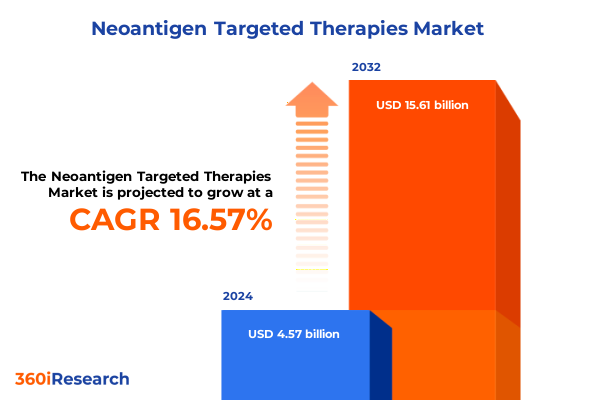

The Neoantigen Targeted Therapies Market size was estimated at USD 5.30 billion in 2025 and expected to reach USD 6.15 billion in 2026, at a CAGR of 16.66% to reach USD 15.61 billion by 2032.

Revolutionizing Cancer Care with Neoantigen Targeted Therapies by Harnessing Tumor-Specific Mutations to Drive Precision Immunotherapy and Improve Patient Outcomes

Neoantigen targeted therapies represent a transformative frontier in oncology, offering the potential to harness patients’ unique tumor-specific mutations to direct precise immune attack. These therapies capitalize on the immunogenicity of neoantigens, which arise from non-synonymous somatic mutations absent in healthy tissues, thereby reducing off-target toxicity and maximizing anti-tumor efficacy. Advanced next-generation sequencing platforms coupled with sophisticated bioinformatics pipelines now enable the rapid identification and prioritization of neoantigen candidates, laying the foundation for highly personalized interventions such as adoptive cell therapies (ACT) and individualized vaccine formulations. This evolution marks a clear shift from broadly acting immunotherapies toward tailored approaches that align with the distinct molecular profiles of each patient’s tumor.

Early clinical successes underscore the promise of this paradigm. In a Phase I study involving patients with advanced renal cell carcinoma, researchers at Dana-Farber Cancer Institute and Yale Cancer Center designed bespoke small-peptide vaccines targeting up to 20 patient-specific neoantigens. At a median follow-up of three years, all nine enrolled patients remained cancer-free, and immune monitoring revealed durable T-cell responses against the targeted neoantigens. Concurrently, neoantigen-specific TCR-T cell therapies have demonstrated the feasibility of engineering autologous T cells to recognize mutated peptide–MHC complexes, yielding objective tumor regressions in solid tumors and fostering a new class of precision cellular therapies. As the field matures, integration with checkpoint blockade and optimized vaccine delivery platforms promises to amplify efficacy, positioning neoantigen targeted therapies as a cornerstone of next-generation precision oncology.

Navigating Transformative Shifts in Neoantigen Therapy Landscape Amidst Technological Innovations, Regulatory Advancements, and Collaborative Ecosystems Reshaping Oncology

The neoantigen therapy landscape is undergoing transformative shifts driven by rapid technological innovation, evolving regulatory frameworks, and deepening collaborative ecosystems. On the technological front, breakthroughs in artificial intelligence and machine learning have accelerated epitope prediction accuracy, enabling more reliable in silico selection of high-affinity neoantigen candidates. These advances significantly shorten development timelines for personalized vaccines and T-cell receptor engineering projects, reducing the time from biopsy to treatment initiation. Simultaneously, improvements in mRNA and peptide synthesis technologies have enabled scalable manufacturing of individualized vaccine doses, addressing a historical bottleneck in personalized immunotherapy delivery.

Regulatory agencies worldwide are adapting to these novel modalities by establishing adaptive approval pathways and providing early-stage guidance for complex biologics. The U.S. Food and Drug Administration’s recent issuance of a draft guidance on individualized cellular and gene therapies offers sponsors clarity on required quality attributes, potency assays, and clinical study design. This regulatory transparency is critical for de-risking investment and speeding patient access to life-saving therapies. Moreover, public-private partnerships and multi-stakeholder consortia are proliferating, uniting biotech innovators, academic centers, contract development and manufacturing organizations (CDMOs), and government bodies. These alliances facilitate shared resources, standardize best practices for neoantigen identification and validation, and foster data-sharing networks that propel the field forward.

As these transformative shifts converge, the neoantigen field is poised for rapid expansion. By embracing advanced informatics solutions, engaging proactively with regulators, and forging strategic collaborations across the value chain, stakeholders can navigate complexity and accelerate the translation of personalized cancer immunotherapies into clinical reality.

Evaluating the Cumulative Impact of Newly Implemented 2025 US Tariffs on Neoantigen Therapy Development, Supply Chains, Innovation, Costs, and Regulatory Strategies

In 2025, comprehensive U.S. tariff policies have created a complex economic environment for neoantigen therapy development and deployment. Beginning April 5, a 10% global tariff on nearly all imported goods-including critical active pharmaceutical ingredients (APIs), medical devices, and specialized laboratory consumables-was enacted to bolster domestic manufacturing capacity. While this measure aims to enhance national security and incentivize local production, it has consequently increased raw material costs and placed upward pressure on R&D budgets for neoantigen platforms.

Further compounding these challenges, executive directives announced in July have signaled a phased introduction of pharmaceutical import tariffs, initially set at modest levels in August with plans to escalate substantially after an 18-month grace period. The Biotechnology Innovation Organization’s March 2025 survey revealed that nearly 90% of U.S. biotech firms depend on imported components for at least half of their FDA-approved products, with 94% expecting a surge in manufacturing expenses under EU tariffs and 80% requiring a year or more to identify alternative suppliers. Industry analysts caution that while inventory buffers may mitigate immediate financial impacts through late 2025, sustained tariff escalation risks delaying clinical trial timelines and reducing capital allocated to pioneering neoantigen research projects.

Major pharmaceutical and biotech players have already responded by diversifying supply chains, negotiating tariff-pass-through clauses with CDMOs, and exploring domestic partnerships to localize critical reagent production. However, smaller companies with limited capital reserves face significant hurdles in retooling manufacturing operations domestically, potentially stalling early-stage innovation. As a result, neoantigen developers are under pressure to implement agile procurement strategies, leverage public funding incentives, and engage policymakers to secure carve-outs or phased implementation schedules that preserve the momentum of personalized cancer immunotherapy advancements.

Unlocking Market Nuances Through Segmentation Insights Spanning Therapy Modalities, Treatment Approaches, Administration Routes, Age Groups, Indications, and End Users

A nuanced understanding of market segmentation is central to navigating the evolving neoantigen landscape. From a therapy modality perspective, the sector bifurcates into adoptive cell therapies and personalized neoantigen vaccines. The former encompasses chimeric antigen receptor T-cell constructs, bespoke T-cell receptor therapies, and tumor-infiltrating lymphocyte approaches, each offering distinct mechanisms of tumor eradication. In parallel, personalized vaccine platforms exploit dendritic cell delivery, nucleic acid-based vectors such as DNA or mRNA, and synthetic long-peptide formulations to prime endogenous immunity.

Treatment approaches further delineate the market between standalone monotherapies and combination regimens, the latter integrating neoantigen modalities with checkpoint inhibitors or targeted agents to overcome tumor immunosuppression. Route of administration provides another layer of insight: while oral vaccine formulations are under exploration for patient convenience, parenteral delivery remains predominant, subdividing into intramuscular, intravenous, and subcutaneous injection pathways tailored to optimize antigen presentation and T-cell trafficking.

Age demographics reveal distinct patient clusters-adult, geriatric, and pediatric populations-with variable immune competence and safety considerations shaping clinical protocol design. Meanwhile, target disease indications span bone malignancies, colorectal and gynecological cancers, non–small cell lung cancer, and renal cell carcinoma, each presenting unique mutational landscapes and neoantigen burdens. Finally, end-user analysis highlights differentiated utilization between academic and government research institutes pioneering basic discovery, hospital and clinic networks driving late-stage clinical implementation, and specialty oncology centers fostering ultra-individualized care models.

This comprehensive research report categorizes the Neoantigen Targeted Therapies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Modality

- Treatment Approach

- Route of Administration

- Age Group

- Target Disease Indication

- End-User

Illuminating Regional Dynamics of Neoantigen Therapies Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Guide Strategic Expansion and Collaboration

Regional dynamics play a pivotal role in shaping the trajectory of neoantigen therapeutics. In the Americas, robust R&D ecosystems in the United States and Canada benefit from substantial public and private funding, world-class sequencing infrastructure, and a favorable regulatory climate that has already approved multiple cell and gene therapies. Key academic centers and biotech clusters along the U.S. coasts drive early-stage discovery, while leading CDMOs and clinical networks enable scalable manufacturing and multisite trial execution.

Across Europe, the Middle East, and Africa, a heterogeneous landscape reflects varied regulatory frameworks and reimbursement models. Western European nations, notably Germany, Switzerland, and the United Kingdom, have launched national precision oncology initiatives, investing in harmonized genomic databases and cross-border clinical trial consortia. Meanwhile, select Middle Eastern hubs are leveraging sovereign wealth for biotechnology incubators, and emerging African partnerships emphasize capacity-building for next-generation sequencing and late-phase clinical deployment.

In the Asia-Pacific region, rapid market expansion is driven by innovative biotech ecosystems in China, Japan, and South Korea, each backed by government-led genomics programs and streamlined approval pathways for advanced therapies. Australia’s nexus of public research institutes and private developers has catalyzed early adoption of neoantigen vaccines in clinical trials, while India is emerging as a cost-competitive manufacturing hub, offering opportunities to establish regional supply chains and collaborative R&D ventures that can accelerate global patient access.

This comprehensive research report examines key regions that drive the evolution of the Neoantigen Targeted Therapies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Companies Driving Neoantigen Innovation from Established Biopharma Titans to Agile Biotech Pioneers Shaping the Future of Personalized Immunotherapy

The neoantigen field is propelled by a diverse array of industry leaders, ranging from established biopharma giants to nimble biotech innovators. Prominent vaccine developers leverage proprietary sequencing and predictive algorithms to create personalized mRNA and peptide formulations, while leading cell therapy manufacturers engineer next-generation CAR-T and TCR platforms optimized for neoantigen specificity. Several CDMOs specialize in rapid, small-batch production of individualized biologics, providing critical scalability and quality-assurance capabilities.

Technology providers offering advanced bioinformatics tools and AI-driven epitope prediction solutions form another cornerstone of the ecosystem, enabling streamlined target discovery and data management workflows. Concurrently, a growing roster of contract research organizations supports preclinical validation and translational studies, ensuring robust immunogenicity testing across diverse HLA backgrounds. Collaborative partnerships between academic institutions and industry players have given rise to dedicated neoantigen research consortia, pooling expertise in genomics, immunology, and clinical trial design.

Together, these leading entities are shaping a vibrant ecosystem in which specialized service providers, integrative technology platforms, and clinical development sponsors coalesce to drive neoantigen therapies from bench to bedside. Their collective efforts and investments lay the groundwork for sustainable innovation in personalized cancer immunotherapy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neoantigen Targeted Therapies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Achilles Therapeutics Limited

- Agenus Inc.

- AstraZeneca plc

- BioNTech SE

- Bristol‑Myers Squibb Company

- CureVac N.V.

- Eli Lilly and Company

- EpiVax, Inc.

- F. Hoffmann-La Roche AG

- Genentech, Inc.

- Genocea Biosciences, Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Gritstone bio, Inc.

- Immatics N.V.

- Immunomic Therapeutics, Inc.

- IOVANCE Biotherapeutics, Inc.

- Medigene AG

- Merck & Co., Inc.

- Moderna, Inc.

- Neon Therapeutics, Inc.

- Nykode Therapeutics

- Pfizer Inc.

- Precision Biologics

- Valo Therapeutics Ltd

Formulating Actionable Strategies for Industry Leaders to Accelerate Integration, Enhance Collaboration, and Navigate Market Complexities in Neoantigen Therapeutics

Industry leaders must adopt multifaceted strategies to capitalize on the promise of neoantigen targeted therapies. First, forging strategic alliances across the value chain-from genomics providers and bioinformatics innovators to CDMOs and clinical research organizations-will streamline development pathways and de-risk complex personalized manufacturing processes. Engaging early with regulatory bodies to align on adaptive approval frameworks and agile trial designs can expedite market access and establish precedent for individualized biologics.

Simultaneously, organizations should diversify supply chains by integrating domestic manufacturing capabilities and identifying alternative raw material sources to mitigate tariff-driven cost volatility. Investing in modular, automated production platforms will enhance flexibility and throughput, supporting just-in-time delivery of patient-specific doses. Moreover, establishing centers of excellence for neoantigen discovery and translational research can attract top talent and foster continuous innovation.

Finally, aligning with payers and health-economics experts to develop value demonstration models will be critical to securing reimbursement for high-cost, personalized interventions. By illustrating clear clinical benefits and long-term cost offsets, stakeholders can build compelling value propositions for healthcare systems. Through a concerted focus on partnerships, regulatory engagement, supply chain resilience, and health-economics alignment, industry leaders can accelerate the integration of neoantigen therapies into standard oncology practice.

Detailing a Robust Research Methodology Combining Primary Engagements, Secondary Analysis, and Rigorous Triangulation to Ensure Comprehensive Neoantigen Market Insights

This research synthesizes primary stakeholder engagements with leading oncologists, biotech executives, and specialized CDMO representatives to capture firsthand insights into the operational and strategic imperatives of neoantigen development. Structured in-depth interviews and advisory board sessions provided qualitative context around R&D challenges, regulatory expectations, and commercial considerations. Concurrently, a systematic review of secondary sources-including peer-reviewed publications, conference proceedings, and public policy documents-ensured a comprehensive understanding of technological advancements, clinical trial progress, and policy landscapes.

Rigorous data triangulation methodologies were employed, cross-referencing company disclosures, patent filings, and clinical trial registries to validate market activity and pipeline dynamics. Quantitative analysis of publication volumes, funding allocations, and approval trends complemented qualitative findings, creating a multidimensional view of the ecosystem. Segmentation frameworks were defined through iterative consultation with domain experts, differentiating clinical approaches, patient demographics, and regional market characteristics.

Finally, the report’s conclusions and recommendations were subjected to peer validation by an external panel of scientific advisors and industry veterans, ensuring objectivity and actionability. This robust methodological foundation underpins the strategic insights and ensures the highest level of credibility for stakeholders seeking to navigate the complex neoantigen therapeutics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neoantigen Targeted Therapies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neoantigen Targeted Therapies Market, by Therapy Modality

- Neoantigen Targeted Therapies Market, by Treatment Approach

- Neoantigen Targeted Therapies Market, by Route of Administration

- Neoantigen Targeted Therapies Market, by Age Group

- Neoantigen Targeted Therapies Market, by Target Disease Indication

- Neoantigen Targeted Therapies Market, by End-User

- Neoantigen Targeted Therapies Market, by Region

- Neoantigen Targeted Therapies Market, by Group

- Neoantigen Targeted Therapies Market, by Country

- United States Neoantigen Targeted Therapies Market

- China Neoantigen Targeted Therapies Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthetizing Core Conclusions on Neoantigen Targeted Therapies Highlighting Clinical Promise, Market Dynamics, and Strategic Imperatives for Stakeholders in Oncology

Neoantigen targeted therapies stand at the cusp of transforming oncology, offering a precision-driven approach that harnesses each patient’s unique tumor mutations to direct potent immune responses. Clinical successes in personalized vaccines and TCR-based adoptive cell therapies validate the core scientific premise and underscore the potential for durable remissions in challenging solid tumors. At the same time, advances in AI-driven epitope prediction, modular manufacturing technologies, and adaptive regulatory frameworks are converging to accelerate development timelines and broaden patient access.

However, the trajectory of neoantigen innovations is intertwined with external factors such as global tariff policies, supply chain resilience, and reimbursement uncertainties. Navigating these complexities demands strategic foresight, agile operational models, and collaborative engagement across the innovation ecosystem. Leaders who proactively integrate advanced bioinformatics, secure diversified manufacturing partnerships, and engage policymakers will be best positioned to sustain momentum and translate early clinical promise into widespread therapeutic applications.

Ultimately, stakeholders who blend scientific rigor with strategic adaptability can unlock the transformative potential of neoantigen targeted therapies, driving a new era of personalized immuno-oncology that redefines standards of care and delivers meaningful patient impact.

Empowering Decision Makers with a Tailored Call-to-Action to Connect with Ketan Rohom for Exclusive Access to In-Depth Neoantigen Therapeutics Market Research

To gain unparalleled strategic insights and drive your organization’s leadership in the rapidly evolving neoantigen therapeutics market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. With deep expertise in oncology market research and an extensive network across biopharma and investment communities, Ketan can tailor a comprehensive research solution to your unique objectives. Reach out today to discuss your priorities, unlock actionable intelligence, and secure a customized market research report that delivers clarity, foresight, and competitive advantage.

- How big is the Neoantigen Targeted Therapies Market?

- What is the Neoantigen Targeted Therapies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?