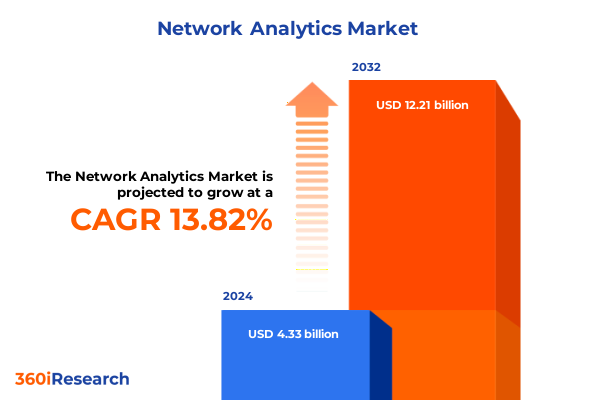

The Network Analytics Market size was estimated at USD 4.92 billion in 2025 and expected to reach USD 5.60 billion in 2026, at a CAGR of 15.14% to reach USD 13.21 billion by 2032.

Setting the Stage for Strategic Excellence in Network Analytics: A Comprehensive Exploration of Market Forces, Opportunities, and Challenges

In today’s hyperconnected world, network analytics has become a linchpin for organizations striving to optimize performance, enhance security, and extract actionable intelligence from the ever-growing volumes of data traversing their infrastructures. As enterprises and service providers navigate a landscape defined by rapid digital transformation, the ability to monitor, analyze, and predict network behavior distinguishes forward-thinking organizations from their peers. Beyond mere packet inspection and traffic monitoring, modern analytics platforms harness advanced algorithms and artificial intelligence to uncover hidden patterns, preempt disruptions, and deliver real-time insights that inform critical decisions.

Against this backdrop, stakeholders across industries are intensifying their focus on network visibility as an enabler of operational efficiency and competitive differentiation. From financial services firms leveraging predictive analytics to preempt system anomalies, to healthcare providers ensuring uninterrupted telemetry in life-critical applications, the strategic value of comprehensive network analytics has never been more apparent. As regulatory programs and security frameworks evolve in parallel, the imperative to maintain resilient and transparent networks underscores the significance of this domain.

This executive summary sets the stage for a deep dive into the market forces, technological shifts, and strategic considerations that shape the network analytics ecosystem. Through an examination of transformative trends, the impact of evolving trade policies, critical segmentation dimensions, regional dynamics, and key players, we illuminate the pathways that industry leaders can pursue to achieve sustained success.

Exploring the Pivotal Technological and Market Shifts That Are Redefining Network Analytics Frameworks and Driving Strategic Evolution Across Industries

The network analytics landscape is undergoing seismic changes driven by the convergence of artificial intelligence, edge computing, and zero trust security paradigms. Artificial intelligence is no longer a conceptual notion but an operational imperative; AI-driven systems increasingly empower networks to self-optimize and recover autonomously, reducing latency and minimizing manual intervention while dynamically adapting to shifting traffic patterns. Concurrently, the proliferation of edge computing has localized data processing, enabling real-time analytics at the point of data generation and reducing dependence on centralized data centers. These capabilities are particularly critical for latency-sensitive applications in healthcare diagnostics, industrial automation, and smart city infrastructure.

At the same time, security architectures are transitioning toward zero trust models, where every access request undergoes rigorous authentication and authorization regardless of origin. This shift is redefining the perimeter and driving integration of analytics into every segment of the network, fostering granular visibility and rapid threat detection. Moreover, the rollout of 5G connectivity is catalyzing a new wave of edge-to-cloud integration, enabling seamless data flows across hybrid infrastructures and unlocking unprecedented bandwidth and throughput for analytics workloads.

These transformative shifts are not isolated; they are interdependent drivers that collectively reshape how organizations approach network design, deployment, and management. As these trends gain momentum, they set the foundation for a competitive environment where agility, scalability, and security converge to define leadership in network analytics.

Unpacking the Complex Web of United States Trade Tariffs Implemented in 2025 and Their Far-Reaching Implications on Network Analytics Supply Chains and Costs

The array of tariffs introduced by the United States in 2025 has created a multifaceted impact on the global network analytics supply chain, compelling organizations to reevaluate procurement strategies and cost structures. A 10% global tariff that took effect in early April, layered atop existing duties of 20% on Chinese imports and 25% on Canadian and Mexican equipment, has elevated component prices for routers, switches, and specialized analytics appliances. In parallel, reciprocal duties imposed by trading partners on U.S.-sourced hardware have intensified supply chain complexity, driving equipment vendors to seek alternative manufacturing hubs in regions such as India, Malaysia, and Vietnam.

Telecom and broadband equipment providers are experiencing this disruption acutely, with key suppliers diversifying their production footprints to mitigate exposure to high duty thresholds. Analyses indicate that wireless infrastructure capex could rise by an average of 7% for major carriers, potentially slowing 5G rollouts and prompting strategic stockpiling of critical network components to hedge against further tariff escalations. On the broadband front, the near-term cost increases for optical network terminals and customer-premise equipment are likely to extend deployment timelines, particularly in underserved markets where subsidy-driven programs are highly sensitive to equipment expenditures.

Beyond the immediate financial implications, these tariffs are accelerating a broader trend toward nearshoring and supply chain resilience. Hardware vendors are establishing localized assembly lines and forging alliances with domestic electronics manufacturers to reduce reliance on high-tariff geographies. While these initiatives promise long-term stability, they require substantial capital and operational realignment, underscoring the complex trade-offs that stakeholders must navigate in the evolving tariff environment.

Delving into the Multifaceted Segmentation of Network Analytics Markets to Reveal How Product Types, Applications, End Users, Deployment Models, Pricing and Sales Channels Shape Industry Dynamics

A granular examination of market segmentation reveals how the network analytics ecosystem is structured across multiple dimensions, each presenting unique strategic considerations. When evaluated by product type, the landscape bifurcates into services and software, with managed services addressing operational oversight and professional services spanning consulting, integration, and ongoing support. Within software, historical analytics platforms provide post-event visibility, predictive analytics enable forward-looking insights, and real-time analytics underpin immediate operational decisions.

From an application perspective, solutions are deployed across network monitoring, performance management-including capacity planning and quality of service monitoring-security analytics featuring anomaly and threat detection, and traffic analysis. Each application vertical demands tailored capabilities, ranging from deep packet inspection to behavior-based anomaly identification, reflecting diverse organizational priorities.

End users further segment into enterprise and telecommunications verticals; within enterprise, industry-specific requirements emerge in BFSI, healthcare, IT, and retail environments. Deployment mode choices between cloud and on-premises infrastructures factor in considerations such as data residency, scalability, and integration with hybrid cloud strategies encompassing private, public, and hybrid cloud models. Pricing models, whether license-based, pay-as-you-go, or subscription-which itself can be annual or monthly-inform procurement flexibility and total cost of ownership. Finally, sales channels extend through channel partners, including system integrators and value-added resellers, direct sales forces, and distributors, shaping go-to-market dynamics and customer engagement.

This comprehensive research report categorizes the Network Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pricing Model

- Application

- Deployment Mode

- End User

Illuminating Regional Variations and Growth Drivers in Network Analytics Across the Americas, EMEA and Asia-Pacific to Guide Strategic Investments and Operational Priorities

Regionally, the Americas continue to drive innovation and early adoption of advanced network analytics, with stakeholders harnessing analytics to deliver differentiated service offerings and optimize operational expenditures. The maturity of telecommunications infrastructure and the concentration of leading technology providers foster a dynamic environment where continuous upgrades and pilot deployments of AI-enabled analytics tools are commonplace.

In Europe, Middle East & Africa, regulatory frameworks such as GDPR and regional data sovereignty mandates have elevated the importance of analytics solutions that embed robust compliance and privacy controls. Enterprises and service providers in this region prioritize solutions that seamlessly integrate policy enforcement with real-time monitoring, meeting both security and legislative requirements while accommodating a diverse set of national regulations.

Asia-Pacific markets represent a vibrant growth frontier, powered by aggressive digital transformation initiatives and substantial investments in 5G and edge infrastructure. Rapidly expanding data centers and progressive government programs to bridge the digital divide drive high demand for analytics platforms capable of scaling in tandem with explosive traffic growth. Moreover, localized innovation hubs in key economies are fostering novel use cases-ranging from smart manufacturing to next-generation retail experiences-that leverage network analytics as a foundational enabler.

This comprehensive research report examines key regions that drive the evolution of the Network Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape of Leading Network Analytics Providers to Highlight Differentiation Strategies, Innovative Solutions, and Collaboration Trends Shaping Market Leadership

The competitive landscape of network analytics is anchored by a diverse array of providers offering differentiated value propositions. Global incumbents leverage extensive portfolios that integrate network management, security, and analytics, enabling holistic visibility across enterprise and service provider environments. These players often emphasize broad platform interoperability and extensive partner ecosystems to extend their market reach.

Specialized analytics vendors, on the other hand, focus on deep technical capabilities such as machine learning-driven anomaly detection and real-time telemetry processing. These firms differentiate through modular architectures that facilitate rapid deployment and customization to address niche requirements, from high-frequency trading operations to mission-critical industrial controls.

Meanwhile, emerging disruptors are introducing cloud-native analytics solutions designed for elastic scalability and consumption-based pricing. By embracing microservices architectures and containerization, these providers empower customers to deploy analytics workloads across hybrid and multi-cloud environments with minimal friction. Collaboration partnerships between large systems integrators and innovative startups are further accelerating go-to-market velocity, blending domain expertise with advanced analytics craftsmanship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Network Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx

- Apixio, Inc.

- Arcadia Solutions, LLC

- Athenahealth, Inc.

- Cisco Systems, Inc.

- CitiusTech Inc.

- Clarify Health Solutions, Inc.

- ClosedLoop.ai Inc.

- Cloudticity, L.L.C

- Cotiviti, Inc.

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Google LLC by Alphabet Inc.

- Health Catalyst, Inc.

- HealthVerity, Inc.

- HOKUTO Inc.

- Inovalon Holdings, Inc.

- International Business Machines Corporation

- IQVIA Inc.

- McKesson Corporation

- MedeAnalytics, Inc.

- Microsoft Corporation

- Optum, Inc.

- Oracle Corporation

- RIB Datapine GmbH

- SAP SE

- SAS Institute, Inc.

- Veradigm LLC

- Verinovum

- Virgin Pulse

- Wipro

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Market Disruptions, Capitalize on Emerging Opportunities and Future-Proof Network Analytics Investments

Industry leaders should prioritize the integration of AI-centric analytics into their network operations, ensuring that machine learning models are continuously trained on real-world traffic patterns to deliver adaptive insights. Building a roadmap for edge-enabled analytics deployments will unlock low-latency decision-making, enhancing performance for distributed applications and critical services.

Organizations must also reevaluate their supply chains in light of ongoing tariff fluctuations, exploring strategic nearshoring partnerships and diversifying component sourcing to mitigate cost volatility. Establishing vendor alliances that include localized assembly or co-development efforts can provide a buffer against sudden duty increases while fostering stronger ecosystem relationships.

To maintain robust security postures, adopting zero trust principles that integrate analytics at every access point is paramount. Embedding real-time threat detection and automated remediation workflows into the network fabric will minimize dwell time and reduce incident response cycles. Further, leveraging hybrid cloud models that balance on-premises control with cloud-based analytics scalability can optimize both operational agility and compliance adherence.

Finally, fostering a culture of data-driven decision-making requires investment in training and change management. Empowering cross-functional teams with intuitive analytics dashboards and scenario-based workshops will accelerate adoption, ensuring that insights translate into tangible performance improvements.

Detailing the Rigorous Research Approach, Data Sources, and Analytical Frameworks Employed to Deliver Robust, Actionable Insights Within the Network Analytics Domain

This research combines extensive secondary research, including regulatory filings, vendor documentation, and peer-reviewed technical publications, with primary insights obtained through interviews and surveys of network architects, CIOs, and technology partners. Data triangulation methods were employed to validate findings, ensuring consistency across diverse information sources.

Quantitative analysis leverages traffic telemetry data, published vendor performance metrics, and real-world case studies, while qualitative assessment draws on expert panel discussions and end-user feedback sessions. This mixed-methods approach facilitated a comprehensive understanding of both technological capabilities and market dynamics.

Benchmarking exercises compared solution attributes such as analytics throughput, anomaly detection accuracy, and deployment timeframes, providing context for relative vendor positioning. Additionally, geopolitical and trade policy considerations were integrated through scenario modeling to assess potential impacts on supply chains and cost structures.

Quality assurance processes included peer reviews by subject matter experts and iterative validation cycles with participating stakeholders, ensuring that recommendations and insights reflect actionable realities. The methodology underscores transparency, replicability, and rigor, delivering a robust foundation for strategic decision-making in network analytics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Network Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Network Analytics Market, by Product Type

- Network Analytics Market, by Pricing Model

- Network Analytics Market, by Application

- Network Analytics Market, by Deployment Mode

- Network Analytics Market, by End User

- Network Analytics Market, by Region

- Network Analytics Market, by Group

- Network Analytics Market, by Country

- United States Network Analytics Market

- China Network Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Critical Findings and Strategic Imperatives That Illuminate the Path Forward for Network Analytics Stakeholders in an Era of Heightened Complexity and Opportunity

As the network analytics domain continues to evolve under the influence of artificial intelligence, edge computing, and shifting trade dynamics, organizations must adopt an adaptive, data-driven mindset to sustain competitive advantage. The interplay between advanced analytics capabilities and emerging security architectures offers unprecedented opportunities to optimize performance, fortify resilience, and unlock new service models.

At the same time, external forces-ranging from tariff policies to regional regulatory regimes-are reshaping the contours of supply chains and operational strategies. Navigating these complexities requires a balanced approach that combines strategic foresight with tactical agility, leveraging partnerships and technology alliances to mitigate risk.

By synthesizing segmentation insights, regional variations, and competitive differentiators, this executive summary provides a cohesive framework for leaders to align network analytics initiatives with broader business objectives. Embracing the outlined actionable recommendations will position organizations to rapidly respond to market shifts, capitalize on innovation trends, and deliver measurable value.

Ultimately, success in network analytics hinges on an organization’s ability to integrate intelligence into every layer of its network fabric, fostering a culture that values continuous optimization and informed decision-making.

Engage with Our Associate Director to Secure Your Comprehensive Network Analytics Report and Drive Strategic Growth

Elevate your strategic planning and empower decision-making by engaging directly with Ketan Rohom, whose expertise in network analytics can provide tailored insights and facilitate seamless access to the full breadth of our market research report. Ketan Rohom, as a seasoned leader in sales and marketing, is ready to guide you through the report’s detailed findings and answer any questions on how these insights can be translated into actionable strategies for your organization. Reach out today to secure your copy and embark on a journey of data-driven growth and innovation with the guidance of an expert who understands the nuances of the network analytics landscape.

- How big is the Network Analytics Market?

- What is the Network Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?