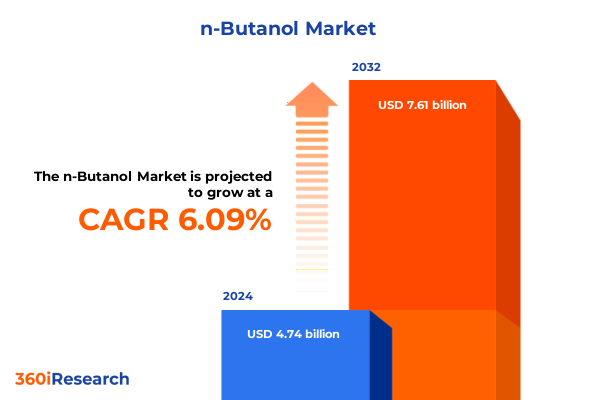

The n-Butanol Market size was estimated at USD 5.01 billion in 2025 and expected to reach USD 5.30 billion in 2026, at a CAGR of 6.14% to reach USD 7.61 billion by 2032.

Revealing the Vital Role of n-Butanol in Modern Industrial Applications and its Strategic Significance for Chemical Manufacturers Worldwide

n-Butanol is a four-carbon primary alcohol that plays a pivotal role as both an industrial intermediate and a versatile solvent in the chemical manufacturing landscape. Derived via an oxo process from propylene or renewable fermentation pathways, this compound bridges traditional petrochemical production and emerging bio-based technologies. Its polar hydroxyl group imparts strong solvency power for a wide range of resins, varnishes, and nitrocellulose applications, while its moderate volatility and compatibility with existing infrastructure make it a preferred choice for numerous formulations.

Beyond its function as a solvent, n-butanol serves as a precursor for critical derivatives, including butyl acetate, butyl acrylate, n-butylamines, glycol ethers, isobutyraldehyde, and methyl methacrylate. These downstream products underpin sectors from coatings and adhesives to plastics and pharmaceutical intermediates, underscoring n-butanol’s centrality in modern value chains. In recent years, its potential as a biofuel additive has garnered attention due to higher energy density, lower volatility compared to ethanol, and compatibility with gasoline blends, fueling research into fermentation optimization and strain engineering.

Given its dual sourcing routes - conventional petrochemical and renewable bio-based - n-butanol occupies a unique strategic position amid evolving regulatory imperatives around carbon footprint reduction. This introduction establishes the foundation for a deeper exploration of transformative shifts, trade policy impacts, segmentation dynamics, and actionable strategies shaping the n-butanol market today.

Exploring the Disruptive Technological and Sustainability-Driven Transformations Redefining n-Butanol Production and Consumption Dynamics Globally

The n-butanol landscape is being reshaped by a confluence of technological advancements and sustainability imperatives that are redefining production, feedstock choice, and end-use patterns. On one front, bio-based fermentation technologies have seen breakthroughs through the engineering of high-yield microbial strains and continuous bioreactor processes, enabling more efficient conversion of sugars and agricultural residues into biobutanol. These innovations lower downstream purification costs and mitigate the inhibitory effects of butanol accumulation, paving the way for integrated biorefinery models that co-produce multiple green chemicals and fuels.

Concurrently, the petrochemical route continues to evolve with the adoption of advanced catalysts and process intensification techniques in oxo synthesis. Homogeneous and heterogeneous catalyst improvements have increased selectivity for butyraldehyde intermediates and reduced energy consumption during hydrogenation steps. These enhancements enhance overall yields and lower environmental impact, allowing synthetic n-butanol producers to maintain competitiveness amid rising feedstock prices.

Market demands are also steering n-butanol toward novel applications in high-performance coatings, sustainable plastics, and greener plasticizer solutions. The push for low-VOC formulations and circular economy frameworks is driving greater integration of bio-based variants into existing product lines. As regulatory bodies tighten greenhouse gas thresholds and incentivize renewable chemicals, the balance between bio-based and synthetic production will continue to shift. In turn, consumers in the automotive, construction, and personal care sectors are increasingly valuing the environmental profile of raw materials, underscoring the transformative nature of these market trends.

Unpacking the Far-Reaching Consequences of Recent U.S. Trade Tariff Measures on n-Butanol Supply Chains and Global Industry Resilience

The imposition of new U.S. tariffs in early 2025 has introduced significant complexity across n-butanol supply chains, prompting producers and distributors to reassess sourcing strategies and cost structures. Under Section 301 measures enacted on January 1, 2025, additional duties were applied to chemical intermediates, driving an 8–15% increase in landed costs due to direct tariff pass-through, elevated freight rates, and insurance premiums. As a result, margin compression has been most acute in contract-manufactured and toll-processed products where price escalation clauses lag behind cost adjustments.

By April 9, 2025, reciprocal tariffs expanded under HTSUS 9903.01.25 introduced a basic 10% levy on a broad array of imports, further spurring lead time extensions and inventory front-loading across importers. Chemical companies are navigating new documentation requirements and customs classification complexities, with smaller specialty producers expressing particular concern over the time-intensive process of securing exclusions. Meanwhile, not all chemicals were included; major polymers and some petrochemicals were spared, offering partial relief for integrated producers whose portfolios extend beyond alcohols.

Exporters of U.S. n-butanol derivatives are confronting rising compliance costs and the specter of retaliatory duties in key Asia-Pacific markets. The combined headwinds of Section 301 levies and evolving anti-dumping duties abroad underscore the need for resilient supply chains and diversified manufacturing footprints. Companies are responding by expanding or retooling domestic capacity, negotiating tariff exclusion requests, and forging partnerships to secure feedstocks in more tariff-neutral regions.

Deciphering the Intricate Market Segmentation Landscape of n-Butanol Spanning Product Type Purity Applications and End-User Sectors for Strategic Clarity

Understanding the nuances of market segmentation is critical for tailoring strategies in the n-butanol landscape. When viewed through the lens of product type, bio-based n-butanol is gaining traction among sustainability-focused end users due to lower lifecycle greenhouse gas emissions, while synthetic n-butanol remains favored for its established supply reliability and cost stability. Demand patterns reveal that petrochemical-driven volumes continue to underpin large-scale coatings and solvent markets, even as fermentative routes bolster green credentials and diversify feedstock risk.

Analyzing the market by downstream product yields deeper insights into value creation. Butyl acetate and butyl acrylate serve as foundational monomers for polymer beads and specialty adhesives, respectively; glycol ethers deliver exceptional solvency in high-performance paints; while methyl methacrylate is indispensable in acrylate resin production. Producers of n-butylamines rely on n-butanol as a precursor for agrochemical and pharmaceutical intermediates, illustrating the compound’s centrality across diverse supply chains.

Purity level segmentation underscores application-driven quality requirements. High-purity grades dominate personal care and pharmaceutical formulations where trace levels of impurities can affect stability and safety, whereas lower-purity grades meet the specifications of industrial solvents and antifreeze formulations without incremental purification costs. This differentiation informs production pathway choices and R&D investment priorities.

The breadth of end-use applications further highlights n-butanol’s versatility, spanning anti-freeze agents in automotive coolants, fuel additives enhancing octane ratings, industrial solvents for textile dyeing, inks and printing formulations, rubbers and plasticizers in elastomer processing, surfactants in personal care, and intermediates for a spectrum of chemical syntheses. Each application segment exhibits distinct growth drivers and regulatory pressures, from low-emission mandates in transportation to stringent purity thresholds in healthcare, guiding targeted innovation and market positioning efforts.

This comprehensive research report categorizes the n-Butanol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product

- Purity Level

- Application

- End-User Industries

Analyzing Regional Market Dynamics Impacting n-Butanol Across the Americas Europe Middle East Africa and Asia-Pacific for Geographical Advantage

Regional dynamics are shaping divergent growth trajectories for n-butanol markets. In the Americas, regulatory frameworks such as the U.S. Renewable Fuel Standard and Clean Air Act have bolstered the incorporation of bio-based butanol in fuel blends, while the domestic shale revolution continues to ensure feedstock availability for synthetic routes. Investment in Gulf Coast and Midwestern production facilities is on the rise as companies seek to mitigate tariff exposure and leverage abundant propylene supplies.

Across Europe, the Middle East, and Africa, evolving sustainability mandates under the EU’s Renewable Energy Directive (RED II) are incentivizing advanced biofuels and renewable chemicals. With binding sub-targets for advanced biofuels of 1% by 2025 and 3.5% by 2030, producers in the region are expanding fermentation capacities and partnering with feedstock suppliers to meet stringent GHG savings thresholds. Meanwhile, emerging economies in the Middle East and Africa are gradually building chemical parks to integrate n-butanol into local value chains, driven by petrochemical diversification strategies.

In Asia-Pacific, rapid industrialization and urbanization in China, India, and Southeast Asia continue to fuel demand for solvents, plasticizers, and chemical intermediates. Chinese producers have cemented their regional leadership through large-scale capacities, albeit subject to anti-dumping duties on imports from the U.S., Taiwan, and Malaysia, which will remain in place through 2029. Concurrently, government incentives across India and Thailand are supporting bio-based ventures, reflecting a balance between petrochemical expansion and renewable adoption in one of the world’s most dynamic n-butanol markets.

This comprehensive research report examines key regions that drive the evolution of the n-Butanol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategies and Innovations of Leading n-Butanol Manufacturers Shaping Competitive Landscape and Future Growth Trajectories

Leading players are deploying varied strategies to strengthen their positions in the n-butanol arena. BASF has deepened its presence in Asia through a memorandum of understanding with UPC Technology Corporation, securing supply agreements for n-butanol from its Zhanjiang Verbund site. This partnership underscores BASF’s commitment to regional collaboration and low-carbon solutions as it integrates biomass-balanced products into its alcohol portfolio.

Dow is capitalizing on North American and European growth opportunities by expanding alkoxylation and carbonate solvent capacities. On the U.S. Gulf Coast, Dow’s planned world-scale carbonate solvents facility, developed in collaboration with the Department of Energy’s clean energy programs, aims to support electric vehicle battery supply chains and energy storage markets. Simultaneously, European investments in specialty amines and alkoxylation chemistries are driving growth in pharmaceutical, home care, and cleaning sectors, leveraging the region’s push for renewable inputs.

Eastman Chemical targets premium applications by adjusting its Oxo segment pricing to reflect higher raw material and operating costs, while aligning its specialty portfolio toward circular economy solutions. The divestiture of its Texas City acetic acid assets to INEOS Acetyls further illustrates Eastman’s focus on high-margin derivatives and recycled feedstocks, positioning the company for resilient earnings in changing market conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the n-Butanol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bharat Petroleum Corporation Limited

- Chemex Organochem Private Limited

- China National Petroleum Corporation

- Clariant International Ltd.

- DhanLaxmi Organics & Chemicals

- Eastman Chemical Company

- Formosa Plastics Group

- GODAVARI BIOREFINERIES LTD.

- Green Biologics Ltd.

- Grupa Azoty S.A.

- INEOS Group Holdings S.A.

- KH Neochem Co., Ltd

- LG Chem Ltd.

- Loba Chemie Pvt. Ltd.

- LyondellBasell Industries Holdings B.V.

- Merck KGaA

- Mitsubishi Chemical Corporation

- OQ Chemicals Gmbh

- Otto Chemie Pvt. Ltd.

- Sasol Limited

- Saudi Basic Industries Corporation

- Solventis by Brenntag

- Tasnee

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- Vizag Chemical International

Empowering Industry Leaders with Targeted Actionable Strategies to Enhance n-Butanol Supply Resilience Sustainability and Market Agility in a Dynamic Environment

To navigate the shifting n-butanol environment, industry leaders should prioritize diversifying feedstock portfolios by integrating bio-based fermentation alongside conventional oxo capacity. This dual-track approach enhances supply security while aligning with tightening sustainability mandates. Companies can accelerate the development of engineered microbial strains and continuous fermentation protocols to drive down operating costs and support advanced biofuel targets under evolving regulatory frameworks.

Supply chain resilience can be bolstered by establishing multiple manufacturing sites across tariff-neutral regions and negotiating early exclusion requests. Strategic alliances with feedstock producers and logistics partners will mitigate the impact of Section 301 and reciprocal tariffs, while enabling near-shoring of intermediate chemicals to reduce exposure to anti-dumping measures in key export markets.

Innovation funding should be channeled into catalyst improvements for synthetic routes and process intensification to minimize energy and water footprints. Concurrently, engaging with policy forums and trade associations provides a platform to influence tariff exclusion processes and shape sustainability standards. By aligning R&D, procurement, and government affairs functions, companies can translate market insights into actionable initiatives that safeguard margins, capture emerging demand in coatings, pharmaceuticals, and fuel sectors, and strengthen competitive advantage.

Outlining the Rigorous Multi-Source Research Methodology Employed to Deliver Robust Qualitative Insights into n-Butanol Market Dynamics

This analysis synthesizes insights drawn from a rigorous multi-source research methodology. Secondary research involved reviewing academic journals, regulatory frameworks, and white papers to map technological advancements and sustainability criteria. Key documents included peer-reviewed fermentation studies, innovation disclosures from major chemical producers, and policy texts such as the EU’s Renewable Energy Directive and U.S. Section 301 tariff announcements.

Primary research comprised in-depth interviews with industry executives, supply chain specialists, and technical experts spanning production, R&D, and trade compliance functions. These discussions validated market trends, tariff impacts, and strategic responses. Production data was cross-checked with customs databases and trade flow analyses to assess import-export patterns under anti-dumping and reciprocal tariff regimes.

Segmentation and regional dynamics were evaluated through a combination of trade association reports, government publications, and targeted company filings. All findings underwent rigorous triangulation to ensure accuracy and mitigate bias. This methodology underpins the qualitative insights presented, offering a robust foundation for strategic decision-making in the n-butanol sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our n-Butanol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- n-Butanol Market, by Product Type

- n-Butanol Market, by Product

- n-Butanol Market, by Purity Level

- n-Butanol Market, by Application

- n-Butanol Market, by End-User Industries

- n-Butanol Market, by Region

- n-Butanol Market, by Group

- n-Butanol Market, by Country

- United States n-Butanol Market

- China n-Butanol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings on n-Butanol Market Evolution Key Challenges and Opportunities to Chart Strategic Pathways for Stakeholder Decision-Making

The comprehensive examination of n-butanol’s industrial significance, emergent production paradigms, trade policy upheavals, and segmentation intricacies reveals a market at the intersection of tradition and transformation. Petrochemical producers are embracing process intensification and catalyst innovation to uphold cost competitiveness, while bio-based pathways gain momentum in response to lifecycle emission targets and circular economy initiatives.

Trade tariffs enacted in early 2025 have catalyzed shifts in sourcing philosophies, with firms realigning manufacturing footprints and securing tariff exclusions to preserve margins. Regional insights emphasize differentiated strategies: Americas harness energy abundance and biofuel mandates, EMEA navigates stringent sustainability criteria, and Asia-Pacific balances expansive synthetic capacities against emerging renewable ventures.

Major chemical companies are driving growth through collaborative partnerships, capacity expansions, and portfolio refinements, exemplifying the agility required in a complex regulatory and market environment. Actionable recommendations underscore the imperative for supply chain diversification, targeted innovation investments, and proactive engagement with policy stakeholders.

Bridging market intelligence with strategic foresight, stakeholders are poised to capitalize on n-butanol’s dual role as a foundational intermediate and a green chemical candidate. In doing so, they will chart resilient pathways that blend economic performance with environmental stewardship.

Connect with Ketan Rohom to Secure Comprehensive n-Butanol Market Intelligence and Partner in Transforming Your Strategic Growth Initiatives Today

To explore how n-butanol market insights can empower your strategic decisions and drive growth in your organization, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise in specialty chemicals and market intelligence will guide you through the tailored analysis and custom solutions that are critical for staying ahead in this dynamic sector. Engage with Ketan today to secure your comprehensive report, gain immediate access to proprietary data, and partner in shaping your next phase of growth with actionable intelligence.

- How big is the n-Butanol Market?

- What is the n-Butanol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?