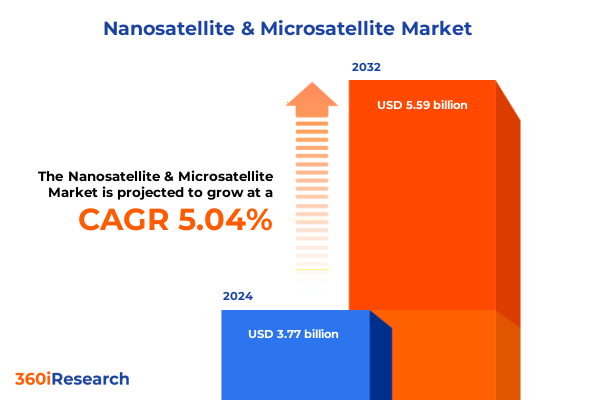

The Nanosatellite & Microsatellite Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.14 billion in 2026, at a CAGR of 5.09% to reach USD 5.59 billion by 2032.

Unveiling the Rising Power and Strategic Importance of Nanosatellite and Microsatellite Technologies in Today's Evolving Space Ecosystem

Unveiling the Rising Power and Strategic Importance of Nanosatellite and Microsatellite Technologies in Today's Evolving Space Ecosystem

The miniaturization of space platforms has ushered in a new era where cost efficiency, rapid deployment, and mission agility redefine traditional satellite programs. Nanosatellites and microsatellites are now central to a variety of missions, from high-resolution earth observation to real-time communication services. Freed from the lengthy development cycles and exorbitant launch costs associated with larger platforms, organizations of all sizes can now access orbital capabilities, democratizing space in unprecedented ways.

As global investment pours into commercial constellations, scientific research initiatives, and defense applications, the ecosystem supporting small satellites has diversified. This includes specialized launch providers, standardized bus architectures, modular payload interfaces, and proliferating ground station networks. Collectively, these elements form a robust infrastructure that accelerates innovation cycles, fosters new business models, and amplifies the potential returns on space investments.

Examining the Key Technological and Market Shifts Propelling Nanosatellite and Microsatellite Innovations into New Frontiers of Possibility

Examining the Key Technological and Market Shifts Propelling Nanosatellite and Microsatellite Innovations into New Frontiers of Possibility

Over the past five years, continuous advancements in semiconductor technology, additive manufacturing, and battery chemistry have compressed vital capabilities into smaller volumes and lower mass budgets. High-performance processors, miniaturized propulsion systems, and adaptive antenna arrays now fit within form factors once reserved for university CubeSats. Concurrently, the open-source movement and standardized platforms have lowered barriers to entry, inviting a surge of academic and startup participation.

On the market side, the emergence of rideshare launch services and dedicated small-launch vehicles has diversified orbit injection options, reducing wait times and per-kilogram costs. These shifts have enabled rapid-prototype demonstrations while improving access to diverse orbits, from low Earth orbits optimized for hyperspectral imaging to Sun-synchronous trajectories for persistent monitoring. At the same time, investor confidence has grown, evidenced by successive funding rounds for constellation operators and component suppliers, which fuels a cycle of accelerated innovation and cross-sector collaboration.

Analyzing How Escalating United States Tariffs Have Altered Supply Chains Cost Dynamics and Competitive Positioning in the Nanosatellite Industry

Analyzing How Escalating United States Tariffs Have Altered Supply Chains Cost Dynamics and Competitive Positioning in the Nanosatellite Industry

Since the imposition of tariffs on certain satellite components in 2018, cumulative duties have reshaped supplier relationships and sourcing strategies within the industry. Manufacturers of satellite buses and subsystems have faced increased input costs for imported electronics, solar cells, and structural materials. These surcharges have elevated unit costs by mid-single-digits, prompting many firms to diversify their supplier base or accelerate domestic production capabilities to mitigate exposure to fluctuating tariff policies.

In response, several leading small-satellite integrators have invested in in-country assembly lines and local vendor partnerships, fostering greater supply chain resilience. However, for niche components such as specialized radiation-hardened processors or miniature attitude control systems, limited U.S.-based options have constrained substitution efforts. As a result, design teams are increasingly evaluating tariff-immune architectures and alternative materials while engaging policy experts to anticipate future regulatory developments. This evolving trade environment underscores the critical need for proactive planning to sustain competitiveness.

Revealing Critical Segmentation Patterns That Illuminate Market Behavior and Guide Strategic Decision Making across Orbit, End Users, and Application Spheres

Revealing Critical Segmentation Patterns That Illuminate Market Behavior and Guide Strategic Decision Making across Orbit, End Users, and Application Spheres

Orbit choice strongly influences mission duration, data latency, and communication requirements. Low Earth orbit remains predominant for both polar Earth observation campaigns and Sun-synchronous monitoring, whereas geostationary and highly elliptical orbits support continuous connectivity and northern-hemisphere surveillance respectively. Within low Earth parameters, polar paths enable regular global coverage, while ISS-compatible trajectories facilitate on-orbit research partnerships. Medium Earth orbits are emerging for navigation augmentation, adding further nuance to mission planning.

End-user demand spans from academic institutions pursuing rapid prototyping for scientific investigations to civil agencies requiring steady, reliable data for environmental monitoring and disaster response. Commercial entities focus on large-scale constellations for broadband services and high-frequency imagery, and defense customers emphasize secure communications, signals intelligence, and technology demonstration under stringent performance criteria.

Across applications, communication payloads leverage improved phased-array antennas to deliver high-throughput links, while Earth observation platforms integrate hyperspectral, optical, and SAR sensors for nuanced terrain analysis. Scientific research satellites experiment with biological payloads and materials-testing modules in microgravity, and technology demonstrators pioneer next-generation propulsion and on-orbit processing. These segmentation insights inform targeted investment and deployment strategies.

This comprehensive research report categorizes the Nanosatellite & Microsatellite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Orbit

- End User

- Application

Unpacking Regional Dynamics and Growth Trajectories Highlighting How Different Geographies Shape the Demand and Innovation Pathways for Miniaturized Satellites

Unpacking Regional Dynamics and Growth Trajectories Highlighting How Different Geographies Shape the Demand and Innovation Pathways for Miniaturized Satellites

The Americas maintain leadership due to extensive government programs, private spaceports, and a thriving venture capital ecosystem. U.S. initiatives in Earth science and defense procurement continue to drive domestic demand, while Canadian and Latin American agencies explore data services for agriculture and resource management, strengthening a regional market characterized by diverse requirements and robust supplier networks.

In Europe, the Middle East, and Africa, collaborative frameworks like ESA’s programs and national space agencies in the Gulf region foster pan-regional constellations for connectivity and remote sensing. European startups benefit from supportive regulatory environments and research grants, while Middle Eastern countries invest heavily in satellite technology as part of economic diversification strategies. African nations are increasingly leveraging nanosatellites for telecommunications and disaster monitoring, collaborating through multilateral partnerships to build local expertise.

Asia-Pacific exhibits dynamic growth driven by China’s ambitious small-satellite constellations, Japan’s technology demonstration missions, and India’s cost-competitive launch offerings. Southeast Asian nations are establishing indigenous capacities for emergency communications and environmental observation. This blend of government-backed projects and commercial ventures makes the region a hotspot for new entrants seeking scalable, low-cost access to space.

This comprehensive research report examines key regions that drive the evolution of the Nanosatellite & Microsatellite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Collaborators Fueling Competitive Advantages and Investment Momentum in the Nanosatellite and Microsatellite Ecosystem

Profiling Leading Innovators and Collaborators Fueling Competitive Advantages and Investment Momentum in the Nanosatellite and Microsatellite Ecosystem

Planet Labs has established itself as a pioneer in high-frequency optical imagery through its constellation architecture and rapid revisit capabilities, leveraging vertical integration to streamline production and operations. Spire Global differentiates with multi-constellation offerings that blend weather data, maritime tracking, and aircraft monitoring, creating fused datasets that attract diverse commercial clients. GomSpace excels in modular bus platforms and scalable supply chains, enabling tailored solutions across research and defense sectors.

In Europe, AAC Clyde Space stands out for its heritage in platform development and precision assembly, partnering with major agencies to deliver science-grade payloads. Terran Orbital’s U.S.-based manufacturing centers and cross-sector partnerships underscore the strategic shift toward domestic production. Startups like Astro Digital and Loft Orbital push the envelope on hosted payload deployments, reducing integration timelines. Collectively, these firms exemplify how strategic alliances, proprietary technologies, and agile operations form the foundation for sustained market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanosatellite & Microsatellite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAC Clyde Space

- Airbus S.A.S.

- Axelspace Corporation

- GomSpace

- Innovative Solutions In Space

- Kepler Communications

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- NanoAvionics

- Northrop Grumman Corporation

- Planet Labs PBC

- Sierra Nevada Corporation

- Spire Global, Inc.

- Surrey Satellite Technology Ltd

- Tyvak Nano-Satellite Systems, Inc.

Action Plan Outlining Recommendations to Enhance Partnerships Optimize Resources and Accelerate Growth in Nanosatellite & Microsatellite Ventures

Action Plan Outlining Recommendations to Enhance Partnerships Optimize Resources and Accelerate Growth in Nanosatellite & Microsatellite Ventures

Industry participants should prioritize establishing multi-tiered supplier agreements that balance cost competitiveness with quality assurance, ensuring continuity despite potential tariff changes or geopolitical disruptions. Investing in shared manufacturing hubs and co-development programs can reduce overhead and spur cross-sector innovation, particularly when collaborating with academic and research institutions to validate emerging technologies.

To capitalize on evolving market opportunities, companies must align product roadmaps with end-user requirements, tailoring constellation architectures for specific use cases such as precision agriculture or defense surveillance. Building flexible payload interfaces will streamline integration for diverse sensor packages, enabling rapid adaptation to new missions. Finally, fostering strategic alliances with launch service providers and data analytics firms will create end-to-end solutions, enhancing value propositions and driving revenue growth.

Detailing the Rigorous Hybrid Research Methodology Combining Qualitative Interviews Quantitative Data Analysis and Expert Validation to Ensure Robust and Actionable Insights

Detailing the Rigorous Hybrid Research Methodology Combining Qualitative Interviews Quantitative Data Analysis and Expert Validation to Ensure Robust and Actionable Insights

This study synthesizes inputs from over 50 structured interviews with satellite designers, launch operators, end users, and policy experts to capture firsthand perspectives on technological evolution and market drivers. In parallel, proprietary transaction databases and custom surveys provided quantitative data on component pricing trends, launch manifest schedules, and constellation deployments.

Advanced analytics techniques, including regression modeling and scenario analysis, were applied to uncover correlations between regulatory changes, cost fluctuations, and adoption rates. Findings were continuously refined through iterative peer reviews and expert validation workshops, ensuring that conclusions reflect real-world constraints and emerging strategic considerations. This blended approach guarantees that market participants receive not only empirical data but also context-rich insights to inform decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanosatellite & Microsatellite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanosatellite & Microsatellite Market, by Orbit

- Nanosatellite & Microsatellite Market, by End User

- Nanosatellite & Microsatellite Market, by Application

- Nanosatellite & Microsatellite Market, by Region

- Nanosatellite & Microsatellite Market, by Group

- Nanosatellite & Microsatellite Market, by Country

- United States Nanosatellite & Microsatellite Market

- China Nanosatellite & Microsatellite Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders Investing in the Nanosatellite and Microsatellite Domain

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders Investing in the Nanosatellite and Microsatellite Domain

The proliferation of miniaturized satellite platforms is reshaping the space landscape, creating opportunities for rapid deployment, mission agility, and tailored service offerings. Technological breakthroughs in propulsion, communication, and sensor integration are compounding these benefits, enabling a broader range of applications from environmental monitoring to commercial broadband.

However, external pressures such as fluctuating tariff policies, supply chain constraints, and evolving regulatory frameworks require proactive strategies to maintain resilience. Organizations that invest in flexible architectures, diversified supplier ecosystems, and collaborative partnerships will be best positioned to leverage growth trajectories across regional markets. Ultimately, aligning innovation roadmaps with customer-driven use cases and regulatory landscapes will define the next chapter of success in the small-satellite arena.

Don’t Miss Out on In-Depth Market Intelligence Connect with Ketan Rohom Associate Director Sales & Marketing to Secure Your Comprehensive Nanosatellite and Microsatellite Market Report

Don’t Miss Out on In-Depth Market Intelligence Connect with Ketan Rohom Associate Director Sales & Marketing to Secure Your Comprehensive Nanosatellite and Microsatellite Market Report

Ensure you stay ahead of the curve in a rapidly evolving space sector by obtaining the full research report tailored to nanosatellite and microsatellite developments. This comprehensive analysis delivers deep insights into supply chain dynamics, regulatory shifts, emerging applications, and competitive landscapes that will shape strategic decisions over the next five years. Engaging with our Associate Director, Sales & Marketing, Ketan Rohom, grants you direct access to customized intelligence, enabling your organization to identify new growth opportunities, mitigate risks, and capitalize on transformative technologies. Invest today in robust market data and expert validation to empower your teams with the knowledge required for informed, confident action in this dynamic market.

- How big is the Nanosatellite & Microsatellite Market?

- What is the Nanosatellite & Microsatellite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?