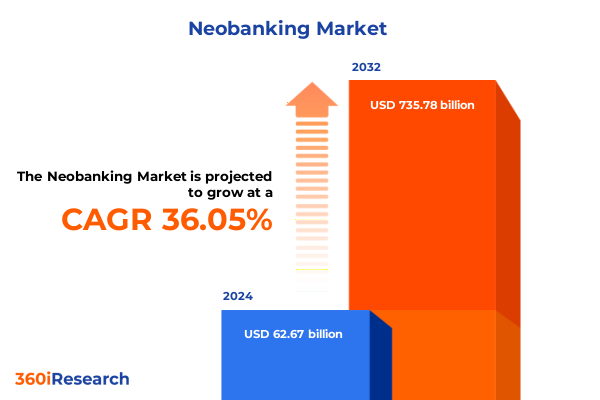

The Neobanking Market size was estimated at USD 84.37 billion in 2025 and expected to reach USD 113.58 billion in 2026, at a CAGR of 36.25% to reach USD 735.78 billion by 2032.

How rapid digital adoption, platform-first product models, and evolving regulatory expectations are reshaping competitive advantage across retail, corporate, and SME banking

The modern neobanking landscape sits at the intersection of rapid technological change, evolving regulatory expectations, and shifting consumer behavior. Digital-first account experiences, embedded finance propositions, and an expanded set of value-added services have altered how individuals and businesses access finance. As a result, incumbents and challengers increasingly compete on user experience, data-driven personalization, and platform interoperability rather than branch footprints or legacy product catalogs alone. This environment places a premium on speed of innovation, partnerships with payments rails and infrastructure vendors, and the ability to orchestrate products across lending, payments, foreign exchange, savings, and wealth services.

Against this backdrop, boards and C-suite leaders face a narrower window to translate strategic intent into customer outcomes. Product road maps must reconcile aggressive time-to-market targets with robust compliance and operational resiliency. Meanwhile, commercial leaders must evaluate platform choices that determine whether products are delivered primarily through mobile applications, omnichannel integrations, or web portals. Ultimately, success in this era depends on aligning technology architecture with regulatory readiness, and on converting data and experience design into sustainable customer lifetime value rather than short-term acquisition wins. This report synthesizes these dynamics into practical implications for leaders preparing for 2025 and beyond.

The convergence of embedded payments, API-driven banking-as-a-service, and AI-enabled personalization is creating new competitive moats and platform winners across financial services

The past 24 months have accelerated several structural shifts that will define the next cycle of value creation in digital banking. First, consumer and merchant payment behaviours are converging around digital wallets and embedded payment flows, creating new moments of monetization upstream of checkout. This trend elevates the strategic importance of partnerships with payment processors, card networks, and platform providers, and it increases the payoff for owning the user journey from discovery to settlement. McKinsey’s assessments of consumer digital payments show rising in‑store and in‑app wallet adoption and a meaningful shift in the purchase journey toward payment-led discovery and engagement, which creates both opportunity and competitive pressure for neobanks that can embed financial primitives into commerce ecosystems.

Second, open banking APIs and Banking-as-a-Service models have moved from experimentation to mainstream execution in many markets. The implications are profound: players that expose modular capabilities can monetize data and distribution, while platform integrators capture disproportionate share by bundling financial primitives into industry flows such as payroll, supply‑chain finance, and vertical SaaS. Third, artificial intelligence and advanced analytics have matured into practical features-automated underwriting, personalized savings nudges, and real‑time fraud detection-which materially reduce unit economics when implemented on a disciplined product‑engineering cadence. Together these shifts mean that the next wave of winners will be those that combine embedded distribution, API‑centric architecture, and analytics-driven risk and product management.

How recent USTR Section 301 modifications and ongoing legal challenges to tariff authority are elevating cross-border cost volatility and operational complexity for digital finance providers

Trade policy changes and tariff adjustments through 2024–2025 are producing ripple effects that extend beyond goods and supply chains to influence cross-border liquidity, pricing for hardware and energy inputs, and the economics of international payment corridors. Recent modified Section 301 actions and the targeted increases on categories such as solar wafers, EV components, semiconductors, and other strategic inputs have raised the landed costs for firms that depend on integrated global supply chains. USTR final notices and related modifications implemented in late 2024 and scheduled to take effect across 2024–2026 illustrate that tariff policy is being used to shape domestic industrial strategy, and those actions have direct implications for corporate treasury, FX hedging, and fees associated with trade finance and cross-border payments.

In addition to administrative tariff adjustments, the broader legal and political environment introduced new uncertainty when appellate rulings challenged the authorities used to impose broad emergency tariffs. That combination of enacted tariff increases in selected sectors and pending litigation has produced a higher‑variance planning environment for firms handling cross‑border flows. For neobanks and digital payment providers, the practical impacts include greater complexity in pricing international remittances, shifting partner risk when settlement rails touch jurisdictions affected by new duties, and potential increases in the cost of card and terminal hardware that can alter merchant economics. These effects are most acute on corridors and merchant verticals tied to exposed supply chains, underscoring the need for dynamic corridor pricing, more granular counterparty due diligence, and scenario planning that incorporates tariff-driven cost shocks.

Integrating service type, platform delivery choice, and end‑user needs to design composable product stacks and tailored go-to-market models for neobanking success

Understanding customer value requires segmentation across service types, deployment platforms, and end‑user categories because each axis defines distinct product design, revenue logic, and operational risk. When viewed through the lens of service type, offerings such as foreign exchange, lending, payments, savings and deposits, and wealth management each demand different capital, compliance, and distribution choices. Foreign exchange operations themselves split into currency exchange cards, forward contracts, and spot transactions-each with unique margin profiles, hedging needs, and technology requirements. Lending must be differentiated between business loans and personal loans, with the former hinging on account-level cash flow data and supply‑chain integrations and the latter on behavioral data and real‑time affordability checks. Payments manifest through bill payments, international remittances, and merchant payments, and the settlement and compliance workflows differ materially across those subsegments. Savings and deposits cover demand, fixed, and recurring products that vary in liquidity risk and pricing sensitivity. Wealth management now spans automated savings, portfolio management, and robo‑advisory capabilities that require a blend of trust, regulatory disclosure, and recital of fiduciary safeguards.

Platform choice-whether product delivery is primarily via mobile app, omnichannel integration, or web portal-affects activation funnels, retention levers, and the scope for embedded experiences. Mobile applications remain the primary channel for frequent, high‑engagement touchpoints and ephemeral features like round‑ups and instant offers, while omnichannel approaches support corporate and SME workflows that rely on richer document exchange and human-assisted onboarding. Web portals continue to be important for advisory work, bulk treasury operations, and complex product configuration. Finally, end‑user segmentation-large corporations, retail consumers, and small and medium enterprises-creates clear distinctions in pricing models, compliance burdens, and success metrics. Large corporates prioritize treasury features, FX limits, and dedicated account management; retail consumers prioritize UX, fees, and safety of deposits; and SMEs require a hybrid of embedded payments, affordable working capital, and accounting integrations. Integrating insights across these three axes enables product teams to design modular, composable offerings that address the specific economics and regulatory exposures of each customer cohort.

This comprehensive research report categorizes the Neobanking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Platform

- End User

How region-specific rails, regulatory regimes, and customer behaviors in the Americas, EMEA, and Asia-Pacific shape distinct go-to-market and product priorities for digital banks

Regional dynamics materially influence product priorities and partnership strategies because regulatory regimes, payment rails, and customer behavior diverge significantly across geographies. In the Americas, the United States and major regional markets emphasize scale, regulatory scrutiny, and integrated payments ecosystems; mobile-first adoption and large merchant networks create opportunity for embedded payments and lending partnerships, while regulatory focus on bank‑fintech relationships and consumer protections raises the bar for operational transparency and custodial arrangements. Europe, the Middle East & Africa presents a heterogeneous landscape: Europe’s open banking frameworks and PSD2 legacy support rapid API integration and account‑to‑account payments, whereas markets in the Middle East and Africa present high-growth corridors for remittances and mobile money with differing levels of financial infrastructure maturity. This divergence requires adaptable corridor strategies and local partnerships to manage FX, compliance, and liquidity. Asia‑Pacific is characterized by rapid digital payments adoption in many markets, fragmented rails across jurisdictions, and large pockets of embedded finance innovation-here, neobank strategies must combine localized product-market fit with the capability to integrate with domestic identity and payment networks.

Because payment costs, regulatory tolerance for non‑bank providers, and platform preferences vary by region, commercial strategies must reflect both local execution capability and global product standardization where possible. Effective regional playbooks typically combine a core, reusable technology stack with dedicated local compliance teams, tiered partnership models for settlement and FX, and product adaptations tuned to prevalent customer behaviours such as mobile‑first savings in Asia or treasury automation for export‑oriented corporates in the Americas. These regional choices will determine where scaled returns accrue and where investment is required to bridge infrastructure gaps.

This comprehensive research report examines key regions that drive the evolution of the Neobanking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive playbook and operational patterns observed among app-first challengers, BaaS enablers, and vertical specialists that are scaling neobanking services

Across the neobanking ecosystem a range of business models has emerged-app‑first retail challengers, platform incumbents offering embedded banking for partners, BaaS providers enabling white‑label banking, and specialized vertical players focused on SMEs or treasury services. Success patterns reveal that the highest‑momentum firms either own key aspects of the customer journey or secure privileged distribution via platform partnerships and vertical integration. Winning operators combine disciplined unit economics with a relentless focus on product velocity: they instrument funnels to shorten testing cycles, deploy data and AI to lift conversion and lifetime value, and use API wrappers to make their services easy to embed.

At an operational level, the firms that scale sustainably emphasize compliance-first engineering, clear separation between custody and ledger functions, and diversified funding sources for lending lines. Strategic alliances with card issuers, payments networks, and local settlement partners are recurring themes across mature players, enabling faster geographical expansion without duplicative balance‑sheet investments. In addition, several players demonstrate the value of modularity-packaging FX, treasury, and lending primitives so partners can compose them into industry workflows, thereby increasing stickiness. Taken together, these company-level insights point to a practical prescription: prioritize durable distribution channels, invest in platform resiliency and compliance automation, and pursue modular product architectures that balance reuse with local customisation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neobanking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ally Financial Inc.

- Atom Bank plc

- Bunq B.V.

- Chime Financial, Inc.

- Fi Money

- GoHenry Ltd.

- Jupiter Money

- Mercury Technologies, Inc.

- Monzo Bank Limited

- N26 GmbH

- Nu Pagamentos S.A.

- Open Financial Technologies Pvt. Ltd.

- RazorpayX

- Revolut Ltd.

- SoFi Technologies, Inc.

- Starling Bank Limited

- Tide Platform Ltd.

- Varo Bank, N.A.

- WeBank Co., Ltd.

- Wise Plc

High-impact, sequenced actions for product, risk, partnerships, and operations leaders to convert neobanking strategy into sustainable growth and regulatory resilience

Leaders must move from strategic intent to prioritized action by sequencing investments across product, risk, partnerships, and operations. First, invest in resilient, API-first platform architecture that supports modular product composition so teams can launch and iterate without long release cycles. Second, embed advanced analytics and AI into core workflows for risk, personalization, and automation so that underwriting, pricing, and fraud detection become competitive differentiators rather than cost centers. Third, develop a corridor and tariff-aware pricing engine that can react to sudden changes in cross‑border costs and provide transparent pricing to business and retail customers. Fourth, formalize a regulatory playbook that anticipates intensified scrutiny on bank‑fintech relationships and strengthens customer protections through balance‑sheet segregation, clear disclosures, and contingency liquidity planning. Fifth, accelerate partnerships with payments processors, card networks, and local settlement agents to reduce time to market while sharing settlement and compliance burdens.

Finally, prioritize commercial experiments that increase customer lifetime value rather than just lowering acquisition cost. Examples include embedding savings and investment nudges into payment journeys, offering merchant financing that ties repayment to sales volumes, and providing API bundles to vertical SaaS partners. Executives should sequence these recommendations by immediate feasibility and expected impact-start with platform and compliance hardening, follow with analytics and corridor pricing capabilities, and then scale distribution through partnership playbooks. This approach will reduce operational risk while enabling sustainable growth.

A mixed-methods research approach combining executive interviews, scenario modelling, and regulatory analysis to produce validated, implementation-focused intelligence

This research synthesizes primary and secondary inquiry to produce actionable insight tailored to executive decision making. Primary inputs include structured interviews with senior product and compliance leaders at digital banking and payments firms, executive workshops to validate scenario assumptions, and anonymized user‑journey testing across key market segments. Secondary inputs include policy and regulatory notices, payments and remittance reports, industry surveys, and trade press that together contextualize macro and corridor-level developments. Where regulatory or tariff actions are relevant, official notices and legal analyses were reviewed to ensure practical interpretation rather than speculative reading of policy intent.

Analytical methods combined qualitative synthesis with quantitative cohort segmentation and scenario modelling. Segmentation analysis reconciled service-level needs, platform delivery trade‑offs, and end‑user economics. Scenario modelling focused on operational sensitivity to tariff-driven cost shocks, FX corridor volatility, and regulatory escalation tied to bank‑fintech partnerships. Throughout the methodology, assumptions were stress‑tested against recent market actions and validated with practitioners to ensure that strategic recommendations are implementable within typical governance and risk frameworks. Limitations include dependence on evolving regulatory decisions and corridor-level data quality; where policy uncertainty was material, multiple scenarios were presented to aid executive planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neobanking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neobanking Market, by Service Type

- Neobanking Market, by Platform

- Neobanking Market, by End User

- Neobanking Market, by Region

- Neobanking Market, by Group

- Neobanking Market, by Country

- United States Neobanking Market

- China Neobanking Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Balancing velocity with resilience: why modular platforms, disciplined compliance, and corridor-aware pricing will determine which digital banks become indispensable

The neobanking sector stands at an inflection point where technology, policy, and international trade dynamics intersect to create both risk and opportunity. While digital distribution, API ecosystems, and AI provide powerful levers to improve unit economics and customer relevance, increased regulatory scrutiny and tariff-driven externalities mean that execution risk is non‑trivial. Boards and executive teams must therefore balance velocity with resilience: speed without proper controls will amplify exposure to operational failures and regulatory pushback, while excessive conservatism risks ceding distribution advantages to more nimble partners. A pragmatic middle path focuses on modular platform investments, rigorous partnership governance, and corridor-aware pricing strategies that can be adjusted rapidly as policy outcomes crystallize.

In sum, organizations that pair a product-led growth mindset with disciplined compliance engineering and flexible regional playbooks are best positioned to capture durable value. The coordinated adoption of API-first architectures, advanced analytics, and tariff-aware operational playbooks will determine which providers transition from promising challengers to strategically indispensable financial platforms.

Immediate executive pathway to acquire the full neobanking market research report and schedule a tailored commercial briefing with sales leadership

For executives ready to convert insight into advantage, purchasing the full market research report is the most direct way to secure evidence-based strategic guidance and tailored market intelligence. The report offers detailed segmentation analysis, regional deep dives, vendor benchmarking, regulatory scenario planning, and a prioritized action road map that can be operationalized by product, partnerships, compliance, and commercial teams. Clients who have engaged with this level of research find it accelerates decision cycles, reduces exploratory risk, and improves the alignment of go-to-market investments with measurable customer outcomes.

To proceed with a purchase or to request a customized briefing, please contact Ketan Rohom, Associate Director, Sales & Marketing, who will coordinate access to the full deliverable, arrange a tailored walkthrough, and discuss client-specific licensing and consultancy options. Outreach through your organization’s standard procurement or vendor-engagement channels will enable Ketan to provide the appropriate commercial and delivery timeline details. We recommend scheduling a short briefing call to align scope and to identify any bespoke analysis your team requires before finalizing the order.

Act now to convert strategic insight into executional momentum and to secure priority access to proprietary data and scenario modelling that will support board-level briefings, product road maps, and international expansion plans.

- How big is the Neobanking Market?

- What is the Neobanking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?