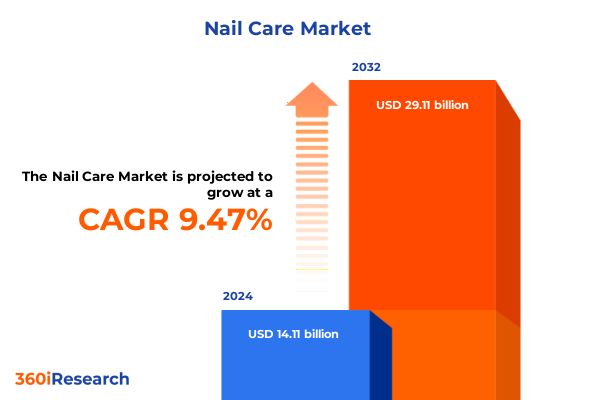

The Nail Care Market size was estimated at USD 24.19 billion in 2025 and expected to reach USD 25.43 billion in 2026, at a CAGR of 5.23% to reach USD 34.58 billion by 2032.

Navigating the Evolving Nail Care Sphere with Innovative Strategies and Consumer-Centric Perspectives for Sustainable Growth and Competitive Advantage

Consumers are elevating nail care from a routine grooming habit to an essential component of personal wellness and fashion expression. The convergence of health consciousness with aesthetic innovation has positioned nail care as a critical touchpoint for brands seeking to resonate with modern consumers. Driven by the rise of the wellness movement and heightened interest in self-care, nail care products are no longer confined to color and shine; they now emphasize nail health, ingredient transparency, and multifunctional benefits. Social media platforms like Instagram and TikTok have amplified these trends, showcasing bold designs and healthy nail treatments that have captured global attention

Amid these cultural shifts, consumer behavior is also evolving toward DIY treatments and seamless digital experiences. As salon visits face disruption from economic pressures and tariff-driven price increases, a growing segment of consumers is embracing at-home nail care kits and virtual consultations. E-commerce platforms now account for a significant share of retail sales, fueled by convenience and broader product access. Meanwhile, professional salons are adapting by offering hybrid services and curated retail assortments to maintain engagement. This dual-channel growth underscores the need for brands to optimize both online and offline touchpoints for holistic consumer journeys

Embracing Technological Innovation Sustainability and Cultural Trends to Redefine the Nail Care Landscape and Drive Unprecedented Consumer Engagement

The nail care industry is undergoing a profound transformation fueled by cutting-edge technologies and creative innovation. Artificial Intelligence and Augmented Reality have emerged as game changers in product personalization, allowing consumers to virtually preview custom shades and finishes before purchase. Brands are leveraging AI-driven analytics to tailor formulations based on individual skin tone, style preferences, and trending color palettes, resulting in hyper-personalized experiences that foster deeper engagement. AR-enabled virtual try-on apps further bridge the gap between digital and physical retail, driving both discovery and conversion by reducing buyer uncertainty

Sustainability and wellness have also taken center stage, reshaping product development and marketing strategies. Eco-conscious formulations-free from harmful chemicals and packaged in biodegradable or refillable containers-are increasingly demanded by health- and environment-focused consumers. Biodegradable artificial nails and cruelty-free ingredients underscore the shift toward ethical consumption. At the same time, innovations in magnetic “cat eye” polishes, 3D-printed nail accessories, and multi-functional treatment finishes highlight the sector’s commitment to blending artistry with performance. This dynamic interplay between sustainability and technological advancement signals an era of limitless possibilities for brands willing to invest in both creativity and responsibility

Assessing the Cumulative Effects of 2025 United States Tariffs on Input Costs Supply Chain Dynamics and Consumer Behavior in the Nail Care Sector

United States import tariffs introduced in 2025 have exerted significant pressure on the nail care sector by raising costs for raw materials such as pigments, solvents, and packaging components. Brands heavily reliant on imports from tariffed regions have experienced margin compression, prompting many to reevaluate supplier networks and negotiate long-term contracts. Some manufacturers are shifting sourcing to tariff-free markets or nearshoring production to mitigate price fluctuations. However, these transitions often require extensive regulatory compliance and adaptation of manufacturing lines, creating temporary disruptions in product availability and innovation cycles

On the consumer front, rising prices have accelerated the DIY trend, with individuals opting for at-home nail treatments and polishes over professional salon services. Economic concerns and cost-saving motivations have driven notable declines in salon foot traffic, particularly among younger demographics. Meanwhile, brands have countered by introducing value-driven, multi-functional care kits and digital tutorials designed to retain loyalty despite shifting buying behaviors. This evolving landscape underscores the critical balance between maintaining quality standards and offering affordable, accessible solutions that align with consumer priorities in a tariff-influenced economy

Unveiling the Diverse Product Distribution and Consumer Profiles That Shape Competitive Dynamics and Opportunity in the Nail Care Industry

Product segmentation in the nail care market encompasses a diverse array of offerings from artificial nails and decorative nail art to conventional, gel, and Shellac nail polishes, alongside treatments focusing on cuticle care, strengtheners, and protective base and top coats. Complementing these are a wide range of tools and accessories, each catering to specific application methods and consumer preferences. This depth of product variety requires brands to clearly position their core innovations while ensuring cohesive consumer narratives that highlight both aesthetic appeal and therapeutic benefits.

Distribution channels significantly influence market reach and brand perception, spanning from traditional hypermarkets, pharmacies, and specialty stores to digital-first platforms like brand websites and third-party e-commerce. Professional salons and spas serve as both sales channels and experiential hubs, reinforcing product efficacy and fostering trust through expert recommendations. End users range from individual consumers who value convenience and cost-effectiveness to professional salons that prioritize high-performance, salon-grade formulations. Ingredient type further differentiates offerings into conventional, mineral-based, and organic categories, reflecting evolving consumer demand for clean, cruelty-free, and eco-friendly solutions.

This comprehensive research report categorizes the Nail Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Ingredient Type

- Packaging Format

- End User

- Distribution Channel

Decoding Regional Variations in Consumer Preferences Digital Adoption and Regulatory Environments Across Key Nail Care Markets Globally

The Americas region continues to demonstrate robust adoption of innovative nail care solutions, driven by high consumer spending power and strong brand loyalty. The United States leads with advanced salon services and a growing DIY segment, while Canada and Mexico exhibit steady growth in premium and organic product lines. Regulatory frameworks in North America, such as VOC restrictions in California, have accelerated reformulation efforts, prompting 40% of brands to advance eco-friendly finishes that comply with stringent environmental standards. Meanwhile, social media and influencer partnerships remain pivotal in driving trends and purchase decisions across the region

Europe, Middle East & Africa displays a heterogeneous landscape where regulatory rigor, cultural nuances, and emerging markets intersect. Western Europe’s established markets favor luxury and wellness-driven formulations, supported by a mature salon infrastructure. In contrast, Middle Eastern and African markets are increasingly attractive due to rising disposable incomes and growing urbanization. Consumers in these markets often seek premium or halal-certified products, emphasizing cultural inclusivity and niche compliance. Throughout EMEA, digital penetration varies, creating differentiated opportunities for omnichannel expansion and local brand collaborations that resonate with diverse consumer segments.

This comprehensive research report examines key regions that drive the evolution of the Nail Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovation Portfolios and Market Leadership of the Major Players Shaping the Global Nail Care Industry Today

Global leadership in the nail care arena is defined by extensive R&D investments, diversified portfolios, and multi-channel distribution networks. L’Oréal S.A. stands out for its robust nail care sub-brands and commitment to sustainable formulations, leveraging its global retail footprint to drive both premium and mass-market growth. The Estée Lauder Companies Inc. reinforces its market position through high-end nail lacquer innovations and strategic collaborations that align with luxury fashion trends. Shiseido Company, Limited combines minimalist Japanese-inspired aesthetics with advanced performance formulas, appealing to both domestic and international consumers

Mass-market dominance is exemplified by Coty, Inc. through its Sally Hansen and OPI brands, which offer affordable yet effective solutions across drugstores and major retailers. OPI continues to set trend benchmarks with its extensive shade portfolio and high-performance gel lines, while Sally Hansen’s Miracle Gel system caters to both salon professionals and home users with chip-resistant, lamp-free formulas. Essie, under L’Oréal’s umbrella, remains a salon staple renowned for its trend-driven shade launches and collaborative collections that resonate with fashion-forward audiences

Emerging niche specialists like Miniluxe, Inc. and CND (Creative Nail Design) are redefining industry boundaries by integrating clean beauty standards with salon-grade experiences. Miniluxe’s omnichannel model combines in-salon luxury services with toxin-free retail products, fostering consumer loyalty through immersive brand experiences. CND expands its professional-grade Shellac and Vinylux systems into at-home applications, leveraging its reputation for durability and innovation to capture both salon and consumer segments. These strategic differentiators highlight the competitive edge gained through specialized expertise and authentic brand positioning

This comprehensive research report delivers an in-depth overview of the principal market players in the Nail Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American International Industries

- Art of Beauty Inc.

- BeautyPro Tools Inc.

- Beurer GmbH

- Chanel Limited

- ChinaGlaze.com, Inc.

- Cosmax. INC.

- Coty Inc.

- Deborah Lippmann

- Fancii & Co.

- Fiabila S.A.

- IL Cosmetics Group

- KISS Products Inc.

- L'Oréal S.A.

- LCN USA

- LVMH Moët Hennessy Louis Vuitton S.E.

- Mavala AG

- Mehaz Professional

- Nail Tek Inc.

- NailPro Solutions

- Olive & June, LLC. by Helen of Troy

- OPI Products Inc. by Wella Operations Us Llc

- Orly International Inc.

- Precision Nail Instruments Ltd

- ProNail Instruments

- Pure Elegance Beauty Corp

- Revlon, Inc.

- Young Nails Inc.

Implementing Strategic Frameworks to Enhance Agility Sustainability and Digital Integration While Strengthening Supply Chains and Brand Differentiation

To fortify resilience against future tariff fluctuations and supply chain disruptions, industry leaders should establish cross-functional command centers that facilitate real-time market monitoring and rapid response. These dedicated teams, comprised of procurement, logistics, finance, and marketing experts, can leverage predictive analytics to map potential tariff impacts and adjust sourcing strategies accordingly. Prioritizing supplier diversification-including nearshoring to regions with favorable trade agreements and cultivating domestic partnerships-will mitigate exposure to geopolitical risks and enhance cost stability

Digital transformation remains a critical lever for growth. Brands must invest in advanced AI-driven customization platforms and AR-enabled virtual try-on solutions that deepen consumer engagement and reduce purchase hesitation. By integrating interactive packaging elements such as QR codes and NFC tags, companies can bridge offline and online experiences, offering exclusive content, sustainability reports, and loyalty incentives that reinforce brand affinity. Rapid feedback loops through digital polls and sentiment analysis will enable agile product development aligned with evolving consumer preferences

Sustainability and transparency must anchor long-term strategies. Brands should accelerate the adoption of biodegradable materials, water-based formulations, and refillable packaging systems that resonate with eco-aware consumers. Publishing comprehensive ingredient disclosures and obtaining third-party certifications will build consumer trust and differentiate brand narratives. Collaborative initiatives-such as cross-industry recycling programs and incentive-based bottle returns-can extend circular economy principles, demonstrating environmental stewardship while enhancing brand reputation.

Outlining the Robust Mixed Methods Research Approach Employed to Deliver Comprehensive and Reliable Insights into the Nail Care Market Dynamics

This research employs a robust mixed-methods approach to ensure comprehensive and reliable insights. Primary data was gathered through in-depth interviews with industry executives, salon professionals, and distribution channel partners across key regions. A structured consumer survey provided quantitative inputs on purchasing behavior, brand perception, and category preferences. Secondary research included a thorough review of trade publications, corporate filings, regulatory databases, and industry association reports. Triangulation techniques were applied to validate findings, ensuring consistency across data sources. Analytical frameworks-such as Porter’s Five Forces for competitive analysis and PESTEL for macroenvironmental assessment-were leveraged to contextualize market dynamics within broader economic, regulatory, and technological trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nail Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nail Care Market, by Product Type

- Nail Care Market, by Formulation

- Nail Care Market, by Ingredient Type

- Nail Care Market, by Packaging Format

- Nail Care Market, by End User

- Nail Care Market, by Distribution Channel

- Nail Care Market, by Region

- Nail Care Market, by Group

- Nail Care Market, by Country

- United States Nail Care Market

- China Nail Care Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing Critical Insights and Strategic Imperatives to Empower Stakeholders in Navigating the Future of the Nail Care Market with Confidence

The nail care industry stands at the crossroads of innovation and tradition, where emerging technologies converge with timeless grooming rituals. As consumers prioritize health, sustainability, and personalization, brands that adapt swiftly will capture market momentum. Supply chain agility, digital engagement, and ingredient transparency emerge as non-negotiable pillars for future success. Navigating tariff uncertainties and regional regulatory landscapes requires strategic foresight and operational flexibility. By aligning product development with evolving consumer values and investing in integrated omnichannel experiences, industry stakeholders can unlock new growth pathways. Sustained collaboration between brands, suppliers, and service providers will be critical in shaping a resilient, consumer-centric ecosystem poised for long-term expansion.

Engage with Ketan Rohom to Unlock In-Depth Nail Care Market Intelligence and Tailored Strategic Guidance for Informed Decision-Making and Growth

Ready to gain a competitive edge in the dynamic nail care landscape? Request a comprehensive market report today by connecting with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can provide you with customized insights, deeper analysis, and strategic recommendations tailored to your organization’s specific needs. Don’t miss this opportunity to leverage industry-leading research for decisive action and sustainable growth

- How big is the Nail Care Market?

- What is the Nail Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?