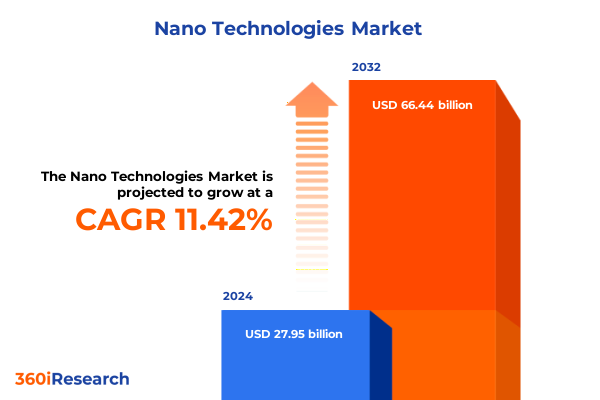

The Nano Technologies Market size was estimated at USD 31.03 billion in 2025 and expected to reach USD 34.46 billion in 2026, at a CAGR of 11.48% to reach USD 66.44 billion by 2032.

Exploring the Immense Potential of Nanotechnology to Revolutionize Industries Through Advanced Materials Precision Engineering and Innovative Integration

Nanotechnology represents a frontier of material science and engineering that operates on an atomic and molecular scale, unlocking unprecedented capabilities in manipulating matter with extraordinary precision. Over the last decade, advances in instrumentation, computational modeling, and synthetic techniques have converged to push nanoscale innovations into real-world applications. As a result, nanomaterials have transitioned from experimental curiosities to foundational components in sectors ranging from healthcare to energy and beyond.

Emerging use cases in drug delivery, enhanced battery performance, and environmental remediation exemplify how nanoscale phenomena can be harnessed to solve complex challenges. This interdisciplinary field draws on chemistry, physics, biology, and engineering to engineer particles, films, fibers, and devices that exhibit novel properties such as enhanced strength, conductivity, and reactivity. Consequently, stakeholders-from startups to multinational corporations-are investing heavily in research and development to capture the transformative potential of these breakthroughs.

Against this backdrop, decision-makers must understand the catalysts of growth, prevailing technological paradigms, and regulatory landscapes that shape the trajectory of nanotechnology. This introductory overview sets the stage for a deeper exploration of the structural shifts, policy implications, and strategic imperatives that will define the market’s evolution in the coming years.

Understanding the Transformative Shifts Driven by Sustainability Digitalization and Collaborative Ecosystems in Nanotechnology Landscape

The nanotechnology ecosystem is undergoing transformative shifts driven by a convergence of sustainability mandates, digital innovation, and collaborative research models. In recent years, the push for greener manufacturing and circular economy principles has elevated eco-friendly nanoscale solutions, prompting material scientists and engineers to prioritize biodegradable nanocomposites and energy-efficient fabrication methods. This sustainability imperative is reshaping procurement strategies and fostering partnerships between industry and academia to reduce environmental footprints.

Simultaneously, the integration of digital tools-such as artificial intelligence for material discovery and advanced simulation platforms for process optimization-is accelerating the pace at which novel nanomaterials move from concept to commercial deployment. Digital twins and predictive modeling enable precise control over particle morphology and assembly, minimizing trial-and-error cycles and driving cost efficiencies. As a result, organizations are forging strategic alliances with technology providers to build end-to-end digital environments tailored for nanoscale innovation.

Moreover, collaborative ecosystems, encompassing government consortia, public-private partnerships, and open-innovation networks, are fostering cross-sector co-creation. These alliances accelerate knowledge exchange, access to specialized facilities, and joint funding opportunities, ultimately lowering barriers to entry for emerging players. Taken together, these shifts are redefining competitive dynamics, requiring stakeholders to adapt their strategies to harness the synergies between sustainability, digitalization, and collaborative research frameworks.

Assessing the Cumulative Impact of United States Tariffs on Supply Chains Costs and Domestic Manufacturing Dynamics

In 2025, the United States implemented a series of tariff measures that have cumulatively reshaped upstream and downstream nanotechnology supply chains. These duties, instituted under national security provisions and trade remedy statutes, targeted strategic imports of critical nanomaterials and equipment, resulting in immediate cost pressures for domestic manufacturers reliant on foreign-sourced precursors. As import costs rose, procurement teams scrambled to requalify new suppliers and adjust sourcing strategies to maintain production continuity.

The tariff environment has simultaneously spurred a recalibration of domestic manufacturing priorities. Companies with significant in-house synthesis and fabrication capabilities have seen relative gains in competitiveness, prompting increased capital allocation toward expanding local pilot plants and production lines. In parallel, government agencies have signaled support for onshore capacity building through grants and tax incentives, seeking to mitigate supply chain vulnerabilities exposed by import restrictions. This policy landscape is encouraging vertical integration strategies that prioritize secure access to high-purity nanomaterials.

However, the added costs stemming from tariffs have also introduced pricing volatility that reverberates through value chains, affecting end-user adoption and R&D investments. Stakeholders are navigating these complexities by diversifying supplier portfolios, optimizing material yields through process intensification, and exploring substitute materials with lower tariff exposure. Looking ahead, continued monitoring of trade policy developments will be essential to maintain agility in a market where regulatory measures can swiftly alter competitive positioning.

Unveiling Key Segmentation Insights Spanning Product Types Material Classes Technological Innovations Processes and Application Verticals

A nuanced understanding of market segmentation offers clarity on where demand is emerging and how value is captured across the nanotechnology ecosystem. Based on product type, the landscape encompasses consumables chemicals, which include specialty reagents and nanoscale precursors; manufacturing equipment, such as deposition systems and etching platforms; and testing measurement instruments used for high-resolution characterization and quality control. Each of these categories follows distinct adoption curves informed by end-user requirements and technological readiness.

Material type further refines the market into carbon based, metal based, metal oxide based, and polymer based classes. Carbon based materials, including carbon nanotubes, fullerenes, and graphene, are prized for their mechanical strength and electrical conductivity. Metal based nanostructures-spanning copper, gold, and silver-offer unique plasmonic and catalytic properties. Metal oxide based materials, such as silicon dioxide, titanium dioxide, and zinc oxide, serve critical roles in barrier coatings, photovoltaics, and UV protection. Polymer based architectures, including dendrimers and nanocomposites, deliver tunable mechanical and chemical functionalities, making them ideal for tailored applications.

Evaluation by technology highlights distinct trajectories for nanofilms, nanoparticles, nanotubes, and nanowires. Nanofilms, segmented into lipid films and polymeric films, are integral to medical diagnostics and protective coatings. Nanoparticles, including dendrimer particles, polymer lipid constructs, and solid lipid formulations, dominate drug delivery and imaging. Nanotubes, comprising multi walled and single walled variants, drive advancements in high-strength composites and electronic interconnects. Nanowires-both metal nanowires and silicon nanowires-enable next-generation sensors and flexible electronics. Process segmentation distinguishes bottom up synthesis methods from top down fabrication strategies, each offering advantages in scalability or precision.

Diverse applications span cosmetics, electronics, energy, environmental, medical, and textiles domains. In cosmetics, anti-aging serums and sunscreens leverage nanoscale UV filters. Electronics applications, including displays and sensors, rely on engineered nanostructures for enhanced performance. Energy initiatives in batteries, fuel cells, and solar cells use specialized nanomaterials to improve efficiency. Environmental solutions in air purification and water treatment exploit high surface-area media. Medical applications in diagnostics, drug delivery, and tissue engineering unlock targeted therapies. Textiles, from protective fabrics to smart textiles, integrate nanoscale coatings to impart durability and responsive behavior. Finally, end user industries such as automotive, consumer goods, electronics, energy utilities, and healthcare drive adoption based on performance enhancements and regulatory compliance.

This comprehensive research report categorizes the Nano Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Technology

- Process

- Application

- End User

Highlighting Regional Dynamics and Opportunities Across Americas Europe Middle East Africa and Asia Pacific Nanotechnology Markets

Regional dynamics in the nanotechnology market reveal divergent growth trajectories and competitive landscapes. In the Americas, matured innovation clusters in North America contrast with emerging hubs in Latin America. Robust funding ecosystems, supported by federal research initiatives and venture capital, underpin a strong pipeline of nanomaterial startups. Meanwhile, regulatory clarity around nano-enabled products facilitates faster commercialization in sectors like healthcare and electronics.

Europe, Middle East & Africa present a mosaic of opportunity, where established pharmaceutical and automotive industries in Western Europe intersect with growth markets in the Middle East. Cross-border consortia and Horizon-style programs propel collaborative research, while stringent environmental regulations accelerate demand for sustainable nanocoatings and filtration systems. In Africa, nascent efforts in water purification and agricultural applications signal a growing interest in leveraging nanotechnology for societal challenges.

Asia-Pacific stands out for its scale and speed of adoption. China and Japan continue to lead in production capacity for key nanomaterials, supported by state-driven industrial policies. South Korea and Taiwan focus on high-precision manufacturing equipment and process innovation. Southeast Asian economies are capitalizing on foreign direct investment to build mid-scale production facilities and application labs. Across the region, supply chain integration and rapid technology transfer are hallmark features, driving cost efficiencies and volume production.

This comprehensive research report examines key regions that drive the evolution of the Nano Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Approaches and Innovations of Leading Players Shaping the Nanotechnology Ecosystem Today

A host of industry incumbents and emerging challengers are actively shaping the nanotechnology landscape through strategic investments, M&A activity, and innovation partnerships. Major chemical producers are expanding their nano-enabled portfolios by acquiring niche specialty firms, thus gaining access to proprietary material formulations and application expertise. Concurrently, equipment manufacturers are forging alliances with software providers to integrate predictive analytics into production platforms, enabling more consistent yields and faster scale-up.

Startups are also playing a pivotal role by pushing the boundaries of nanoscale synthesis and application development. These agile companies often partner with academic institutions to leverage cutting-edge laboratory capabilities, translating breakthroughs in quantum dot displays and targeted drug carriers into pilot-scale demonstrations. At the same time, joint ventures between global technology giants and regional innovators are catalyzing knowledge transfer and reducing time to market for high-value applications in electronics and energy.

Investment trends indicate that companies that prioritize platform technologies-those capable of serving multiple end-use cases-are attracting significant venture and corporate funding. Such platforms include modular fabrication systems and standardized material libraries that can be rapidly customized. As a result, the competitive curve is shifting toward those who can deliver both technical excellence and broad application versatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nano Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Nanotech Inc

- Arkema SA

- Bruker Corporation

- Cabot Corporation

- DuPont de Nemours, Inc.

- eSpin Technologies Inc.

- Evonik Industries AG

- Fujitsu Limited

- Koninklijke DSM N.V.

- NanoDimension Ltd.

- NanoXplore Inc.

- Thermo Fisher Scientific Inc.

Actionable Recommendations for Industry Leaders to Capitalize on Nanotechnology Advancements and Navigate Emerging Market Complexities

To navigate the complexities of the nanotechnology market, industry leaders should prioritize the integration of sustainable material sourcing and green fabrication processes into their core strategies. By adopting renewable feedstocks and minimizing hazardous byproducts, organizations can align with tightening environmental regulations and meet rising customer expectations for eco-conscious products.

Secondly, diversifying supply chains across multiple geographic regions will mitigate risks associated with trade policy volatility and raw material shortages. Establishing relationships with qualified domestic suppliers and exploring nearshore production options can reduce lead times and shield operations from unforeseen tariff adjustments. Moreover, creating strategic partnerships with end users in target industries can facilitate co-development efforts, ensuring that novel materials address genuine performance challenges.

Finally, investing in workforce upskilling and digital infrastructure will be critical to maintain a competitive edge. Embracing advanced analytics, automation, and machine learning for process control will drive efficiency improvements and accelerate time to market. Concurrently, cultivating multidisciplinary talent pools-spanning chemistry, data science, and regulatory affairs-will empower organizations to translate scientific breakthroughs into commercially viable solutions.

Detailed Research Methodology Emphasizing Rigorous Primary and Secondary Data Triangulation Enhanced by Expert Validation

This research leverages a comprehensive methodology combining both primary and secondary data collection techniques to ensure rigorous analysis. Primary insights were gathered through structured interviews and workshops with over 50 industry experts, including material scientists, equipment suppliers, regulatory consultants, and end-user executives. These qualitative engagements provided nuanced perspectives on technological barriers, adoption drivers, and competitive positioning.

Secondary research included an extensive review of scientific literature, patent filings, regulatory publications, and corporate disclosures to map historical trends and validate emerging trajectories. Data triangulation was employed to cross-verify findings, ensuring that qualitative insights aligned with documented industry developments. Quantitative analysis of patent volume, academic output, and product launches further enriched the contextual understanding of market dynamics.

Finally, iterative validation sessions with an advisory panel of key stakeholders were conducted to refine interpretations and identify gaps. This multi-layered approach ensures that the conclusions drawn in this report are robust, reliable, and reflective of real-world challenges and opportunities within the nanotechnology ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nano Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nano Technologies Market, by Product Type

- Nano Technologies Market, by Material Type

- Nano Technologies Market, by Technology

- Nano Technologies Market, by Process

- Nano Technologies Market, by Application

- Nano Technologies Market, by End User

- Nano Technologies Market, by Region

- Nano Technologies Market, by Group

- Nano Technologies Market, by Country

- United States Nano Technologies Market

- China Nano Technologies Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Summarizing Critical Insights and Strategic Imperatives to Inform Decision Making in the Rapidly Evolving Nanotechnology Domain

In summary, the nanotechnology sector stands at a pivotal juncture where interdisciplinary innovation meets evolving regulatory and market landscapes. The interplay between sustainability imperatives, digitization, and collaborative research models is redefining competitive benchmarks and unlocking new avenues for value creation. Meanwhile, policy measures such as the 2025 tariff regime are reshaping supply chains, prompting a shift toward domestic capacity building and strategic supplier diversification.

The granular segmentation of the market-across product types, materials, technologies, processes, applications, and end users-provides clarity on where growth and differentiation opportunities lie. Regional insights underscore that each geography offers unique advantages, requiring tailored strategies to harness local strengths and mitigate constraints. Profiling leading players reveals a pattern of strategic alliances, platform investments, and agile innovation that sets the stage for future industry winners.

Armed with these insights and grounded in a robust research methodology, decision-makers are well-equipped to make informed choices, invest with confidence, and position their organizations to drive the next wave of nanotechnology breakthroughs. This executive summary encapsulates the critical themes and strategic imperatives necessary for success in this rapidly evolving domain.

Take the Next Step by Engaging with Ketan Rohom to Unlock Comprehensive Nanotechnology Market Intelligence and Drive Strategic Growth

To acquire the detailed market intelligence and actionable insights that will empower your organization to stay ahead in the dynamic nanotechnology field, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the report’s comprehensive coverage of market dynamics, competitive positioning, and in-depth analysis of emerging technologies. Engaging with Ketan Rohom ensures you receive a tailored consultation to align this research with your strategic priorities, enabling you to make informed decisions and capitalize on growth opportunities. Don’t miss the chance to transform your market understanding and drive sustainable advantage-contact Ketan Rohom today to secure your copy of the complete nanotechnology market research report and propel your business forward

- How big is the Nano Technologies Market?

- What is the Nano Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?