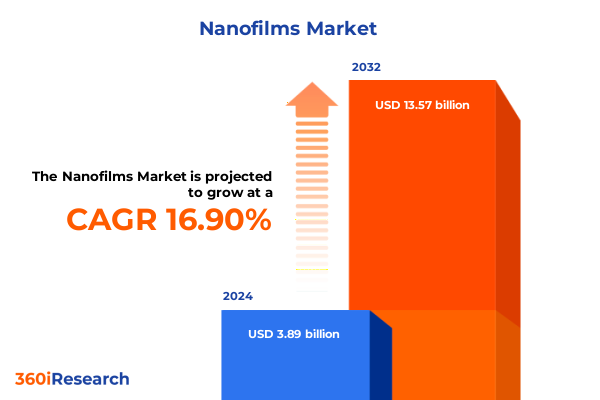

The Nanofilms Market size was estimated at USD 4.56 billion in 2025 and expected to reach USD 5.35 billion in 2026, at a CAGR of 16.84% to reach USD 13.57 billion by 2032.

Understanding How Ultra-Thin Nanofilm Coatings Unlock Unprecedented Material Properties and Enable Next-Generation Industrial Applications

Nanofilms represent an emerging class of coatings characterized by thicknesses ranging from one to one hundred nanometers, where quantum confinement and surface phenomena impart unique chemical and physical behaviors. These atomically controlled films exhibit exceptional properties such as altered refractive indices, low surface energy, and tailored tribological performance that cannot be achieved by bulk materials. The confluence of surface-dominated interactions and tunable electronic states makes nanofilms an indispensable tool for engineers and scientists seeking precise control over interfacial phenomena

Across sectors as diverse as solar energy conversion, biomedical devices, and next-generation food packaging, these ultra-thin layers function as anti-corrosion barriers, anti-scratch surfaces, and selective optical filters. In medical applications, polymeric and inorganic nanofilms conformally coat implantable devices to mitigate biofouling, while in photovoltaics, tailored oxide stacks enhance spectral selectivity and overall collector efficiency. Food contact surfaces leverage antimicrobial nanofilm matrices to extend shelf life without compromising edibility or regulatory compliance.

Driven by a convergence of advancing deposition platforms and expanding application demands, nanofilm coatings are transitioning from niche laboratory curiosities to mainstream industrial solutions. The maturation of precise vapor-phase and solution-based synthesis routes has lowered manufacturing barriers, enabling high-throughput production of multifunctional films. Consequently, market stakeholders are increasingly prioritizing nanofilm integration to achieve lightweight, high-performance, and sustainable material architectures across a spectrum of end uses.

Exploring Dramatic Technological Breakthroughs Reshaping the Production and Performance of Nanofilm Coatings Across Diverse Manufacturing Processes

Recent years have witnessed a quantum leap in deposition methodologies that fundamentally reshape how nanofilms are synthesized and tailored. Atomic layer deposition (ALD), once limited to semiconductor fabs, has expanded into plasma-assisted and thermal variants, offering sub-nanometer precision and conformality on complex geometries. This evolution has empowered engineers to assemble multilayer architectures with bespoke dielectric, conductive, and barrier functionalities, effectively bridging the gap between laboratory-scale innovation and industrial throughput.

Parallel advances in physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques have further broadened the palette of accessible nanofilm chemistries. Modern thermal evaporation systems now incorporate real-time thickness monitoring and high-purity sources to minimize contamination, while magnetron sputtering platforms deliver dense, adherent metal and oxide films suited for demanding environments. Likewise, plasma-enhanced CVD variants facilitate low-temperature growth of hybrid inorganic-organic layers, unlocking applications in flexible electronics and low-cost photovoltaics.

Complementing these vacuum-based approaches, solution-phase strategies-such as sol-gel precursor routes and layer-by-layer assemblies-have undergone significant refinement. Automation of dip coating and spray deposition has enabled rapid, large-area processing of functional films, while hybrid techniques integrate nanoparticle building blocks to impart self-cleaning and anti-fog capabilities. Together, these transformative shifts in the nanofilm landscape provide a versatile toolkit that catalyzes product innovation across industries.

Analyzing the Compounded Effects of 2025 United States Tariffs on Nanofilm Coating Supply Chains and Operational Cost Structures

In January 2025, the United States Trade Representative finalized escalated Section 301 tariffs, elevating duties on direct semiconductor imports from China to fifty percent and increasing rates on related electronic materials effective January 1, 2025. This measure directly affects nanofilm inputs used in high-performance display, integrated circuit, and sensor applications by raising landed costs for foundational compounds and deposition equipment components.

Concurrently, expanded tariffs on selected chemical coatings-including polymer precursors and metal oxide dispersions-introduced twenty percent duties on imports from the European Union and twenty-four percent on those from Japan starting April 9, 2025. While certain high-volume chemicals such as polyethylene and titanium dioxide received exclusions, numerous advanced coating formulations remain subject to elevated charges, thereby compressing supplier margins and prompting downstream price adjustments.

These layered trade measures have prompted strategic realignments across supply chains, as organizations accelerate nearshoring initiatives and diversify vendor portfolios to mitigate duty exposure. Many stakeholders are investing in domestic chemical manufacturing capacity or leveraging tariff exclusions through proactive classification reviews. This adaptive response aims to preserve access to critical materials for nanofilm fabrication, sustain innovation timelines, and uphold cost competitiveness in an increasingly complex global trade environment.

Unveiling Critical Segmentation Insights That Illuminate Market Dynamics Through Type Application Material Thickness and Deposition Techniques

The nanofilm market’s differentiation by type reveals that protective coatings, spanning chemical-, scratch-, and wear-resistant variants, have ascended as a pivotal segment driven by rigorous demands for durability in automotive and industrial machinery. Anti-corrosion films leverage nanoscale barrier layers to inhibit oxidative degradation under extreme conditions, while anti-scratch treatments incorporate hard, nanostructured interfaces that extend service life without altering substrate aesthetics.

Examining end-use applications underscores the significance of the electronics and semiconductor sectors, where display-quality films and conformal layers for integrated circuits and sensors are essential. Ultra-thin anti-fog treatments on optical surfaces enhance clarity in consumer devices, whereas nanopatterned barriers on sensors improve environmental resilience and signal stability in challenging operating environments.

Material-wise, metal oxide and ceramic nanofilms continue to lead development due to their intrinsic chemical inertness and thermal stability, supporting high-temperature processes and harsh chemical exposures. Polymer nanofilms, conversely, offer flexibility and lightweight protection, particularly in flexible electronic assemblies and wearable medical patches. Hybrid nanofilm formulations blend organic and inorganic constituents to combine mechanical robustness with tunable functionality.

The interplay of thickness categories-from thick films offering robust protection to ultra-thin layers optimized for optical transparency-enables precise tailoring of performance parameters. Deposition techniques such as plasma and thermal atomic layer deposition, plasma-enhanced and thermal chemical vapor deposition, as well as evaporation and sputtering PVD methods, facilitate this versatility by delivering controlled layer uniformity, adhesion, and composition, thereby underpinning the dynamic segmentation landscape.

This comprehensive research report categorizes the Nanofilms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Thickness

- Deposition Technique

- Application

Delineating Key Regional Trends That Showcase How Americas Europe Middle East Africa and Asia Pacific Drive Diverse Nanofilm Adoption Patterns

In the Americas, advanced research ecosystems and robust semiconductor fabrication infrastructure have positioned North America at the forefront of nanofilm development. The region’s leading-edge facilities, particularly in the United States, support sophisticated thin film deposition for consumer electronics, defense optics, and medical devices, underpinning a strong installed base of vacuum and atomic layer deposition equipment. This technical prowess is complemented by proactive regulatory frameworks that incentivize domestic production of specialized coating precursors.

Within Europe, Middle East, and Africa, stringent environmental standards and the European Green Deal’s Chemicals Strategy for Sustainability have galvanized the transition toward safer and more sustainable nanofilm chemistries. Manufacturers across the EU are incorporating safe-and-sustainable-by-design principles, prioritizing halogen-free formulations and low-VOC processing to meet increasingly rigorous REACH regulations. The confluence of policy-driven innovation and established automotive and aerospace supply chains continues to shape EMEA as a key incubator for eco-friendly and high-performance film technologies.

Asia-Pacific stands as the fastest-growing regional market, fueled by rapid industrialization, expansive consumer electronics production hubs, and burgeoning investments in renewable energy infrastructure. Countries such as China, Japan, and South Korea are leading nanocoatings adoption, applying scratch- and anti-corrosion treatments across high-volume automotive manufacturing and flexible display assembly lines. The region’s capacity for large-scale sol-gel and layer-by-layer processing is further supported by significant R&D funding, ensuring continual adaptation of cutting-edge deposition techniques to meet local market needs.

This comprehensive research report examines key regions that drive the evolution of the Nanofilms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Dominant Industry Players and Their Technological Leadership That Shape the Competitive Landscape of Nanofilm Materials and Services

A cohort of specialized technology providers dominates the global nanofilm landscape, each leveraging unique process expertise to address segment-specific performance requirements. Nanofilm Technologies International, headquartered in Singapore, is widely recognized for its proprietary vacuum deposition solutions that deliver sub-nanometer control and high-throughput coating for consumer electronics and solar applications. Cosmo Films Limited has established leadership in polymeric film composites, pioneering barrier-enhanced and biodegradable packaging solutions for global food supply chains.

In the United States, Advanced Thin Film distinguishes itself through precision optical coatings deployed in aerospace and defense applications, including contributions to the James Webb Space Telescope, which benefited from their vacuum-deposited UV and IR filter stacks. MetaTechnica’s California-based operations specialize in tunable metamaterial films, enabling dynamic optical filtering and augmented reality waveguide surfaces that are integral to next-generation display platforms.

Beyond these leaders, a spectrum of niche innovators offers bespoke deposition services and R&D partnerships. Ceramic and metal oxide film specialists focus on high-temperature and chemical-resistant layers for industrial process equipment, while hybrid material developers collaborate with academic institutions to advance safety and functionality in biomedical coatings. This constellation of market participants drives continuous evolution of coatings capabilities and ensures a competitive environment conducive to rapid iteration of nanofilm technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanofilms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BASF SE

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- LG Chem Ltd.

- SKC Co., Ltd.

- Solvay S.A.

- Toray Industries, Inc.

Strategic Roadmap of Actionable Recommendations to Propel Innovation Efficiency and Resilience in Nanofilm Coating Production and Deployment

Industry leaders should prioritize strategic investments that align with evolving material innovations and emerging regulatory landscapes to maintain competitive advantage. First, establishing collaborative partnerships with equipment manufacturers specializing in plasma-enhanced atomic layer deposition and advanced PVD platforms can accelerate process optimization and reduce time to market. By co-developing tailored deposition recipes, firms can unlock novel functionality in film compositions while sharing the capital burden of next-generation equipment deployment.

Second, organizations must proactively engage in supply chain diversification strategies to mitigate the impact of import tariffs and material shortages. This entails identifying alternative raw material sources, qualifying multiple vendors across regions, and evaluating nearshoring options that preserve process quality and cost stability. Strengthening supplier relationships through long-term agreements and joint quality assurance programs can fortify resilience against tariff-driven disruptions.

Third, integrating sustainability criteria into product roadmaps will not only satisfy tightening environmental regulations but also resonate with end customers demanding eco-conscious solutions. Incorporating safe-and-sustainable-by-design frameworks, such as substituting critical substances and reducing VOC emissions, can position companies as leaders in green nanofilm technologies.

Finally, investing in workforce development and cross-disciplinary training ensures that technical teams possess the necessary expertise to harness complex deposition systems and interpret nanoscale characterization data effectively. Cultivating a culture of continuous learning and cross-functional collaboration will be essential to sustain innovation velocity and translate research breakthroughs into scalable commercial outcomes.

Unraveling the Rigorous Research Methodology Underpinning Comprehensive Analysis of Nanofilm Market Dynamics and Segmentation Frameworks

This report’s insights are underpinned by a comprehensive research methodology designed to capture the multifaceted nature of the nanofilm market. Primary research included interviews with senior executives and technical directors from leading deposition equipment suppliers, raw material producers, and end-use manufacturers across automotive, electronics, and healthcare sectors. These interviews provided nuanced perspectives on adoption barriers, performance benchmarks, and emerging application requirements.

Secondary research encompassed an extensive review of patent databases, peer-reviewed journals, and regulatory publications. Key scientific articles detailing advancements in atomic layer deposition, chemical vapor deposition, and layer-by-layer assembly were analyzed to correlate technological maturity with commercial viability. Regulatory documents, such as harmonized tariff schedules and environmental standards, were examined to understand policy-driven market dynamics.

Quantitative data inputs were further triangulated through attendance at major industry conferences and equipment trade shows, where real-world demonstrations of deposition platforms and nanofilm applications were evaluated. Publicly available OEM integration case studies and white papers were used to validate performance claims and extract operational metrics.

Across all stages, rigorous data verification processes-including cross-referencing multiple sources and consulting domain experts-ensured that findings reflect the latest developments and provide a reliable foundation for strategic decision making. This methodological rigor underpins the clarity and depth of analysis presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanofilms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanofilms Market, by Type

- Nanofilms Market, by Material

- Nanofilms Market, by Thickness

- Nanofilms Market, by Deposition Technique

- Nanofilms Market, by Application

- Nanofilms Market, by Region

- Nanofilms Market, by Group

- Nanofilms Market, by Country

- United States Nanofilms Market

- China Nanofilms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Transformative Role of Nanofilm Innovations in Shaping Industrial Standards and Future Material Engineering Pathways

In summary, the evolution of nanofilm coatings has been characterized by rapid advancements in deposition techniques and expanding application frontiers. The intersection of atomic-scale control and tailored material chemistries has unlocked levels of performance previously unattainable with conventional coatings, enabling breakthroughs in durability, optical efficiency, and environmental resilience.

Trade policy shifts, most notably the escalation of Section 301 tariffs in 2025, have introduced new complexities into global supply chains, prompting industry stakeholders to adopt diversified sourcing models and nearshoring strategies. Concurrently, regional regulatory frameworks-from the European Green Deal’s sustainable chemicals strategy to Asia-Pacific’s robust manufacturing investments-continue to drive innovation and geographic differentiation of market trends.

Segmentation analysis underscores the heterogeneity of the nanofilm sector, spanning protective barrier solutions, electronics-grade coatings, and hybrid material architectures. The competitive environment is robust, with specialized players and full-service providers advancing proprietary processes that cater to highly specific performance requirements.

As the pace of technological development accelerates, companies that align strategic investments with emerging material capabilities, regulatory mandates, and sustainability objectives will secure leadership positions. This report offers a clear roadmap for navigating the evolving nanofilm landscape, setting the stage for informed decision making and long-term value creation.

Empowering Decision Makers to Secure a Competitive Edge in Nanofilm Technologies Through Direct Engagement with Associate Director of Sales Marketing

For decision makers seeking to harness the transformative potential of advanced nanofilm coatings, partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, offers an unparalleled opportunity to access customized insights and strategic guidance. Through a tailored consultation, industry leaders can align the nuances of their specific operational challenges with the latest advancements in film deposition techniques and high-performance surface treatments. Engaging with Ketan Rohom ensures direct dialogue with a seasoned expert who can translate complex technical findings into pragmatic action plans aimed at enhancing product durability, optimizing supply chain strategies, and accelerating time to market. This personalized approach not only empowers organizations to refine their competitive positioning but also facilitates informed investment decisions in material innovation pathways. To secure this strategic advantage and explore the full scope of the comprehensive market research report, reach out today to Ketan Rohom and unlock the specialized intelligence necessary to drive growth in the dynamic nanofilm landscape.

- How big is the Nanofilms Market?

- What is the Nanofilms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?