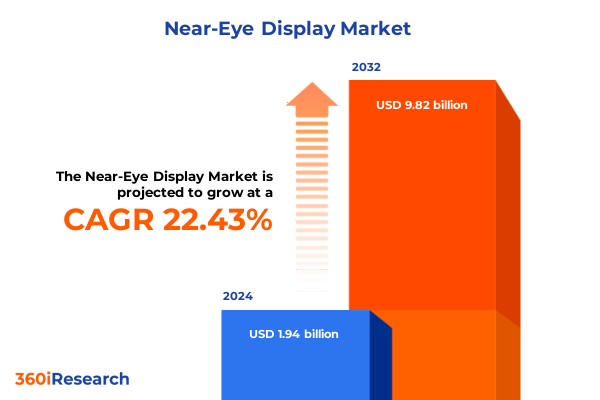

The Near-Eye Display Market size was estimated at USD 2.35 billion in 2025 and expected to reach USD 2.86 billion in 2026, at a CAGR of 22.59% to reach USD 9.82 billion by 2032.

Introducing a Comprehensive Exploration of Near-Eye Displays Shaping the Future of Immersive Visualization and Human-Computer Interaction

Near-eye displays represent a transformative interface between the digital and physical realms, enabling users to access augmented and virtual realities with unprecedented immediacy. Advances in optical waveguides, miniature projection systems, and transparent display substrates have propelled these devices from experimental prototypes into commercially viable platforms. As leading technology firms and startups alike converge on this space, the proliferation of applications-from immersive gaming and remote collaboration to hands-free industrial guidance-underscores the expansive potential of near-eye visualization.

In parallel, improvements in miniaturized sensors, low-latency wireless communication, and sophisticated software ecosystems have lowered barriers to adoption. Hardware refinements in power efficiency and ergonomic form factors now allow for extended wear times without compromising user comfort. This synergy of hardware and software innovation is enabling entirely new user experiences that were once constrained by bulkier systems and limited graphical fidelity. As a result, stakeholders across consumer electronics, defense, healthcare, and manufacturing sectors are reevaluating their strategic priorities to leverage these immersive platforms.

Looking ahead, the convergence of artificial intelligence–driven content generation with high-resolution near-eye displays promises to further catalyze innovation. By harnessing machine learning algorithms for real-time environment mapping and user behavior prediction, developers are set to deliver highly personalized and context-aware applications. Consequently, understanding the technological foundations and adoption drivers for near-eye displays has never been more critical for decision-makers aiming to stay at the forefront of immersive computing.

Examining the Pivotal Technological and Market Transformations Redefining Near-Eye Display Capabilities and User Experiences Across Industries

The near-eye display sector is undergoing a period of rapid metamorphosis, driven by converging advancements in micro-display engines, optical waveguides, and high-speed connectivity standards. At the hardware level, shifts from traditional Liquid Crystal Display technologies toward next-generation MicroLED and LCoS architectures have reduced power consumption and increased brightness, enabling clearer visuals in diverse lighting conditions. Concurrently, the maturing of Organic Light-Emitting Diode panels offers superior contrast ratios and thinner form factors, catalyzing a shift in how designers conceptualize wearable head mounted displays and smart glasses.

On the software front, the integration of real-time spatial computing frameworks has redefined the parameters of acceptable latency, steering the market toward low-latency tethered solutions while also accelerating the performance of standalone devices. Connectivity enhancements, including the widespread adoption of Wi-Fi 7 and emerging 5G+ networks, are ensuring seamless high-bandwidth data transfer, thereby supporting rich mixed reality content delivery. These developments are complemented by breakthroughs in field of view expansion techniques, where optical combiners now facilitate medium to wide viewing angles without sacrificing image fidelity.

These transformative shifts are resulting in a more modular and scalable ecosystem, with discrete innovations in display engines, optics, and sensor arrays coalescing into integrated platforms. As a consequence, consumer electronics brands, enterprise solution providers, and content developers are aligning their roadmaps toward interoperability and open standards, spurring collaborative ecosystems that promise to accelerate commercialization and broaden market reach.

Assessing How United States Tariff Measures Introduced in 2025 Are Reshaping Supply Chains Development Costs and Strategic Sourcing Decisions in Near-Eye Display Sector

In 2025, the United States enacted a suite of tariffs targeting advanced display components and optical modules commonly used in near-eye display assemblies. These measures were intended to bolster domestic manufacturing and encourage local supply chain development, but they have also introduced new complexities for global suppliers and OEMs. Component costs for critical elements-such as MicroLED arrays, precision waveguides, and high-volume OLED substrates-have been subject to incremental duty adjustments, prompting procurement teams to reexamine vendor agreements and logistical strategies.

Supply chain diversification has emerged as a direct response, with many manufacturers exploring alternative sourcing from Asia-Pacific partners outside the tariff scope. This reorientation has, in turn, impacted lead times and inventory management practices, as firms calibrate their networks to mitigate the risk of further policy shifts. Meanwhile, research and development budgets are being rebalanced to account for increased material costs, driving a renewed focus on localization of key value-chain processes. In some instances, original equipment manufacturers have accelerated partnerships with domestic fabricators to secure priority allocations of critical components.

Despite these challenges, the tariff landscape has also stimulated innovation in component efficiency and materials engineering. Companies are experimenting with hybrid display architectures and novel packaging techniques to reduce the overall duty exposure per unit. Consequently, while end users may experience marginal price adjustments, the long-term effect may be a more resilient and diversified supply infrastructure that can better withstand geopolitical fluctuations and foster sustainable growth.

Uncovering In-Depth Segmentation Perspectives That Illuminate Near-Eye Display Market Dynamics Across Major Technology and Application Dimensions

A nuanced examination of near-eye display market segmentation reveals distinct performance and user experience dynamics that cut across various technology layers and usage scenarios. In display engine typologies, traditional LCD modules often compete with emerging MicroLED and OLED platforms, each delivering unique trade-offs in power efficiency, brightness, and color gamut. Liquid Crystal on Silicon solutions meanwhile occupy a critical niche where ultrahigh pixel densities are required for enterprise and simulation environments. Transitioning between these display types necessitates design compromises that significantly influence form factor, battery life, and overall device weight.

When considering the spectrum of wearable formats, head mounted displays currently dominate applications requiring immersive field of view capabilities, particularly those exceeding seventy degrees for simulation and training use cases. In contrast, head up displays and smart glasses cater to scenarios where ambient awareness and lightweight ergonomics are paramount. These device distinctions align closely with the connectivity paradigm: tethered systems often leverage high-bandwidth wireless and wired interfaces to support advanced compute requirements, while standalone units prioritize onboard processing and battery optimization for untethered mobility.

Application segmentation further delineates the market, as consumer electronics offerings emphasize entertainment, mobile gaming, and social engagement, while government and defense initiatives prioritize situational awareness and secure communications. Healthcare deployments, spanning medical training simulations through surgical navigation platforms, demand precision optics, sterilizable designs, and integration with diagnostic imaging systems. Industrial manufacturing use cases focus on assembly assistance, maintenance procedures, and quality control, leveraging real-time overlay of schematics and work instructions. Finally, distribution channels, whether direct offline partnerships with distributors or digital storefronts, shape how these solutions reach end users, influencing factors such as customization options, service agreements, and post-sales support.

This comprehensive research report categorizes the Near-Eye Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Type

- Device Type

- Field of View

- Connectivity

- Application

- Distribution Channel

Highlighting Regional Trends and Distinct Drivers That Are Positioning the Americas EMEA and Asia-Pacific as Key Players in Near-Eye Display Adoption

The Americas region represents a hub of innovation, where North American research centers and Silicon Valley startups lead advances in optical design and sensor fusion. Established consumer electronics companies headquartered in this region are leveraging extensive distribution networks to pilot new hardware prototypes and developer kits, fostering a robust early adopter base. Meanwhile, favorable government initiatives and defense funding in the United States have catalyzed growth in mission-critical applications, including pilot training, simulation, and secure communications platforms.

In Europe, Middle East & Africa, strategic collaborations among established industrial players and emerging tech hubs are streaming investments into augmented reality solutions for manufacturing and logistics. Regulatory frameworks prioritizing data privacy and interoperability standards are shaping how companies engineer their systems, ensuring compliance across multiple jurisdictions. Additionally, defense agencies in the region are exploring near-eye displays for situational awareness, driving demand for night-vision compatibility and rugged form factors.

The Asia-Pacific market, fueled by robust consumer electronics ecosystems and high-volume component manufacturing, is rapidly scaling both standalone and tethered near-eye display offerings. Strong government-backed innovation clusters in East Asia facilitate partnerships between device OEMs and semiconductor foundries, accelerating the commercialization of MicroLED and advanced optical waveguide technologies. Moreover, emerging markets within Southeast Asia are adopting mixed reality tools for education and remote collaboration, showcasing the region’s potential to bridge supply chain strength with growing end-user acceptance.

This comprehensive research report examines key regions that drive the evolution of the Near-Eye Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives and Collaborative Innovation Efforts by Leading Companies Driving Advancements in Near-Eye Display Technologies

Leading technology providers continue to invest heavily in next-generation optical engines and custom silicon to differentiate their near-eye display portfolios. Major consumer electronics brands have announced collaborations with defense contractors to integrate augmented reality capabilities into secure communication headsets, underscoring a convergence of commercial and military use cases. At the same time, specialist firms with deep expertise in photonics and waveguide fabrication are forming strategic alliances with software developers, seeking to deliver turnkey solutions for enterprise customers.

Several cloud service giants are developing platform-level ecosystems that combine edge computing with near-eye visualization tools. By embedding AI-driven computer vision algorithms directly into their device management frameworks, these platforms enable real-time analytics and remote monitoring for industrial and healthcare applications. Meanwhile, startups focusing on lightweight smart glasses have secured venture funding to refine ergonomic designs and enhance battery longevity, signaling a shift toward consumer wellness and augmented telepresence applications.

Cross-industry partnerships are also redefining distribution strategies, as companies integrate co-development agreements with distributors and service providers to offer end-to-end implementation support. This collaborative approach ensures seamless deployment, covering everything from hardware commissioning to software integration and ongoing maintenance. Consequently, the competitive landscape is characterized by both horizontal consolidation among technology providers and vertical integration strategies that align component makers, system integrators, and application specialists.

This comprehensive research report delivers an in-depth overview of the principal market players in the Near-Eye Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- eMagin Corporation

- Himax Technologies

- HOLOEYE Photonics AG

- Kopin Corporation

- LG Electronics Inc.

- Lightning Silicon Technology, Inc.

- MICROOLED Technologies

- OMNIVISION

- SeeYA Technology

- Seiko Epson Corporation

- Sony Group Corporation

- Syndiant

- Vuzix Corporation

- WaveOptics

- WiseChip Semiconductor Inc.

- Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

Providing Actionable Roadmaps and Strategic Guidance to Help Industry Leaders Capitalize on Emerging Opportunities in Near-Eye Display Ecosystems

Industry leaders should prioritize the establishment of modular design frameworks that facilitate rapid integration of new display engines, optics, and sensor modules. By adopting a plug-and-play architecture across hardware and software layers, they can accelerate product development cycles and respond swiftly to evolving user requirements. Equally important is the cultivation of open standards for interoperability, which will unlock broader partner ecosystems and reduce integration complexity across diverse operating environments.

Furthermore, executives must consider proactive supply chain diversification strategies in light of emerging trade policies. Cultivating relationships with multiple component suppliers across different geographies, while simultaneously investing in domestic manufacturing capabilities, can mitigate tariff exposure and lead time risks. Parallel to these efforts, robust intellectual property management practices will safeguard core innovations and enable flexible licensing agreements, thereby fostering collaborative R&D without compromising proprietary assets.

Finally, companies should implement data-driven user feedback loops, leveraging telemetry and usage analytics to inform iterative product enhancements. Close collaboration with key enterprise customers-particularly within healthcare, defense, and industrial manufacturing-will uncover niche requirements and high-value use cases. By aligning product roadmaps with quantifiable performance metrics and demonstrable ROI, industry leaders can solidify market positioning and catalyze the next wave of near-eye display adoption.

Detailing the Rigorous Multi-Source Research Methodologies Employed to Ensure Accuracy Validity and Comprehensive Insights into Near-Eye Display Markets

This research synthesizes insights from a rigorous methodology encompassing primary interviews, secondary data collection, and comprehensive desk research. Primary data was obtained through structured interviews with technology executives, optical engineers, and end-user stakeholders, providing firsthand perspectives on development challenges, adoption motivators, and performance benchmarks. Supplementing this qualitative input, secondary sources including published patent filings, regulatory filings, and industry conference proceedings were analyzed to construct a robust foundation of technical and commercial intelligence.

Analytical rigor was ensured through data triangulation techniques, cross-verifying quantitative inputs against multiple independent sources to confirm consistency and validity. Key driver analyses were conducted to isolate the influence of trade policies, component innovation, and ecosystem partnerships on go-to-market strategies. In addition, competitive profiling was developed by mapping corporate alliances, patent portfolios, and funding activities, yielding a dynamic view of the strategic interplay among market participants.

The research framework emphasizes transparency and reproducibility, with clear documentation of data sources, interview protocols, and analytical assumptions. By integrating both qualitative narratives and quantitative assessments-while explicitly excluding market sizing or forecasting-this study delivers comprehensive, actionable insights into the near-eye display industry’s prevailing trends, challenges, and innovation trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Near-Eye Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Near-Eye Display Market, by Display Type

- Near-Eye Display Market, by Device Type

- Near-Eye Display Market, by Field of View

- Near-Eye Display Market, by Connectivity

- Near-Eye Display Market, by Application

- Near-Eye Display Market, by Distribution Channel

- Near-Eye Display Market, by Region

- Near-Eye Display Market, by Group

- Near-Eye Display Market, by Country

- United States Near-Eye Display Market

- China Near-Eye Display Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Projecting the Enduring Impact of Near-Eye Displays on Technology Integration User Engagement and Industry Growth

The collective insights presented in this report underscore the critical juncture at which near-eye display technologies currently stand. Technological breakthroughs in display materials, optical architectures, and integrated sensor systems are charting a course toward more immersive, ergonomic, and versatile platforms. Complementing these technical advances, shifts in supply chain strategies-driven by evolving trade policies-are fostering a more resilient manufacturing ecosystem capable of scaling to meet diverse application demands.

Segmentation analyses reveal that different device types, display engines, fields of view, and connectivity models each address unique user and industry requirements, from surgical navigation in healthcare to collaborative design in industrial settings. Regional trends further illustrate how innovation hubs in the Americas, regulatory-driven ecosystems in EMEA, and manufacturing scale in Asia-Pacific collectively shape global adoption patterns. Meanwhile, strategic partnerships and collaborative R&D initiatives are redefining competitive dynamics, as major players align along horizontal and vertical value chains.

Looking forward, the integration of artificial intelligence with near-eye display platforms promises to unlock new dimensions of context-aware user experiences, while ongoing advances in battery and wireless power technologies may soon overcome current ergonomic constraints. Together, these developments paint a compelling picture of an industry on the cusp of mainstream commercialization, where informed decision-making and strategic agility will distinguish market leaders from followers.

Engage with Ketan Rohom to Unlock Tailored Insights and Secure Access to Exclusive In-Depth Near-Eye Display Analysis and Strategic Recommendations

Engaging with Ketan Rohom offers an unparalleled opportunity to deepen your understanding of near-eye display dynamics and translate comprehensive intelligence into decisive strategic actions. In today’s rapidly evolving immersive technology landscape, personalized guidance is essential for identifying critical growth vectors, whether in advanced optics, user experience optimization, or content integration. Ketan Rohom, Associate Director of Sales & Marketing, brings a nuanced perspective on market nuances, ensuring that your investment in the complete research dossier yields actionable frameworks tailored to your organization’s competitive positioning.

By initiating a dialogue with Ketan Rohom, you gain direct access to expert interpretation of emerging technology trends, proprietary insights into supply chain adaptations following United States tariffs, and a thorough walkthrough of segmentation breakthroughs across device typologies, fields of view, and application verticals. This tailored engagement not only clarifies how leading companies are steering innovation but also uncovers precise levers for leveraging regional market dynamics. Whether you aim to optimize R&D roadmaps, refine go-to-market strategies, or cement partnerships, Ketan Rohom will equip you with the strategic playbook necessary to outperform rivals.

To secure the full market research report and harness its rich repository of data, trend analyses, and expert recommendations, reach out to Ketan Rohom today. Elevate your decision-making process with a customized consultation that aligns cutting-edge near-eye display intelligence with your corporate vision and objectives.

- How big is the Near-Eye Display Market?

- What is the Near-Eye Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?