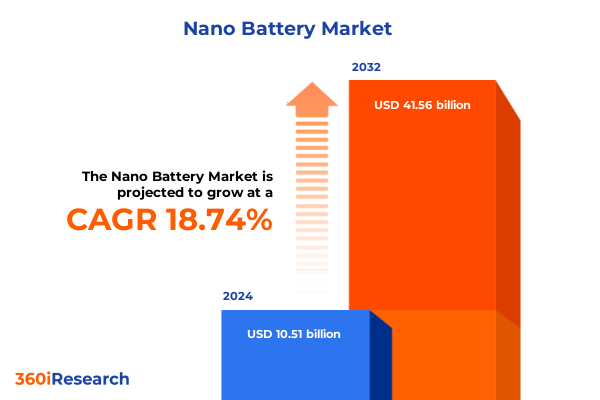

The Nano Battery Market size was estimated at USD 12.47 billion in 2025 and expected to reach USD 14.79 billion in 2026, at a CAGR of 18.76% to reach USD 41.56 billion by 2032.

Uncovering the Strategic Importance of Nano Batteries in Driving Next Generation Energy Storage and the Cornerstone Technologies Shaping Future Applications

The rapid convergence of material science breakthroughs and evolving energy demands has elevated nano batteries from a research curiosity to a pivotal enabler of next-generation devices and systems. In recent years, enhancements in electrode architecture and electrolyte formulations have unlocked significant gains in energy density, safety, and lifecycle performance. As a result, stakeholders across industries are positioning nano batteries as a cornerstone technology for electrification, miniaturization, and sustainable power solutions.

Against this backdrop, the strategic significance of nano batteries extends well beyond incremental performance improvements. Their unique ability to deliver high power in compact form factors has catalyzed innovation in sectors as diverse as consumer electronics, transportation, defense, and medical devices. Moreover, ongoing academic and industrial collaborations are accelerating the translation of laboratory-scale prototypes into scalable manufacturing processes. Consequently, organizations that understand the transformative potential of nano batteries are now crafting roadmaps to harness their competitive advantage.

Revolutionary Advances in Chemistry, Manufacturing, and Policy Are Redefining Nano Battery Performance Safety and Commercialization Pathways

Over the past decade, the nano battery landscape has undergone fundamental shifts driven by breakthroughs in solid-state chemistry, advanced manufacturing techniques, and evolving regulatory frameworks. Notably, developments in solid-state electrolyte materials have alleviated longstanding safety concerns associated with traditional liquid electrolytes, paving the way for more compact and resilient battery designs. In parallel, scalable roll-to-roll processing and 3D printing have redefined production paradigms, enabling uniform nanoscale architectures that translate to higher power output and extended cycle life.

Furthermore, governments worldwide are launching ambitious initiatives to bolster domestic production and incentivize clean energy adoption, thereby reshaping investment priorities along the supply chain. Simultaneously, heightened focus on circular economy principles has compelled industry participants to integrate recycling and reuse strategies at the earliest stages of product development. Collectively, these transformative shifts underscore the industry’s transition from proof-of-concept demonstration to commercial viability across multiple high-value segments.

Understanding How Recent United States Trade Measures Against Imported Battery Cells and Components Are Driving Reshoring and Resilience Strategies

Throughout 2025, the United States has adjusted its trade policy posture to protect critical battery supply chains, enacting new duties and reassessing existing tariff structures. Most notably, lithium-ion cells and essential components imported from selected markets now face increased Section 301 tariffs, while certain non-EV battery forms have also been targeted under Section 232 on national security grounds. These cumulative measures have recalibrated cost assumptions and encouraged stakeholders to reevaluate sourcing strategies and domestic production investments.

Despite the immediate cost pressures introduced by tariff hikes, these policy adjustments have stimulated notable responses from both manufacturers and policymakers. Producers are accelerating localizing initiatives, expanding North American cell and material manufacturing capacity to mitigate exposure to trade uncertainties. At the same time, public–private partnerships are gaining traction as federal funding mechanisms are leveraged to underwrite the development of next-generation chemistries and processing technologies. As a result, the tariffs have acted not only as a short-term cost shift but also as a catalyst for reshoring efforts and enhanced supply chain resilience.

Deep Dive into Nano Battery Segmentation Reveals Unique Dynamics Across Chemistries Applications Form Factors and End Use Industries

Analyzing the nano battery market through the lens of chemistry reveals distinct trajectories for each key formulation. Lithium-ion variants continue to dominate in commercial adoption thanks to mature supply chains and proven performance metrics. Meanwhile, nickel metal hydride maintains relevance in specialized high-temperature and safety-critical niches. At the forefront of next-generation energy storage, solid-state prototypes are transitioning from pilot lines to early-stage commercialization, leveraging novel ceramic and polymer electrolytes to deliver unparalleled energy density and safety improvements.

When considering the application spectrum, the aerospace and defense sector is prioritizing satellite power modules, soldier-worn energy systems, and unmanned aerial vehicle propulsion batteries that demand uncompromising reliability. In the automotive domain, advanced battery management units coexist with fully electric and hybrid propulsion platforms, reflecting automakers’ multifaceted decarbonization roadmaps. Consumer electronics innovation remains vibrant across cameras, laptops, smartphones, and tablets, all craving efficient micro-power sources. Concurrently, grid-scale storage, renewable power integration, and secure backup supply requirements are driving sustained interest in utility-scale formats. The medical field continues to explore nano battery integration into diagnostic scanners, implantable pacemakers, and patient monitoring devices, while the burgeoning wearables and IoT universe applies these advances in fitness trackers, smart sensor nodes, and connected timepieces.

Form factors likewise manifest wide variability. Button cell designs within the coin cell family excel where compact intermittent power bursts are needed. Flexible and soft pack pouch constructs enable ergonomic packaging in emerging wearable devices and conformable sensors. Lastly, prismatic cells encased in hard or soft shells deliver structural stability essential for applications spanning from consumer gadgets to backup power modules. Finally, end use industries such as automotive, consumer electronics, defense and aerospace, energy, healthcare, and industrial harness these form factor innovations to meet precise performance, safety, and regulatory requirements.

This comprehensive research report categorizes the Nano Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemistry

- Application

- Form Factor

- End Use Industry

Examining How Regional Policy Priorities and Industrial Strengths Are Shaping Distinct Nano Battery Ecosystems Across Americas EMEA and Asia Pacific

Regional dynamics in the nano battery arena are profoundly shaped by diverse policy environments and industry capabilities. In the Americas, robust incentives for electric mobility, coupled with federal funding for clean energy projects, have galvanized expansion of domestic cell and material facilities. Canadian initiatives focused on critical minerals processing complement these trends, offering a North American supply chain alternative. Transitioning eastward, Europe, the Middle East, and Africa exhibit a patchwork of strategic agendas: the European Green Deal’s decarbonization targets underpin heavy investment in gigafactories, while Gulf Cooperation Council states explore battery production to diversify energy-led economies. Across Africa, nascent mining ventures are also beginning to feed into global materials flows.

Asia-Pacific remains the epicenter of nano battery innovation and manufacturing scale-up. China continues to invest heavily in electrode and separator production, while Japan’s leading electronics companies push forward with solid-state prototypes. In South Korea, large conglomerates integrate vertically from precursor synthesis through cell assembly. Southeast Asian nations are emerging as attractive contract manufacturing hubs, benefiting from competitive labor costs and government-sponsored technology transfer programs. These regional priorities and capabilities collectively shape the global competitive equilibrium and influence strategic investment decisions for market participants worldwide.

This comprehensive research report examines key regions that drive the evolution of the Nano Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Strategic Moves by Nano Battery Manufacturers Material Suppliers Equipment Providers and Recycling Innovators Transforming the Value Chain

Leading firms across the nano battery value chain are capitalizing on differentiated strategies to secure competitive advantage. Major cell manufacturers are investing in next-generation chemistries and scaling pilot lines into commercial gigafactories. Technology companies are forging alliances with materials specialists to refine electrolyte and separator formulations, aiming to reduce cost and enhance safety profiles. Simultaneously, startups focused on solid-state architectures are navigating capitalization rounds while establishing strategic partnerships with automotive and industrial OEMs.

Equipment suppliers supplying advanced coating, calendaring, and assembly lines are also playing a pivotal role by enabling higher throughput and precision at nanoscale. Raw material producers of lithium salts, nickel precursors, and ceramic electrolytes are intensifying efforts to localize critical upstream processes. Service providers specializing in battery recycling and second-life applications are emerging as vital ecosystem participants, closing the resource loop and addressing end-of-life sustainability imperatives. Collectively, these companies are forming a dynamic matrix of collaboration and competition that is propelling the nano battery landscape forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nano Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A123 Systems, LLC

- Altair Nanotechnologies, Inc.

- Amprius Technologies, Inc.

- Enevate Corporation

- Front Edge Technology, Inc.

- Hitachi, Ltd.

- Ilika plc

- LG Energy Solution, Ltd.

- Log9 Materials Pvt. Ltd.

- mPhase Technologies, Inc.

- Nanode Battery Technologies, Inc.

- nanoFlowcell Holdings plc

- NanoGraf Corporation

- Nanotek Instruments, Inc.

- Nexeon Limited

- OneD Battery Sciences, Inc.

- Panasonic Corporation

- QuantumScape Corporation

- Samsung SDI Co., Ltd.

- Sila Nanotechnologies, Inc.

- Solid Power, Inc.

- StoreDot Ltd.

- Toshiba Corporation

- XG Sciences, Inc.

Actionable Strategic Priorities to Strengthen Supply Chain Resilience Accelerate Chemistries Development and Embed Circularity for Competitive Nano Battery Leadership

Industry leaders seeking to capitalize on nano battery opportunities should prioritize the establishment of resilient supply networks by securing access to critical raw materials and localizing strategic production steps. In parallel, directing capital toward pilot projects for solid-state and advanced hybrid chemistries can yield meaningful differentiation as these technologies mature. Cultivating partnerships with defense, automotive, and grid operators will facilitate early deployment pathways and de-risk integration challenges.

Moreover, integrating circular economy principles from design through end-of-life will not only mitigate regulatory risk but also unlock cost efficiencies linked to material recovery. Staying abreast of evolving trade policies and leveraging government-funded innovation programs can offset tariff headwinds while accelerating R&D timelines. Finally, embedding robust cybersecurity and intellectual property strategies will safeguard proprietary breakthroughs amid growing collaboration. By blending these actions into a cohesive strategic roadmap, organizations can outpace competitors and navigate the shifting nano battery terrain with confidence.

Leveraging Combined Secondary Sources Primary Expert Interviews and Quantitative Triangulation to Build a Robust Nano Battery Market Analysis Framework

This research synthesizes insights from an extensive secondary review of industry literature including technical journals, patent filings, and regulatory filings complemented by primary interviews with executives across battery manufacturers, automotive OEMs, defense primes, and energy storage integrators. Market segmentation and qualitative assessment were validated through expert workshops and vendor briefings, ensuring alignment with evolving use cases and performance benchmarks.

Quantitative triangulation was achieved via a combined top-down and bottom-up approach, leveraging publicly available manufacturing capacity data and proprietary shipment tracking. Scenario analysis was employed to evaluate the impact of trade actions and technology inflection points, while sensitivity testing refined key parameters around cycle life, energy density, and cost variables. The resulting methodology provides a robust framework for stakeholders to assess technology readiness levels, competitive positioning, and strategic investment priorities in the nano battery domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nano Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nano Battery Market, by Chemistry

- Nano Battery Market, by Application

- Nano Battery Market, by Form Factor

- Nano Battery Market, by End Use Industry

- Nano Battery Market, by Region

- Nano Battery Market, by Group

- Nano Battery Market, by Country

- United States Nano Battery Market

- China Nano Battery Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Summarizing How Technological Advances Policy Dynamics and Strategic Collaborations Are Paving the Way for Ecosystem Growth and Differentiation in Nano Batteries

Nano batteries stand at an inflection point where advances in chemistry, manufacturing, and policy converge to unlock transformative applications across sectors. While recent tariffs and trade measures have introduced near-term cost considerations, they have concurrently incentivized localized production and strategic alliances that fortify supply chain resilience. Segmentation analysis highlights the varied demands and growth drivers across chemistries, applications, form factors, and industries, while regional insights underscore the strategic interplay between policy objectives and industrial capacity.

As leading companies refine their portfolios and partnerships, and as technology readiness continues its upward trajectory, the nano battery market is poised to deliver unprecedented performance and efficiency gains. Decision-makers who embrace proactive strategies-integrating innovation with sustainability and regulatory awareness-will be best positioned to shape the future of energy storage and power delivery systems.

Drive Your Strategic Roadmap with Exclusive Nano Battery Market Intelligence Backed by Expert Analysis and Tailored Recommendations for Immediate Value

To explore how these in-depth insights can be tailored to your organization’s strategic objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive Nano Battery Market Research Report and elevate your decision-making with the most up-to-date intelligence and practical guidance available.

- How big is the Nano Battery Market?

- What is the Nano Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?