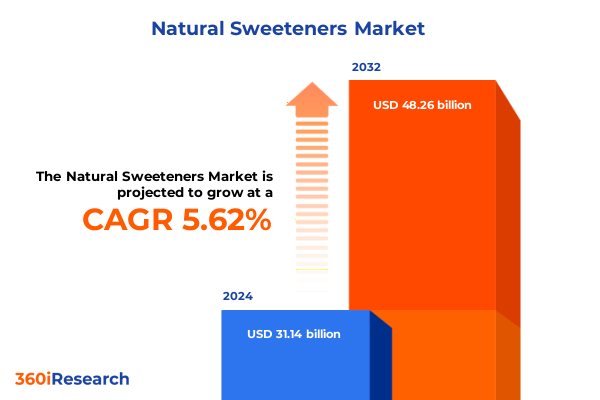

The Natural Sweeteners Market size was estimated at USD 32.89 billion in 2025 and expected to reach USD 34.60 billion in 2026, at a CAGR of 5.62% to reach USD 48.26 billion by 2032.

Embark on an In-Depth Exploration of the Natural Sweeteners Market Highlighting Key Drivers Consumer Trends and Emerging Opportunities in 2025

The natural sweeteners market has emerged as one of the most dynamic segments within the broader sugar alternatives landscape, driven by an ever-growing emphasis on health, wellness, and sustainability. As consumer awareness of the adverse effects of excessive sugar intake intensifies, demand for plant-based and low-calorie sweeteners has accelerated across food and beverage, pharmaceuticals, and personal care applications. This convergence of health-conscious consumer behavior and ongoing innovation in ingredient sourcing has catalyzed a profound shift in how manufacturers, retailers, and ingredient suppliers prioritize product formulation strategies.

Throughout this executive summary, we will explore the multifaceted factors propelling the natural sweeteners market into a new era of growth. Beginning with the influence of evolving consumer preferences and regulatory frameworks, we will examine the transformative shifts reshaping the competitive landscape. Further, we will assess how recent United States tariff measures have affected cost structures and supply chain resilience in 2025. By distilling key insights from segmentation, regional dynamics, and leading industry participants, the sections that follow will furnish decision-makers with actionable intelligence to refine market positioning, optimize distribution strategies, and accelerate product innovation. Ultimately, this summary provides a concise yet comprehensive synthesis of current trends, challenges, and opportunities, offering a strategic roadmap for navigating the complexities of the natural sweetener sector.

Unveiling the Transformative Forces Redefining Natural Sweetener Dynamics from Consumer Health Priorities to Technological Innovations Across the Supply Chain

In recent years, the natural sweeteners landscape has been profoundly influenced by a convergence of technological, regulatory, and consumer-driven forces. Innovations in extraction and fermentation technologies have expanded the range of viable ingredients, enabling commercial-scale production of rare sugars such as tagatose and allulose that previously remained niche due to high costs. Concurrently, the regulatory environment has grown more favorable, with agencies worldwide issuing approvals and establishing guidelines to ensure purity and safety while enabling faster market entry for novel sweeteners.

At the same time, rising health concerns related to metabolic disorders and obesity have heightened consumer vigilance, fostering preference for natural-origin labels and transparent sourcing. This shift has prompted manufacturers to reformulate products across categories from bakery and confectionery to beverages and dairy, striving to satisfy flavor expectations without compromising nutritional profiles. Meanwhile, strategic partnerships between ingredient innovators and major food companies have accelerated co-development pipelines, driving the rapid commercialization of proprietary blends that deliver sweetness profiles closely mimicking sucrose. Collectively, these transformative shifts underscore a market in transition-one where agility, scientific rigor, and a deep understanding of consumer sensibilities define competitive advantage.

Assessing the Cumulative Impact of Recent United States Tariff Measures on Natural Sweetener Imports Production Costs and Market Adaptations Throughout 2025

The introduction and escalation of United States tariff measures in 2025 have exerted a multifaceted impact on the cost and availability of imported natural sweeteners. While Section 301 tariffs initially targeted broader categories of sugar alcohols and rare sugar imports, subsequent revisions expanded coverage to include refined plant extracts and key intermediates used in allulose and tagatose production. As a result, manufacturers relying heavily on overseas fermentation and extraction facilities faced higher landed costs, instigating a reconfiguration of supply chains to mitigate margin erosion.

In response, several companies accelerated investments in domestic production capabilities, leveraging state-level incentives and public–private partnerships to establish fermentation and refining sites on U.S. soil. These initiatives not only reduced exposure to tariff volatility but also shortened lead times for new product launches. Nevertheless, the increased operational complexity and capital expenditure requirements have placed upward pressure on pricing, with manufacturers opting to pass a portion of these costs downstream. Retailers and foodservice operators have consequently navigated a delicate balance between maintaining competitive shelf pricing and safeguarding profitability, prompting explorations of blended sweetener systems that optimize cost without sacrificing taste quality.

Deep Insights into Natural Sweetener Market Segmentation Revealing Growth Patterns across Types Applications Forms Distribution Channels and Sources

Analyzing the market through a lens of type reveals distinct growth trajectories for each sweetener. Allulose and tagatose have attracted significant R&D attention due to their low-calorie profiles and functional benefits in baking applications. Erythritol maintains its leadership in beverage and confectionery segments given its clean sweetness and bulk properties, while monk fruit and stevia continue to dominate in formulations prioritizing natural labels and high-intensity sweetness requirements. Xylitol, valued for its dental health benefits and cooling mouthfeel, remains indispensable within oral care products and niche confectionery.

Shifting focus to applications, food and beverage formulations command the lion’s share of innovation, especially within bakery and confectionery where textural replication is critical. Dairy products are increasingly leveraging stevia–erythritol blends to reduce sugar content without compromising creaminess, while beverages ranging from soft drinks to functional teas integrate granular and liquid forms to meet diverse processing needs. In pharmaceuticals and nutraceuticals, tablets combine xylitol and erythritol for pill coatings that improve taste masking and patient compliance. Even animal feed applications have begun to explore tagging sweetness levels, optimizing feed consumption and palatability.

Form considerations play a pivotal role in product design. Granular materials offer direct drop-in functionality for bakers, whereas liquids provide ease of use in beverage lines and continuous processing. Powders deliver precise dosing in powdered drink mixes and nutraceutical blends. Tablets serve distinct value in controlled dosages for pharmaceuticals and chewable supplements. Each form segment commands specialized production practices and distinct supply chain protocols.

Distribution channels further shape market reach and consumer engagement. Grocery outlets encompassing both convenience stores and hypermarkets serve as primary touchpoints for packaged foods and confectionery. Online retail has surged as e-commerce platforms and manufacturer websites offer direct-to-consumer access to novel flavors and personalized packaging. Food service operators, from quick service to institutional catering, lean on bulk formulations to streamline operations, while specialty stores including health food shops and pharmacies cater to consumers seeking premium or therapeutic sweetener options.

Assessing source origin provides insights into sustainability and traceability imperatives. Plant extracts such as monk fruit and stevia drive premium positioning, while rare sugars produced via enzymatic conversion attract interest for their metabolic benefits. Sugar alcohols derived from corn and birch sources remain cost-effective workhorses, underpinning high-volume products across food and oral care. Integrating these dimensions underscores the intricate interplay of type, application, form, distribution, and source, guiding stakeholders to tailor strategies that resonate with specific market demands.

This comprehensive research report categorizes the Natural Sweeteners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Form

- Distribution Channel

- Source

Strategic Regional Perspectives on Natural Sweetener Adoption and Innovation Trends across the Americas Europe Middle East Africa and the Asia Pacific Markets

Regional perspectives on natural sweeteners underscore divergent growth drivers and adoption patterns across the Americas, Europe Middle East Africa, and the Asia Pacific. In the Americas, health and wellness initiatives have spurred reformulation mandates within major fast-moving consumer goods companies, while incentives for domestic fermentation facilities have bolstered local manufacturing capacity. Consequently, ingredient suppliers are forging collaborative research partnerships centered on sustainable production and novel clean label alternatives.

Across Europe Middle East Africa, regulatory frameworks and consumer safety concerns drive stringent quality standards, prompting a strong focus on allergen-free certification and traceability. The region’s robust retail infrastructure, including specialty and health-focused stores, provides an ideal launchpad for premium natural sweeteners, particularly those sourced from exotic plant extracts. Concurrently, Middle Eastern markets emphasize functional benefits and halal compliance, encouraging manufacturers to align formulations with cultural and dietary requirements.

In the Asia Pacific, rising disposable incomes and a growing middle class fuel demand for Western-style confections and beverages reformulated with natural sweeteners. Innovation hubs in Japan and South Korea are pioneering fermentation technologies for rare sugars, while Southeast Asian nations leverage abundant tropical crops to expand stevia and monk fruit cultivation. This region’s disparate economic profiles create opportunities for tiered product offerings, ranging from mass-market erythritol solutions to high-end, specialty sweetener blends targeting affluent urban consumers.

This comprehensive research report examines key regions that drive the evolution of the Natural Sweeteners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Intelligence Highlighting Leading Natural Sweetener Producers Their Innovation Strategies Partnerships and Market Positioning Tactics

Leading companies in the natural sweetener segment demonstrate a blend of strategic acquisitions, partnerships, and internal innovation to fortify market positions. Ingredient specialists are integrating upstream capabilities through vertical mergers with biotechnology firms to secure proprietary enzyme portfolios that enhance rare sugar yields. Meanwhile, consumer packaged goods leaders are collaborating with start-ups to co-develop novel sweetener blends tailored for specific end-use cases, injecting agility into traditional R&D cycles.

Product innovation remains a core differentiator, with firms launching multifunctional blends that address taste, mouthfeel, and stability simultaneously. Collaborative research initiatives with academic institutions further fuel this pipeline, enabling accelerated validation of health claims and regulatory approvals across key geographies. In parallel, companies are investing in digital traceability platforms to underpin clean label assurances, providing end users with transparent origin data and carbon footprint metrics.

Distribution strategies also vary, with some organizations prioritizing e-commerce channels to test new formulations before scaling through grocery and food service. Others leverage established relationships with quick service restaurant chains to pilot limited-edition offerings that gauge consumer acceptance. Across the board, an emphasis on sustainability-ranging from renewable energy integration in manufacturing to waste reduction in fermenter processes-reinforces brand equity and meets growing stakeholder expectations for environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Natural Sweeteners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co Inc

- Archer Daniels Midland Company

- Associated British Foods PLC

- Cargill Incorporated

- DSM-Firmenich AG

- DuPont de Nemours Inc

- Evolva Holding SA

- Foodchem International Corporation

- Fooditive B.V.

- GLG Life Tech Corporation

- Guilin Layn Natural Ingredients Corp

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- MacAndrews & Forbes Holdings Inc

- Monk Fruit Corp

- Morita Kagaku Kogyo Co Ltd

- PureCircle Ltd

- Pyure Brands LLC

- Roquette Frères

- Sunwin Stevia International Inc

- SweeGen Inc

- Südzucker AG

- Tate & Lyle PLC

- Tereos Starch and Sweeteners

- Whole Earth Brands Inc

Actionable Strategic Recommendations Empowering Industry Stakeholders to Navigate Challenges Capitalize on Growth Opportunities and Drive Sustainable Success in Natural Sweeteners

Industry leaders should prioritize strategic investments in domestic production infrastructure to mitigate exposure to import tariffs and supply chain disruptions. Establishing regional fermentation hubs with modular design can enable rapid scaling of production volumes in response to demand fluctuations while maintaining cost efficiencies. Simultaneously, forging partnerships with academic and technological innovators will expedite the development of proprietary rare sugar processes, delivering differentiated solutions that strengthen competitive moats.

To capture evolving consumer preferences, companies must refine portfolio strategies by aligning sweetener profiles with targeted applications-prioritizing functional benefits in bakery and confectionery, taste fidelity in beverages, and clean label transparency in personal care. Leveraging data analytics to monitor real-time consumer feedback across e-commerce and social media channels can inform agile reformulation cycles, ensuring product relevance and minimizing time to market. Moreover, embedding sustainability metrics within product lifecycle assessments-such as water usage, carbon intensity, and waste generation-will enhance brand credibility and support premium positioning.

Finally, channel diversification remains paramount. While grocery and food service continue to anchor volume sales, cultivating direct-to-consumer channels through subscription models and personalized packaging can unlock valuable consumer insights and foster brand loyalty. Tailored promotional campaigns highlighting health benefits and environmental credentials can further differentiate offerings in an increasingly crowded marketplace.

Comprehensive Research Methodology Explaining Data Collection Analytical Frameworks and Validation Processes Underpinning Insights into the Natural Sweetener Market

The research underpinning these insights combines a multi-pronged methodology designed to ensure rigor and reliability. Primary data collection involved interviews with senior executives across ingredient suppliers, food and beverage manufacturers, and regulatory bodies, providing firsthand perspectives on market dynamics and strategic priorities. Complementing these qualitative inputs, extensive secondary research drew on trade publications, patent filings, and regulatory databases to track technological advancements, compliance developments, and policy shifts.

Analytical frameworks such as SWOT, Porter’s Five Forces, and PESTEL analysis were applied to synthesize competitive pressures, macroeconomic influences, and regulatory landscapes. Additionally, a proprietary scoring model evaluated each sweetener type based on parameters including sweetness intensity, functional attributes, regulatory approvals, and cost competitiveness. This model informed segmentation analyses and supported the identification of high-potential growth pockets across applications, forms, distribution channels, and source categories.

To ensure validation, findings were cross-referenced with industry benchmarks and reviewed by an advisory panel comprising subject matter experts in food science, nutrition, and supply chain management. The result is a cohesive set of strategic insights that reflect both the current state of play and emergent trends shaping the future of the natural sweetener market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Natural Sweeteners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Natural Sweeteners Market, by Type

- Natural Sweeteners Market, by Application

- Natural Sweeteners Market, by Form

- Natural Sweeteners Market, by Distribution Channel

- Natural Sweeteners Market, by Source

- Natural Sweeteners Market, by Region

- Natural Sweeteners Market, by Group

- Natural Sweeteners Market, by Country

- United States Natural Sweeteners Market

- China Natural Sweeteners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusive Insights Synthesizing Key Findings Market Implications and Strategic Pathways Shaping the Future Landscape of Natural Sweetener Industry

The natural sweetener market is at an inflection point where health imperatives, technological breakthroughs, and policy developments intersect to create new horizons for growth. Consumer demand for low-calorie, clean label alternatives continues to drive rapid product reformulation across industries, while innovations in rare sugar production are expanding the toolkit available to manufacturers seeking optimal sensory and functional performance. Although tariff pressures have introduced cost volatility, they have also catalyzed strategic shifts toward localized production and supply chain resilience.

Segmentation analyses reveal that targeted sweeteners such as allulose, tagatose, and monk fruit will command premium positioning, while erythritol and xylitol maintain critical roles in mass-market applications. Regional disparities in regulatory frameworks and consumer preferences underscore the need for tailored market entry and expansion strategies. Meanwhile, competitive activity emphasizes the importance of integrated R&D, digital traceability, and sustainability credentials in differentiating offerings. These collective insights provide stakeholders with a clear roadmap for prioritizing investments, optimizing product portfolios, and forging partnerships that align with long-term industry trajectories.

Engage with Ketan Rohom to Unlock the Full Potential of the Natural Sweetener Market Report and Propel Your Business Growth with Tailored Industry Intelligence

As you seek to deepen your market intelligence and confidently navigate the evolving landscape of natural sweeteners, Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide your strategic decisions. Engaging directly with Ketan offers you tailored insights drawn from comprehensive analysis, ensuring that your organization capitalizes on emerging trends and overcomes critical supply chain and regulatory challenges. By collaborating with Ketan Rohom, you gain access to high-impact recommendations, bespoke data visualizations, and dedicated support to translate research findings into measurable business outcomes. Seize the opportunity to unlock detailed profiles of key players, granular segmentation breakdowns, and regional dynamics that will inform your product development, marketing positioning, and partnership strategies. Connect today with Ketan to secure your copy of the full market research report and empower your team with the competitive edge necessary to lead in the natural sweeteners domain.

- How big is the Natural Sweeteners Market?

- What is the Natural Sweeteners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?