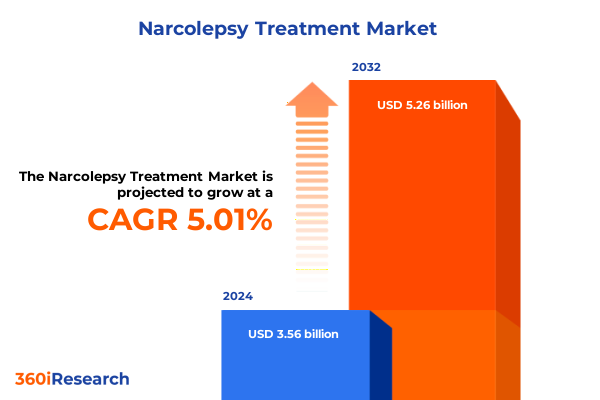

The Narcolepsy Treatment Market size was estimated at USD 3.73 billion in 2025 and expected to reach USD 3.92 billion in 2026, at a CAGR of 5.03% to reach USD 5.26 billion by 2032.

Navigating the Complexities of Narcolepsy Treatment and Establishing the Strategic Imperatives That Drive Future Therapeutic Breakthroughs

The field of narcolepsy treatment has evolved significantly, yet patients and industry leaders alike continue to face a complex array of challenges that require nuanced solutions. In recent years, expanding scientific understanding of the orexin signaling pathway and its role in sleep–wake regulation has catalyzed the development of novel therapeutic modalities, transforming what was once a purely symptom-based approach into one that seeks to modify disease pathology. At the same time, clinicians must balance clinical efficacy with patient adherence, side effect profiles, and cost considerations, underscoring the multifaceted nature of decision-making in this therapeutic area.

Against this backdrop, the U.S. market is poised at a pivotal juncture where policy dynamics, evolving reimbursement models, and the advent of next-generation pharmacologics intersect. Stakeholders ranging from biopharmaceutical innovators to payors must anticipate shifts in treatment paradigms while navigating regulatory pathways that have become increasingly sophisticated. As a result, strategic clarity is paramount; only through a comprehensive synthesis of scientific breakthroughs, market forces, and patient needs can industry participants develop robust frameworks for sustainable growth and improved patient outcomes.

Groundbreaking Approvals and Digital Health Integration Spur Unprecedented Transformation in Narcolepsy Therapeutics

Several key inflection points have reshaped the narcolepsy treatment ecosystem in recent years. Breakthrough approvals of orexin receptor agonists have marked the first novel mechanism of action in the field in decades, challenging long-standing reliance on stimulants and sodium oxybate. Simultaneously, advances in precision diagnostics-such as cerebrospinal fluid orexin level testing-have refined disease classification and enabled more targeted patient selection. These diagnostic innovations have translated into higher clinical trial success rates, shortening development timelines and driving a paradigm shift toward mechanism-based therapies.

In parallel, growing digital health adoption has introduced complementary solutions for symptom management, from wearable sleep trackers to mobile applications that facilitate real-time patient monitoring. By integrating real-world evidence with traditional clinical endpoints, stakeholders are now gaining richer insights into long-term efficacy and safety profiles. Consequently, transformative shifts within the therapeutic landscape are not limited to pharmacology alone but encompass a convergence of diagnostics, digital health tools, and novel therapeutic modalities that collectively redefine the standards of care for patients with narcolepsy.

Amplified Supply Chain Pressures and Cost Volatility Highlight the Cumulative Effects of 2025 Tariff Revisions on Narcolepsy Therapies

The implementation of revised U.S. tariffs on imported pharmaceutical excipients and active ingredients in early 2025 has introduced considerable operational challenges for manufacturers and distributors of narcolepsy therapies. As import duties on key raw materials increased, supply chains experienced delays and cost escalations, prompting strategic realignment in sourcing practices. Domestic production of certain precursors has scaled up in response, yet cannot fully offset the immediate impact on manufacturing costs and lead times, leaving some treatment centers vulnerable to inventory fluctuations.

Moreover, rising input costs have exerted downward pressure on manufacturer margins, forcing price negotiations with payors and accentuating concerns about patient affordability. In anticipation of tighter market conditions, several leading companies have revisited their pricing strategies and engaged in value-based contracting to safeguard market access. Looking ahead, the cumulative impact of these tariffs underscores the need for dynamic supply chain resilience and sustained dialogue between industry stakeholders and policymakers to mitigate the risk of therapy disruptions and preserve patient-centric outcomes.

Unraveling the Layered Market Dynamics Through Drug Class, Disorder Type, Age Group, and Channel Segmentation to Inform Targeted Strategies

A nuanced view of the narcolepsy treatment market emerges when segmenting by therapeutic class, revealing distinct dynamics among antidepressants, orexin receptor agonists, sodium oxybate, and stimulants. Antidepressants continue to play an ancillary role in attenuating cataplexy, yet growing adoption of orexin receptor agonists reflects a preference for disease-modifying strategies over symptomatic relief alone. In this context, sodium oxybate maintains a niche profile for nocturnal symptom control, while stimulants serve as a cornerstone for managing excessive daytime sleepiness, each class contributing uniquely to comprehensive patient management.

In parallel, disorder type segmentation underscores divergent treatment pathways for Type 1 and Type 2 narcolepsy. With Type 1 characterized by orexin deficiency and cataplexy, patients often require combination therapy regimens, whereas those with Type 2 may benefit from monotherapy approaches, influencing formulary placement and prescribing behavior. Further granularity is provided by age group segmentation: adult patients represent the largest cohort, yet pediatric and geriatric populations exhibit specific safety and dosing considerations that drive tailored clinical protocols. Finally, distribution channel insights reveal that hospital pharmacies account for a key share of inpatient initiation, online pharmacies continue to gain traction for maintenance therapy, and retail pharmacies remain essential for patient convenience and adherence.

This comprehensive research report categorizes the Narcolepsy Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Disorder Type

- Age Group

- Distribution Channel

Deciphering Regional Disparities in Access, Regulation, and Development to Craft Location-Specific Approaches in Narcolepsy Treatment

Geographically, the narcolepsy treatment market displays significant heterogeneity across major regions. In the Americas, robust investment in R&D and patient advocacy has accelerated access to cutting-edge therapies, yet disparities in rural and underserved areas persist. Transitioning eastward, Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and reimbursement policies, where centralized approval mechanisms coexist with national payor negotiations that affect time-to-market and patient affordability in variable ways.

Meanwhile, the Asia-Pacific region has emerged as a hotspot for clinical development, buoyed by growing academic–industry collaborations and evolving regulatory harmonization initiatives. Local manufacturing capabilities are expanding, enabling improved supply chain agility, though intellectual property protections and market entry barriers continue to shape competitive dynamics. Across all regions, heterogeneous health system architectures drive divergent adoption curves, underscoring the importance of bespoke market entry and patient engagement strategies.

This comprehensive research report examines key regions that drive the evolution of the Narcolepsy Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Strategic Alliances and Innovative Biotechnologies Are Redefining Competitive Leadership in the Narcolepsy Treatment Ecosystem

Leading biopharmaceutical companies and emerging innovators alike are jockeying for position in the narcolepsy treatment domain. Established firms leverage extensive commercial infrastructures and deep regulatory expertise to maintain momentum behind legacy therapies while selectively in-licensing novel assets. In contrast, nimble biotechnology ventures are pursuing first-in-class orexin agonists and advanced formulation technologies, often relying on strategic partnerships to bridge the gap between early-stage discovery and late-stage development.

Moreover, contract research organizations and specialized disease advocacy groups are playing increasingly critical roles, offering operational support and patient outreach that de-risk clinical trials. Cross-sector collaboration between device manufacturers and pharmaceutical companies is becoming more commonplace, particularly in digital therapeutics aimed at optimizing dosing schedules and monitoring treatment adherence. Collectively, these competitive and cooperative forces shape a dynamic ecosystem where innovation is as much about strategic alliances as it is about scientific discovery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Narcolepsy Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca plc

- Avadel Pharmaceuticals

- Bayer AG

- Boehringer Ingelheim GmbH

- Cipla Limited

- Eli Lilly and Company

- Glenmark Pharmaceuticals Limited

- Indivior plc

- Jazz Pharmaceuticals plc

- Johnson & Johnson Services, Inc.

- Lannett Company, Inc.

- Lupin Limited

- Merck & Co., Inc.

- Mylan N.V. by Viartis

- NLS Pharmaceutics

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Limited

Optimizing Value Propositions and Collaborative Ecosystems to Drive Sustainable Growth and Enhance Patient Access in Narcolepsy Care

Industry leaders seeking to strengthen their foothold in the narcolepsy treatment space should prioritize integrated value propositions that align clinical differentiation with economic value. By deploying real-world evidence programs and patient-centric outcomes studies, companies can substantiate therapy benefits and negotiate favorable reimbursement terms. Simultaneously, pursuing manufacturing diversification-whether through dual‐source suppliers or regional fill-finish partnerships-can mitigate supply chain risks accelerated by policy shifts and geopolitical volatility.

Additionally, cultivating collaborative ecosystems that span payors, healthcare providers, and patient advocacy organizations will be pivotal in driving awareness and adherence. These alliances can underpin educational initiatives and digital support platforms that enhance patient engagement. Finally, embedding advanced analytical capabilities into commercial operations-leveraging predictive modeling and AI-driven insights-will enable agile forecasting of demand patterns and streamline go-to-market strategies, ensuring that new and existing therapies reach the right patients at the right time.

Employing Rigorous Mixed-Methods Research Combining Executive Interviews, Peer-Reviewed Literature, and Quantitative Frameworks for Unbiased Insights

This report synthesizes primary research insights from in-depth interviews with industry executives, clinical investigators, and patient advocacy leaders, complemented by secondary data harvested from peer-reviewed journals, regulatory filings, and public financial disclosures. Quantitative analyses were conducted using a proprietary framework that maps therapeutic innovations against market adoption curves, while qualitative assessments involved scenario planning workshops to evaluate potential policy impacts and stakeholder responses.

To ensure data integrity and relevance, a multi-tiered validation process was employed, including cross-verification with KOL insights and consensus building via Delphi panels. Ethical guidelines were strictly observed in all primary interactions, and data collection methodologies adhered to industry best practices for transparency and reproducibility. The result is a comprehensive, rigorously vetted body of work designed to support strategic decision-making across the narcolepsy treatment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Narcolepsy Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Narcolepsy Treatment Market, by Drug Class

- Narcolepsy Treatment Market, by Disorder Type

- Narcolepsy Treatment Market, by Age Group

- Narcolepsy Treatment Market, by Distribution Channel

- Narcolepsy Treatment Market, by Region

- Narcolepsy Treatment Market, by Group

- Narcolepsy Treatment Market, by Country

- United States Narcolepsy Treatment Market

- China Narcolepsy Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Anticipating Shifts in Therapy Modalities, Policy Landscapes, and Competitive Forces to Secure Lasting Differentiation in Narcolepsy Treatment

As the narcolepsy treatment market transitions into an era of mechanism-based therapies and digital augmentation, the imperative for strategic agility has never been greater. The cumulative effects of regulatory evolutions, tariff adjustments, and emergent competitive forces have redefined the parameters of success. Stakeholders who can anticipate these shifts and proactively adapt will unlock new avenues for clinical and commercial value.

Ultimately, sustainable differentiation will hinge on holistic strategies that integrate scientific innovation, supply chain resilience, and patient-centric engagement. By remaining attuned to the evolving landscape and embracing collaborative models, companies can not only enhance their market positioning but also contribute meaningfully to improving long-term patient outcomes and quality of life.

Unlock Exclusive Expert Insights and Accelerate Strategic Decision-Making by Connecting with Ketan Rohom to Obtain Your Comprehensive Narcolepsy Treatment Market Report

To explore a comprehensive deep dive into the evolving landscape of narcolepsy treatment and secure privileged insights that can inform your strategic initiatives, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage directly with an expert who can guide you through the full market research report, tailoring recommendations to your organization’s unique objectives and ensuring you capitalize on emerging opportunities in this dynamic sector. Accelerate your decision-making process by obtaining exclusive access to proprietary data, analytical frameworks, and actionable intelligence designed to empower your next strategic moves in the narcolepsy treatment domain.

- How big is the Narcolepsy Treatment Market?

- What is the Narcolepsy Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?