-from feed producers to pharmaceutical formulators-demands a flexible service model capable of addressing distinct sensitivity and throughput requirements. Looking ahead, the convergence of digital quality management systems and predictive analytics promises to transform mycotoxin control from a reactive imperative into a proactive component of comprehensive safety regimes.

Ultimately, sustained success in this dynamic environment will hinge on an integrated approach that bridges scientific rigor, regulatory foresight, and strategic collaboration. The findings presented herein chart a path for organizations seeking to elevate their testing capabilities, safeguard public health, and foster enduring competitiveness in the global marketplace.

Empowering Decision Makers to Access the Full Mycotoxin Testing Market Report by Engaging with Ketan Rohom for Tailored Strategic Intelligence

To explore the full depth of insights, methods, and strategic takeaways contained in the comprehensive mycotoxin testing market research report, potential clients are invited to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will provide tailored guidance on how to leverage the report’s rich data, segmented analyses, and expert recommendations to inform procurement strategies, strengthen risk management frameworks, and drive innovation in quality assurance protocols. Prospective stakeholders will gain clarity on subscription options, customized deliverables, and additional consulting services designed to maximize return on investment. We encourage decision-makers across industry, regulatory bodies, and research institutions to seize this opportunity for focused strategic intelligence by reaching out to Ketan Rohom for further details and to secure immediate access to the definitive resource on mycotoxin testing.

- How big is the Mycotoxin Testing Market?

- What is the Mycotoxin Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?