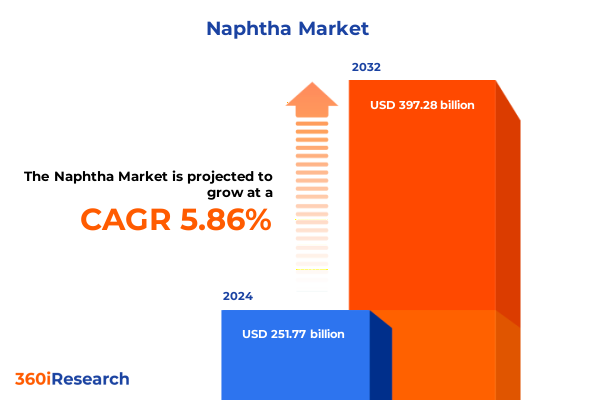

The Naphtha Market size was estimated at USD 266.22 billion in 2025 and expected to reach USD 281.50 billion in 2026, at a CAGR of 5.88% to reach USD 397.28 billion by 2032.

Exploring the Core Role of Naphtha as a Versatile Hydrocarbon Feedstock Shaping Global Energy and Petrochemical Industries

Naphtha stands at the crossroads of the global energy and petrochemical value chains, serving as a critical bridging compound that fuels diverse industrial processes. As a light hydrocarbon mixture derived from crude oil refining and natural gas condensates, its unique properties render it indispensable for gasoline blending, steam cracking, and aromatics production. Furthermore, naphtha’s versatility underpins end-use applications spanning motor fuels, solvents, and base chemicals, making it a barometer for broader market trends and supply chain health.

In recent years, the interplay of energy transition initiatives, feedstock availability, and evolving consumer demand has pushed naphtha into the spotlight. Shifting crude slates, coupled with regulatory pressures aimed at reducing carbon footprints, have compelled refiners and petrochemical manufacturers to reassess their processing strategies. Consequently, naphtha has evolved from a by-product to a strategic asset, with stakeholders prioritizing feedstock flexibility, production efficiency, and end-use adaptability.

Against this backdrop, stakeholders across the refining and petrochemical sectors must understand the fundamental drivers that shape naphtha’s supply, demand, and pricing dynamics. This introduction lays the groundwork for a detailed examination of transformative market shifts, tariff impacts, segmentation insights, and regional variances, culminating in strategic guidance to equip decision-makers with a robust, forward-looking perspective on the naphtha landscape.

Unraveling the Transformative Shifts Defining the Naphtha Market Landscape Amidst Energy Transition and Technological Innovation

The naphtha landscape is undergoing a profound metamorphosis driven by shifts in energy policy, technological breakthroughs, and supply chain realignments. First, the acceleration of decarbonization efforts has steered investment towards low-carbon refining units and advanced petrochemical technologies, enabling producers to optimize naphtha yield while minimizing greenhouse gas emissions. In parallel, digitalization and process automation are enhancing operational agility, allowing plants to swiftly adjust feedstock slates in response to crude quality fluctuations.

Moreover, the rise of alternative feedstocks such as bio-naphtha and pyrolysis oil introduces new competitive dynamics. These renewable variants not only address sustainability mandates but also diversify supply sources, reducing reliance on conventional crude streams. At the same time, improvements in catalyst design and reactor configurations are boosting conversion efficiency, directly influencing naphtha availability and cost structures.

On the demand side, evolving end-use patterns are molding market trajectories. While gasoline blending remains a cornerstone, the petrochemicals segment is witnessing rapid growth, particularly in olefins and aromatics production. This shift is reinforced by urbanization trends and rising consumption of plastics, adhesives, paints, and coatings. Consequently, naphtha’s role has expanded beyond fuel markets, reflecting its strategic importance in underpinning next-generation chemical value chains.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Naphtha Trade Dynamics and Supply Chain Resilience

Throughout 2025, the imposition of successive United States tariffs on key imported feedstocks has reshaped naphtha trade flows, compelling stakeholders to reevaluate sourcing strategies and cost structures. The initial round of duties targeted primary Middle East naphtha shipments, triggering immediate price differentials that incentivized alternative procurement from Asia and Latin America. As a result, traditional logistics corridors were disrupted, with longer transit routes and elevated freight expenses becoming the new norm.

Subsequently, additional levies directed at refined products and intermediates forced refiners to optimize domestic yields, spurring investment in cracking and reforming units. This self-sufficiency drive, while mitigating some tariff pressures, led to temporary feedstock shortages in key Gulf Coast hubs, prompting manufacturers to adopt flexible feedstock strategies and spot-market transactions. Throughout this period, margin compression and inventory rebalancing signaled the cumulative impact of tariffs, underscoring the delicate balance between trade policy and supply chain resilience.

Looking ahead, industry participants must remain vigilant as the tariff landscape continues to evolve. The dual pressures of regulatory intervention and global demand shifts demand robust risk-management frameworks, diversified supplier networks, and dynamic pricing mechanisms to safeguard competitiveness in an increasingly protectionist environment.

Unveiling In-Depth Segmentation Insights Illuminating Diverse Naphtha Supply Chains, Production Pathways, and End Use Applications

A nuanced understanding of naphtha market segmentation reveals the diversity of feedstock grades, production technologies, purity specifications, and end-use requirements that define supplier and consumer preferences. When viewed through the lens of grade classifications-heavy, intermediate, and light-it becomes evident that refiners tailor their crude slates to yield the optimal product for specific downstream processes. Light naphtha frequently feeds steam crackers to maximize olefin output, whereas intermediate and heavy fractions often serve gasoline blending and reforming operations to enhance octane ratings.

Meanwhile, production process segmentation-encompassing catalytic reforming, distillation, pyrolysis, and steam cracking-highlights how technological pathways shape cost profiles and product quality. Distillation remains the foundational step, but catalytic reforming units elevate octane levels, and steam crackers convert naphtha into high-value intermediates. Pyrolysis, increasingly applied to circular feedstocks, introduces an additional dimension of sustainability and circularity.

Purity-driven distinctions-chemical grade, industrial grade, and technical grade-further refine product specification, influencing applications ranging from high-precision chemical synthesis to bulk industrial solvents. In chemical synthesis, stringent purity standards ensure minimal impurities, while industrial and technical grades accommodate less demanding processes. Finally, end-use segmentation underscores the multiplicity of market pathways, from gasoline blending and naphtha reforming in motor fuels to aromatics and olefins production for petrochemicals, extending into adhesives and paint and coatings in the solvents segment. Collectively, these segmentation dimensions illuminate the structural complexity of the market and guide strategic decisions on production, procurement, and investment.

This comprehensive research report categorizes the Naphtha market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Application

- End-Use

- Distribution Channel

Deciphering Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific Influencing Naphtha Market Trajectories

Regional dynamics play a pivotal role in determining naphtha distribution patterns, cost competitiveness, and strategic alignments. In the Americas, a robust refining base combined with expanding petrochemical hubs supports significant naphtha consumption, driving infrastructure upgrades and logistical enhancements along the Gulf Coast and key inland markets. This region’s access to light tight oil and shale condensates affords producers a reliable feedstock supply, enabling them to serve domestic and export markets with competitive pricing.

Shifting focus to Europe, Middle East, and Africa, refining capacity modernization and integration with petrochemical complexes have become central themes. Nations in the Middle East leverage low-cost crude streams to maximize naphtha output, while European refiners emphasize eco-efficient processes and feedstock blending to comply with stringent emissions regulations. Meanwhile, select markets in Africa are gradually scaling up import terminals and storage facilities to capture spillover demand from Europe and Asia.

In Asia-Pacific, rapid industrialization and growing petrochemical demand underpin a surge in naphtha imports. China and India remain dominant players, sourcing volumes from the Middle East and Southeast Asia, while regional infrastructure investments aim to alleviate supply bottlenecks and support diversified sourcing. Coordinated expansions of port capacity and inland terminals enhance resilience, ensuring sustained feedstock availability amid fluctuating global trade conditions.

This comprehensive research report examines key regions that drive the evolution of the Naphtha market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Driving Innovation, Capacity Expansion, and Strategic Partnerships in the Naphtha Market

Leading corporations across the naphtha value chain are distinguished by their strategic investments in refining upgrades, petrochemical integration, and sustainable feedstock development. These companies have prioritized capacity expansions in strategic geographies, establishing joint ventures to secure upstream access and downstream off-take agreements. Technology licensing and catalyst partnerships further enhance operational efficiency and product yield, reflecting a commitment to continuous process optimization.

In addition, proactive collaboration between national oil companies, independent refiners, and chemical producers has fostered integrated value ecosystems. These alliances not only streamline logistics and reduce transaction costs but also facilitate shared research into next-generation cracking technologies and renewable naphtha analogs. Strategic acquisitions and mergers have consolidated market positions, enabling key players to leverage economies of scale and exercise greater influence over pricing mechanisms.

Sustainability initiatives have emerged as a defining characteristic of top performers. By investing in carbon capture retrofits, bio-feedstock trials, and circular economy pilot projects, these companies demonstrate a dual focus on environmental stewardship and future-proofing their portfolios. Collectively, their activities underscore the importance of adaptive strategies and collaborative ecosystems in navigating the evolving naphtha landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Naphtha market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alexandria Mineral Oils Company

- Asahi Kasei Corporation

- Bajrang Petrochemicals Pvt Ltd

- Chevron Corporation

- Chevron Phillips Chemical Company LLC

- China National Petroleum Corporation

- East India Chemical International

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Hari Organics

- Hefei TNJ Chemical Industry Co.,Ltd.

- Hemraj Petrochem Pvt. Ltd.

- Henan Tianfu Chemical Co.,Ltd

- Indian Oil Corporation Ltd.

- JFE Chemical Corporation

- Lakshmi Saraswati Chemicals And Organic Private Limited

- LG Chem, Ltd.

- Reliance Industries Limited

- Sasol Limited

- Saudi Arabian Oil Co.

- Saudi Basic Industries Corporation

- Shell plc

- SINOPEC Hainan Petrochemical Co., Ltd.

- Vizag Chemical International

Actionable Recommendations Empowering Industry Leaders to Capitalize on Market Opportunities and Navigate Future Naphtha Trends

Industry leaders seeking to navigate the evolving naphtha landscape must adopt a multifaceted approach that balances operational efficiency with strategic foresight. First, accelerating investments in process digitalization and advanced analytics will enable real-time feedstock optimization, reducing downtime and enhancing margin management. Coupled with agile procurement frameworks, this digital prowess can mitigate supply disruptions and capitalize on arbitrage opportunities.

Second, diversifying feedstock sources through partnerships with renewable feedstock producers and alternative supply chains will bolster resilience. By integrating bio-naphtha and pyrolysis-derived streams into existing operations, companies can meet sustainability targets while maintaining competitiveness. Third, forging collaborative ventures that align refiners with chemical manufacturers will streamline value chains, unlocking new avenues for co-investment in cracking and reforming technologies.

Finally, embedding environmental, social, and governance criteria into every strategic decision will not only satisfy regulatory imperatives but also enhance brand reputation and stakeholder trust. By prioritizing low-carbon technologies, carbon capture implementations, and circular economy pilots, industry leaders can position themselves as preferred partners for downstream customers and financiers alike. This comprehensive strategy will ensure long-term profitability and market relevance.

Comprehensive Research Methodology Outlining Rigorous Data Collection, Analysis Frameworks, and Validation Protocols

The research underpinning this report employs a rigorous methodology that combines primary interviews, secondary data analysis, and quantitative modeling to ensure analytical integrity. Primary research involved structured discussions with industry executives, process engineers, and procurement specialists across the refining and petrochemical sectors. These interactions provided direct insights into feedstock strategies, technology adoption, and tariff mitigation tactics.

Secondary research encompassed an exhaustive review of industry publications, regulatory filings, and trade statistics from recognized repositories, enabling a contextual understanding of historical trends and policy developments. Market intelligence was further enriched by cross-referencing customs data, trade flow analytics, and proprietary databases to validate supply and demand patterns.

Quantitative models were constructed to simulate tariff scenarios, feedstock yield variations, and regional consumption shifts, employing sensitivity analyses to assess the robustness of strategic options. Data quality assurance protocols, including triangulation and peer review, bolstered the reliability of findings. This comprehensive framework ensures that every conclusion is grounded in empirical evidence and reflects the current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Naphtha market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Naphtha Market, by Product Type

- Naphtha Market, by Source

- Naphtha Market, by Application

- Naphtha Market, by End-Use

- Naphtha Market, by Distribution Channel

- Naphtha Market, by Region

- Naphtha Market, by Group

- Naphtha Market, by Country

- United States Naphtha Market

- China Naphtha Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Critical Naphtha Market Insights Highlighting Strategic Imperatives for Stakeholders in an Evolving Landscape

In summary, naphtha continues to occupy a central position in the global energy and petrochemical ecosystems, its significance shaped by evolving regulatory landscapes, technological advancements, and supply chain realignments. The transformative shifts toward decarbonization and feedstock diversification are redefining production and consumption paradigms, while tariff interventions highlight the critical interplay between trade policy and market resilience.

Segmentation analyses underscore the multifaceted nature of the naphtha value chain, illuminating how grade, production process, purity, and end-use distinctions drive strategic decisions. Regional insights reveal varied dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific, each presenting unique challenges and opportunities. Moreover, key industry players are demonstrating the power of collaboration, innovation, and sustainability in shaping future trajectories.

Stakeholders equipped with a holistic understanding of these trends can craft agile strategies that harness digitalization, diversify feedstock portfolios, and align with environmental objectives. By doing so, they will secure competitive advantage and navigate uncertainty, ensuring that naphtha remains a catalyst for growth and innovation.

Engage Directly with Ketan Rohom to Access the Comprehensive Naphtha Market Research Report and Drive Informed Strategic Decisions

To delve deeper into the comprehensive naphtha market research report and obtain authoritative insights tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He possesses an in-depth understanding of industry drivers, regional dynamics, and emerging trends, ensuring your organization gains the intelligence needed for data-driven decision-making. By engaging with Ketan, you can secure a customized consultation to explore detailed segmentation, tariff impact analyses, and actionable recommendations designed to enhance your competitive positioning. Take this opportunity to partner with a recognized expert who will guide you through the complexities of the naphtha landscape and deliver the clarity you need to navigate future challenges and capitalize on growth prospects.

- How big is the Naphtha Market?

- What is the Naphtha Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?