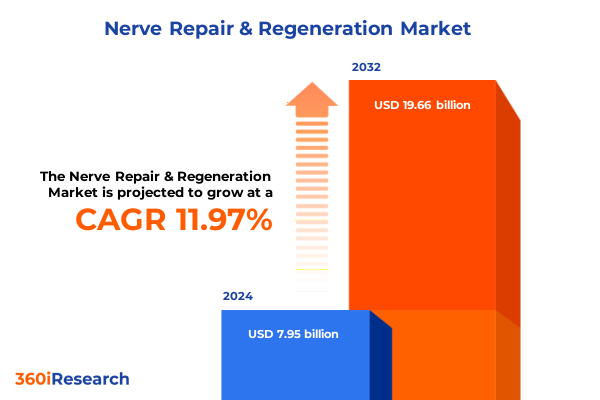

The Nerve Repair & Regeneration Market size was estimated at USD 8.84 billion in 2025 and expected to reach USD 9.86 billion in 2026, at a CAGR of 12.08% to reach USD 19.66 billion by 2032.

Opening the Frontier of Nerve Repair and Regeneration with Cutting-Edge Technologies Driving Clinical and Research Breakthroughs

The field of nerve repair and regeneration is at a pivotal juncture, driven by an unprecedented convergence of clinical demand, technological breakthroughs, and strategic investment. As populations age and chronic conditions such as diabetes-linked neuropathies become more prevalent, there is a mounting imperative to develop solutions that restore neuronal function and improve patient quality of life. In the U.S., more than 30 million individuals live with diabetic neuropathy, underscoring the urgent need for advanced regenerative interventions. Parallel to this demographic shift, trauma-related nerve injuries-whether from accidents, surgical complications, or battlefield wounds-continue to impose a heavy burden on healthcare systems.

At the same time, the overall U.S. medical device market, valued at nearly $200 billion, illustrates the scale and strategic importance of innovation in this domain. This vast ecosystem is increasingly prioritizing nerve repair technologies, as evidenced by growing R&D investments from both established medtech firms and agile startups. Furthermore, interdisciplinary collaborations among clinicians, biomedical engineers, and material scientists are facilitating a research environment where preclinical successes rapidly translate into clinical trials. Consequently, stakeholders across the value chain-from raw material suppliers to contract manufacturers and regulatory bodies-must navigate an evolving landscape characterized by heightened competition, stringent compliance requirements, and accelerating timelines.

Revolutionizing Nerve Healing through Biomaterials Advances, Bioelectronic Medicine Innovations, and Personalized Neurostimulation Therapies

Over the past few years, the nerve repair and regeneration landscape has undergone transformative shifts, propelled by advances in biomaterials, bioelectronic medicine, and precision engineering. Key among these shifts is the integration of bioactive growth factors and stem cells within next-generation conduits, which enhance axonal guidance and accelerate functional recovery. Researchers are now leveraging electrospun nanofiber scaffolds that emulate the native extracellular matrix, providing directional cues for nerve regrowth while minimizing foreign body reactions.

Another critical evolution is the advent of 3D bioprinting technologies, enabling the fabrication of patient-specific nerve grafts tailored to complex anatomical geometries. This customization not only improves fit and reduces surgical time but also fosters optimal tissue integration. Simultaneously, the maturation of bioelectronic implants-such as closed-loop neurostimulation devices featuring real-time sensing and adaptive stimulation algorithms-is redefining pain management and functional restoration for both peripheral and central nervous system injuries. AI-enabled neurofeedback systems now allow clinicians to fine-tune stimulation parameters dynamically, maximizing therapeutic outcomes while reducing adverse effects.

Collectively, these innovations have shifted the focus from reactive repair to proactive, personalized regeneration. As new materials and electronic interfaces converge, the industry is poised for a new era in which treatments are not only more effective but also more predictive, minimizing trial-and-error approaches and expediting patient recovery trajectories.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Nerve Repair Device Supply Chains and Costs

In early 2025, the United States implemented a series of import tariffs that have had significant implications for medical device manufacturers, including those specializing in nerve repair and regeneration. A 10 percent duty on Chinese imports was imposed, while 25 percent tariffs on Canadian and Mexican products were paused-creating both immediate cost pressures and supply chain uncertainties for device makers reliant on global sourcing. As many neural conduits, graft materials, and electronic stimulators incorporate steel, aluminum, or semiconductor components, these levies have translated into increased procurement costs and operational disruptions.

Moreover, tariffs on critical healthcare supplies-ranging from syringes and needles to permanent magnets and specialized polymers-rose from 7.5 percent to as much as 50 percent. These hikes are projected to add billions of dollars annually to hospital supply budgets, further constricting capital available for investment in advanced regenerative therapies. Medical device associations have petitioned for exemptions, highlighting potential delays in patient access and reduced R&D spending, yet policy clarity remains elusive.

Compounding the situation, import duties on select components reached unprecedented highs of up to 145 percent, as noted by industry analysts, forcing manufacturers to reevaluate supplier networks and consider nearshoring production activities. While short-term contractual buffers have mitigated some cost pass-throughs, midstream and downstream partners are beginning to anticipate higher pricing. Consequently, executive teams must now devise strategic responses to secure critical inputs, maintain competitive pricing, and safeguard ongoing innovation efforts in nerve repair and regeneration.

Unlocking Market Dynamics through In-Depth Analysis of Product, Biomaterial, Surgical, Application, and End-User Segmentation Insights

A nuanced understanding of market segmentation is essential for stakeholders seeking targeted growth opportunities in nerve repair and regeneration. The product type landscape encompasses nerve conduits, nerve grafts, nerve protectors, and neurostimulation and neuromodulation devices. Within this framework, each product class addresses distinct clinical needs-from bridging peripheral nerve gaps with bioresorbable conduits to providing chronic pain relief via implantable stimulators. Concurrently, the biomaterial type dimension distinguishes between natural and synthetic options, where natural biomaterials offer inherent biocompatibility and synthetic polymers provide consistent manufacturing quality and tunable degradation profiles.

The surgery type axis further subdivides into direct nerve repair (neurorrhaphy), nerve grafting, and nerve transfers. Neurorrhaphy itself can be performed through epineural, group fascicular, or perineural techniques, each selected based on injury characteristics and available nerve tissue. Nerve grafting options include allografts, autografts, and xenografts, which are chosen based on regenerative capacity, immunogenic profile, and donor site morbidity considerations. From an application standpoint, therapies are directed toward the brain, peripheral nerves, or spinal cord, reflecting the anatomical and functional diversity of neurological repair.

Finally, end-user segmentation spans ambulatory surgical centers, hospitals, research and academic institutes, and specialty clinics. Hospitals typically dominate high-complexity procedures and intensive postoperative care, whereas ambulatory and specialized clinics are proliferating in minimally invasive and outpatient neuromodulation offerings. This multi-dimensional segmentation provides a roadmap to align product development, clinical trial design, and go-to-market strategies with the specific needs and purchasing behaviors of diverse customer cohorts.

This comprehensive research report categorizes the Nerve Repair & Regeneration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Biomaterial Type

- Surgery Type

- Application

- End-User

Decoding Regional Variances in Nerve Repair Adoption and Innovation Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional dynamics in nerve repair and regeneration markets reveal distinct patterns driven by reimbursement frameworks, regulatory environments, and healthcare infrastructure maturity. The Americas, led by the United States, exhibit robust adoption of advanced biomaterials-capturing 38.6 percent of the North American market for regenerative scaffolds in 2024-fueled by favorable Medicare and private insurance coverage and streamlined regulatory pathways. Clinical centers of excellence and specialized rehabilitation facilities further accelerate technology uptake, supporting early adopters in proof-of-concept studies and post-market surveillance.

In Europe, Middle East, and Africa (EMEA), the landscape is shaped by the European Medical Device Regulation (MDR), which has heightened compliance requirements but also harmonized standards across the European Union. Countries such as Germany and the United Kingdom lead in neuromodulation device installations, whereas emerging markets in the Gulf Cooperation Council are rapidly expanding investment in research collaborations and advanced clinical infrastructure to meet growing demand for peripheral nerve repair.

Across Asia-Pacific, large patient populations and government-driven initiatives to enhance neurosurgical capacity underpin future growth prospects. China’s centralized procurement mechanisms and evolving reimbursement programs are making innovative conduits and stimulators more accessible, while Japan’s precision medicine agenda supports personalized neuroregenerative approaches. India and Southeast Asia are following suit, with public–private partnerships facilitating technology transfer and local manufacturing ventures to address cost sensitivity and scale.

This comprehensive research report examines key regions that drive the evolution of the Nerve Repair & Regeneration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Shaping the Future of Nerve Repair and Regeneration through Strategic Growth and Research

The competitive landscape in nerve repair and regeneration features both established healthcare giants and specialized medtech innovators. Medtronic, Abbott Laboratories, and Boston Scientific continue to dominate the neurostimulation device segment, leveraging extensive clinical portfolios and global sales networks. Johnson & Johnson, GE Healthcare, and Intuitive Surgical have publicly signalled preparedness for tariff-related headwinds, underscoring their critical roles in surgical instrumentation and device component manufacturing.

In parallel, companies such as Axogen and Polyganics are pioneering scaffold technologies and synthetic conduits, demonstrating the disruptive potential of next-generation biomaterials in peripheral nerve repair. Startups focusing on closed-loop bioelectronic interfaces-integrating sensing, stimulation, and AI-driven control-are drawing venture capital, setting the stage for rapid innovation cycles. Furthermore, contract development and manufacturing organizations (CDMOs) specializing in sterile processing and implantable electronics are emerging as pivotal partners, enabling scaling and regulatory compliance for smaller innovators.

Strategic alliances and M&A activity are reshaping the ecosystem. Major players are acquiring or licensing breakthrough biopolymers, while consortium-based research initiatives are pooling expertise in stem cell therapies and gene-modified constructs. As competition intensifies, differentiation through proprietary platform technologies, evidence-based clinical outcomes, and comprehensive service offerings will be the key determinants of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nerve Repair & Regeneration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Axogen, Inc.

- B. Braun SE

- Baxter International Inc.

- BioCircuit Technologies, Inc.

- Boston Scientific Corporation

- Checkpoint Surgical, Inc.

- Epineuron Technologies Inc.

- Integra LifeSciences Holdings Corporation

- LivaNova PLC

- Medtronic PLC

- MicroTransponder Inc.

- NervGen Pharma Corp.

- Neuraptive Therapeutics, Inc.

- NeuroPace, Inc.

- Newrotex

- Orthocell Ltd.

- Regenity Biosciences

- ReNerve Pty Ltd

- Saluda Medical Pty Ltd.

- Stryker Corporation

- TOYOBO CO., LTD.

Designing Strategic Pathways for Industry Stakeholders to Enhance Agility, Foster Innovation, and Strengthen Supply Chain Resilience

To navigate the complexities of the nerve repair and regeneration landscape, industry leaders should adopt a multifaceted strategic approach. First, diversifying supply chains by establishing dual or nearshore sourcing for critical components will mitigate exposure to tariff fluctuations and geopolitical disruptions. Concurrently, pursuing joint ventures or licensing agreements can secure access to proprietary biomaterials and neurostimulation platforms, accelerating time to market.

Investments in collaborative R&D consortia-linking academic centers, clinical research organizations, and manufacturing partners-will be instrumental in de-risking early-stage innovations and generating robust clinical evidence. Active participation in policy advocacy through trade associations can influence tariff exemptions for essential medical technologies, preserving affordability for patients and health systems.

Moreover, companies should embed digital health capabilities within neuroregenerative offerings, leveraging remote monitoring, patient engagement apps, and AI-driven analytics to demonstrate long-term value and differentiate services. Tailoring commercialization strategies to high-growth regional markets-by aligning product features with local reimbursement requirements and clinical practice patterns-will unlock new revenue streams. Finally, prioritizing talent development in biomaterials engineering, microsurgery, and regulatory affairs is critical to sustaining innovation pipelines and ensuring compliance in global jurisdictions.

Outlining the Robust Research Framework Integrating Primary Insights, Secondary Intelligence, and Rigorous Validation Methodologies

Our research methodology integrates a rigorous mix of primary and secondary data collection techniques to ensure the highest standard of analytical validity. Primary insights are derived from semi-structured interviews with key opinion leaders-including neurosurgeons, biomedical engineers, and payers-to capture nuanced perspectives on clinical efficacy, adoption barriers, and emerging opportunities. Secondary intelligence is sourced from peer-reviewed journals, regulatory databases, and reputable industry publications, providing context on technological advancements, patent landscapes, and competitive dynamics.

Quantitative analyses leverage proprietary data models, combining cost‐of‐goods inputs, reimbursement schedules, and epidemiological data to triangulate market sizing and growth potential across geographies and segments. Validation is achieved through cross-referencing public financial disclosures of leading companies, government procurement records, and independent market surveys. Sensitivity analyses assess the impact of key variables-such as tariff rates, raw material prices, and reimbursement policy changes-on forecast outcomes.

This layered research framework ensures transparency, replicability, and actionable insight, guiding decision-makers in navigating complex market variables and capitalizing on sustainable growth opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nerve Repair & Regeneration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nerve Repair & Regeneration Market, by Product Type

- Nerve Repair & Regeneration Market, by Biomaterial Type

- Nerve Repair & Regeneration Market, by Surgery Type

- Nerve Repair & Regeneration Market, by Application

- Nerve Repair & Regeneration Market, by End-User

- Nerve Repair & Regeneration Market, by Region

- Nerve Repair & Regeneration Market, by Group

- Nerve Repair & Regeneration Market, by Country

- United States Nerve Repair & Regeneration Market

- China Nerve Repair & Regeneration Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Integrating Key Takeaways to Illuminate the Strategic Imperatives Guiding the Next Chapter of Nerve Repair and Regeneration Advancement

The emerging landscape of nerve repair and regeneration is defined by converging trends in biomaterials science, bioelectronic innovation, and regulatory evolution. As therapeutic paradigms shift towards personalized and proactive treatments, stakeholders must align their strategies with multifaceted segmentation dynamics-from product types and surgical techniques to end-user preferences. Regional variances underscore the necessity of adaptive go-to-market approaches, informed by reimbursement frameworks and clinical infrastructure maturity.

Tariff fluctuations and supply chain complexities present both challenges and catalysts for reshoring initiatives and strategic partnerships. Leading companies are differentiating through integrated platform technologies and evidence-driven value propositions, while agile entrants are driving disruption with next-generation conduits and closed-loop stimulators. To sustain competitive advantage, organizations must balance near-term operational resilience with long-term R&D investment, fostering ecosystems that prioritize patient outcomes and cost-effectiveness.

Looking ahead, the ability to harness data analytics, digital health integration, and cross-sector collaboration will ultimately determine who thrives in this dynamic market. By embracing these imperatives, industry leaders can chart a clear course towards meaningful nerve regeneration therapies that transform lives and generate lasting value.

Connect with Our Associate Director Today to Acquire Comprehensive Insights and Propel Your Leadership in Nerve Repair Market Innovations

For organizations poised to outpace the competition in nerve repair and regeneration, access to comprehensive, data-driven market intelligence is essential. Our team’s deep expertise and rigorous analytical framework ensure that you receive actionable insights tailored to your strategic objectives. From understanding the implications of evolving tariff regimes to mapping segmentation-driven growth opportunities and regional adoption patterns, our report empowers you to make informed decisions with confidence.

Reach out today to discuss how our research can be customized to your specific needs. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions, secure exclusive briefings, and gain first-mover advantage in the dynamic landscape of nerve repair and regeneration.

Invest in a report that not only illuminates current market realities but also charts a clear path forward for innovation, collaboration, and sustainable growth. Contact Ketan to schedule your consultation call or request a proposal and take the critical next step toward strengthening your market leadership.

- How big is the Nerve Repair & Regeneration Market?

- What is the Nerve Repair & Regeneration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?