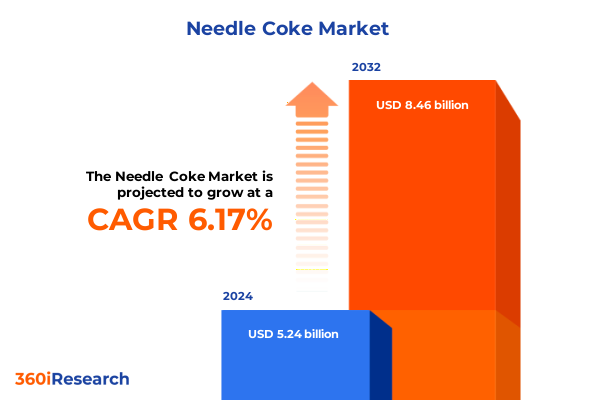

The Needle Coke Market size was estimated at USD 5.53 billion in 2025 and expected to reach USD 5.83 billion in 2026, at a CAGR of 6.26% to reach USD 8.46 billion by 2032.

Emerging Role of Needle Coke as a Critical Precursor Fueling High-Performance Carbon Material Innovations and Strategic Industrial Applications

Needle coke has emerged as an indispensable precursor in the production of advanced carbon materials, underpinning critical technologies across energy storage, aerospace, and electronics. Over the past decade, growing demand for high-performance end products has elevated needle coke from a niche industrial feedstock to a strategic raw material that dictates the performance and quality of graphite electrodes, carbon fibers, and specialty carbons. The unique combination of crystallinity and electrical conductivity inherent to needle coke positions it at the heart of multiple high-growth applications, driving both innovation and competition among producers globally.

As end-use industries intensify their focus on lightweight, durable, and high-strength materials, the needle coke landscape has become increasingly dynamic. Producers are responding with investments in process optimization and feedstock diversification to meet the stringent purity and morphology requirements of ultra high power grades. Meanwhile, applications in lithium-ion batteries and nuclear power demand unprecedented levels of thermal stability and structural integrity, further elevating the material’s strategic significance.

This executive summary distills the critical drivers, transformative shifts, and regional nuances shaping the needle coke market today. By navigating evolving feedstock strategies, regulatory frameworks, and competitive positioning, stakeholders can uncover actionable insights that fuel profitable growth and innovation in this highly specialized sector.

Pioneering Transformations in Feedstock Strategies and Manufacturing Technologies Driving the Next Generation Needle Coke Sector

The needle coke market has undergone profound transformation as industry players adapt to shifting energy policies, technological breakthroughs, and sustainability mandates. Historically reliant on coal-based feedstocks, producers have accelerated their transition towards petroleum-derived sources to achieve greater consistency in particle size distribution and crystallographic orientation. This shift has been propelled by advances in catalytic refinement and decarbonization techniques, which enable higher yields of ultra high power grades while minimizing carbon footprint.

Simultaneously, the integration of digital process controls and real-time analytics has revolutionized production efficiency. Modern manufacturing facilities leverage advanced sensors to monitor calcination temperatures and coke microstructure evolution, ensuring tighter tolerances and reduced scrap rates. Such technological interventions not only lower operational costs but also bolster product uniformity-critical for applications like graphite electrodes where electrical performance is paramount.

Moreover, growing environmental scrutiny has spurred the adoption of circular economy models. Producers are exploring the repurposing of by-products and recovery of volatile aromatic compounds, thereby mitigating waste and unlocking new revenue streams. As the market pivots towards greener production paradigms, collaboration between feedstock suppliers, technology providers, and downstream customers becomes increasingly pivotal, shaping a landscape defined by innovation, sustainability, and strategic partnerships.

Assessing the Cumulative Effects of United States Trade Tariffs on Needle Coke Supply Chains and Production Economics through 2025

United States tariffs implemented in early 2018 on steel, aluminum, and related raw materials have had cascading effects on the needle coke market, particularly as trade policies extended into 2025. The imposition of levies on imported aromatic oils and coal tar pitch feedstocks has incrementally elevated production costs for both coal-based and petroleum-based needle coke. As activities intensified in 2025, these cumulative tariffs have driven manufacturers to seek alternative supply corridors and localize critical inputs to mitigate exposure to import duties.

In response, North American producers have forged strategic alliances with domestic refineries capable of producing isotropic pitch tailored for needle coke synthesis. This realignment has reduced reliance on traditional exporters and facilitated backward integration initiatives. However, the recalibration of supply chains carries its own challenges: capacity constraints at local refining centers and the need for capital investments in retorting infrastructure have introduced timing and cost uncertainties.

Furthermore, downstream customers across aerospace, steel, and energy storage sectors are absorbing a portion of the tariff-driven cost escalation. Supply agreements now increasingly incorporate price adjustment clauses linked to tariff fluctuations, reflecting a broader shift towards dynamic contracting. Despite short-term disruptions, these developments have coaxed the market towards greater resilience and supply chain transparency, underscoring the strategic importance of diversified sourcing and adaptive procurement frameworks.

Unveiling Strategic Insights Across Product Types, Grades, Applications, and End-Use Industries Shaping the Needle Coke Ecosystem

By product type, coal-based needle coke continues to cater to legacy graphite electrode manufacturing, offering established supply routes but facing quality variability that demands rigorous refining. In contrast, petroleum-based needle coke has gained traction in carbon fiber and specialty carbon markets due to its superior crystallinity and lower impurity profile, enabling higher performance in critical applications.

Examining grade segmentation, regular power grade retains its position in conventional steelmaking electrodes, whereas high power grade addresses more demanding arc furnace operations. Ultra high power grade, distinguished by exceptional electrical conductivity and structural integrity, has emerged as the material of choice for premium graphite components in nuclear reactors and high-end battery anodes.

In application terms, carbon fibers leverage the unique microstructure of petroleum-based needle coke to achieve superior tensile strength and modulus. Graphite electrodes, driven by energy-intensive steel production, still absorb significant volumes of coal-based variants. Lithium-ion battery manufacturers increasingly adopt ultra high power grades for anode precursors, improving cycle stability. Nuclear power applications demand the most stringent purity levels, while specialty carbon materials benefit from tailored morphologies that cater to niche chemical and aerospace markets.

End-use industry analysis reveals that aerospace and defense segments prize the lightweight and thermal resilience of advanced carbon fibers. Automotive OEMs are integrating needle coke-derived carbon materials to achieve electrification and lightweight targets. The electronics and semiconductors sector depends on precision machined graphite from ultra high power grades, while energy storage and renewable energy deployments rely on battery grade anode materials. The nuclear industry and steel sector continue to anchor demand for high-performance electrode feedstocks.

This comprehensive research report categorizes the Needle Coke market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Production Technology

- Grade

- Application

- End-Use Industry

Regional Dynamics and Strategic Infrastructure Developments Defining the Needle Coke Market in Americas, EMEA, and Asia-Pacific Territories

The Americas region, led by North American refiners and South American coal producers, benefits from established infrastructure and proximity to major steelmaking hubs. Investment in refining capacity upgrades has been prioritized to offset tariff impacts, driving closer collaboration between feedstock suppliers and electrode manufacturers.

In Europe, Middle East & Africa, stringent environmental regulations and a shift towards circular economy practices have catalyzed the adoption of cleaner production technologies. Regional integration initiatives, such as expanded pipeline networks for aromatic feedstocks and shared R&D consortia, are strengthening supply resilience and fostering innovation within both legacy and emerging markets.

Asia-Pacific remains the dominant consumption center, bolstered by a thriving steel industry and rapid expansion of lithium-ion battery manufacturing. Domestic producers in East Asia are ramping up integrated refining and calcination facilities, while joint ventures with Middle Eastern petrochemical players seek to secure stable feedstock streams. Across Southeast Asia, growing petrochemical investments promise to diversify supply options and support capacity expansions.

This comprehensive research report examines key regions that drive the evolution of the Needle Coke market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Collaborations, Vertical Integration, and Technological Leadership Driving Competitive Advantages among Leading Needle Coke Producers

Key industry participants are redefining competitive landscapes through vertical integration, strategic partnerships, and technological innovation. Leading petroleum refiners have invested in proprietary coke stamping and calcining processes to enhance grade consistency and thermal properties, positioning themselves as preferred suppliers for high-value applications.

Major coal-based producers have expanded their presence in downstream electrode manufacturing, leveraging long-standing relationships with steelmakers to secure offtake agreements and stabilize revenue streams. Meanwhile, nimble regional players are carving niche positions by offering specialty carbon materials tailored for emerging sectors such as additive manufacturing and advanced composites.

Strategic collaboration between feedstock innovators and end-use technology firms has accelerated the development of next-generation ultra high power grades. Joint R&D ventures are focusing on nano-structuring and defect engineering to push the boundaries of electrical performance. As competitive intensity grows, companies that balance operational efficiency with agile product development pipelines will be best positioned to capture premium market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Needle Coke market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anovion LLC

- Asbury Carbons Inc

- BP PLC

- Chevron Lummus Global LLC

- China Baowu Steel Group Corp., Ltd.

- China Petroleum & Chemical Corporation

- ENEOS Holdings, Inc.

- Fangda Carbon New Material Co.,Ltd

- GrafTech International Ltd.

- Graphite India Limited

- HEG Limited

- Indian Oil Corporation Limited

- John Wood Group PLC

- Marathon Petroleum Corporation

- Mitsubishi Chemical Corporation

- Mott Corporation

- NIPPON STEEL Chemical & Material CO., LTD.

- Petroleum Coke Industries Company

- Phillips 66 Company

- POSCO M&C Materials Co., Ltd.

- Rain Carbon Inc.

- Resonac Corporation

- Rizhao Hengqiao Carbon Co.,Ltd.

- Sojitz JECT Corporation

- Sumitomo Corporation

- Tokai Carbon Co., Ltd.

Actionable Pathways for Resilient Feedstock Diversification, Collaborative Innovation, and Sustainable Competitive Differentiation

Industry leaders should prioritize securing diversified feedstock sources by exploring unconventional aromatic oil streams and deepening partnerships with domestic refiners to mitigate tariff vulnerabilities. Investing in advanced process control systems and machine learning-based optimization will unlock enhancements in yield and grade uniformity, fostering both cost efficiency and product quality.

To capture value in high-growth applications, companies must tailor their grade portfolios through co-development agreements with carbon fiber and battery manufacturers. Establishing joint innovation centers will accelerate material qualification cycles and foster end-to-end integration. Likewise, expanding circular economy initiatives-such as recovering volatile compounds and repurposing refractory by-products-can generate incremental revenue while reducing environmental footprint.

Furthermore, a proactive regulatory engagement strategy will be essential to navigate evolving environmental mandates. Collaborating with industry associations and standard-setting bodies can shape pragmatic guidelines that balance performance requirements and sustainability objectives. By adopting a holistic approach that fuses technological advancement, strategic collaborations, and policy foresight, industry players can safeguard resilience and drive profitable growth.

Rigorous Multi-Method Research Framework Leveraging Primary Interviews, Facility Audits, and Scenario Analysis for Robust Insights

This research employed a multi-methodological approach, integrating primary and secondary data sources to ensure comprehensive market coverage. Primary insights were harvested through structured interviews with key executives in refining, electrode manufacturing, and end-use sectors, complemented by site visits to leading production facilities across North America, Europe, and Asia.

Secondary research encompassed an exhaustive review of technical literature, industry white papers, and regulatory filings to validate technological trends and environmental policy developments. Data triangulation was conducted by cross-referencing proprietary project databases with public domain disclosures, ensuring the integrity and reliability of qualitative assessments.

A robust scenario analysis framework was applied to evaluate the implications of tariff fluctuations, feedstock shifts, and emerging end-use demands under varying economic conditions. Throughout the study, strict adherence to ethical research standards and data confidentiality protocols was maintained, guaranteeing that findings are both credible and actionable for strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Needle Coke market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Needle Coke Market, by Product Type

- Needle Coke Market, by Production Technology

- Needle Coke Market, by Grade

- Needle Coke Market, by Application

- Needle Coke Market, by End-Use Industry

- Needle Coke Market, by Region

- Needle Coke Market, by Group

- Needle Coke Market, by Country

- United States Needle Coke Market

- China Needle Coke Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Market Drivers, Strategic Imperatives, and Innovation Pathways Shaping the Future Trajectory of the Needle Coke Industry

As the needle coke market continues to evolve, stakeholders must remain vigilant to the interplay of feedstock innovation, regulatory landscapes, and end-use technology demands. The convergence of advanced production techniques, strategic supply chain realignments, and sustainability imperatives has created a dynamic environment ripe for strategic differentiation.

Producers that successfully navigate tariff pressures by enhancing domestic feedstock capabilities and forging collaborative R&D partnerships will unlock new avenues for growth. Similarly, those investing in digitalization and circular economy practices will achieve both operational excellence and environmental compliance, reinforcing their competitive positioning.

Ultimately, the future of the needle coke sector will be defined by agility, integration, and innovation. By embracing a holistic strategy that harmonizes technological leadership with strategic foresight, industry participants can secure long-term resilience and capitalize on emerging opportunities across diverse applications and regions.

Unlock Exclusive Access to Strategic Needle Coke Market Intelligence by Partnering with Our Senior Sales & Marketing Expert for Tailored Solutions

Act now to secure unparalleled insights into the intricate dynamics shaping the global needle coke market by investing in our in-depth analysis. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive research can empower your strategic planning and drive competitive advantage. Through a personalized discussion, you will explore tailored pathways for leveraging the report’s findings-whether optimizing supply chains, refining product portfolios, or identifying emerging growth corridors.

This report stands as a pivotal tool for organizations seeking precision in an ever-evolving landscape. By reaching out to Ketan Rohom, you gain priority access to executive briefings, detailed data tables, and one-on-one consultations designed to align research outcomes with your specific business objectives. Elevate your decision-making process and seize opportunities in coal-based and petroleum-based needle coke supply, grade innovations, and application diversification.

Don’t let critical developments pass by unnoticed. Contact Ketan Rohom today to receive a customized proposal and explore flexible purchasing options that best suit your organizational needs. Harness the full potential of our expert analysis to navigate tariff challenges, regional shifts, and competitive pressures with confidence and clarity.

- How big is the Needle Coke Market?

- What is the Needle Coke Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?