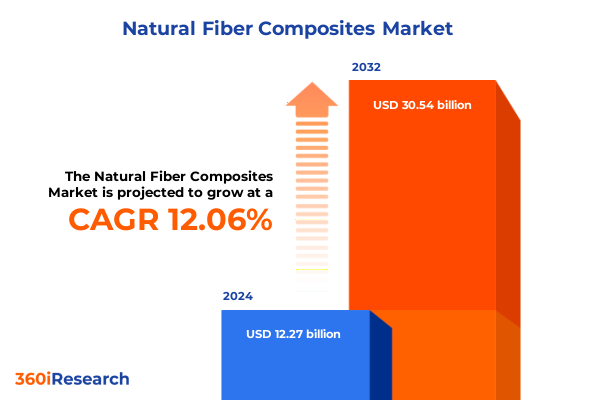

The Natural Fiber Composites Market size was estimated at USD 13.74 billion in 2025 and expected to reach USD 15.38 billion in 2026, at a CAGR of 12.08% to reach USD 30.54 billion by 2032.

Explore How Natural Fiber Composites Are Revolutionizing Sustainable Material Adoption Across Multiple Sectors with Environmental and Performance Benefits

The accelerating shift towards sustainable material solutions has propelled natural fiber composites into the spotlight, as industries seek to reduce environmental impact without sacrificing performance. Derived from renewable sources such as plant-based fibers and bio-resins, these composites offer a compelling combination of lightweight strength, enhanced mechanical properties, and reduced carbon footprint. This introduction lays the foundation for understanding how natural fiber composites are emerging as a viable alternative to traditional materials, offering a unique value proposition to manufacturers and end-users across multiple sectors.

In recent years, advances in fiber extraction, surface treatments, and composite processing techniques have significantly improved the compatibility of natural fibers with engineering resins, driving broader adoption. These developments have unlocked new applications in automotive parts, construction panels, and consumer goods, demonstrating that eco-friendly materials can meet rigorous quality and safety standards. Furthermore, partnerships between research institutions and industry leaders have fostered innovation in bio-resin formulations, enabling natural fiber composites to achieve property enhancements that rival traditional thermoplastics and thermosets. In this context, stakeholders must recognize the strategic importance of integrating natural fiber composites into product development roadmaps to stay ahead in a market increasingly defined by environmental regulations and consumer demand for sustainability.

Unveiling the Pivotal Technological and Consumer-Driven Transformations Propelling the Natural Fiber Composites Market into a New Era of Innovation

The natural fiber composites landscape is undergoing transformative shifts driven by both technological breakthroughs and evolving consumer expectations. Cutting-edge surface modification techniques, such as plasma treatment and nano-coating, have substantially improved interfacial bonding between fibers and resin matrices. Consequently, manufacturers are achieving higher tensile strength, better moisture resistance, and improved fatigue life in composite parts. Simultaneously, the rise of digital manufacturing tools-digital twins, additive manufacturing prototypes, and process simulation software-has streamlined production cycles, reduced waste, and accelerated time-to-market for complex composite components.

Equally significant are the macroeconomic drivers reshaping demand patterns. Corporate sustainability mandates and stringent environmental regulations are compelling organizations to substitute carbon-intensive materials with bio-based alternatives. Consumer preferences have likewise shifted, with buyers increasingly willing to pay a premium for products that demonstrate verifiable environmental credentials. These converging forces have catalyzed a wave of investment in circular economy initiatives, where natural fiber composites play a critical role in enabling closed-loop recycling and upcycling practices. As this market continues to evolve, stakeholders must align their R&D investments and supply-chain strategies with these transformative shifts to capitalize on emerging opportunities.

Analyzing the Broad Economic and Operational Repercussions of 2025 United States Tariff Measures on the Natural Fiber Composites Supply Chain and Pricing

United States tariff policies enacted in 2025 have introduced a new layer of complexity to the natural fiber composites supply chain. By imposing additional duties on certain imported fibers and bio-resin precursors, these measures have elevated procurement costs and disrupted established sourcing strategies. Companies that previously relied on competitively priced fibers from Southeast Asia and Europe have been compelled to reassess their supplier portfolios, seeking alternatives that mitigate exposure to tariff-related margin pressures.

This regulatory shift has produced both challenges and unexpected advantages. On one hand, raw material expenses have increased, prompting manufacturers to implement cost-containment measures and explore domestic fiber cultivation partnerships. On the other hand, the elevated cost landscape has accelerated interest in fiber innovation, with research efforts focusing on improving yield and quality of homegrown crops like hemp and flax. Furthermore, the policy changes have invigorated discussions around nearshoring and vertical integration, as organizations evaluate the strategic benefits of bringing fiber processing and composite manufacturing closer to end-market locations. To navigate this tariff-impacted ecosystem, decision-makers must undertake scenario planning to balance cost management with long-term growth objectives.

Delving into Strategic Segment Performance Across Fiber Types, Resin Varieties, End Use Industries, Manufacturing Processes, and Diverse Product Forms

Natural fiber composites exhibit diverse performance and cost characteristics across multiple segment dimensions, which influence material selection and application strategies. When considering plant-derived fiber sources such as bamboo, flax, hemp, jute and kenaf, differences emerge in fiber morphology and tensile properties, driving optimized use cases from high-impact automotive panels to lightweight consumer electronics housings. Resin selection adds a further layer of complexity; thermoplastic matrices like polyethylene, polypropylene and polystyrene offer recyclability and ease of processing, whereas thermoset varieties such as epoxy, polyester and vinyl ester deliver superior thermal stability and mechanical integrity for demanding structural applications.

End-use sector requirements also guide segmentation dynamics. Automotive OEMs are attracted to the weight-saving potential and crash-energy absorption of natural fiber laminates, while construction stakeholders appreciate the fire retardancy and acoustic dampening of fiber-reinforced panels. In consumer goods and electrical and electronics markets, designers leverage the aesthetic versatility and reduced carbon footprint of bio-composites to differentiate products on sustainability credentials. Additionally, manufacturing techniques ranging from compression molding and extrusion to injection molding, pultrusion and vacuum bag molding each impart distinct advantages in part complexity, cycle time and cost efficiency. Finally, product form considerations - whether injection molded parts, pipes and tubes, profiles and rods or sheets and panels - determine final application suitability and end-of-life recycling pathways.

This comprehensive research report categorizes the Natural Fiber Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Resin Type

- Fiber Type

- Manufacturing Process

- End Use Industry

Understanding Regional Dynamics and Growth Drivers Shaping Demand for Natural Fiber Composites across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping the adoption trajectory of natural fiber composites, driven by varying regulatory environments, infrastructure maturity and resource availability. In the Americas, environmental legislation and automotive OEM sustainability goals have catalyzed demand for lightweight, bio-based materials, particularly within the United States and Brazil. Investments in domestic fiber crop cultivation and pilot-scale processing facilities are strengthening the regional supply base and reducing dependence on imports.

Across Europe, Middle East and Africa, stringent greenhouse gas reduction targets and circular economy directives have fueled government incentives and public-private partnerships aimed at accelerating bio-composite innovation. European manufacturers benefit from well-established agricultural research networks that support flax and hemp fiber quality improvement, while Middle Eastern industrial players explore jute and kenaf cultivation suited to arid climates. Africa’s growing agribusiness sector presents untapped potential for fiber production, although challenges in logistics and standardization remain.

In the Asia-Pacific region, favorable agronomic conditions in countries such as China, India and Southeast Asian nations underpin a robust export market for natural fibers. Local resin and composite fabricators are integrating these fibers into cost-sensitive products for domestic consumption, even as environmental regulations begin to tighten. Meanwhile, established manufacturing hubs in Japan and South Korea focus on high-performance, value-added composite components for automotive, electronics and marine applications. These regional disparities underscore the importance of aligning market entry and expansion strategies with localized drivers and industry frameworks.

This comprehensive research report examines key regions that drive the evolution of the Natural Fiber Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage and Technological Advancement in the Natural Fiber Composites Sector

Leading participants in the natural fiber composites landscape are leveraging strategic alliances, vertical integration, and proprietary technology to build competitive differentiation. Global conglomerates with established automotive and industrial plastics divisions are expanding their bio-composite offerings through joint ventures with agricultural processors, ensuring reliable fiber supply and enhancing resilience against tariff fluctuations. Meanwhile, specialized material businesses are investing in advanced fiber surface treatments and resin chemistries to deliver high-strength, moisture-resistant composites tailored for marine and construction markets.

In parallel, technology startups are disrupting traditional value chains by introducing novel bio-resin formulations that simplify composite recycling and biodegradation at end of life. These innovators are often backed by sustainability-focused investors and research grants, enabling rapid prototyping and scaled production trials. Strategic mergers and acquisitions continue to reshape the competitive landscape, as larger players seek to incorporate niche fiber technologies and processing capabilities. To remain at the forefront, companies must cultivate a balanced portfolio of R&D partnerships and mergers that align with long-term sustainability targets and evolving end-use requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Natural Fiber Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.B.Composites Pvt. Ltd.

- Avient Corporation

- BASF SE

- Bcomp Ltd.

- Bodo Möller Chemie GmbH

- CFF GmbH & Co. KG

- DuPont de Nemours, Inc.

- Fiberon

- FlexForm Technologies

- Fyteko

- JELU-WERK J. Ehrler GmbH & Co. KG

- Nouryon Chemicals Holding B.V.

- PROCOTEX BELGIUM SA

- Rakuten Kobo Inc.

- Sireg Geotech Srl

- Stora Enso Oyj

- Taishan Fiberglass Inc.

- Tecnaro GMBH

- Toray Industries, Inc.

- Trex Company, Inc

- TTS

- UPM-Kymmene Corporation

Implementing Tactical Strategies and Forward-Looking Initiatives to Capitalize on Emerging Opportunities and Mitigate Risks in Natural Fiber Composites

Industry leaders aiming to thrive in this dynamic environment must adopt a multi-pronged strategic approach that balances innovation, risk management, and market engagement. Organizations should prioritize investment in research initiatives that advance fiber quality, processing efficiency, and resin compatibility to differentiate their product portfolios. Concurrently, strengthening relationships with agricultural stakeholders and fiber growers will secure raw material stability and support ethical sourcing practices. In addition, companies must explore collaborative ventures with resin producers to co-develop next-generation bio-resins that align with internal sustainability frameworks.

Moreover, executives should integrate scenario planning processes that account for tariff volatility and supply-chain disruptions, enabling agile responses to policy shifts. Expanding nearshore production capacity and exploring vertical integration opportunities can further insulate operations from international trade uncertainties. Equally important is the pursuit of certifications and eco-labeling that verify environmental claims, thereby enhancing market credibility and command premium pricing. By executing these recommendations in concert, leaders can navigate complex market dynamics while positioning themselves for accelerated growth and sustainable impact.

Detailing Rigorous Research Methodology Integrating Comprehensive Primary and Secondary Approaches for Enhanced Market Intelligence Accuracy

This analysis is grounded in a rigorous methodology that integrates both primary and secondary research to ensure comprehensive and accurate insights. Primary research involved in-depth interviews with key stakeholders across the value chain, including composite manufacturers, fiber growers, machinery suppliers and end-use producers in automotive, construction and consumer goods sectors. These conversations provided firsthand perspectives on production challenges, raw material sourcing strategies and emerging application needs.

Secondary research encompassed a thorough review of industry publications, regulatory documents, agronomic studies, and patent filings to map technological advancements and policy environments. Data triangulation was employed to validate findings, cross-referencing interview inputs with published reports and market intelligence databases. Additionally, case studies of leading composite installations and pilot-scale projects were analyzed to benchmark performance metrics and identify best practices. This blended approach underpins the credibility of the research, offering decision-makers a robust foundation for strategic planning and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Natural Fiber Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Natural Fiber Composites Market, by Product Form

- Natural Fiber Composites Market, by Resin Type

- Natural Fiber Composites Market, by Fiber Type

- Natural Fiber Composites Market, by Manufacturing Process

- Natural Fiber Composites Market, by End Use Industry

- Natural Fiber Composites Market, by Region

- Natural Fiber Composites Market, by Group

- Natural Fiber Composites Market, by Country

- United States Natural Fiber Composites Market

- China Natural Fiber Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Critical Insights and Strategic Imperatives to Guide Stakeholders in Navigating the Complexities of the Natural Fiber Composites Ecosystem

The natural fiber composites market stands at a critical juncture, shaped by converging trends in sustainability, innovation, and regulatory change. Stakeholders who embrace advanced fiber processing technologies, cultivate resilient supply chains, and align with environmental mandates will be best positioned to capture value and drive growth. Companies that neglect these imperatives risk falling behind as competitors introduce higher-performance bio-composites and leverage regional growth engines.

In summary, the industry’s evolution will hinge on strategic collaboration, from farm to factory, to enhance fiber quality and optimize processing efficiency. The integration of digital manufacturing tools and circular economy principles will further accelerate product development cycles and reduce lifecycle environmental impact. As tariff policies and geopolitical dynamics continue to reshape sourcing landscapes, agile organizations must adopt holistic risk management and invest in localized production strategies. By synthesizing these insights into coherent action plans, stakeholders can navigate complexities and emerge as leaders in the burgeoning natural fiber composites ecosystem.

Connect with Ketan Rohom to Unlock Comprehensive Insights and Secure Your Customized Natural Fiber Composites Market Research Solution Today

Ketan Rohom, Associate Director of Sales and Marketing, invites you to embark on an informed partnership that will elevate your strategic decision-making with unparalleled depth of analysis and customized insights. By securing this comprehensive research solution, your organization will gain exclusive access to in-depth intelligence on supply-chain dynamics, competitive landscapes, and actionable trends within the natural fiber composites industry. Our tailored approach ensures you will receive a report that is aligned precisely with your specific business objectives, empowering your teams to outpace competitors, anticipate market shifts, and drive sustainable growth.

Partnering with Ketan guarantees dedicated support throughout your research journey, from data interpretation to strategy development. Don’t miss this opportunity to capitalize on the momentum of natural fiber composites; connect directly with Ketan Rohom to learn how this report can be customized to address your organization’s unique challenges and opportunities. Reach out today to transform raw data into strategic advantage and lead the transition towards eco-efficient, high-performance composite solutions.

- How big is the Natural Fiber Composites Market?

- What is the Natural Fiber Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?