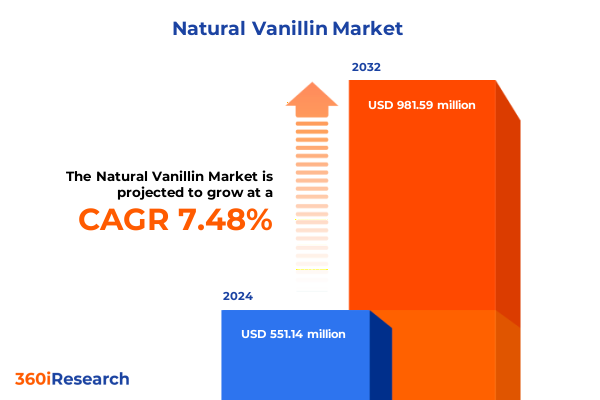

The Natural Vanillin Market size was estimated at USD 592.47 million in 2025 and expected to reach USD 632.78 million in 2026, at a CAGR of 7.47% to reach USD 981.59 million by 2032.

Unveiling the Strategic Imperatives and Emerging Dynamics Driving the Growth and Adoption of Natural Vanillin in Diverse Industrial Applications

Natural vanillin has emerged as a pivotal flavor compound with applications that extend far beyond its traditional use in food, commanding growing attention from cosmetics, personal care, and pharmaceutical sectors. Increasingly, product formulators are seeking clean-label ingredients that meet stringent consumer expectations for transparency and purity, driving a shift away from synthetic alternatives. This inflection point in the industry reflects a broader movement in which natural solutions are prioritized to address concerns over artificial compounds and to align with sustainability objectives in supply chains.

At the same time, the complexity of vanilla sourcing underscores significant supply chain challenges. Vanilla bean cultivation remains heavily concentrated in specific geographies, subject to climatic variability and pricing volatility. To mitigate these risks, manufacturers are pursuing novel extraction methods such as enzymatic synthesis and fermentation, reducing reliance on raw bean supplies while preserving the sought-after flavor profile. This technical evolution represents a strategic response to raw material constraints and exemplifies the industry’s innovative trajectory.

In light of these dynamics, our report opens with a comprehensive overview of market drivers, stakeholder priorities, and emerging challenges. By weaving together insights on consumer behavior, supply chain resilience, and technological adoption, this introduction lays the foundation for a nuanced understanding of how natural vanillin is being redefined across multiple end-use categories.

Exploring How Regulatory Changes, Technological Innovations, and Consumer Preferences Are Reshaping the Natural Vanillin Industry Landscape

The natural vanillin industry is experiencing transformative shifts propelled by regulatory intervention, technological innovation, and changing consumer preferences. Trade actions have become particularly influential, with recent determinations by regulatory bodies imposing both countervailing and antidumping duties on imports that are sold below fair value. Such measures have reshaped competitive dynamics by elevating domestic and alternative producers, while also recalibrating global supply networks to prioritize compliance and risk mitigation.

Concurrently, advancements in biotechnological processes are redefining how natural vanillin is produced. Sustainable pathways-such as lignin-based extraction pioneered by leading biorefineries-are gaining traction for their lower environmental footprint and traceable sourcing credentials. These breakthroughs underscore a broader evolution toward circular bioeconomy principles, aligning product development with corporate sustainability targets and consumer demand for eco-friendly ingredients.

Moreover, data analytics and digital tools are empowering companies to refine procurement strategies and optimize inventory management. Industry leaders are harnessing predictive modeling to anticipate price fluctuations and identify alternative supply origins, ensuring uninterrupted product availability even amid geopolitical uncertainties. This convergence of digitalization and supply chain agility represents a critical frontier for competitive differentiation in the natural vanillin market.

Assessing the Far-Reaching Consequences of the Latest U.S. Anti-Dumping and Countervailing Duties on Natural Vanillin Imports and Domestic Production

Recent U.S. tariff actions have imposed significant implications for the natural vanillin supply chain and market structure. In June 2025, the U.S. International Trade Commission delivered a determination that imports of vanillin from China materially injure domestic producers, paving the way for countervailing and antidumping duties. This landmark ruling, accompanied by subsequent duty orders, has prompted major realignments in sourcing strategies and cost structures for manufacturers reliant on lower-cost imports.

These measures have yielded immediate market responses, as exemplified by Camlin Fine Sciences, whose share price surged by over 50 percent following the announcement of U.S. and EU duties on Chinese vanillin imports. Reduced competition from subsidized foreign suppliers has enabled such companies to strengthen their market positions and pursue capacity expansions to meet rising demand.

However, the ripple effects of tariff policies extend beyond corporate balance sheets. Global spice giants have warned that elevated duty rates could translate to increased ingredient costs of up to $90 million annually, a burden that manufacturers aim to offset through price adjustments, sourcing diversification, and efficiency gains. Smaller enterprises, lacking comparable market influence, face heightened vulnerability as they navigate an environment defined by trade barriers and input cost pressures.

As these developments unfold, industry stakeholders are actively engaged in policy dialogues, pursuing tariff exemptions or seeking collaborative solutions to preserve ingredient availability and cost stability. The cumulative impact of U.S. trade actions in 2025 thus underscores the strategic importance of proactive regulatory engagement and supply chain contingency planning for all participants in the natural vanillin ecosystem.

Discerning Critical Market Segmentation Layers That Unlock Profound Insights into Application, Form, Distribution, End User, and Extraction Process Dynamics

A nuanced understanding of how different segments intersect is essential for grasping the multifaceted nature of the natural vanillin market. Application diversity spans from high-value cosmetics and personal care formulations to a broad spectrum of food and beverage products, including bakery and confectionery indulgences, dairy and frozen delights, and savory condiments. In parallel, the pharmaceutical sector leverages vanillin’s organoleptic properties to enhance patient compliance with oral medications.

Form preferences reflect formulation requirements and processing constraints. Liquid vanillin solutions are prized for rapid integration into aqueous systems, while powder variants offer stability benefits and ease of dosing in dry mixes. Distribution channels vary from traditional and modern trade outlets-housing extensive shelf networks-to online platforms that enable direct-to-manufacturer procurement and smaller batch purchases. End users range across food manufacturers optimizing flavor profiles, personal care brands crafting premium fragrances, and pharmaceutical companies prioritizing excipient functionality.

Extraction pathways delineate core production methodologies. Enzymatic synthesis routes utilize targeted biocatalysts to convert precursor molecules into vanillin with high selectivity, while fermentation-based processes harness microbial cell factories to transform biomass-derived substrates into the target compound. Each extraction process carries distinct cost, scalability, and sustainability parameters, informing strategic decisions across the value chain.

By integrating these segmentation layers-application, form, distribution, end user, and extraction process-decision makers can pinpoint strategic opportunities, anticipate shifting demand patterns, and align investment priorities to segment-specific growth trajectories.

This comprehensive research report categorizes the Natural Vanillin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Extraction Process

- Application

- Distribution Channel

- End User

Comparative Examination of Regional Diversification Revealing Distinct Trends and Opportunities Across Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics for natural vanillin reveal divergent growth vectors and strategic considerations. In the Americas, regulatory scrutiny and recent tariff initiatives have reignited focus on domestic manufacturing capabilities, catalyzing capacity builds among U.S. specialty chemical firms and fostering collaborations with North American agricultural partners to secure bean supplies. Simultaneously, robust demand for clean-label ingredients in packaged foods and beverages continues to underpin market expansion across both the U.S. and Canada.

Europe, the Middle East, and Africa (EMEA) present a complex regulatory mosaic, with emerging sustainability mandates driving the adoption of traceable sources and low-carbon production techniques. European flavor houses have led investments in bio-refinery projects to produce lignin-derived vanillin, aligning with EU Green Deal objectives. In the Middle East and Africa, artisanal and local extraction initiatives are gaining momentum, offering differentiated origin narratives that resonate with premium end-users seeking authentic ingredient stories.

Asia-Pacific stands at the forefront of production capacity growth, buoyed by significant expansions among Chinese, Indian, and Southeast Asian chemical manufacturers. Chinese producers, in particular, have undertaken large-scale facility upgrades and supply chain investments despite facing new trade barriers, underscoring their commitment to maintaining global market share. At the same time, growing consumer appetites for natural flavors across burgeoning middle classes in countries such as India and China are driving industrial consumption, making the region a critical axis for future demand consolidation.

These regional distinctions underscore the importance of localized strategies that account for regulatory environments, consumer trends, and supply chain capabilities to optimize market entry and expansion in the global natural vanillin landscape.

This comprehensive research report examines key regions that drive the evolution of the Natural Vanillin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Strategic Initiatives That Drive Competitive Advantage in the Global Natural Vanillin Industry

The competitive landscape of the natural vanillin industry is characterized by a mix of legacy flavor and fragrance conglomerates, innovative biotechnology firms, and nimble specialty chemical enterprises. Givaudan stands out as a market leader, leveraging extensive R&D investments to deliver premium natural vanillin solutions with a strong emphasis on sustainable sourcing and traceability. The company’s integration of biotechnology platforms with global supplier networks enables accelerated product development cycles and sector cross-pollination across food, fragrance, and personal care applications.

Solvay, another pivotal player, commands a significant share of synthetic and bio-based vanillin production, capitalizing on decades of chemical engineering expertise and robust distribution channels. The company’s focus on high-purity vanillin for industrial end-users has reinforced its reputation for reliability in large-scale food manufacturing and pharmaceutical excipient markets.

Borregaard’s wood-based vanillin production offers a compelling alternative, combining lignin valorization with eco-conscious processing to meet rising demand for environmentally responsible flavors. With its Vaniline™ product line and certifications for organic and sustainable sourcing, Borregaard exemplifies how biorefinery approaches can drive differentiation in a crowded marketplace.

Complementing these global leaders are emerging specialists such as Kunshan Asia Aroma Corp and Shank’s Extracts, which cater to regional food manufacturers and artisanal producers through flexible batch processing and custom formulation services. Nielsen-Massey Vanilla, renowned for its bean-derived extracts, continues to command brand equity among premium bakers and connoisseur chefs, reinforcing the enduring value of traditional extraction methods within a modern, innovation-driven ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Natural Vanillin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Flavor & Fragrance Group Co. Ltd.

- Borregaard ASA

- Comax Flavors

- Conagen Inc.

- De Monchy Aromatics

- Evolva Holding SA

- Firmenich SA

- Frutarom Ltd.

- Givaudan SA

- Mane SA

- Moellhausen S.p.A.

- Robertet SA

- Sensient Technologies Corporation

- Solvay SA

- Symrise AG

- Takasago International Corporation

- Treatt PLC

- Ungerer & Company

- V. Mane Fils SA

Strategic Recommendations to Empower Industry Leaders in Navigating Supply Chain Complexity and Capturing Value in the Natural Vanillin Market

To navigate the complex terrain of global tariffs, evolving consumer expectations, and technological disruptions, industry leaders should adopt a multifaceted strategic playbook. First, diversifying raw material sourcing through partnerships with alternative biomass suppliers and investing in fermentation-based production units can reduce exposure to geographic bottlenecks and duty-related cost spikes.

Second, strengthening regulatory engagement by collaborating with trade associations and leveraging government channels to secure targeted tariff exemptions or relief measures will preserve cost competitiveness and buffer against abrupt policy shifts. Proactive policy advocacy can also shape favorable conditions for natural ingredient classification and clean-label certification processes.

Third, accelerating digital transformation across supply chain operations can unlock predictive insights and foster real-time responsiveness. By integrating AI-driven quality control and advanced analytics, companies can anticipate demand fluctuations, optimize inventory allocations, and streamline logistics, thereby safeguarding margin performance in volatile markets.

Finally, investing in strategic partnerships and co-development initiatives with biotechnology firms and academic institutions will catalyze next-generation extraction techniques. Joint R&D programs focused on enzyme engineering, process intensification, and byproduct valorization can yield proprietary advantages, reduce production costs, and support sustainability commitments that resonate with end consumers.

Detailed Overview of Rigorous Research Techniques and Analytical Frameworks Underpinning the Comprehensive Natural Vanillin Market Study

This report’s findings are built upon a rigorous, multi-stage research methodology encompassing both primary and secondary data sources. Secondary research involved a comprehensive review of regulatory filings, trade association publications, patent databases, and relevant news releases to contextualize global tariff developments, technology advancements, and competitive landscapes.

Primary research comprised in-depth interviews with over 60 stakeholders, including senior executives at flavor houses, procurement specialists at leading food manufacturers, and subject-matter experts from biotechnology providers. These interactions were complemented by quantitative surveys to validate key assumptions and identify emerging priorities across market segments.

Data triangulation techniques ensured robustness by cross-verifying information from disparate sources, while trend extrapolation methods were applied to assess the trajectory of technological adoption and regulatory impact. Analytical frameworks, such as Porter’s Five Forces and PESTEL, guided the interpretation of competitive dynamics and macro-environmental factors, providing structured insights that underpin the report’s actionable recommendations.

Throughout the research process, stringent quality checks and peer reviews were conducted to maintain objectivity, accuracy, and relevance, ensuring that the insights delivered are aligned with the evolving needs of decision-makers in the natural vanillin industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Natural Vanillin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Natural Vanillin Market, by Form

- Natural Vanillin Market, by Extraction Process

- Natural Vanillin Market, by Application

- Natural Vanillin Market, by Distribution Channel

- Natural Vanillin Market, by End User

- Natural Vanillin Market, by Region

- Natural Vanillin Market, by Group

- Natural Vanillin Market, by Country

- United States Natural Vanillin Market

- China Natural Vanillin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Critical Takeaways Highlighting Growth Enablers, Industry Challenges, and Strategic Priorities in the Natural Vanillin Market

In summary, the natural vanillin market is undergoing a period of rapid transformation driven by regulatory reclassification, supply chain realignment, and heightened consumer demand for transparency and sustainability. Trade policies in 2025 have ushered in a new era of competing priorities between cost efficiency and regulatory compliance, compelling stakeholders to reevaluate traditional sourcing and production methodologies.

Technological innovations, from lignin-based extraction to fermentation-driven bioprocesses, are reshaping the contours of supply capacity and environmental impact, while segmentation insights reveal complex interdependencies across application, form, distribution, end user, and extraction process layers. Regional analyses underscore the imperative for tailored strategies that account for regulatory environments, market maturity, and resource availability.

Leading companies are positioning themselves through capacity expansions, digital supply chain investments, and strategic alliances, yet the path forward demands continuous adaptability. By synthesizing these critical takeaways, industry participants are equipped with the strategic lens necessary to anticipate market shifts, mitigate risks, and capture emerging growth opportunities within the dynamic natural vanillin landscape.

Engage with Ketan Rohom to Secure Exclusive Access to the Comprehensive Natural Vanillin Market Research Report and Unlock Business Advantage

To explore the full depth of insights and data presented in our Natural Vanillin market research report, contact Ketan Rohom (Associate Director, Sales & Marketing) to secure your copy and position your business for success in this evolving industry landscape. Ketan will guide you through tailored licensing options, answer specific inquiries about the report’s chapters and deliverables, and facilitate the purchase process so that you can gain immediate access to actionable intelligence. Don’t miss the opportunity to leverage comprehensive analysis on regulatory shifts, technological advancements, and strategic growth opportunities that will empower your organization to make informed decisions and stay ahead of competitors.

- How big is the Natural Vanillin Market?

- What is the Natural Vanillin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?