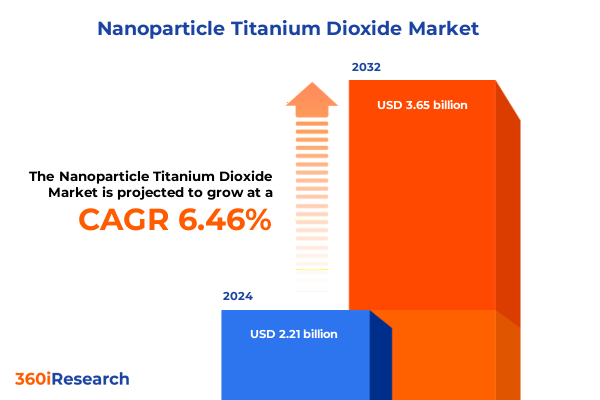

The Nanoparticle Titanium Dioxide Market size was estimated at USD 2.35 billion in 2025 and expected to reach USD 2.50 billion in 2026, at a CAGR of 6.47% to reach USD 3.65 billion by 2032.

Exploring the Evolving Universe of Nanoparticle Titanium Dioxide and Its Strategic Significance Across Diverse Global Industries

Nanoparticle titanium dioxide has emerged as a cornerstone material in modern industry due to its unique physicochemical properties and multifaceted applications. These particles, typically measuring less than 100 nanometers in diameter, exhibit exceptional light scattering, strong ultraviolet absorption, and catalytic activity that distinguish them from their micron-sized counterparts. As a result, they have garnered significant attention in sectors ranging from advanced coatings and plastics to environmental remediation and pharmaceuticals.

Over the past decade, advances in synthesis techniques have refined control over particle morphology, crystal phase distribution, and surface functionalization. Such progress has not only improved performance characteristics but also broadened the scope of possible uses. In turn, both established and emerging end-use industries are prioritizing nanoparticle titanium dioxide for its capacity to deliver superior brightness and opacity in paints, enhanced barrier properties in plastics, and photocatalytic degradation of environmental contaminants.

At the same time, regulatory bodies around the world are intensifying scrutiny of nanomaterials, prompting manufacturers to adopt rigorous safety assessments and transparent lifecycle analyses. This dual focus on performance and compliance underscores the strategic importance of nanoparticle titanium dioxide development and positions it as a catalyst for innovation in material science.

Together, these dynamics shape a market landscape in which the pursuit of sustainable production methods, applied research partnerships, and cross-sector collaboration will determine which companies lead the next wave of technological breakthroughs.

Unveiling the Game-Changing Innovations and Regulatory Forces Transforming the Nanoparticle Titanium Dioxide Landscape Worldwide

The landscape of nanoparticle titanium dioxide has undergone profound transformations driven by environmental imperatives and technological breakthroughs. Foremost among these is the shift toward sustainable synthesis processes. Traditional sulfate and chloride routes are giving way to green methodologies that utilize benign precursors, lower energy inputs, and recyclable reaction media. In parallel, digitalization is revolutionizing production. Advanced process control systems now enable real-time monitoring of particle size distribution and crystal phase composition, resulting in tighter quality tolerances and reduced waste.

Concurrently, end-users are demanding multifunctional performance. In the coatings industry, for instance, customers now expect pigmentation that not only delivers superior whiteness but also imparts self-cleaning and antimicrobial properties through photocatalysis. Likewise, plastics manufacturers increasingly require titanium dioxide grades that reinforce polymer matrices while maintaining recyclability. These requirements have spurred research into hierarchical particle structures and hybrid composites.

Moreover, the application of nanoparticle titanium dioxide in environmental improvement is gaining momentum. Photocatalytic water treatment and air purification technologies are leveraging the material’s ability to generate reactive oxygen species under ultraviolet or visible light. This shift is reshaping the value proposition of titanium dioxide from a passive pigment to an active functional agent, opening pathways for new business models centered on environmental services and circular economy principles.

Taken together, these forces are converging to redefine market expectations and competitive strategies. Companies that swiftly adapt to green synthesis, digital manufacturing, and multifunctional product development will secure differentiated positions in a landscape increasingly defined by sustainability and innovation.

Analyzing the Cumulative Ramifications of 2025 United States Tariff Policies on Nanoparticle Titanium Dioxide Supply Chains and Costs

The introduction of new U.S. tariff policies in 2025 has created a complex environment for the supply and cost structures of nanoparticle titanium dioxide. Initially, the administration’s reciprocal tariffs excluded many bulk chemicals, and titanium dioxide was explicitly listed among the exempted products, providing temporary relief to downstream manufacturers who rely on imported pigment for coatings and plastics. However, these reciprocal tariffs maintained a baseline duty of 10 percent on imports from most trading partners, except for China, which continues to face elevated levies due to separate trade actions.

Beyond these reciprocal measures, the U.S. Department of Commerce launched Section 232 investigations into critical minerals, including titanium oxide, under the Trade Expansion Act of 1962. This probe is evaluating potential national security risks associated with reliance on foreign sources of mineral feedstocks for key industries. Should the investigation result in Section 232 tariffs, duties on titanium sponge and derivative products could be implemented later in 2025, significantly impacting upstream supply chains and driving raw material costs higher.

Further compounding pressures, the administration announced a 25 percent tariff on imported automobiles effective April 2, 2025. While this action targets finished vehicles, it indirectly influences nanoparticle titanium dioxide costs by increasing expenses for automotive coatings and components. Paints and coatings producers now face higher production costs for primers and topcoats used in vehicle finishes, which may ultimately be passed downstream to manufacturers and end-users.

Collectively, these measures are prompting industry players to reevaluate supply chain strategies. Manufacturers are accelerating efforts to secure domestic feedstock through vertical integration or partnership with North American mining operations. At the same time, they are negotiating long-term contracts with key suppliers to hedge against tariff-induced volatility. While short-term cost pressures have intensified, these shifts may catalyze investments in local capacity expansion and supply resiliency that reshape market dynamics over the medium to long term.

Decoding Market Dynamics Through Product, Process, Application, and End-Use Industry Segmentation Trends for Titanium Dioxide Nanoparticles

Key insights emerge when disaggregating the market through product, process, application, and end-use industry lenses. Crystal structure exerts a first-order influence on performance: anatase forms deliver superior photocatalytic activity, brookite structures offer niche electronic properties, and rutile phases provide optimal opacity and weather resistance in coatings. Distinct market segments therefore align with these characteristics, impacting formulation choices across industries.

Similarly, production pathways-whether the chloride process or the sulfate route-shape the impurity profile and environmental footprint of the final powder. The chloride process tends to yield higher-purity rutile particles with lower iron content, making it preferable for high-end coating and plastic applications. Conversely, the sulfate process retains residual sulfates but can be more cost-effective for bulk pigment production, sustaining its role in sectors where extreme purity is less critical.

Application segments further stratify demand. In agriculture, nanoparticle titanium dioxide serves as a UV-blocking agent in greenhouse covers and as a photocatalyst for pesticide degradation. Environmental improvement applications harness its photocatalytic potential for wastewater treatment and air purification systems. Within pharmaceutical and medical device manufacturing, titanium dioxide’s biocompatibility and brightness make it indispensable for tablet coatings and diagnostic devices. Each application demands tailored particle properties, driving suppliers to offer specialized grades.

End-use industries round out the segmentation picture. The cosmetics sector benefits from nanopigments that provide UV protection and aesthetic appeal in sunscreens and color cosmetics. Healthcare leverages antibacterial surface coatings infused with nanoscale titanium dioxide. Paints and coatings manufacturers rely on rutile grades for durable, weather-resistant finishes, while plastics producers integrate the pigment into polymers to enhance opacity and UV stability. Finally, the pulp and paper industry utilizes titanium dioxide to improve brightness and print quality. Understanding these intersecting segments enables suppliers and formulators to precisely target value propositions and optimize product portfolios.

This comprehensive research report categorizes the Nanoparticle Titanium Dioxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Production Process

- Application

- End-Use Industry

Illuminating Regional Dynamics Shaping Demand and Production of Nanoparticle Titanium Dioxide Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the global nanoparticle titanium dioxide landscape. In the Americas, robust demand for high-performance pigments in automotive, aerospace, and architectural coatings coexists with an evolving domestic mining and processing infrastructure. North American producers are investing in vertical integration, securing titanium ore supplies from mines in the United States and Canada, while downstream formulators collaborate on pilot projects for advanced photocatalytic applications.

Meanwhile, the Europe, Middle East & Africa region grapples with capacity constraints and regulatory headwinds. The European Union’s anti-dumping duties on Chinese titanium dioxide imports have spurred local expansions, but permit delays and environmental compliance requirements extend project timelines. Across the Middle East, nascent manufacturing hubs are emerging, leveraging low-cost energy and strategic port access to target export markets, while African mineral sands deposits underpin long-term feedstock prospects.

Asia-Pacific remains the largest and fastest-growing market, driven by substantial investments in coatings, plastics, and renewable energy projects. China and India dominate production, operating large-scale chloride process plants. Japanese and South Korean firms lead in specialty grades with stringent purity and performance standards. Regional collaborations and technology transfers are accelerating capacity upgrades, particularly for anatase grades aimed at environmental and energy applications.

These regional profiles underscore the importance of aligning supply chain strategies with local drivers and constraints. Companies that tailor investments and partnerships to each region’s unique opportunities and regulatory landscape will be best positioned to capture market share and foster sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Nanoparticle Titanium Dioxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation, Sustainability, and Competitive Strategy in the Nanoparticle Titanium Dioxide Sector

A diverse set of industry participants is advancing the nanoparticle titanium dioxide market through innovation, strategic investments, and sustainability initiatives. Established chemical majors are expanding capacity to meet demand for high-purity grades, while specialty players are carving out niches with bespoke surface chemistries designed for specific end-use requirements.

Some firms are pioneering novel treatment technologies to enhance dispersion and surface compatibility in polymer matrices, addressing long-standing challenges in producing uniformly pigmented plastics. Others are focusing on integrated photocatalytic systems, embedding nanoparticles into construction materials and environmental remediation platforms. Collaborative research agreements between producers, academic institutions, and end-users are accelerating these developments by bridging fundamental science and applied engineering.

In parallel, sustainability has become a critical competitive factor. Leading organizations are setting ambitious targets for reducing greenhouse gas emissions and water usage in production. Several have achieved third-party certifications for environmental management, and some have initiated take-back programs for end-of-life products containing titanium dioxide nanoparticles. These efforts not only address regulatory pressures but also resonate with corporate responsibility agendas and investor expectations.

The competitive landscape is thus characterized by a dynamic interplay of scale, specialization, and sustainability leadership. Companies that demonstrate both technical prowess and a credible commitment to environmental performance will emerge as benchmarking partners for value-driven supply chains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanoparticle Titanium Dioxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Elements

- BASF SE

- CD Bioparticles

- Central Drug House (P) Ltd.

- Croda International PLC

- Henan Jinhe Industry Co., Ltd.

- High Purity Laboratory Chemicals Pvt. Ltd.

- Huntsman International LLC

- Langfang Pairs Horses Chemical Co., Ltd.

- Merck KGaA

- Nano Labs

- Nanoshel LLC

- Otto Chemie Pvt. Ltd.

- Qingdao Tida International Trade Co., Ltd

- Reinste Nanoventure

- SAT nano Technology Material Co., Ltd.

- Solaronix SA

- Tayca Corporation

- Techinstro

- The Chemours Company LLC

- Titan Kogyo, Ltd.

- Tronox Holdings PLC

- US Research Nanomaterials, Inc.

- Venator Materials PLC

- Zhengzhou Meiya Chemical Products Co.,Ltd

Strategic Roadmap for Industry Leaders to Harness Opportunities and Mitigate Risks in the Nanoparticle Titanium Dioxide Market

To capitalize on emerging opportunities and mitigate risks, industry leaders should prioritize several strategic imperatives. First, investing in flexible manufacturing platforms that can switch between sulfate and chloride routes will enable rapid adaptation to feedstock availability and regulatory constraints. This agility will buffer against supply disruptions and cost fluctuations.

Second, collaborations across the value chain-from mining operations to end-use formulators-will be key. Developing long-term agreements with upstream feedstock suppliers can secure raw material access, while joint development projects with downstream customers will ensure that product innovations address real-world performance requirements.

Third, embedding sustainability at every stage of the lifecycle will build resilience. Adopting circular economy principles, such as reclaiming and reprocessing titanium dioxide from waste streams, can reduce dependency on virgin ore and enhance brand credibility. Concurrently, aligning production practices with evolving global standards for nanomaterial safety will facilitate market acceptance and regulatory compliance.

Finally, staying at the forefront of digital transformation across manufacturing and logistics will unlock efficiencies. Implementing predictive analytics for process optimization, blockchain for supply chain traceability, and advanced modeling for product performance will differentiate market leaders and drive profitable growth.

Comprehensive Methodological Framework Underpinning the Nanoparticle Titanium Dioxide Report Employing Rigorous Qualitative and Quantitative Analysis

This report is grounded in a rigorous, multi-pronged research methodology designed to deliver comprehensive and actionable findings. Primary research involved in-depth interviews with senior executives and technical experts across the supply chain, including mining operations, pigment producers, and end-use formulators. Site visits to manufacturing and research facilities supplemented these discussions, providing direct observation of emerging production technologies and process controls.

Secondary research encompassed analysis of peer-reviewed journals, patent filings, regulatory databases, and industry association publications. This phase allowed for cross-verification of market trends and identification of technological breakthroughs in synthesis, functionalization, and application development. Quantitative data were triangulated with insights from proprietary databases to ensure consistency and reliability.

Furthermore, the segmentation framework was developed through iterative validation, mapping product types, production processes, applications, and end-use industries to real-world supply and demand dynamics. Regional analyses incorporated macroeconomic indicators, trade flow data, and policy assessments, while company profiles were constructed through financial reports, investor presentations, and expert consultations.

This comprehensive approach ensures that the conclusions drawn and recommendations offered reflect a balanced synthesis of qualitative insights and quantitative evidence, supporting informed strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanoparticle Titanium Dioxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanoparticle Titanium Dioxide Market, by Product Type

- Nanoparticle Titanium Dioxide Market, by Production Process

- Nanoparticle Titanium Dioxide Market, by Application

- Nanoparticle Titanium Dioxide Market, by End-Use Industry

- Nanoparticle Titanium Dioxide Market, by Region

- Nanoparticle Titanium Dioxide Market, by Group

- Nanoparticle Titanium Dioxide Market, by Country

- United States Nanoparticle Titanium Dioxide Market

- China Nanoparticle Titanium Dioxide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Critical Findings and Forward-Looking Perspectives on the Role of Nanoparticle Titanium Dioxide in Future Industrial Applications

The multifaceted analysis presented herein underscores the critical role that nanoparticle titanium dioxide plays across a spectrum of industries. From the nuanced distinctions among anatase, brookite, and rutile structures to the divergent pathways of sulfate and chloride production, this material’s complexity demands a strategic approach to innovation and supply chain management.

The transformative trends in green synthesis, digital manufacturing, and multifunctional applications are reshaping how stakeholders perceive and utilize titanium dioxide nanoparticles. Regulatory pressures and sustainability imperatives are accelerating the adoption of eco-efficient processes, while tariff policies are prompting supply chain realignments that may ultimately enhance domestic production capabilities.

By synthesizing segmentation and regional insights with a detailed understanding of the competitive landscape, organizations can pinpoint the levers that will drive differentiation in product performance, cost efficiency, and environmental stewardship. The actionable recommendations provided chart a clear path for industry participants to secure raw material access, forge collaborative partnerships, and leverage digital tools to achieve operational excellence.

As global priorities evolve toward sustainability and resilience, nanoparticle titanium dioxide stands as a material of both enduring relevance and transformative potential. The strategic decisions made today will determine which companies capitalize on its promise and lead the market forward.

Connect Directly with Ketan Rohom to Unlock Tailored Nanoparticle Titanium Dioxide Market Insights and Strategic Guidance

We appreciate your interest in gaining comprehensive insights into the nanoparticle titanium dioxide market. To explore the full depth of this report and harness its strategic value for your organization, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through tailored data, customized analyses, and strategic frameworks that will empower your decision-making and help you stay ahead in this rapidly evolving sector.

Reach out to schedule a personalized consultation and discover how our rigorous research can drive actionable strategies and competitive advantage for your business.

- How big is the Nanoparticle Titanium Dioxide Market?

- What is the Nanoparticle Titanium Dioxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?