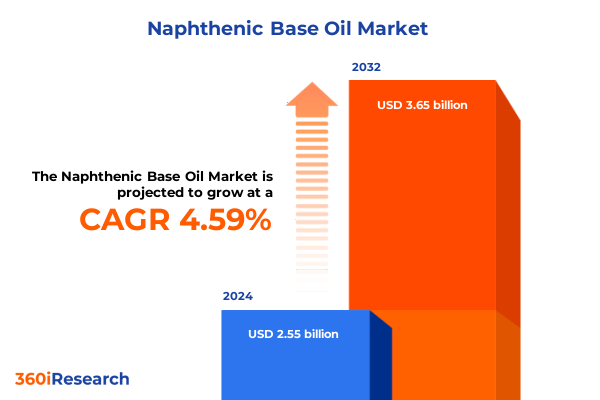

The Naphthenic Base Oil Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 4.62% to reach USD 3.65 billion by 2032.

Understanding the Essential Properties and Industrial Importance of Naphthenic Base Oils in Contemporary Manufacturing and Lubrication Applications

Naphthenic base oils represent a specialized class of petroleum-derived stocks distinguished by a high proportion of cycloparaffinic hydrocarbons and minimal wax content, imparting unique solvency, thermal stability, and low-temperature performance. According to chemical composition analyses, these oils exhibit intermediate viscosity indices and high aromatic solvency, making them essential feedstocks for specialty lubricant and process oil formulations. Their chemical purity and low aniline points enable compatibility with diverse additives and polymer systems, a feature that underpins their widespread use in rubber compounding, metalworking fluids, and insulating oils.

Over the past decade, increasing regulatory scrutiny on polycyclic aromatic hydrocarbons and environmental mandates for reduced volatility have driven refiners to invest in high-severity hydrotreating and solvent refining processes. These technological advancements have elevated product quality, with hydrotreated naphthenic base oils now offering lower sulfur content and superior oxidative resistance compared to conventional solvent-refined alternatives. As industries demand more consistent performance under extreme conditions, naphthenic oils have emerged as indispensable inputs for applications requiring precise thermal management and solvency.

In tandem with refining innovations, global end-use sectors such as automotive manufacturing, industrial machinery, and power generation have intensified their reliance on naphthenic base oils. Their ability to enhance lubricity, reduce wear, and maintain fluidity at low temperatures continues to drive adoption, even as alternative base oil groups gain traction. This introduction sets the stage for an in-depth exploration of market shifts, trade policy impacts, segmentation nuances, and actionable strategies that define the current naphthenic base oil landscape.

Exploring How Emerging Refining Technologies and Sustainability Imperatives Are Dynamically Reshaping the Naphthenic Base Oil Value Chain Worldwide

The naphthenic base oil value chain is undergoing profound transformation fueled by emerging refining technologies and evolving sustainability imperatives. In recent years, the rise of advanced hydrotreating processes-particularly high-severity hydroisomerization-has enabled refiners to produce basestocks with greater purity, improved viscosity profiles, and enhanced color stability. Compared to solvent-refined oils, hydrotreated naphthenic stocks exhibit lower total acid numbers and superior oxidative resistance, attributes that extend asset life and reduce maintenance cycles in high-temperature applications.

Concurrently, regulatory pressures and corporate sustainability targets are accelerating the shift toward bio-based and recyclable lubricant solutions. Industry reports indicate that synthetic and bio-derived lubricants are securing a growing share of the market as formulators seek low-carbon alternatives and compliance with global PFAS restrictions. These trends are prompting base oil suppliers to explore circular economy models, invest in reclaim infrastructure, and develop low-viscosity blends that meet stringent environmental standards without compromising performance.

Digital transformation also plays a pivotal role, with the integration of IoT-enabled sensors and data analytics enhancing supply chain transparency and predictive maintenance capabilities. By capturing real-time insights on lubricant condition and equipment health, end users can optimize oil change intervals, reduce waste, and improve overall equipment effectiveness. The convergence of cutting-edge refining techniques, sustainability goals, and digitalization is thus reshaping the traditional naphthenic base oil ecosystem, creating new opportunities and competitive dynamics across the global value chain.

Analyzing the Comprehensive Effects of the 2025 United States Trade Tariffs on Naphthenic Base Oil Supply Chains and Cost Structures

The introduction of sweeping U.S. trade tariffs in early 2025 has exerted mixed influences on naphthenic base oil supply chains and cost structures. While base oil imports were broadly exempted under the energy-related goods carve-out, certain Canadian energy imports that fail to meet strict rules of origin now attract duties up to 25% under revised USMCA enforcement guidance. This nuanced tariff landscape has prompted North American lubricants manufacturers to reevaluate sourcing strategies, turning to domestic and allied suppliers to mitigate duty exposure.

Canada’s retaliatory levies, including 25% duties on U.S. finished lubricants and naphthenic oils, have further complicated cross-border trade flows, compelling multinational firms to restructure distribution networks and negotiate new offtake agreements with local partners. These actions have disrupted established logistics corridors, leading to short-term inventory surges in certain ports and tightness in key distribution hubs. As a result, supply continuity planning and freight cost optimization have become critical priorities for industry stakeholders.

Industry associations such as SOCMA and the American Chemistry Council have voiced concerns over the potential for prolonged uncertainty, highlighting that input cost inflation and shifting trade alliances could erode downstream competitiveness. Nevertheless, some domestic refiners and base oil producers have leveraged tariff protections to secure improved margin structures, aligning capacity expansions with localized demand centers. Looking ahead, the cumulative impact of these tariffs underscores the need for dynamic risk management and collaborative engagement with trade policy makers to ensure resilient, cost-effective access to naphthenic basestocks.

Uncovering Critical Segmentation Perspectives That Illuminate Product, Process, Packaging, Application, Distribution, and End-Use Dynamics in Naphthenic Base Oils

A multifaceted segmentation framework illuminates the diverse requirements and performance attributes that shape naphthenic base oil utilization across end markets. Product type segmentation reveals a continuum of viscosity-gravity constant (VGC) grades-ranging from light naphthenic oils prized for their low pour points and precision flow to heavy naphthenic oils valued for film thickness and load-bearing capacity-each tailored to specific formulation and operational criteria.

Process type differentiation underscores the distinction between hydrotreated and solvent refined naphthenic basestocks. Hydrotreated products deliver enhanced saturation, reduced sulfur content, and elevated viscosity indices, whereas solvent refined variants maintain natural aromatics that aid seal compatibility and solubility of select additives. The packaging type segmentation-spanning bulk tankers for large industrial accounts, intermediate drums for mid-volume users, and small cans and pails for laboratory and specialty applications-reflects the logistical and inventory management needs of varied customer profiles.

Application segmentation encompasses a spectrum of end uses. Lubricants and greases branch into automotive and industrial specialties, with each requiring unique additive blends and performance metrics. Metalworking fluids, printing inks and dyes, refrigeration oils, and transformer insulating fluids each leverage naphthenic oils’ solvency and stability in distinct ways. Distribution channel insights highlight the coexistence of legacy offline networks-driven by technical sales and warehousing-and emerging online platforms that facilitate direct, rapid fulfillment. End-use segmentation spans automotive, chemical & petrochemical, construction, industrial manufacturing, marine & shipping, printing & packaging, rubber & plastics, and textile sectors, illustrating the broad applicability and tailored value propositions of naphthenic base oils across industrial landscapes.

This comprehensive research report categorizes the Naphthenic Base Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Process Type

- Packaging Type

- Application

- Distribution Channel

- End-use

Evaluating Regional Market Dynamics and Demand Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific for Naphthenic Base Oils

Regional market dynamics reveal distinct drivers and supply characteristics that inform strategic planning and investment. In the Americas, robust infrastructure for refining and blending supports a mature market where demand for industrial lubricants and greases remains steady. Despite increased domestic capacity, the United States continues to import premium Group III basestocks predominantly from Northeast Asia and the Middle East, reinforcing the importance of diversified supply agreements to offset tariff and geopolitical risks.

Europe, the Middle East & Africa (EMEA) is shaped by stringent environmental and performance regulations, prompting refiners to emphasize low-PAH naphthenic oils and invest in advanced hydrotreating units. Energy-producing nations in the Middle East export competitively priced stocks, while European end users seek high-quality, low-aromatic solutions for transformer, printing ink, and specialty lubricant applications. Africa’s growing infrastructure projects and nascent industrialization are generating incremental demand, setting the stage for future capacity additions.

Asia-Pacific stands out as the fastest-growing consumption region, driven by expanding automotive markets, rising metallurgical and chemical manufacturing, and investment in power generation. China’s state refiners have ramped up throughput to address low product inventories, with naphthenic production capacities accounting for nearly a quarter of national base oil output. India’s burgeoning construction and petrochemical sectors further bolster demand for solvent refined and hydrotreated naphthenic oils, making the region a focal point for capacity expansion and partnerships.

This comprehensive research report examines key regions that drive the evolution of the Naphthenic Base Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Competitive Positioning of Leading Naphthenic Base Oil Producers and Specialty Suppliers in a Shifting Market

Leading producers and specialty suppliers are deploying strategic initiatives to strengthen their competitive positioning in the evolving naphthenic base oil market. Calumet Specialty Products Partners, through its HYDROCAL™ line, leverages multi-stage hydrotreating technology to deliver naphthenic oils with rigorous IP-346 compliance and broad viscosity-gravity profiles tailored for metalworking, hydraulic, and aviation fluid applications. Its INKOL® series addresses the unique solvency and color stability demands of high-quality printing inks.

Shell’s lubricants stewardship programs emphasize product safety and environmental responsibility, providing comprehensive guidance on hydrotreated heavy and light naphthenic stocks as part of its voluntary ICCA Global Product Strategy commitments. The company also offers advanced catalyst licensing via Shell Catalysts & Technologies to optimize yields and quality for both naphthenic and paraffinic basestocks across global refining operations.

State-owned PetroChina commands a leading share of China’s naphthenic output, reflecting over 40% of domestic production volume. Its ongoing investments in additional hydroprocessing units aim to upgrade existing plants and expand capacity in response to rising petrochemical feedstock demand. Strategic collaborations, capacity expansions, and technology licensing agreements among these and other key players are reshaping the competitive landscape, underscoring the importance of innovation and localized supply solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Naphthenic Base Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Calumet Specialty Products Partners, L.P.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Ergon, Inc.

- Exxon Mobil Corporation

- GS Caltex Corporation

- H&R Ölwerke Schindler GmbH

- Hindustan Petroleum Corporation Limited (HPCL)

- Idemitsu Kosan Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited (IOCL)

- Jiangsu Zhongneng Chemical Technology Co., Ltd.

- Lukoil Oil Company

- Nynas AB

- Panama Petrochem Ltd.

- Petro-Canada Lubricants Inc

- Petrobras – Petróleo Brasileiro S.A.

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Repsol S.A.

- Royal Dutch Shell PLC

- Sepahan Oil Company

- Tatneft PJSC

- TotalEnergies SE

Delivering Practical Strategic Recommendations for Industry Leaders to Enhance Resilience, Innovation, and Growth in the Naphthenic Base Oil Sector

To navigate the complex interplay of tariff regimes, evolving refining technologies, and shifting end-use requirements, industry leaders should prioritize the diversification of feedstock and product portfolios. Establishing long-term agreements with both domestic and allied international suppliers will mitigate exposure to discretionary duties and geopolitical disruptions. Furthermore, investing in flexible refining configurations-capable of toggling between hydrotreating severity levels-will enhance resilience and allow rapid response to inlet crude quality fluctuations.

Embracing sustainability drivers through the development of low-PAH and recyclable naphthenic basestocks can open new market segments in bio-lubricant and PFAS-free formulations, aligning with tightening environmental regulations. Collaborations with additive manufacturers to engineer tailored chemistries optimized for low-viscosity, high-solvency naphthenic fluids can differentiate portfolios and capture value in specialty applications.

Finally, leveraging digital supply chain platforms that integrate real-time inventory monitoring and predictive maintenance analytics will improve service levels and support data-driven decision making. By combining supply chain agility with continuous technology enhancements and sustainability commitments, companies can position themselves for growth and maintain competitive advantage in the naphthenic base oil sector.

Detailing a Robust Methodological Framework Integrating Primary Interviews, Secondary Research, and Data Validation for Naphthenic Base Oil Market Analysis

'This study employs a comprehensive research methodology that integrates primary and secondary data sources to ensure robust market insights. Primary research involved structured interviews with senior executives from leading refiners, additive specialists, and end-use sector experts to capture qualitative perspectives on supply chain dynamics, technology adoption, and regulatory impacts. These insights were triangulated with field surveys conducted at key production and distribution facilities across North America, EMEA, and Asia-Pacific to validate operational data and emerging trends.

Secondary research encompassed in-depth analysis of public disclosures, technical whitepapers, industry association publications, and government customs databases. Refining technology advancements were corroborated through technical journals and proprietary catalyst licensing reports. Trade policy impacts were assessed by reviewing official tariff schedules, USTR announcements, and trade association statements. Data validation procedures included cross-referencing import/export statistics from national customs agencies and shipment data from specialized logistics providers.

Quantitative analyses leveraged a structured segmentation framework, encompassing product type, process type, packaging, application, distribution channel, and end-use dimensions. Regional market sizing and supply chain assessments were conducted using harmonized data inputs to ensure consistency. This methodological rigor underpins the credibility and actionable value of the resulting strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Naphthenic Base Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Naphthenic Base Oil Market, by Product Type

- Naphthenic Base Oil Market, by Process Type

- Naphthenic Base Oil Market, by Packaging Type

- Naphthenic Base Oil Market, by Application

- Naphthenic Base Oil Market, by Distribution Channel

- Naphthenic Base Oil Market, by End-use

- Naphthenic Base Oil Market, by Region

- Naphthenic Base Oil Market, by Group

- Naphthenic Base Oil Market, by Country

- United States Naphthenic Base Oil Market

- China Naphthenic Base Oil Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude the Comprehensive Analysis of the Naphthenic Base Oil Landscape

The convergence of refining innovations, sustainability priorities, and trade policy developments has redefined the strategic landscape for naphthenic base oils. Enhanced hydrotreating and solvent refinement processes now underpin product differentiation, while digital transformation and circular economy initiatives drive operational efficiency and environmental stewardship. Tariff exemptions on energy-related imports have provided short-term relief, yet nuanced USMCA enforcement and retaliatory duties underscore the need for diversified sourcing and agile supply chain management.

Segmentation insights highlight the importance of matching specific viscosity-gravity grades and process types to application requirements, with product, packaging, and distribution considerations shaping customer value propositions. Regional variations-from North America's import reliance to Asia-Pacific’s accelerated consumption growth-emphasize the imperative for localized strategies and partnerships. Key producers and specialty suppliers are advancing through capacity expansions, technology licensing, and sustainability commitments to strengthen market positioning.

Collectively, these findings demonstrate that success in the naphthenic base oil sector hinges on integrated approaches that blend technological adaptability, supply chain resilience, and strategic foresight. Stakeholders who proactively address these dimensions will be best equipped to capitalize on emerging opportunities and navigate the complexities of a dynamic global marketplace.

Engage with Associate Director Ketan Rohom Today to Secure Your Comprehensive Naphthenic Base Oil Market Research Report and Accelerate Strategic Decision Making

To obtain the full market research report and gain deeper visibility into critical trends, supply chain dynamics, and strategic opportunities within the naphthenic base oil industry, contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in guiding decision-makers toward data-driven strategies and can provide you with customized insights, flexible licensing options, and executive summaries tailored to your organization’s priorities. Reach out to Ketan today to arrange a personalized briefing, secure your copy of the comprehensive report, and equip your team with the intelligence needed to stay ahead in a rapidly evolving market landscape

- How big is the Naphthenic Base Oil Market?

- What is the Naphthenic Base Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?