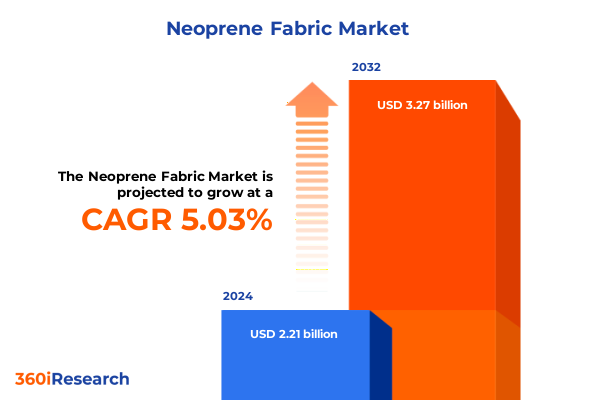

The Neoprene Fabric Market size was estimated at USD 2.30 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 5.18% to reach USD 3.27 billion by 2032.

Unveiling the Versatile World of Neoprene Fabric: Understanding Its Composition Applications and Industrial Significance Across Emerging and Established Markets

Neoprene fabric has emerged as a cornerstone material across a diverse array of industrial and consumer applications, owing to its unique blend of durability, flexibility, and resistance to environmental factors. Originally developed as a synthetic alternative to natural rubber, neoprene’s closed-cell structure provides exceptional thermal insulation and chemical stability, which have driven its adoption in markets ranging from protective apparel to automotive components. As end-user demands evolve, neoprene continues to adapt, leveraging innovations in polymer chemistry and manufacturing processes to meet increasingly stringent performance requirements.

In recent years, the emphasis on sustainability and eco-friendly materials has further elevated neoprene’s profile, with manufacturers investing in bio-based feedstocks and recycling initiatives. Meanwhile, the shift toward digital design and rapid prototyping has accelerated the development of specialized formulations capable of addressing niche performance challenges, such as ultra-lightweight insulating layers for wearable technology and high-precision seals for medical devices. These technological strides underscore neoprene’s capacity to maintain relevance in a market characterized by rapid change.

Against this backdrop, stakeholders must cultivate a nuanced understanding of neoprene’s material properties, application potential, and supply chain considerations. This executive summary offers a structured exploration of pivotal shifts shaping the neoprene fabric landscape, assesses the impact of recent policy changes, delves into segmentation and regional trends, highlights leading industry players, and culminates with actionable recommendations to guide strategic decision-making. By articulating these insights, this report lays the groundwork for informed investment, product development, and market expansion strategies.

Tracing the Transformative Shifts in Neoprene Production Usage and Sustainability Driven by Technological Advances and Consumer Demands

Over the past decade, the neoprene industry has undergone transformative shifts driven by technological breakthroughs and evolving consumer demands. Innovations in polymer synthesis and foam extrusion have enabled high-density and low-density foam neoprene variants to achieve superior compression resistance and thermal performance. Parallel advances in liquid neoprene adhesives, available in both solvent-based and water-based formulations, have enhanced bonding integrity across diverse substrates, fostering expanding use cases in construction, automotive, and wearable goods.

Sustainability imperatives have also prompted a pivot toward bio-derived neoprene precursors and closed-loop recycling programs. Manufacturers are exploring alternatives to chloroprene monomer feedstocks, while industry collaborations aim to establish standardized recycling protocols for end-of-life neoprene products. Moreover, the integration of digital mixing platforms and real-time quality monitoring has streamlined production workflows, reducing material variability and enabling rapid customization. These developments illustrate the sector’s commitment to operational agility and environmental stewardship.

Consumer preferences for high-performance sportswear, medical supports, and precision seals have further reshaped the neoprene landscape. Demand for wet-suit materials with enhanced elasticity and UV resistance has spurred new blends, while medical-grade molded neoprene in seals and gaskets supports critical applications in respiratory devices and wearable braces. As a result, industry players are reallocating R&D resources to balance performance, cost, and ecological considerations, cementing neoprene fabric’s position at the nexus of innovation and sustainability.

Assessing the Cumulative Impact of 2025 United States Tariffs on Neoprene Fabric Supply Chains Pricing and Strategic Sourcing Patterns

In 2025, the United States implemented a series of tariffs targeting imported neoprene fabrics, aiming to protect domestic producers and encourage onshore manufacturing. These measures have reverberated across the supply chain, prompting global suppliers to reassess their cost structures, shipment schedules, and contractual terms. Importers reliant on solvent-based and water-based liquid neoprene adhesives have absorbed higher landed costs, while end-users in the automotive and industrial sectors are negotiating longer lead times or transitioning to alternative sealant materials.

The cumulative effect of the tariffs has also accelerated strategic sourcing initiatives, encouraging manufacturers to diversify their procurement base beyond traditional Asian hubs. Regions such as Europe and the Middle East, home to established neoprene producers specializing in molded gaskets and solid sheets, have gained traction as viable partners. Meanwhile, some original equipment manufacturers (OEMs) have initiated vertical integration strategies to mitigate exposure, investing in in-house compounding and extrusion capabilities. These shifts illustrate an industry-wide rebalancing of supplier landscapes in response to evolving trade policies.

Despite short-term cost pressures, the tariff landscape has catalyzed long-term structural adjustments. Domestic foam neoprene producers offering high-density and low-density variants are scaling up capacity, while collaborative ventures between U.S. firms and overseas manufacturers aim to optimize supply chain resilience. As tariff policies remain under review, stakeholders who proactively adapt sourcing strategies, embrace material innovation, and engage in strategic partnerships are well-positioned to navigate the evolving regulatory environment.

Revealing Key Segmentation Insights to Illuminate How Product Types Applications and Distribution Channels Shape the Neoprene Market Dynamics

A comprehensive examination of the neoprene market reveals distinct dynamics across product type, application, distribution channel, thickness categories, and color choices. Foam neoprene, further differentiated into high-density and low-density variants, continues to dominate applications requiring thermal insulation and impact resistance, whereas liquid neoprene adhesives-available in solvent-based and water-based forms-address critical bonding requirements across construction and apparel assembly. Meanwhile, molded neoprene components, spanning gaskets and seals, cater to stringent tolerances in automotive and medical devices, and solid neoprene sheets in thicknesses ranging from under three millimeters to over six millimeters support a spectrum of industrial and consumer needs.

Application insights underscore neoprene’s versatility, as sectors such as apparel and wearable goods leverage gloves and wetsuits to optimize comfort and durability, and the automotive industry relies on specialized insulation and sealing solutions to meet evolving emissions and performance standards. Industrial settings utilize gaskets and insulation for equipment safety and efficiency, while medical applications demand seals, gaskets, supports, and braces that comply with regulatory hygiene and biocompatibility mandates. In sports and leisure, neoprene’s protective gear and yoga mat segments benefit from material flexibility and resilience.

Distribution channels shape market accessibility, with OEM and aftermarket direct sales carving out dedicated pathways for bulk industrial and automotive orders, while industrial distribution networks provide critical reach through distributors and wholesalers. The online retail space, consisting of e-commerce platforms and manufacturer websites, complements traditional channels by facilitating smaller orders and specialized product offerings, particularly in consumer-focused applications. Ultimately, thickness category and color variant trends-spanning black and multi-color or single-color options-reflect the nuanced preferences of end users seeking both performance and aesthetic customization.

This comprehensive research report categorizes the Neoprene Fabric market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Thickness Category

- Color

- Application

Navigating Regional Nuances in Neoprene Fabric Demand Highlighting Growth Drivers Challenges and Opportunities Across Major Global Markets

Regional analysis highlights divergent growth drivers and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, established markets in North America benefit from robust automotive and medical device sectors, with domestic manufacturers capitalizing on tariff-induced demand shifts and strategic investments in high-performance embodiments of foam and molded neoprene. Latin American players are increasingly importing specialized grades to support emerging infrastructure projects and expanding sportswear lines, even as logistical complexities persist.

The Europe Middle East & Africa region exhibits a strong orientation toward sustainability certifications and regulatory compliance, particularly in applications such as medical supports and environmental seals. European producers of solid neoprene sheets and liquid adhesives are advancing bio-based compound initiatives, while Middle Eastern industrial expansions spur demand for gaskets and insulation in energy and construction. Africa, though nascent in large-scale neoprene manufacturing, represents a growing market for imported solutions that meet durability requirements in harsh climates.

Asia-Pacific remains the largest manufacturing hub, with dominant capacities in both product innovation and volume production. Domestic players are extending capabilities in high-density foam and precision molding for gaskets and seals, while emerging economies are fostering small-scale production to serve local automotive and sportswear niches. Across the region, the digitalization of distribution channels is accelerating market penetration, enabling direct engagement with end users and facilitating rapid adoption of new material variants.

This comprehensive research report examines key regions that drive the evolution of the Neoprene Fabric market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Pioneering Neoprene Fabric Manufacturers and Suppliers to Highlight Their Strategic Initiatives Innovations and Competitive Advantages

Leading companies in the neoprene fabric ecosystem are distinguished by their integrated pipelines, innovation roadmaps, and strategic partnerships. Global chemical producers specializing in chloroprene monomer derivatives have expanded their footprints through joint ventures with technical fabric converters, ensuring seamless end-to-end supply chains. Meanwhile, specialized compounding firms have differentiated with proprietary foam extrusion techniques and advanced adhesive chemistries to cater to high-performance markets such as aerospace and medical devices.

Many of these companies are investing heavily in sustainability, forging research collaborations with academic institutions to explore bio-based feedstocks and developing pilot recycling programs for closed-loop neoprene recuperation. Others are bolstering digital capabilities, implementing Industry 4.0-enabled manufacturing platforms to reduce downtime and improve quality control. Strategic alliances between distributors, wholesalers, and online platforms are also reshaping the competitive landscape, as companies aim to provide omnichannel access to both standardized and customized neoprene solutions.

Competitive differentiation is further amplified by investments in application engineering services, enabling suppliers to co-innovate with end users on product formulations and fabrication techniques. In turn, this collaborative approach has accelerated time-to-market for specialized solutions, cementing these key players’ positions as preferred partners across multiple verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neoprene Fabric market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Colmant Coated Fabrics S.A.

- Denka Company Limited

- DuPont de Nemours, Inc.

- Eastex Products, Inc.

- Kumho Petrochemical Co., Ltd.

- LANXESS AG

- Macro Products, Inc.

- Mitsui Chemicals, Inc.

- Rivertex Technical Fabrics Group Ltd.

- Sheico Group

- Tiong Liong Industrial Co., Ltd.

- Tosoh Corporation

- Yamamoto Corporation

- Zeon Corporation

- Zhejiang Jianbo New Material Technology Co., Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Neoprene Fabric Trends Optimize Supply Chains and Enhance Market Positioning

Industry stakeholders should prioritize material innovation by exploring sustainable neoprene alternatives and partnering with technology providers to refine recycling and bio-feedstock adoption. Concurrently, diversifying supplier networks beyond traditional regions will mitigate tariff and logistics risks, with a focus on fostering relationships with emerging producers in Europe Middle East & Africa and strategic hubs within Asia-Pacific. This approach will bolster supply chain agility and reduce dependency on any single sourcing origin.

In product development, organizations are advised to invest in application engineering capabilities that accelerate prototype iterations and enable co-development of customized formulations. By integrating digital material libraries and virtual testing environments, firms can shorten development cycles and respond quickly to evolving end-user specifications. Additionally, enhancing omnichannel distribution strategies-balancing direct sales, industrial distribution, and ecommerce-will expand market reach and cater to varying order volumes and service expectations.

Finally, establishing robust market intelligence frameworks is critical. Leaders should deploy continuous monitoring of trade policy developments and competitive moves, leveraging data analytics to guide strategic investments in capacity expansion, portfolio optimization, and sustainability initiatives. A proactive posture, underpinned by cross-functional collaboration, will empower decision-makers to navigate uncertainty and capitalize on shifting industry dynamics.

Outlining Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Market Validation for Credible Insights

This research leverages a hybrid methodology combining primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary inputs were gathered through in-depth interviews with key stakeholders, including material scientists, supply chain executives, and end-user procurement leaders, providing firsthand perspectives on performance requirements, sourcing strategies, and emerging application trends.

Secondary research encompassed extensive review of technical publications, industry association reports, patent filings, and regulatory filings to map the competitive landscape and identify advances in polymer chemistry, extrusion technologies, and recycling processes. Data triangulation methods were used to validate insights, cross-referencing supplier disclosures with independent third-party analyses and proprietary databases to corroborate emerging patterns.

Quantitative analysis focused on segmentation breakdowns and regional performance indicators, while qualitative assessments explored strategic initiatives, innovation roadmaps, and policy impacts. The result is a synthesized view of the neoprene fabric market, underpinned by robust data governance protocols and peer review to ensure accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neoprene Fabric market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neoprene Fabric Market, by Product Type

- Neoprene Fabric Market, by Distribution Channel

- Neoprene Fabric Market, by Thickness Category

- Neoprene Fabric Market, by Color

- Neoprene Fabric Market, by Application

- Neoprene Fabric Market, by Region

- Neoprene Fabric Market, by Group

- Neoprene Fabric Market, by Country

- United States Neoprene Fabric Market

- China Neoprene Fabric Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Core Insights to Convey the Strategic Imperatives and Future-Proof Strategies for Stakeholders in the Neoprene Fabric Ecosystem

Throughout this executive summary, core insights into neoprene fabric’s multifaceted landscape have been elucidated, from the material’s intrinsic properties and transformative industry shifts to the repercussions of United States tariffs and nuanced segmentation dynamics. Regional and competitive analyses further underscore the importance of supply chain diversification, sustainability integration, and application-driven innovation for maintaining competitive advantage.

Strategically, stakeholders must balance short-term responses to regulatory changes with long-term investments in sustainable feedstocks, digital manufacturing, and collaborative product development. By aligning organizational structures and R&D pipelines with these imperatives, companies can fortify their market positions and anticipate evolving end-user requirements.

Ultimately, the insights presented here serve as a foundation for informed decision-making, guiding investments in capacity, technology, and partnerships. As the neoprene fabric ecosystem continues to evolve, those who embrace a proactive, data-driven approach will be best equipped to harness emerging opportunities and navigate potential disruptions.

Secure Comprehensive Neoprene Fabric Market Intelligence Today by Partnering with Ketan Rohom for Tailored Insights and Strategic Guidance

Are you prepared to deepen your understanding of the global neoprene fabric market and gain tailored strategic insights? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to unlock a comprehensive research report designed to inform critical decisions. His expertise in market dynamics and customized consultation will ensure you acquire exactly the intelligence you need to drive growth and maintain competitive advantage. Engage today to secure your copy and benefit from exclusive analysis that will shape your next strategic moves.

- How big is the Neoprene Fabric Market?

- What is the Neoprene Fabric Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?