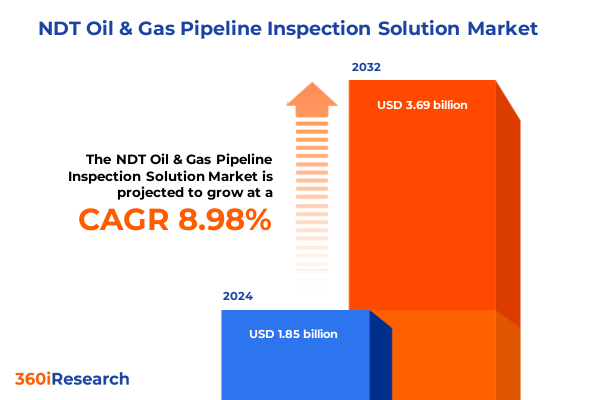

The NDT Oil & Gas Pipeline Inspection Solution Market size was estimated at USD 2.01 billion in 2025 and expected to reach USD 2.20 billion in 2026, at a CAGR of 9.03% to reach USD 3.69 billion by 2032.

Pioneering Advances in Non-Destructive Oil and Gas Pipeline Diagnostics Shaping Operational Excellence and Asset Integrity

In an era defined by stringent safety mandates and an unwavering focus on environmental stewardship, non-destructive testing (NDT) has emerged as an indispensable pillar in the oil and gas pipeline inspection domain. The confluence of aging pipeline infrastructure and evolving regulatory frameworks has created unprecedented urgency for operators to adopt advanced diagnostic techniques that not only detect flaws before they escalate but also preserve the operational lifespan of these critical assets. Against this backdrop, the landscape of pipeline inspection is undergoing a profound transformation, driven by innovative technologies and integrated workflows that redefine how integrity assessments are conceived and executed.

Stakeholders across the oil and gas value chain are increasingly prioritizing data-driven decision making, recognizing that traditional inspection regimes-often reliant on periodic manual interventions-are no longer sufficient to address the complexities inherent in modern networks. Today's executives are demanding continuous visibility into asset health, supported by high-resolution imaging, real-time analytics, and automated reporting capabilities that foster proactive maintenance strategies. By weaving together sensor-rich platforms, remote monitoring tools, and seamless data pipelines, organizations can now transition from reactive maintenance schedules to a predictive posture that maximizes uptime and mitigates the risk of environmental incidents. This report provides an executive-level overview of these emerging capabilities, setting the stage for deeper analysis into the trends reshaping the market and the strategic considerations that will guide investment decisions.

Transformative Shifts Redefining Oil and Gas Pipeline Inspection Through Hybrid Intelligence, Real-Time Data Analytics, and Autonomous Robotic Innovations

As the industry navigates mounting pressure to reduce costs and enhance safety, transformative shifts are materializing that recalibrate the entire pipeline inspection ecosystem. Emerging at the forefront is the convergence of hybrid intelligence systems, which pair machine learning algorithms with domain expertise to accurately identify corrosion, fatigue cracks, and weld defects. These systems leverage high-throughput imaging sensors and phased array ultrasonic testing modules to deliver granular insights that far surpass the resolution of legacy approaches, thereby enabling maintenance teams to prioritize interventions with surgical precision.

Simultaneously, autonomous robotic platforms are revolutionizing accessibility in challenging terrains and confined spaces, whether inside pressurized sections or beneath subsea installations. These advanced inspection robots integrate digital radiography and electromagnetic acoustic transducer techniques to perform continuous monitoring, feeding rich data streams into cloud-based analytics environments. The real-time capability afforded by Internet of Things–enabled communication systems empowers operators to adapt inspection plans dynamically, shifting focus to high-risk segments as anomalies are detected. Collectively, these advances signal a departure from siloed, episodic interventions to a holistic, continuously optimized methodology for asset integrity management.

Evolving Tariff Dynamics Reshaping Supply Chains and Technology Procurement for Pipeline Inspection in the Wake of 2025 United States Trade Policies

The introduction of new tariff measures in 2025 has had a cascading effect on the global supply chain for pipeline inspection technologies. Recent adjustments to duty rates on imported steel, imaging sensors, and inspection robots have elevated procurement costs and compressed vendor margins, compelling end users to reexamine sourcing strategies. In particular, the increased levies on high-strength steel and precision components have put pressure on manufacturers to localize critical production steps or risk passing elevated expenses onto customers.

In response, many operators have pursued strategic alliances with domestic suppliers to secure preferred pricing and ensure continuity in equipment availability. This pivot toward nearshoring has spurred investments in in-country machining capabilities and accelerated the development of modular sensor modules that can be assembled on-site, thereby minimizing the impact of cross-border delays. Moreover, service providers are renegotiating long-term maintenance agreements to lock in pricing commitments, while some innovators are pursuing alternative materials-such as composite pipelines compatible with guided wave testing-to hedge against tariff volatility. As a result, organizations across the value chain are adopting a more agile procurement framework, balancing the imperative for cutting-edge inspection solutions with the realities of an increasingly complex trade environment.

Uncovering Segmentation Insights Across Equipment Types, Inspection Techniques, Materials, Applications, and End-User Industries Driving NDT Performance

The equipment landscape for pipeline inspection is more nuanced than ever, encompassing communication systems, data acquisition systems, imaging sensors, inspection robots, and sensor modules. Each category plays a distinct role in creating a cohesive inspection ecosystem: communication systems provide the backbone for real-time data transmission, data acquisition systems ensure accurate capture of high-fidelity readings, imaging sensors render visual and subsurface anomalies, inspection robots negotiate challenging geometries, and sensor modules deliver specialized diagnostic capabilities. Together, these elements form a configurable toolkit that can be tailored to asset characteristics and operational imperatives.

Inspection techniques themselves have expanded to include computed tomography, digital radiography, eddy current testing, electromagnetic acoustic transducers, guided wave testing, phased array ultrasonic testing, and remote visual inspection. This plurality of methods allows organizations to apply the most appropriate diagnostic strategy based on defect type, pipeline geometry, and access constraints. Further granularity arises when considering pipeline material types: composite pipelines demand different sensor calibrations and robotic platforms compared to plastic or steel networks. Moreover, applications such as corrosion monitoring, gas infrastructure evaluation, integrity management protocols, leak detection initiatives, and oil modernization programs each present unique requirements that influence the choice of inspection hardware and software.

End-user industries spanning oil and gas production, petrochemical processing, power generation, and water utilities emphasize divergent performance metrics and regulatory obligations, shaping how solutions are packaged and delivered. By integrating these segmentation insights, decision makers can navigate the technology landscape more effectively, aligning inspection strategies to specific operational goals and compliance frameworks.

This comprehensive research report categorizes the NDT Oil & Gas Pipeline Inspection Solution market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Inspection Technique

- Pipeline Material Type

- Application

- End-User Industry

Key Regional Dynamics Shaping Oil and Gas Pipeline Inspection Solutions Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics exert a profound influence on how pipeline inspection solutions are deployed and optimized. In the Americas, stringent regulatory frameworks established by agencies such as PHMSA and CSA guide inspection protocols, fostering widespread adoption of advanced robotics and data analytics platforms. North American operators prioritize stakeholder transparency and environmental stewardship, driving demand for leak detection systems that integrate remote visual inspection with phased array ultrasonic testing. Meanwhile, Latin American markets are characterized by rapid infrastructure expansion, where cost-effective sensor modules and data acquisition systems play a crucial role in extending the service life of new pipelines.

In Europe, Middle East, and Africa, a diverse mix of mature networks and greenfield projects necessitates flexible inspection frameworks. Gulf nations leverage remote monitoring and imaging sensors to oversee offshore pipeline corridors, while European operators emphasize integrity management techniques to comply with comprehensive EU directives. In Sub-Saharan Africa, remote visual inspection solutions combined with eddy current testing provide a practical entry point for asset owners seeking to enhance safety without extensive capital outlays. Across these regions, partnerships between local service companies and global technology vendors have become instrumental in localizing support and ensuring rapid deployment.

The Asia-Pacific realm encompasses megaprojects in China, India, and Australia, where the convergence of industrial modernization and energy transition goals drives robust demand for computed tomography systems and guided wave testing. Asian operators are investing heavily in digital twins and integrated communication architectures to manage sprawling pipeline networks, while Southeast Asian and Oceanic entities explore sensor module innovations to address the logistical challenges of remote installations. In each geography, a unique blend of regulatory rigor, infrastructure maturity, and technological ambition is reshaping the NDT landscape.

This comprehensive research report examines key regions that drive the evolution of the NDT Oil & Gas Pipeline Inspection Solution market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Advancing Non-Destructive Pipeline Inspection Through Collaboration and Technology Integration

A cadre of leading innovators and strategic players are defining the trajectory of pipeline inspection through targeted R&D, cross-industry partnerships, and expanded service portfolios. Global powerhouses have harnessed their extensive distribution networks to deliver integrated solutions that combine inspection robots with advanced imaging sensors and cloud-based analytics. Simultaneously, agile specialized firms are differentiating themselves through niche offerings-whether that be high-resolution computed tomography modules or electromagnetic acoustic transducer systems designed for ultra-long-range guided wave testing.

Collaborations between robotics developers and NDT experts have yielded hybrid platforms capable of navigating complex pipeline geometries, enabling seamless transitions between inspection techniques based on defect profiles. Moreover, software providers are rolling out AI-driven analytics engines that correlate multivariate inspection data, automating anomaly detection and prioritization for maintenance teams. Service companies are also entering alliances with pipeline operators to offer outcome-based contracts, aligning commercial incentives with integrity targets and uptime metrics.

This dynamic competitive environment fosters a virtuous cycle of innovation, driving incremental improvements in sensor accuracy, communication latency, and robotic autonomy. As the ecosystem matures, companies that combine technical excellence with flexible deployment models-and who can adapt to regional regulatory requirements-are poised to capture the greatest value and usher in a new era of predictive asset management.

This comprehensive research report delivers an in-depth overview of the principal market players in the NDT Oil & Gas Pipeline Inspection Solution market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applus Services, S.A..

- AXIOM Engineering Associates Ltd.

- Baker Hughes Company

- Bruker Corporation

- Creaform by AMETEK, Inc.

- Eddyfi Canada Inc.

- Evident by Olympus Corporation

- General Electric Company

- Intertek Group plc

- IRISNDT Inc.

- Magnaflux by Illinois Tool Works Inc.

- Magnetic Inspection Laboratory, Inc (MIL)

- MFE Enterprises, Inc.

- MISTRAS Group, Inc.

- NDT Global Corporate Limited

- Pro QC International Private Limited

- Rosen Group

- Russell NDE Systems Inc.

- SGS S.A.

- Sonatest Ltd.

- T.D. Williamson, Inc.

- TechnipFMC plc

- TSC Subsea Ltd.

- TÜV Rheinland AG

- Zetec Inc.

Crafting Actionable Strategies to Enhance Operational Resilience, Safety Protocols, and Cost Efficiency in Oil and Gas Pipeline Inspection

Industry leaders seeking to stay ahead of emerging operational and regulatory pressures should embrace a series of strategic imperatives. First, organizations must adopt an integrated inspection framework that unites diverse diagnostic modalities under a single data architecture, facilitating comparative analysis across multiple techniques. This holistic approach will accelerate anomaly detection and streamline decision processes by eliminating data silos and ensuring consistency in reporting standards.

Second, companies should cultivate partnerships with technology suppliers to co-develop modular robotic platforms and sensor modules tailored to their specific pipeline profiles. By engaging early in pilot programs and joint development initiatives, end users can influence product roadmaps and gain early access to cutting-edge capabilities. Third, investment in workforce development is essential; training programs should emphasize cross-disciplinary skills spanning robotics operation, data analytics, and materials science, enabling inspection teams to derive maximum value from complex systems.

Further, executives should integrate predictive analytics into maintenance planning, using real-time feeds from communication systems and data acquisition platforms to anticipate failure modes before they manifest. Exploring alternative materials, such as composite pipeline segments compatible with guided wave testing, can also mitigate exposure to supply chain and tariff fluctuations. Finally, embedding continuous improvement cycles-fueled by post–inspection performance reviews-will drive incremental enhancements in safety protocols, cost efficiency, and overall operational resilience.

Rigorous Research Methodology Combining Qualitative Interviews, Technical Assessments, and Data Synthesis Ensuring Unbiased Insights and Comprehensive Analysis

The findings presented in this document are underpinned by a rigorous and transparent research methodology. Initially, a comprehensive desk study was conducted, analyzing publicly available technical papers, regulatory filings, and industry whitepapers to establish a foundational understanding of current inspection technologies and market dynamics. This was complemented by in-depth qualitative interviews with senior executives, field engineers, and inspection specialists across operators, service providers, and equipment manufacturers.

To validate and enrich these insights, technical assessments were performed on representative inspection solutions in collaboration with independent laboratories and certification bodies. Each technology underwent standardized performance evaluations, measuring parameters such as defect detection accuracy, deployment speed, and data throughput. Concurrently, site visits to operating pipeline networks provided practical perspectives on the logistical and environmental factors that influence technology selection and deployment.

All primary and secondary data were synthesized through a structured data triangulation process, which cross-referenced interview findings, lab results, and documented case studies to ensure consistency and objectivity. The analysis was reviewed by an advisory panel of subject matter experts to mitigate potential biases and confirm the relevance of key conclusions. This methodological approach delivers a balanced, comprehensive perspective on the evolving NDT landscape and its strategic implications for asset integrity management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our NDT Oil & Gas Pipeline Inspection Solution market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- NDT Oil & Gas Pipeline Inspection Solution Market, by Equipment Type

- NDT Oil & Gas Pipeline Inspection Solution Market, by Inspection Technique

- NDT Oil & Gas Pipeline Inspection Solution Market, by Pipeline Material Type

- NDT Oil & Gas Pipeline Inspection Solution Market, by Application

- NDT Oil & Gas Pipeline Inspection Solution Market, by End-User Industry

- NDT Oil & Gas Pipeline Inspection Solution Market, by Region

- NDT Oil & Gas Pipeline Inspection Solution Market, by Group

- NDT Oil & Gas Pipeline Inspection Solution Market, by Country

- United States NDT Oil & Gas Pipeline Inspection Solution Market

- China NDT Oil & Gas Pipeline Inspection Solution Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Synthesis Reflecting on the Evolution, Challenges Overcome, and the Future Trajectory of Pipeline Inspection Solutions

The journey of pipeline inspection has traversed a remarkable arc, evolving from manual, periodic assessments to a sophisticated tapestry of autonomous robots, high-fidelity imaging systems, and predictive analytics ecosystems. Along the way, stakeholders have surmounted challenges ranging from inconsistent data standards and limited access points to the imperative for near-zero environmental risk. The synthesis of advanced inspection techniques with real-time communication architectures signals a generational shift in how asset integrity is conceived and maintained.

Although cost pressures and trade policy uncertainties continue to pose strategic hurdles, the industry’s collective response-pivoting toward localized manufacturing, modular sensor designs, and outcome-based service contracts-demonstrates a resilience that will define future progress. The integration of hybrid intelligence and data-driven workflows has already unlocked unprecedented visibility into pipeline conditions, enabling teams to make rapid, informed decisions that prevent incidents and optimize maintenance budgets.

Looking forward, the emphasis will increasingly fall on holistic asset management frameworks that incorporate digital twin simulations, cross-domain analytics, and sustainable materials. As these elements coalesce, pipeline operators and service providers will be better positioned to achieve higher levels of safety, reliability, and operational excellence, ultimately safeguarding critical energy infrastructure in an era of dynamic regulatory and environmental expectations.

Engage with Ketan Rohom to Secure Comprehensive NDT Oil and Gas Pipeline Inspection Insights and Drive Strategic Decision Making Today

Are you ready to elevate your organization’s approach to pipeline integrity and operational continuity? Partnering with Ketan Rohom will give you direct access to tailored insights, in-depth technical evaluations, and strategic frameworks that can be immediately applied to improve asset performance and reduce downtime. Ketan Rohom, with extensive experience guiding leading energy companies through complex decision landscapes, will work with your team to align the research findings with your specific objectives and operational context.

Engaging with Ketan means you will receive a comprehensive consultation that outlines the critical technologies, regional considerations, and strategic imperatives shaping the sector today. This collaboration will ensure you’re equipped with a clear roadmap to prioritize investments, mitigate emerging risks associated with tariffs and supply chain disruptions, and accelerate the adoption of innovative non-destructive testing solutions. To secure your organization a competitive advantage and drive measurable ROI, don’t delay in scheduling your strategic briefing with Ketan Rohom. Reach out now to gain the insights that will define the next generation of pipeline integrity management.

- How big is the NDT Oil & Gas Pipeline Inspection Solution Market?

- What is the NDT Oil & Gas Pipeline Inspection Solution Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?