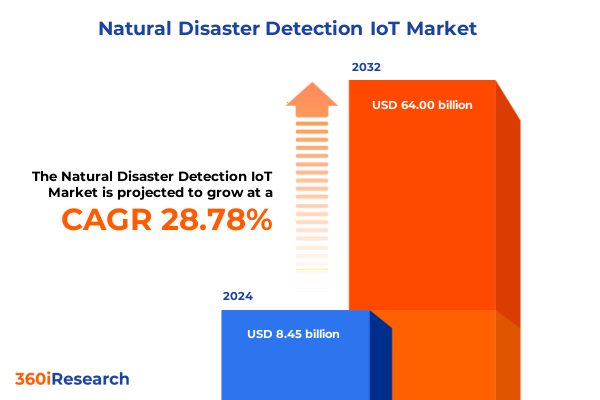

The Natural Disaster Detection IoT Market size was estimated at USD 693.28 million in 2025 and expected to reach USD 930.37 million in 2026, at a CAGR of 34.49% to reach USD 5,519.78 million by 2032.

Understanding the Rapid Rise of IoT-Powered Natural Disaster Detection Solutions and Strategic Imperatives for Proactive Risk Management and Resilience Building

The growing frequency and intensity of natural disasters driven by climate change underscore the urgent need for advanced warning and response frameworks. Integrating Internet of Things technologies into detection systems has emerged as a pivotal strategy, enabling real-time environmental monitoring that transcends the constraints of legacy infrastructure. By combining robust sensor networks with seamless connectivity protocols, these solutions deliver timely alerts that empower authorities and communities to act proactively rather than reactively.

As the global ecosystem of governments, emergency services, private enterprises, and rescue personnel seeks to bolster resilience, IoT architectures offer a unified platform for capturing and analyzing diverse data streams. From seismic tremors to sudden shifts in hydrological patterns, the capacity to aggregate and interpret granular measurements transforms disparate signals into coherent insights. Moreover, the convergence of sensor miniaturization and low-power communication standards extends the reach of detection networks to remote and vulnerable regions, closing critical gaps in situational awareness and response coordination.

Emerging Technological Transformations Redefining the Natural Disaster Detection Landscape Through Innovations in Connectivity Intelligence and Resilience

The landscape of natural disaster detection has been reshaped by a wave of technological breakthroughs that extend far beyond traditional sensor deployments. Advances in edge computing now enable on-site data preprocessing, reducing latency by executing machine learning algorithms directly within sensor hubs. This localized intelligence ensures that anomalies are flagged instantaneously, even when central connectivity is compromised.

Simultaneously, next-generation connectivity solutions such as 5G and Low-Power Wide-Area Networks have catalyzed the creation of highly scalable detection infrastructures. These networks support the transmission of high-resolution data, from ultra-wideband seismic readings to high-definition aerial imagery, with unprecedented reliability. The proliferation of cloud-native analytics platforms has further accelerated the integration of satellite, drone, and ground-based sensor feeds, forging a comprehensive real-time view of evolving disaster scenarios.

In this environment, open standards and interoperability frameworks are gaining traction as essential enablers of multi-vendor ecosystems. By prioritizing secure data exchange and harmonized protocols, organizations can seamlessly integrate legacy hardware with emerging AI-driven applications. This shift toward modular, API-centric architectures not only streamlines deployment but also empowers stakeholders to iterate rapidly and iterate solutions in response to shifting risk profiles.

Analyzing the Aggregate Effects of 2025 United States Tariff Policies on Global Supply Chains for Natural Disaster Detection IoT Components and Services

In 2025, the United States adopted a series of tariff measures targeting imported electronic components critical to IoT systems, including advanced semiconductors and specialized sensing modules. These policy changes have elevated input costs for manufacturers and integrators operating within the natural disaster detection ecosystem, prompting a reassessment of supply chain strategies.

As a direct consequence, many original equipment manufacturers have accelerated their diversification efforts, forging partnerships with alternative suppliers in regions not subject to punitive duties. Nearshoring initiatives have gained momentum, with production nodes increasingly established in Mexico and Canada to maintain proximity to end markets while mitigating tariff exposure. Meanwhile, select vendors have reconfigured their bill of materials to substitute certain high-impact components with domestically manufactured equivalents, balancing performance trade-offs against cost predictability.

Despite the headwinds introduced by these fiscal policies, the drive toward resilient localization has yielded positive downstream effects. Regional assembly and calibration facilities shorten lead times for emergency deployments, ensuring that critical detection nodes can be brought online more swiftly. Accordingly, organizations that proactively navigated the 2025 tariff shifts have bolstered both their operational agility and their capacity to respond effectively to emergent disaster events.

Deriving Actionable Insights from Component Technology Application and End User Segmentation to Guide Strategic Decisions in IoT-Based Disaster Detection

Across the spectrum of IoT-driven disaster detection, a nuanced understanding of component, technology, application, and end-user dimensions reveals differentiated value pools. Hardware architectures encompass everything from computational and storage devices that manage data at the edge to high-precision sensors that capture seismic and hydrological indicators, all the way through to user interface and notification systems that deliver critical alerts. Balancing these elements with managed services ensures seamless integration and ongoing operational support.

On the software front, robust communication and networking platforms underpin secure data exchange, while advanced analytics and management suites transform raw sensor feeds into actionable intelligence. Geographic Information System applications contextualize these insights within spatial frameworks, enabling stakeholders to visualize threat zones and optimize resource allocation.

Technology pathways, such as advanced computing and big data analytics, form the analytical core, while artificial intelligence and machine learning models refine predictive accuracy. Mobile and communication technologies ensure that frontline responders remain connected, irrespective of terrain or infrastructure limitations.

The breadth of applications spans drought management, earthquake preparedness, flood monitoring, wildfire response, landslide detection, and routine weather surveillance, each with distinct performance criteria. Stakeholder groups are similarly varied, from government organizations and law enforcement agencies to private sector operators and rescue personnel, creating a dynamic ecosystem where precision, reliability, and adaptability are paramount.

This comprehensive research report categorizes the Natural Disaster Detection IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End-User

Exploring Regional Dynamics Shaping the Adoption and Evolution of IoT-Powered Natural Disaster Detection Across Americas EMEA and Asia-Pacific Markets

Regional dynamics play a decisive role in shaping the trajectory of IoT-enabled disaster detection. In the Americas, the longstanding investment in telecommunications infrastructure and public emergency frameworks fosters rapid pilot deployments and proof-of-concept initiatives. This environment supports collaborative ventures between federal agencies and private innovators, driving streamlined regulatory pathways and incentivizing multistakeholder innovation clusters.

Within Europe Middle East & Africa, cross-border coordination mechanisms and comprehensive civil protection mandates encourage interoperable system design. Funding instruments at the regional level, coupled with stringent data privacy regulations, have steered solution providers toward privacy-centric architectures and tokenized data sharing models. As a result, pan-regional testbeds have emerged that stress-test interoperability and stress-proof communications under varying geopolitical conditions.

In Asia-Pacific, the prevalence of high-impact natural hazards has accelerated government directives for early warning networks. Rapid urbanization and digital transformation agendas in key markets have underpinned investments in large-scale sensor rollouts, drone integration, and AI-driven predictive models. Partnerships between national research institutions and global vendors have yielded scalable platforms that can be customized for archipelagic archipelagos as well as dense megacities.

This comprehensive research report examines key regions that drive the evolution of the Natural Disaster Detection IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Leadership Strategies and Innovation Approaches of Leading Companies in the Natural Disaster Detection IoT Ecosystem

A select group of technology leaders has emerged at the vanguard of the natural disaster detection IoT domain, leveraging comprehensive portfolios and strategic alliances to define competitive benchmarks. Global network infrastructure specialists have extended their offerings to include hardened edge-compute gateways optimized for environmental resilience, while software powerhouses have embedded domain-specific machine learning modules into their analytics suites to refine event detection thresholds.

Industrial automation conglomerates are collaborating with remote-sensing pioneers to integrate satellite telemetry with ground sensor grids, creating layered situational awareness frameworks. At the same time, emerging pure-play IoT providers focus on turnkey solutions that pair modular hardware stacks with subscription-based monitoring platforms, catering to both large enterprise and municipal use cases.

These leading players prioritize continuous innovation through dedicated R&D investments, field trials in collaboration with disaster management agencies, and interoperable solution roadmaps. By adopting flexible licensing models and ecosystem partnerships, they ensure that end users benefit from seamless upgrades, rapid feature rollouts, and robust support channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Natural Disaster Detection IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture PLC

- ALE International SAS

- Aplicaciones Tecnológicas S.A.

- AT&T Inc.

- Atos SE

- BlackBerry Limited

- Cisco Systems Inc.

- Eaton Corporation PLC

- Environmental Systems Research Institute, Inc

- Google LLC by Alphabet Inc.

- Green Stream Technologies, Inc.

- Grillo Holdings Inc.

- Hala Systems, Inc.

- Hitachi Ltd.

- InfiSIM Ltd.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Knowx Innovations Pvt. Ltd.

- Mitsubishi Electric Corporation

- NEC Corporation

- Nokia Corporation

- One Concern, Inc.

- Optex Co., Ltd.

- OroraTech GmbH

- Responscity Systems Private Limited

- Sadeem International Company

- SAP SE

- Scanpoint Geomatics Ltd.

- Semtech Corporation

- Sony Group Corporation

- Telefonaktiebolaget LM Ericsson

- Tractable Ltd.

- Trinity Mobility Private Limited

- Venti LLC

- Zebra Technologies Corporation

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Advancing IoT-Driven Natural Disaster Detection Capabilities and Resilience

Industry leaders should prioritize the deployment of hybrid cloud and edge architectures that harness the strengths of real-time local processing and scalable centralized analytics. By constructing systems that intelligently allocate workloads, organizations can maintain operational continuity even when network connectivity fluctuates during crises.

Cultivating public-private partnerships and aligning with government resilience initiatives enables access to shared data lakes and interoperable platforms. Such collaborations reduce duplication of efforts and accelerate the development of standardized protocols for early warning dissemination.

Supply chain resilience must be reinforced through diversified sourcing strategies, including nearshore assembly hubs and partnerships with alternative component manufacturers. These measures help to mitigate geopolitical risk and ensure uninterrupted device availability during peak demand periods.

Finally, workforce readiness is paramount; comprehensive training programs and simulation exercises grounded in real-world scenarios enhance first responder familiarity with emerging tools. Embedding continuous learning pathways and certification frameworks ensures that personnel can leverage advanced features and maintain situational composure under pressure.

Detailing a Robust Research Methodology Integrating Primary and Secondary Data Collection Analysis and Validation to Ensure Comprehensive Insights

Our research methodology integrates both primary and secondary data sources to produce a multidimensional view of the landscape. Secondary research included analysis of industry white papers, published technical standards, regulatory filings, and public agency reports to frame the historical and regulatory context. Primary research comprised in-depth interviews with senior executives and technical experts across solutions providers, emergency management agencies, and end-user organizations, ensuring direct insight into evolving needs and adoption drivers.

Quantitative data collection involved structured surveys distributed to a representative sample of system integrators and end users, validating qualitative findings with empirical usage patterns. Data points were cross-referenced and triangulated through multiple sources to detect inconsistencies and corroborate emerging themes.

Finally, validation workshops convened with domain experts and independent consultants assessed preliminary findings, enabling iterative refinement of insights. This rigorous, layered approach guarantees that our conclusions reflect both the current state of the market and the directional forces shaping future innovation trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Natural Disaster Detection IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Natural Disaster Detection IoT Market, by Component

- Natural Disaster Detection IoT Market, by Technology

- Natural Disaster Detection IoT Market, by Application

- Natural Disaster Detection IoT Market, by End-User

- Natural Disaster Detection IoT Market, by Region

- Natural Disaster Detection IoT Market, by Group

- Natural Disaster Detection IoT Market, by Country

- United States Natural Disaster Detection IoT Market

- China Natural Disaster Detection IoT Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding the Strategic Imperatives and Key Takeaways for Stakeholders Leveraging IoT in Natural Disaster Detection to Drive Resilience and Innovation

The convergence of advanced sensing networks, intelligent analytics, and resilient connectivity protocols is redefining how organizations anticipate and respond to natural disasters. Understanding the interplay of component architectures, technology enablers, application demands, and stakeholder imperatives is essential for designing detection solutions that balance precision with scalability.

Regional variations in infrastructure maturity, regulatory landscapes, and hazard profiles necessitate tailored approaches, while the strategic maneuvers of leading companies illustrate the competitive dynamics at play. By adopting proactive supply chain strategies, forging cross-sector partnerships, and investing in workforce competencies, organizations can translate cutting-edge capabilities into tangible risk reduction outcomes.

As the frequency of extreme events escalates, leveraging the insights and recommendations presented herein will equip decision-makers to navigate uncertainty, strengthen resilience, and foster innovation across the natural disaster detection domain.

Engage with Ketan Rohom to Secure Your Customized Natural Disaster Detection IoT Market Intelligence Report and Stay Ahead

To explore tailored insights and capitalize on the strategic opportunities within the natural disaster detection IoT space, reach out to Ketan Rohom, Associate Director, Sales & Marketing. A deeper discussion with Ketan can clarify how the report aligns with your organization’s unique risk mitigation and resilience objectives. Engage today to secure a customized briefing, gain exclusive data-driven perspectives, and ensure you stay at the forefront of innovation and preparedness in the rapidly evolving landscape of IoT-based disaster detection.

- How big is the Natural Disaster Detection IoT Market?

- What is the Natural Disaster Detection IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?