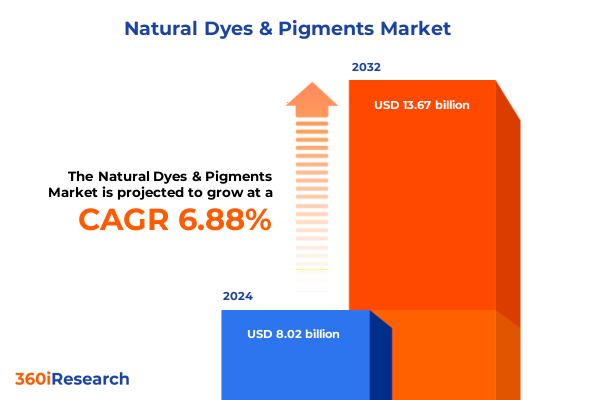

The Natural Dyes & Pigments Market size was estimated at USD 8.53 billion in 2025 and expected to reach USD 9.07 billion in 2026, at a CAGR of 6.96% to reach USD 13.67 billion by 2032.

Illuminating the Roots and Resurgence of Natural Dyes and Pigments in Modern Sustainable Applications Across Diverse Industries Worldwide

Natural dyes and pigments have woven vibrant color stories into human culture for millennia, from the indigo-dyed textiles of ancient India to the cochineal crimson prized by the Aztec civilization. Over time, these traditional chromophores shaped artisanal practices and regional aesthetics as dyers and painters refined extraction methods to yield ever more consistent hues. With the advent of petrochemical dyes in the nineteenth century, many natural colorants fell out of favor, sparking a decline in local expertise and biodiversity that lasted generations.

In recent years, however, natural dyes and pigments have experienced a renaissance driven by renewed environmental consciousness and consumer health concerns. As awareness grows around the ecological footprint of synthetic dyes, brands and manufacturers are re-evaluating supply chains to source biodegradable, non-toxic alternatives. Regulatory bodies have begun tightening restrictions on hazardous dye components, further elevating the appeal of plant- and mineral-derived options. Meanwhile, innovative processing technologies are improving yield and colorfastness, making natural colorants viable at scale.

Consequently, natural dyes and pigments have recaptured attention across sectors such as textiles, cosmetics, food, and pharmaceuticals. These developments reflect a broader shift towards circularity and transparency, where the story behind each pigment can become a compelling asset. By understanding both the historical roots and the contemporary drivers of this market, stakeholders can position themselves to harness the unique blend of heritage and innovation that defines today’s natural colorant landscape.

Examining How Consumer Preferences, Technological Breakthroughs, and Sustainability Mandates Are Redefining the Natural Colorant Landscape

The natural colorant landscape is undergoing transformative shifts as evolving consumer preferences, regulatory frameworks, and technological breakthroughs converge. Modern shoppers are increasingly drawn to products that demonstrate environmental responsibility and ingredient transparency. This demand has prompted companies to integrate natural dyes and pigments into their portfolios, leveraging the narrative of traceable, non-toxic color solutions to distinguish themselves in crowded markets.

Parallel to consumer dynamics, government agencies and international standards bodies are imposing stricter limits on synthetic dye effluents and by-products. These mandates have accelerated investment in green chemistry and cleaner production processes. As a result, research institutions and private entities are collaborating to refine extraction methods that maximize yield while minimizing energy consumption and waste generation.

Technological innovations in biotechnology and process engineering further augment this trajectory. Advanced enzymatic treatments, supercritical fluid systems, and hybrid extraction platforms have enhanced the consistency and stability of natural extracts. Digital tools-ranging from spectroscopic color matching to blockchain traceability-promise to streamline quality assurance and supply chain transparency. Taken together, these shifts are redefining what it means to produce, certify, and commercialize natural dyes and pigments, ultimately enabling industry players to meet both ecological targets and consumer expectations with greater confidence.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on Supply Chains, Pricing Structures, and Sourcing Strategies of Natural Colorants

The introduction of new United States tariffs in 2025 has exerted a notable influence on the natural dye and pigment supply chain, reshaping sourcing strategies and cost structures across the industry. Faced with increased duties on plant extract imports, many companies have pivoted towards domestic cultivation of raw materials, forging partnerships with regional growers to secure stable inventories of turmeric, madder, and other botanical sources. This local-sourcing trend not only mitigates tariff exposure but also enhances traceability and carbon footprint reduction.

Simultaneously, mineral-based pigment suppliers have had to re-negotiate long-standing contracts as levies on imported ochre, cinnabar, and azurite rose. Companies responded by diversifying their supplier base, exploring secondary markets in allied trade regions, and investing in stockpiling strategies to buffer price volatility. While these measures have partially offset elevated import costs, the ripple effects have manifested in adjusted pricing models for end-users, compelling brands to reevaluate margins or incorporate surcharges for premium natural colorants.

Overall, the 2025 tariff landscape has underscored the importance of agile procurement frameworks and vertically integrated supply chains. By embracing strategic inventory management and fostering stronger ties with domestic and partner-nation producers, industry leaders have absorbed tariff pressures more effectively. As the tariff regime evolves, companies that maintain diversified sourcing, forward-looking contract negotiations, and robust trade compliance infrastructures will continue to thrive in a restructured market environment.

Unveiling Comprehensive Segmentation Perspectives That Illuminate Diverse Type, Source, Extraction, and Application Categories in the Market

The market’s segmentation framework encompasses multiple dimensions that provide clarity on the diverse pathways to color innovation. Within the Type axis, natural colorants divide into dyes and pigments, where the dyes category elaborates across acid, basic, direct, mordant, and vat dyes, and the pigments branch into inorganic and organic formulations. Source Type introduces an additional lens, distinguishing between animal-derived materials-such as secretions, insect parts, and shell extracts-mineral origins, and plant sources, which include bark, flowers, fruits, leaves, and roots.

A deeper granularity emerges under the Source dimension, which explores animal and insect-based chromophores such as cochineal, kermes, and mollusk-derived purple, alongside mineral pigments like azurite, malachite, and ultramarine. Plant-based sources also receive detailed treatment, featuring henna, hibiscus, indigo, madder, onion skins, saffron, turmeric, and woad. Extraction Method segmentation captures the state of process innovation, with acidic and alkaline extractions standing alongside aqueous, enzymatic, fermentation, solvent, supercritical fluid, and ultrasonic-microwave techniques.

Usage Methods shape application strategy by differentiating advanced systems-where precise color blending and microencapsulation are critical-from conventional systems familiar to traditional dyehouses. Form segmentation considers liquid colorants, paste concentrates, and powders, with powder further sub-segmented into coarse and fine grades. Finally, the Application dimension links these technical groupings to industry verticals such as cosmetics and personal care, food and beverages, packaging, pharmaceuticals, and textiles. Together, these segmentation perspectives unlock a comprehensive view of product development opportunities and entry points across the natural colorant value chain.

This comprehensive research report categorizes the Natural Dyes & Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source Type

- Source

- Extraction Method

- Usage Methods

- Form

- Application

Discovering Regional Dynamics That Shape Demand Patterns Across the Americas Europe Middle East Africa and Asia Pacific in Natural Colorants

Regional dynamics exert a pronounced influence on the adoption and evolution of natural dyes and pigments. In the Americas, sustainability commitments and consumer activism have catalyzed investments in domestic cultivation of plant sources like annatto and turmeric. North American manufacturers are scaling up partnerships with farmers and investing in green extraction facilities to ensure year-round supply, while Latin American producers continue to leverage indigenous biodiversity and artisan expertise to meet global demand.

Across Europe, Middle East and Africa, stringent environmental regulations and robust eco-labeling frameworks shape market behavior. European Union directives on chemical safety and wastewater management compel companies to favor biodegradable colorants, and this regulatory rigor extends to Middle Eastern markets seeking to elevate quality standards. Meanwhile, African nations are rapidly integrating natural dye cooperatives into their agricultural portfolios, tapping traditional knowledge to generate new income streams for smallholder farmers.

In the Asia Pacific region, historical precedence and scale of production converge to position it as both the largest supplier and consumer of traditional colorants. India and China continue to dominate raw material outputs, but they are also pioneering advanced technologies such as microbial fermentation and enzymatic extraction to improve consistency. Southeast Asian governments are partnering with research institutes to establish pilot facilities, further reinforcing the region’s role as an innovation hub. These differentiated regional narratives highlight the necessity of customized market entry approaches and localized partnerships to leverage each continent’s unique advantages.

This comprehensive research report examines key regions that drive the evolution of the Natural Dyes & Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Driving Advances in Sustainable Natural Dye and Pigment Technologies Worldwide

Leading companies in the natural dyes and pigments sector are advancing sustainability goals while forging pathways for commercial scalability. EarthColors, a division specializing in natural pigment solutions, has prioritized the development of hydro-extraction techniques to optimize yield and reduce water usage. Givaudan’s Naturex business line has deepened its botanical supply chain, securing fair-trade certifications for henna and madder growers and integrating digital traceability across its extraction facilities.

Sensient Technologies has launched a series of encapsulated color systems tailored to cosmetics and food applications, demonstrating how microencapsulation can enhance stability and color intensity. Kalsec’s plant-derived colorant portfolio has expanded into e-commerce packaging, targeting niche beverage brands seeking clean-label differentiation. At the same time, DIC Corporation and Sun Chemical have jointly invested in fermentation-based dye synthesis, seeking to combine microbial engineering with plant extracts to bridge consistency gaps.

Smaller innovators are making strides as well. Botanical Colors, a specialty start-up, applies cold-press and ultrasonic-assisted extraction to sensitive flower and leaf pigments. Meanwhile, Archroma has adapted its waste valorization expertise to recover pigment compounds from agricultural byproducts. These strategic moves illustrate a growing alignment around low-impact operations, collaborative R&D, and certification schemes that affirm product integrity-key factors for companies aiming to lead in this rapidly evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Natural Dyes & Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarkay Food Products Ltd.

- Abbey Color

- Alliance Organics LLP

- AMA Herbal GROUP

- Archer Daniels Midland Company

- Archroma Management GmbH

- Atul Ltd.

- BioconColors

- DSM-Firmenich AG

- Döhler GmbH

- Exberry by GNT Group B.V.

- Givaudan SA

- International Flavors & Fragrances Inc.

- Kalsec Inc.

- Kolorjet Chemicals Pvt Ltd.

- Lycored Ltd. by ADAMA Ltd.

- Nactarome S.p.a.

- NIG GmbH

- Oterra A/S

- Plant Lipids Private Limited

- Pylam Products Company, Inc.

- ROHA Dyechem Pvt. Ltd.

- Roquette Frères S.A.

- San-Ei Gen F.F.I.,Inc.

- Seelect Inc. by Nature's Flavors, Inc.

- Sensient Technologies Corporation

- Symrise AG

- Synthite Industries Ltd.

Actionable Strategic Steps for Industry Leaders to Capitalize on Sustainability Trends, Optimize Operations, and Fortify Competitive Differentiation

Industry leaders should prioritize establishing resilient, vertically integrated supply chains that blend local cultivation with strategic import partnerships. By collaborating early with agricultural stakeholders, organizations can secure preferential access to high-quality raw materials while mitigating the risks posed by fluctuating tariffs and climate variability. Additionally, investing in advanced extraction platforms-such as supercritical fluid and enzymatic processes-can enhance product consistency and reduce energy consumption, delivering both environmental and operational efficiencies.

Simultaneously, companies must strengthen traceability and certification mechanisms, leveraging digital tools like blockchain to provide immutable provenance records. Such transparency fosters trust among end-users in cosmetics, food, and textiles that increasingly demand clean-label credentials. It is equally vital to allocate R&D resources toward color stability and fastness improvements, ensuring that natural formulations can meet or exceed the performance of synthetic analogues.

Finally, forging cross-industry collaborations with academic institutions and technology partners can accelerate innovation and catalyze new application frontiers. Whether piloting cell-culture platforms for pigment synthesis or exploring co-marketing alliances with sustainable fashion brands, proactive engagement with emerging ecosystems will differentiate market leaders. Through these strategic actions, stakeholders can transform shifting market dynamics into tangible competitive advantages and pave the way for a more sustainable chromatics economy.

Detailing Rigorous Research Methodology Combining Primary Inputs, Secondary Intelligence, and Triangulated Data for Robust Insights

The research methodology underpinning this analysis combines a rigorous blend of primary and secondary intelligence to ensure both depth and accuracy. Primary research involved in-depth interviews with industry executives, extraction technology specialists, and agricultural cooperatives, enabling firsthand insights into operational challenges and emerging innovations. Complementing these conversations, visits to extraction plants and dyeing facilities provided observational validation of processing techniques and waste-management practices.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patents, regulatory filings, and corporate sustainability reports. This extensive literature mapping allowed for the identification of breakthrough extraction methods, evolving regulatory mandates, and consumer sentiment data. Publicly available trade data was analyzed to trace shifts in import and export flows, illuminating the effects of tariffs and trade agreements on material sourcing.

Data triangulation was achieved by cross-referencing interview findings with market intelligence from specialized academic centers and non-governmental organizations. Quality control measures included expert panel reviews and scenario validation workshops, where draft insights were tested against real-world case studies. The segmentation framework emerged iteratively, guided by thematic clustering of technical and application attributes, ensuring that the final analysis captures the multifaceted nature of the natural dye and pigment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Natural Dyes & Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Natural Dyes & Pigments Market, by Type

- Natural Dyes & Pigments Market, by Source Type

- Natural Dyes & Pigments Market, by Source

- Natural Dyes & Pigments Market, by Extraction Method

- Natural Dyes & Pigments Market, by Usage Methods

- Natural Dyes & Pigments Market, by Form

- Natural Dyes & Pigments Market, by Application

- Natural Dyes & Pigments Market, by Region

- Natural Dyes & Pigments Market, by Group

- Natural Dyes & Pigments Market, by Country

- United States Natural Dyes & Pigments Market

- China Natural Dyes & Pigments Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Consolidating Key Takeaways and Overarching Conclusions to Reinforce the Strategic Value of Natural Dyes and Pigments Analysis

In summary, the natural dyes and pigments market is entering a period of robust transformation, as sustainability imperatives and technological innovation converge to redefine the field. Renewed consumer interest in clean-label products, coupled with stringent environmental regulations, is driving demand for biodegradable and non-toxic colorants across multiple industries. Concurrently, advancements in extraction and fermentation techniques are enhancing the performance and consistency of natural formulations, closing the gap with synthetic alternatives.

Regional dynamics offer distinct pathways for growth, with the Americas focusing on domestic cultivation, EMEA emphasizing regulatory compliance and artisan integration, and Asia-Pacific leveraging both scale and technological investments. Companies that adapt to evolving tariff landscapes, diversify their sourcing strategies, and embrace digital traceability stand to benefit most from these shifts. Strategic collaborations between established players and innovative start-ups further underscore the market’s vibrancy and potential for breakthrough applications.

By grounding decisions in a nuanced understanding of segmentation dimensions-from source types and extraction methods to application use cases-industry stakeholders can identify the most promising opportunities. This analysis sets the stage for informed strategic planning, ensuring that natural dyes and pigments maintain their historic legacy while charting a sustainable and commercially viable future.

Engaging with Ketan Rohom to Unlock In-Depth Intelligence and Secure Your Customized Natural Dyes and Pigments Market Research Report Today

Engaging with Ketan Rohom will connect you directly to specialized expertise on natural dyes and pigments research. As Associate Director of Sales & Marketing, he can guide you through tailored solutions that align with your strategic priorities and sustainability objectives. Whether you require in-depth analysis of extraction technologies, granular regional intelligence, or bespoke competitive benchmarking, Ketan Rohom can arrange customized deliverables that fit your organizational needs.

Reach out today to secure priority access to the complete market research report and leverage insights that can accelerate your product development, de-risk supply chain decisions, and unlock new revenue streams. By partnering with him, you will gain a collaborative advisor committed to helping you translate deep market intelligence into action. Contact Ketan Rohom now to transform your understanding of natural dyes and pigments into a competitive advantage.

- How big is the Natural Dyes & Pigments Market?

- What is the Natural Dyes & Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?