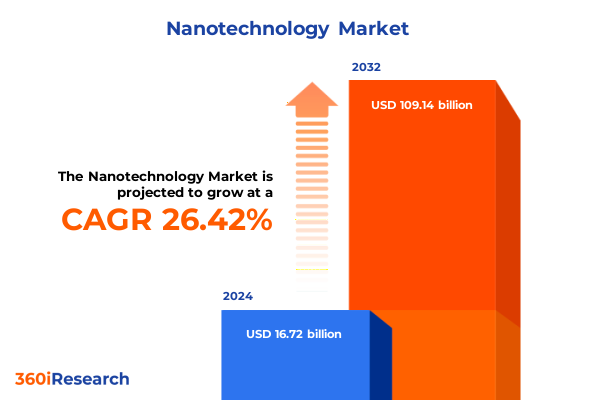

The Nanotechnology Market size was estimated at USD 20.96 billion in 2025 and expected to reach USD 26.33 billion in 2026, at a CAGR of 26.57% to reach USD 109.14 billion by 2032.

Pioneering Nanotechnology Advancements Set to Revolutionize Industries with Unprecedented Precision and Performance Improvements

In recent years, nanotechnology has emerged as a transformative force, integrating atomic-scale engineering into a breadth of industries and unlocking unparalleled advancements. From enhancing the strength and durability of materials to revolutionizing medical diagnostics and targeted drug delivery, the precise manipulation of nanoscale structures is redefining what is possible. This executive summary distills the most critical developments, market dynamics, and strategic imperatives shaping the nanotechnology sector, offering leaders a concise yet comprehensive foundation for informed decision-making.

As global economies prioritize innovation-driven growth, the demand for nanotechnology solutions continues to accelerate. Companies across sectors seek to harness nanoscale phenomena to drive performance, reduce costs, and meet evolving regulatory and sustainability standards. In parallel, academic research breakthroughs and expanded funding initiatives are fueling a pipeline of novel applications, from energy storage enhancements to next-generation electronics. Within this context, understanding the interplay of technological breakthroughs, market forces, and policy shifts is essential for capturing emerging opportunities and mitigating risks.

This summary is structured to guide stakeholders from an overarching landscape overview to actionable insights. By examining key transformational trends, tariff impacts, segmentation nuances, regional dynamics, and competitive positioning, readers will gain a multi-dimensional perspective. Concluding with pragmatic recommendations and a clear call to action, this document equips executives with the clarity and confidence needed to craft robust strategies in an increasingly complex and dynamic nanotechnology ecosystem.

Fundamental Shifts in Nanotechnology Innovations Reshaping Manufacturing Paradigms and Driving Cross-Sector Transformation

Nanotechnology is at the cusp of a new era, driven by fundamental shifts that extend beyond mere material innovation. The convergence of artificial intelligence, big data analytics, and nanoscale fabrication is enabling predictive design of nanostructures, significantly reducing development cycles. Moreover, the integration of digital twin methodologies with nanofabrication processes is fostering real-time monitoring and quality control, resulting in higher yields and lower waste. These technological synergies are setting the stage for scalable commercialization across diverse applications.

In parallel, the pursuit of sustainability has catalyzed the development of eco-friendly nanomaterials and green manufacturing practices. Biodegradable polymer-based nanocomposites, self-cleaning surfaces, and catalytic nanostructures for pollutant degradation illustrate how environmental imperatives are reshaping R&D priorities. Additionally, regulatory frameworks are evolving to address safety and lifecycle concerns, prompting companies to embed responsible innovation principles from the earliest stages of product design.

The shift toward open innovation and cross-sector partnerships is another hallmark of this transformative landscape. Leading corporations, startups, and academic institutions are forming consortiums and public-private collaborations to share resources, standardize testing protocols, and accelerate market entry. As a result, the boundaries between research, manufacturing, and end-use industries are blurring, creating a more interconnected ecosystem that fosters rapid scaling of breakthrough technologies.

Assessing the Aggregate Effects of Updated U.S. Tariff Regimes on Material Costs Supply Chains and Competitive Dynamics in 2025

In 2025, U.S. tariff adjustments on critical nanomaterials and related inputs have introduced significant cost pressures and supply chain complexities. Duties on high-purity metal nanoparticles and certain ceramic compounds have elevated procurement expenses for manufacturers, leading to tighter margins and the need for strategic sourcing alternatives. Companies reliant on imports from key Asian and European suppliers have been compelled to re-evaluate supply agreements and explore local production partnerships to mitigate exposure to duty fluctuations.

These tariff measures have also accelerated efforts to onshore nanomaterial synthesis capabilities. Domestic startups and research institutes are ramping up pilot-scale production of carbon nanotubes and advanced ceramics to capture market share previously dominated by foreign suppliers. This shift, while promising for long-term supply security, necessitates substantial capital investment and development of specialized infrastructure. As a result, organizations are re-prioritizing budget allocations to support domestic capacity building and drive economies of scale.

Moreover, the ripple effects of tariff changes extend to downstream application developers. Increased input costs are reshaping pricing strategies for high-value sectors such as semiconductor manufacturing and life sciences. To preserve competitiveness, several leaders are negotiating multi-year contracts with fixed pricing clauses, leveraging consortium-based purchasing, and adopting advanced inventory management systems. These adaptive practices reflect a broader trend toward proactive risk mitigation and supply chain resilience in an era of evolving trade policies.

Unlocking Comprehensive Market Perspectives through Multidimensional Nanotechnology Segment Analysis Spanning Materials Functions Technologies and Structures

In dissecting the nanotechnology landscape, a multidimensional segmentation framework illuminates where innovation and market traction intersect. The first dimension examines material types, encompassing carbon-based forms such as carbon nanotubes, fullerenes, and graphene alongside ceramic variants including alumina, silica, and titanium dioxide, as well as metal-based matrices and versatile polymers. By categorizing materials this way, stakeholders can pinpoint which chemistries and structural classes are garnering the most research funding, patent filings, and commercial interest.

Functionality serves as the second lens, covering antimicrobial coatings, catalytic surfaces, conductive films, magnetic nanoparticles, self-cleaning treatments, and UV-protection layers. This perspective highlights the direct performance benefits driving end-use adoption, whether in healthcare environments seeking sterile surfaces or industrial processes aiming to enhance reaction rates.

A third dimension focuses on technology approaches, contrasting bottom-up assembly, top-down lithography, nanofabrication platforms, precise nanomanipulation tools, and advanced nanolithography techniques. Understanding these technological pathways reveals how companies allocate R&D budgets, which fabrication paradigms are reaching commercial maturity, and where intellectual property clusters are forming.

The structural segmentation axis spans zero-dimensional quantum dots, one-dimensional nanowires and nanotubes, two-dimensional nanosheets and membranes, and three-dimensional hierarchical architectures. Finally, application segmentation encompasses a wide range of industries: automotive and aerospace innovations for lightweight composites; construction solutions incorporating self-cleaning and antimicrobial additives; cosmetics and personal care products leveraging UV-blocking or encapsulation functions; electronics and semiconductor enhancements in data storage, flexible electronics, and transistor performance; energy and environmental applications targeting improved battery electrodes and pollutant remediation; food and agriculture uses for targeted delivery of nutrients and pesticide control; healthcare and life sciences breakthroughs in diagnostics, drug delivery, imaging, and regenerative medicine; and textile treatments that confer durability, stain resistance, and functional properties. This comprehensive segmentation panorama guides strategic investments by mapping material and technological competencies to market needs.

This comprehensive research report categorizes the Nanotechnology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Functionality

- Technology

- Structure

- Application

Deciphering Regional Nanotechnology Market Dynamics and Growth Pathways across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the nanotechnology domain vary markedly, shaped by distinct regulatory, economic, and innovation ecosystems. In the Americas, robust venture capital flows and strong intellectual property protections underpin rapid growth in advanced materials research and commercial ventures. The United States remains a focal point for pilot-scale manufacturing facilities and collaborative consortiums, whereas Canada’s emphasis on sustainable nanomaterial development complements shifting industry standards toward greener processes. Meanwhile, Latin American players are emerging in agritech applications, leveraging nanoscale formulations to enhance crop yields and post-harvest preservation.

Across Europe, the Middle East, and Africa, policy frameworks such as the European Union’s Horizon funding programs and stringent safety directives are driving companies to adopt harmonized testing and certification pathways. Germany and the United Kingdom lead in automated nanofabrication and high-precision instrumentation, supported by dedicated research clusters. The Middle East’s strategic investments in renewable energy have spurred interest in nanoscale catalysts for hydrogen production, whereas African initiatives are exploring low-cost nanomaterials for water purification.

In the Asia-Pacific region, China’s sustained government backing for nanotechnology, coupled with rapidly expanding manufacturing capabilities, has established it as a dominant force in both raw material production and device integration. Japan and South Korea continue to excel in semiconductor-grade nanomanufacturing and nanoelectronics innovations, while emerging players in India and Southeast Asia focus on cost-effective healthcare and environmental applications. These regional variances underscore the importance of localized strategies to capture unique market opportunities and navigate regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Nanotechnology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Leadership and Competitive Positioning of Key Nanotechnology Innovators Shaping the Industry Landscape

Examining the competitive arena reveals a spectrum of organizations driving progress through patent portfolios, strategic alliances, and proprietary platforms. Established multinationals leverage extensive R&D networks and economies of scale to commercialize bulk nanomaterials and integrate them into existing product lines. In parallel, specialized innovators secure leadership in niche segments by focusing on high-value applications, such as ultra-pure graphene derivatives for electronics or biofunctionalized nanoparticles for therapeutic delivery.

Emerging startups differentiate through agile research models and close university partnerships, frequently spinning out patented discoveries and forming joint ventures with industry incumbents. Their smaller organizational structures enable rapid iteration cycles and bespoke customer solutions. Meanwhile, contract development and manufacturing organizations expand service offerings, bridging gaps between lab-scale breakthroughs and industrial-scale output by providing tailored process optimization, regulatory support, and supply chain management.

Collaborative ecosystems are further enriched by inter-company consortia and public-private partnerships that facilitate shared access to high-cost equipment, standardized testing protocols, and workforce training programs. These arrangements accelerate technology transfer and reduce barriers to entry, especially for mid-sized enterprises seeking to scale novel nanomaterials or functional coatings. Overall, the competitive landscape is characterized by a balance between large organizations anchoring volume supply and nimble innovators targeting specialized functionalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nanotechnology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied Materials, Inc.

- Applied Nanotech, Inc.

- Arkema SA

- BASF SE

- Bayer Aktiengesellschaft

- Bruker Corporation

- Cabot Corporation

- CMC Materials, Inc.

- Coherent Corp.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- HZO, Inc.

- Imina Technologies SA

- InnoScience (Suzhou) Technology Co., Ltd.

- JEOL Ltd.

- Merck KGaA

- Nanocarrier Co., Ltd.

- Nanoco Group plc

- Nanoco Technologies Ltd.

- Nanophase Technologies Corp.

- Nanophase Technologies Corporation

- Nanosys, Inc.

- OCSiAl Group

- PPG Industries, Inc.

- QuantumSphere, Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Tekna Holding ASA

- THERMO FISHER SCIENTIFIC INC.

- Tokyo Electron Limited

- Veeco Instruments Inc.

- Zyvex Labs, LLC

Crafting Proactive Strategies and Practical Recommendations to Drive Competitive Advantage and Sustainable Growth in the Nanotechnology Sector

Industry leaders must pursue a balanced portfolio approach, investing in both core material improvements and groundbreaking application areas. Cultivating partnerships across academia, government research institutes, and end-user organizations will streamline transition from conceptual frameworks to product commercialization. By prioritizing modular pilot lines and flexible manufacturing platforms, companies can de-risk scale-up processes while maintaining agility to adapt to evolving regulatory standards and cost fluctuations.

Embracing sustainability imperatives requires integration of life-cycle assessments early in development stages, ensuring that novel nanomaterials meet environmental safety benchmarks and circular economy criteria. Leadership teams should establish cross-functional task forces to monitor emerging regulations, engage with standardization bodies, and adopt best practices for safe handling and disposal. Robust governance frameworks will not only mitigate compliance risks but also reinforce brand reputation in increasingly eco-conscious markets.

Furthermore, proactive talent development is critical. Firms should implement targeted training programs in nanoscale metrology, data analytics, and regulatory affairs to build interdisciplinary expertise. Concurrently, fostering open innovation through challenge-driven hackathons and collaborative research grants will surface fresh ideas and strengthen organizational resilience. Finally, conducting periodic strategic reviews to reassess tariff exposures, supplier dependencies, and intellectual property landscapes will enable leaders to pivot swiftly and capitalize on emerging growth vectors.

Illuminating Rigorous Research Methodology and Analytical Frameworks Underpinning Comprehensive Nanotechnology Market Insights

The insights presented herein derive from a rigorous, multi-stage research process combining primary and secondary methodologies. Initial desk research involved analysis of publicly available patent filings, academic publications, regulatory directives, and industry white papers to establish a foundational understanding of technology trajectories and policy environments. This phase informed development of targeted interview guides and surveys for primary engagement.

Subsequently, in-depth interviews with senior executives, technical leads, and regulatory specialists across multiple regions provided granular perspectives on supply chain dynamics, cost structures, and market entry barriers. These qualitative insights were triangulated with quantitative data from trade databases, customs reports, and company disclosures to validate emerging trends and competitive positioning.

A comprehensive framework for segment analysis was constructed by mapping material classes, functional attributes, technology approaches, structural forms, and application domains to real-world use cases. Regional dynamics were examined through a blend of macroeconomic indicators, policy reviews, and case studies of successful commercialization pathways. Finally, an iterative validation workshop with industry stakeholders ensured coherence, relevance, and practical applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nanotechnology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nanotechnology Market, by Material Type

- Nanotechnology Market, by Functionality

- Nanotechnology Market, by Technology

- Nanotechnology Market, by Structure

- Nanotechnology Market, by Application

- Nanotechnology Market, by Region

- Nanotechnology Market, by Group

- Nanotechnology Market, by Country

- United States Nanotechnology Market

- China Nanotechnology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Distilling Core Insights and Concluding Perspectives to Solidify Critical Understanding of Nanotechnology Market Imperatives

The interconnected narrative of technological innovation, regulatory evolution, and strategic adaptation underscores the maturation of the nanotechnology field. By synthesizing multidimensional segment analyses with regional and competitive perspectives, this summary elucidates the pathways through which organizations can derive significant value and maintain a competitive edge. The cumulative effect of U.S. tariff revisions, sustainability demands, and cross-sector collaborations highlights the need for agile strategic planning and robust governance frameworks.

As the sector advances, market participants are tasked with balancing the imperatives of rapid commercialization against rigorous safety and environmental standards. Strategic alliances, dynamic supply chain configurations, and continuous talent development emerge as recurring themes essential for navigating complexity. Ultimately, stakeholders that integrate holistic segmentation insights with tailored regional approaches will be best positioned to capitalize on the most promising nanotechnology applications, from next-generation electronics to precision medicine.

Looking ahead, ongoing monitoring of trade policies, regulatory shifts, and technological breakthroughs will be critical. Leaders are encouraged to leverage the structured insights and recommendations presented here to inform investment decisions, partnership strategies, and product roadmaps. Through disciplined execution and a commitment to responsible innovation, the potential of nanotechnology to revolutionize industries can be fully realized.

Empowering Decision Makers with Comprehensive Nanotechnology Market Intelligence to Accelerate Strategic Partnerships and Drive Informed Investments Today

To explore how these insights can inform your strategic roadmap and position your organization at the forefront of nanotechnology innovation, reach out to Ketan Rohom, Associate Director, Sales & Marketing, for tailored guidance and exclusive access to the full market research report. His expertise will help you identify the most promising partnerships, technology investments, and growth opportunities in a market defined by rapid advances and competitive intensity. Don’t miss the chance to leverage comprehensive data, in-depth analysis, and expert recommendations designed to accelerate your decision-making and deliver measurable business impact in the evolving nanotechnology landscape.

- How big is the Nanotechnology Market?

- What is the Nanotechnology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?