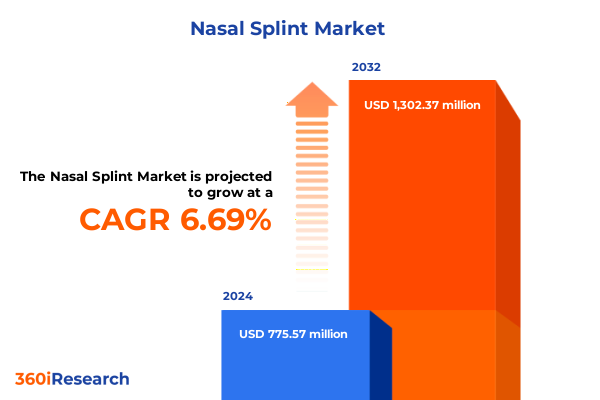

The Nasal Splint Market size was estimated at USD 827.12 million in 2025 and expected to reach USD 883.63 million in 2026, at a CAGR of 6.70% to reach USD 1,302.38 million by 2032.

Exploring the Critical Evolution of Nasal Splints as Essential Tools in Clinical and Cosmetic Procedures Across Modern Healthcare Environments

Nasal splints have evolved into indispensable medical devices, bridging the gap between controlled internal support and patient comfort following rhinoplasty, septoplasty, and trauma-related interventions. Traditionally perceived as simple mechanical aids, these devices now embody a fusion of ergonomic engineering, advanced materials science, and patient-centric design philosophies. As surgical techniques have refined over the decades, the demand for splints that conform precisely to individual nasal anatomy has intensified, elevating the role of these devices from auxiliary tools to critical determinants of postoperative success.

In recent years, the convergence of aesthetic medicine and reconstructive surgery has further heightened the importance of nasal splints. Surgeons are increasingly dependent on devices that not only stabilize delicate nasal structures but also mitigate common complications such as mucosal edema and septal hematoma. Concurrently, patient expectations have risen, driving demand for splints that minimize discomfort, reduce overall recovery time, and adapt to minimally invasive procedural trends. In this introductory overview, we will examine how these evolving imperatives have reshaped product development, spurred a wave of innovation, and positioned nasal splints at the forefront of postoperative care solutions.

Unveiling Groundbreaking Advances in Materials, Digital Customization, and Patient-Centric Design Transforming the Nasal Splint Landscape

The nasal splint marketplace is undergoing a profound transformation driven by breakthroughs in material chemistry and digital manufacturing techniques. Silicone blends with enhanced biocompatibility have supplanted traditional metal frameworks in many postoperative splints, offering patients greater comfort without sacrificing structural rigidity. At the same time, advanced plastics engineered for controlled flexure have empowered external splint architectures to better distribute pressure and reduce skin irritation, setting a new benchmark for patient adherence.

Analyzing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains, Pricing Dynamics, and Strategic Sourcing for Nasal Splint Manufacturers

The introduction of elevated tariff measures in early 2025 targeting medical device imports has created a new economic landscape for domestic and international nasal splint suppliers. These duties, aimed at insulating local manufacturers and recalibrating trade balances, have inadvertently influenced procurement strategies across hospital networks and outpatient clinics. Institutions sensitive to cost pressures have diversified sourcing portfolios, seeking partnerships with domestic fabricators capable of delivering comparable quality without incurring additional tariff burdens.

Comprehensive Analysis of Segmentation Drivers Across Product Types, Channels, Applications, End Users, and Material Preferences in Nasal Splints

A nuanced understanding of segmentation dynamics reveals that external nasal splints continue to dominate settings emphasizing rapid postoperative stabilization, while internal splint variants have gained traction among practitioners prioritizing anatomical conformability. Distribution channels have likewise evolved, with direct-to-consumer channels through manufacturer websites coexisting alongside online pharmacy storefronts and traditional hospital pharmacy formularies. In parallel, the rise of aesthetic applications has catalyzed demand within rhinoplasty suites, even as trauma care settings rely on robust splint constructions designed for high-impact stabilization. The distinction between procedures emerges most sharply in postoperative subcategories, where rhinoplasty cases favor low-profile, transparent designs and septoplasty interventions lean on splints tailored for septal realignment. End users across clinics, home care environments, and hospitals are recalibrating purchasing criteria; private hospitals often invest in premium splint materials to align with high-acuity surgical offerings, whereas government facilities may emphasize cost-effective, high-volume solutions. Material preferences further stratify the landscape, with plastic formulations driving broad adoption, silicone blends enabling superior patient comfort, and metal frames retaining a foothold in complex reconstructive procedures.

This comprehensive research report categorizes the Nasal Splint market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Material

- Distribution Channel

- End User

Illuminating Regional Dynamics Shaping the Nasal Splint Market Growth Patterns Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Territories

Regional dynamics exert a profound influence on the trajectory of nasal splint adoption and innovation. In the Americas, high volumes of elective cosmetic procedures have bolstered investment in premium splint offerings, while evolving reimbursement frameworks in North America incentivize focus on patient comfort and minimized recovery time. Meanwhile, Latin American markets grapple with complex import regulations, prompting local manufacturers to explore creative material sourcing to maintain price competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Nasal Splint market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves, Partnerships, and Innovations by Leading Medical Device Companies Dominating the Nasal Splint Sphere in Competitive Global Markets

Major medical device manufacturers are redefining market boundaries through strategic partnerships and targeted acquisitions. Industry leaders specializing in ENT solutions have integrated cutting-edge additive manufacturing capabilities, enabling on-demand production of patient-specific nasal splints. Collaborative research agreements between device makers and academic medical centers have accelerated validation of novel biocompatible polymers, while joint ventures in emerging economies signal long-term commitment to localized supply chains. Additionally, several innovators are piloting subscription-based service models, bundling splint provision with digital postoperative monitoring platforms to enhance clinical outcomes and forge deeper customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nasal Splint market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acclarent, Inc.

- B. Braun Melsungen AG

- Boston Medical Products, Inc.

- Cook Medical, LLC

- DTR Medical Ltd

- Innovia Medical, LLC

- Integra LifeSciences Holdings Corporation

- Intersect ENT, Inc.

- Medline Industries, LP

- Medtronic plc

- Mentor Worldwide LLC

- Merit Medical Systems, Inc.

- Network Medical Products Ltd

- Olympus Corporation

- Shippert Medical Technologies

- Smith & Nephew plc

- Spiggle & Theis Medizintechnik GmbH

- Stryker Corporation

- Summit Medical Group

- Surgiform Technologies LLC

Tactical Recommendations to Enhance Innovation, Optimize Supply Chains, and Capitalize on Emerging Opportunities in the Nasal Splint Industry

Industry stakeholders must prioritize agile manufacturing ecosystems capable of toggling between internal and external splint production in response to shifting demand patterns. Investing in modular production lines that accommodate silicone blends and high-performance plastics will reduce time-to-market for new design iterations. In governance and compliance domains, proactive engagement with regulatory authorities can streamline premarket notifications for next-generation spline materials, ensuring uninterrupted market access. Furthermore, cultivating digital channels-including branded manufacturer portals and telehealth integration-can secure direct customer touchpoints, enhancing both brand loyalty and feedback loops. Lastly, diversifying raw material networks to include domestic suppliers can mitigate the financial impact of tariff fluctuations and fortify resilience across the supply chain.

Outlining Rigorous Qualitative and Quantitative Research Approaches, Data Sources, and Validation Techniques Underpinning the Nasal Splint Market Analysis

This analysis synthesizes primary insights from in-depth interviews with leading otolaryngologists, biomedical engineers, and procurement executives. Quantitative data were collated through structured surveys issued to hospital networks, ambulatory centers, and pharmaceutical distributors, ensuring representation across diverse end users. Secondary research encompassed a comprehensive review of regulatory filings, patent databases, and peer-reviewed literature on splint materials and design methodologies. Triangulation of multiple data sources, including open-access clinical trial registries and device registries, enabled cross-validation of emerging trends. All findings were subjected to rigorous quality checks, with data integrity reinforced through iterative stakeholder feedback and benchmarking against historical adoption metrics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nasal Splint market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nasal Splint Market, by Product Type

- Nasal Splint Market, by Application

- Nasal Splint Market, by Material

- Nasal Splint Market, by Distribution Channel

- Nasal Splint Market, by End User

- Nasal Splint Market, by Region

- Nasal Splint Market, by Group

- Nasal Splint Market, by Country

- United States Nasal Splint Market

- China Nasal Splint Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Future Imperatives for Stakeholders to Navigate Shifting Market Dynamics in the Evolving Nasal Splint Landscape

This executive summary has exposed the multifaceted shifts shaping the nasal splint arena, from advanced material adoption and tariff-induced supply chain realignments to nuanced segmentation behaviors and region-specific growth catalysts. Stakeholders are advised to embrace flexible production strategies, invest in next-generation materials science, and deepen customer engagement through digital ecosystems. By aligning operational, regulatory, and innovation efforts, market participants can navigate evolving clinical requirements while capitalizing on emergent opportunities. Ultimately, the capacity to anticipate patient and provider needs will determine which organizations ascend as market leaders in this rapidly advancing medical device sector.

Connect with Ketan Rohom to Unlock In-Depth Nasal Splint Insights and Secure Your Comprehensive Market Research Report Today

To explore the full spectrum of market intelligence on advancements, competitive landscapes, and strategic opportunities within the nasal splint domain, engage directly with Ketan Rohom (Associate Director, Sales & Marketing) to secure your definitive research report. This collaboration will equip you with tailored insights and actionable strategies to drive growth, enhance procurement structures, and innovate product offerings. Contact Ketan today to transform your market positioning and accelerate leadership in this dynamic medical device segment.

- How big is the Nasal Splint Market?

- What is the Nasal Splint Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?